Amundi MSCI All Country World UCITS ETF USD Acc: NAV Explained

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the intrinsic value of a single share in an ETF. It's calculated by taking the total value of all the assets held within the ETF, subtracting liabilities (including expenses), and then dividing by the total number of outstanding shares. Unlike the market price, which fluctuates throughout the trading day based on supply and demand, the NAV reflects the actual underlying value of the investments within the fund.

- NAV reflects the underlying assets' value: This means it's a measure of the true worth of the holdings within the Amundi MSCI All Country World UCITS ETF USD Acc, based on their current market prices.

- Calculated daily, usually at the end of the trading day: The NAV is typically calculated once per day, giving investors a clear picture of the ETF's value at the close of the market.

- Represents the intrinsic value of one ETF share: This provides a standardized measure to assess the value of your investment.

- Crucial for understanding your investment's performance: Tracking NAV changes over time allows investors to accurately gauge their returns.

Calculating the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc

Calculating the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc involves several steps:

- Total asset value of the ETF (all holdings): This includes the market value of all the individual stocks, bonds, or other assets held within the ETF, weighted according to their representation in the MSCI All Country World Index. This index tracks the performance of a wide range of global equities.

- Minus expenses (management fees, operational costs): The ETF's expenses, including management fees and operational costs, are deducted from the total asset value. These fees impact the net value available to investors.

- Divided by the total number of outstanding shares: This calculation normalizes the value to represent the NAV per share.

- Result is the NAV per share: This figure represents the net asset value attributable to each share of the Amundi MSCI All Country World UCITS ETF USD Acc. The "USD Acc" designation signifies that the NAV is reported in US Dollars, accumulating dividends. Currency fluctuations can impact the USD value of the NAV if the underlying assets are in different currencies.

The Importance of NAV for Amundi MSCI All Country World UCITS ETF USD Acc Investors

Understanding the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is essential for several reasons:

- Track investment growth over time: By regularly monitoring the NAV, investors can track the growth or decline of their investment.

- Compare to benchmark indices (MSCI All Country World Index): Comparing the ETF's NAV performance to the MSCI All Country World Index helps assess the fund manager's performance against the benchmark.

- Identify potential buying or selling opportunities: Changes in the NAV relative to the market price can signal potential buying or selling opportunities, although timing the market is risky.

- Evaluate the ETF’s overall performance against its peers: Comparing the NAV performance of the Amundi MSCI All Country World UCITS ETF USD Acc to similar global equity ETFs allows for a comparative analysis of investment strategies.

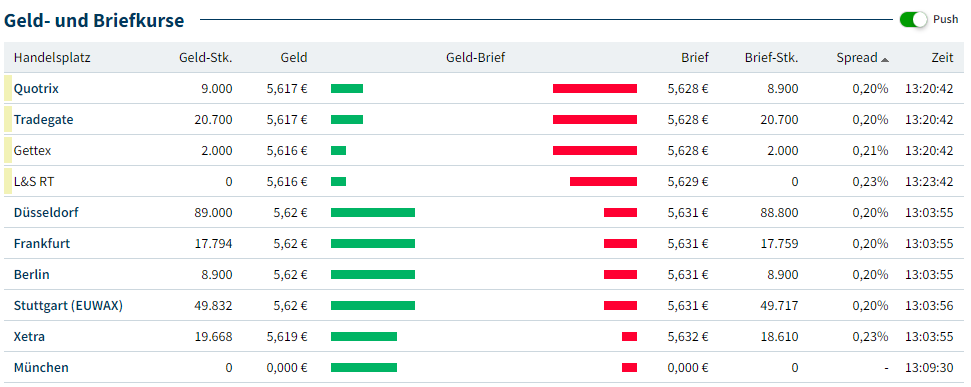

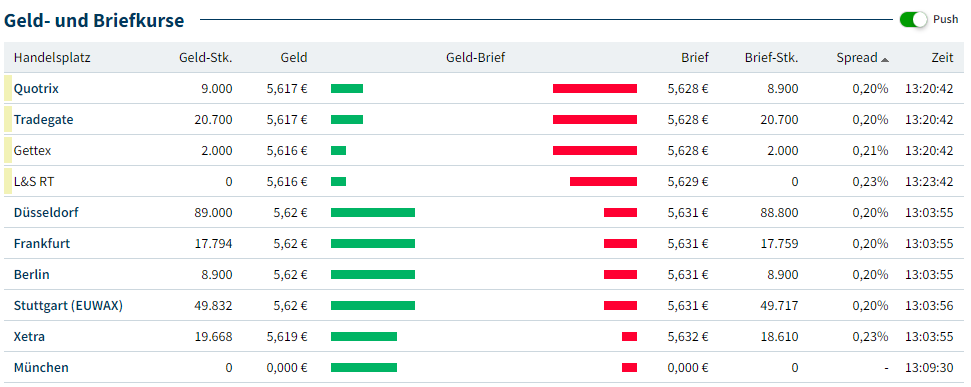

Where to Find the NAV for Amundi MSCI All Country World UCITS ETF USD Acc

Reliable sources for accessing the daily NAV data for the Amundi MSCI All Country World UCITS ETF USD Acc include:

- Amundi's official website: The asset manager typically publishes daily NAV updates on its website.

- Major financial data providers (Bloomberg, Refinitiv): Professional financial data platforms provide real-time and historical NAV information.

- Your brokerage account: Most brokerage platforms display the NAV of your holdings, including ETFs, directly within your account statement or portfolio overview.

Understanding how to interpret the presented NAV data is crucial. Look for clear labels indicating the date and time of the NAV calculation to avoid confusion.

Conclusion

This article explained the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc, detailing its calculation, significance for investors, and sources for obtaining this critical information. Understanding NAV is critical for effectively managing your investment in this global equity ETF. Regularly monitoring the NAV helps you stay informed about your investment's performance and make well-informed decisions regarding your portfolio.

Call to Action: Learn more about the Amundi MSCI All Country World UCITS ETF USD Acc and its NAV by visiting [link to Amundi's website or relevant resource]. Stay informed about your investment’s performance and make well-informed decisions with a clear understanding of Amundi MSCI All Country World UCITS ETF USD Acc Net Asset Value.

Featured Posts

-

Camunda Con 2025 Amsterdam Orchestrating The Next Generation Of Ai And Automation

May 25, 2025

Camunda Con 2025 Amsterdam Orchestrating The Next Generation Of Ai And Automation

May 25, 2025 -

The Often Overlooked Role Of Middle Managers In Business Success

May 25, 2025

The Often Overlooked Role Of Middle Managers In Business Success

May 25, 2025 -

Naomi Kempbell I Ee Deti Foto Syna I Docheri

May 25, 2025

Naomi Kempbell I Ee Deti Foto Syna I Docheri

May 25, 2025 -

A Critical Analysis Of Claire Williams Treatment Of George Russell

May 25, 2025

A Critical Analysis Of Claire Williams Treatment Of George Russell

May 25, 2025 -

Amsterdam Stock Market 7 Opening Plunge Sparks Trade War Concerns

May 25, 2025

Amsterdam Stock Market 7 Opening Plunge Sparks Trade War Concerns

May 25, 2025