Amundi MSCI All Country World UCITS ETF USD Acc: A Guide To Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV)?

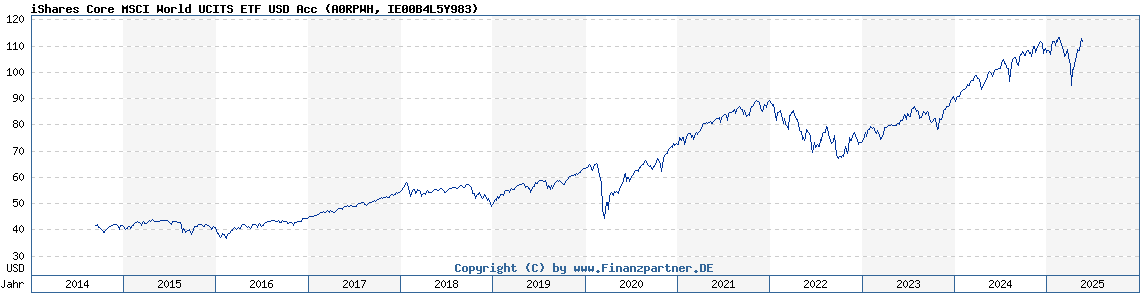

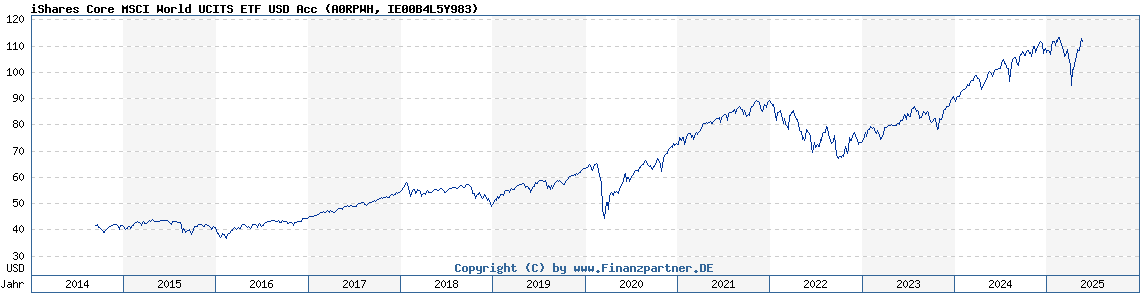

Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. For the Amundi MSCI All Country World UCITS ETF USD Acc, the NAV reflects the total value of all the global stocks held within the ETF, minus any liabilities. Understanding NAV is vital because it represents the intrinsic value of your investment, independent of market fluctuations.

The basic formula for calculating NAV is straightforward: Assets - Liabilities = NAV. The ETF's assets comprise the market value of all its holdings, while liabilities encompass expenses and other obligations. The Amundi MSCI All Country World UCITS ETF USD Acc's NAV is typically calculated and published daily, at the close of market hours.

- NAV reflects the intrinsic value of the ETF's holdings.

- NAV fluctuates based on the market value of the underlying assets.

- Understanding NAV helps investors track performance and compare it to the market price.

Factors Affecting the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Several factors influence the Amundi MSCI All Country World UCITS ETF USD Acc's NAV. Understanding these influences is crucial for interpreting NAV changes and making well-informed investment decisions.

Market Fluctuations: Global market movements directly impact the NAV. A rise in global stock markets generally leads to an increase in the NAV, while a decline will decrease it. This ETF, with its broad global exposure, is particularly susceptible to these overall market trends.

Currency Exchange Rates: Since the Amundi MSCI All Country World UCITS ETF USD Acc is denominated in USD, fluctuations in the value of the dollar against other currencies influence the NAV. A strengthening dollar can positively affect the NAV (if holdings are in other currencies), while a weakening dollar may have the opposite effect.

Dividend Distributions: Dividend payouts from the underlying companies held within the ETF impact the NAV. When dividends are paid, the NAV typically decreases by the amount distributed, reflecting the reduction in the ETF's assets. However, reinvested dividends contribute to long-term NAV growth.

Expense Ratio: The ETF's expense ratio, representing the annual cost of managing the fund, subtly affects the NAV. The expense ratio is deducted from the ETF's assets, leading to a slight reduction in the NAV over time.

- Global economic events significantly influence the NAV.

- Currency fluctuations can lead to gains or losses for USD-based investors.

- Reinvested dividends generally increase NAV over time.

How to Find the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Accessing the Amundi MSCI All Country World UCITS ETF USD Acc's NAV is straightforward through various official and readily available sources.

Official Sources: The most reliable source is Amundi's official website. Major financial data providers, such as Bloomberg and Refinitiv, also publish the daily NAV.

Brokerage Accounts: Most brokerage accounts display the current NAV of your holdings, including the Amundi MSCI All Country World UCITS ETF USD Acc, directly within your account dashboard.

Financial News Websites: Reputable financial news websites and investment portals often provide ETF NAV data, alongside other market information.

- Always check official sources for accurate NAV data.

- Regularly monitoring the NAV helps track investment performance.

- Comparing the NAV to the market price helps identify potential buying or selling opportunities.

NAV vs. Market Price: Understanding the Difference

The NAV and market price of an ETF, including the Amundi MSCI All Country World UCITS ETF USD Acc, aren't always identical. The market price reflects the current trading price on the exchange, influenced by supply and demand.

Premium/Discount: A premium exists when the market price trades above the NAV, indicating higher investor demand. A discount occurs when the market price is below the NAV, reflecting lower demand.

Arbitrage Opportunities: For sophisticated investors, significant discrepancies between NAV and market price can present arbitrage opportunities. These involve buying at a discount and selling at a premium to profit from the price difference.

- Market price can differ from NAV due to supply and demand.

- A premium indicates the market price is higher than the NAV.

- A discount indicates the market price is lower than the NAV.

Conclusion: Mastering Amundi MSCI All Country World UCITS ETF USD Acc NAV

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is fundamental to successful ETF investing. By regularly monitoring the NAV, considering factors influencing its fluctuations, and comparing it to the market price, investors can make more informed decisions about their investments. Remember to utilize official sources for accurate NAV data and consider the impact of global market conditions, currency exchange rates, dividends, and the expense ratio.

By understanding the Net Asset Value of the Amundi MSCI All Country World UCITS ETF USD Acc, you can make more strategic and successful investment choices. Start monitoring your NAV today!

Featured Posts

-

Escape To The Country How Nicki Chapman Made 700 000 From A Property Investment

May 24, 2025

Escape To The Country How Nicki Chapman Made 700 000 From A Property Investment

May 24, 2025 -

Evrovidenie Pobediteli Poslednikh 10 Let Gde Oni Seychas

May 24, 2025

Evrovidenie Pobediteli Poslednikh 10 Let Gde Oni Seychas

May 24, 2025 -

Burclar Ve Zeka En Yetenekli Burclar Kimler

May 24, 2025

Burclar Ve Zeka En Yetenekli Burclar Kimler

May 24, 2025 -

Apple Stock Dip Key Levels Under Pressure Before Q2 Earnings

May 24, 2025

Apple Stock Dip Key Levels Under Pressure Before Q2 Earnings

May 24, 2025 -

Amsterdam Stock Market Aex Index Falls To Lowest Point In 12 Months

May 24, 2025

Amsterdam Stock Market Aex Index Falls To Lowest Point In 12 Months

May 24, 2025