Amundi MSCI All Country World UCITS ETF USD Acc: Net Asset Value (NAV) Explained

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net worth of an investment fund, like the Amundi MSCI All Country World UCITS ETF USD Acc, per share. It's essentially the total value of all the assets held within the ETF (in this case, a globally diversified portfolio of equities) minus any liabilities. For the Amundi MSCI All Country World UCITS ETF USD Acc, this calculation involves summing the market values of all the underlying stocks in the index it tracks (the MSCI All Country World Index) and subtracting any expenses. This figure is then divided by the total number of outstanding shares to arrive at the NAV per share.

Several factors influence the daily fluctuations of the Amundi MSCI All Country World UCITS ETF USD Acc's NAV:

- Market movements of underlying assets: Changes in the prices of the individual stocks within the ETF directly impact its overall value. A rising market generally leads to a higher NAV, while a falling market results in a lower NAV.

- Currency exchange rates (USD Acc implications): The "USD Acc" designation signifies that the ETF is denominated in US dollars. Fluctuations in exchange rates between the USD and other currencies where the underlying assets are traded will affect the NAV calculated in USD.

- Dividend distributions and reinvestments: When the underlying companies pay dividends, the ETF receives these payments, which can increase the total assets and subsequently the NAV. How these dividends are handled (reinvestment or distribution to shareholders) impacts the NAV.

- Management fees: The ETF's management fees are deducted from the assets, reducing the overall NAV.

How to Find the NAV of Amundi MSCI All Country World UCITS ETF USD Acc?

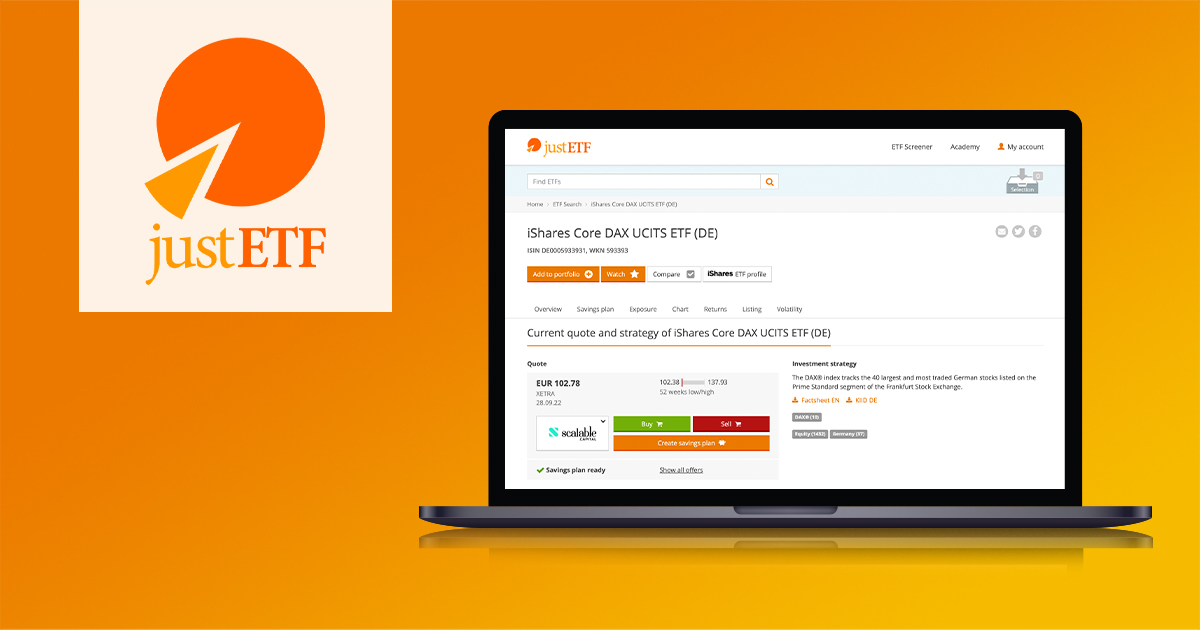

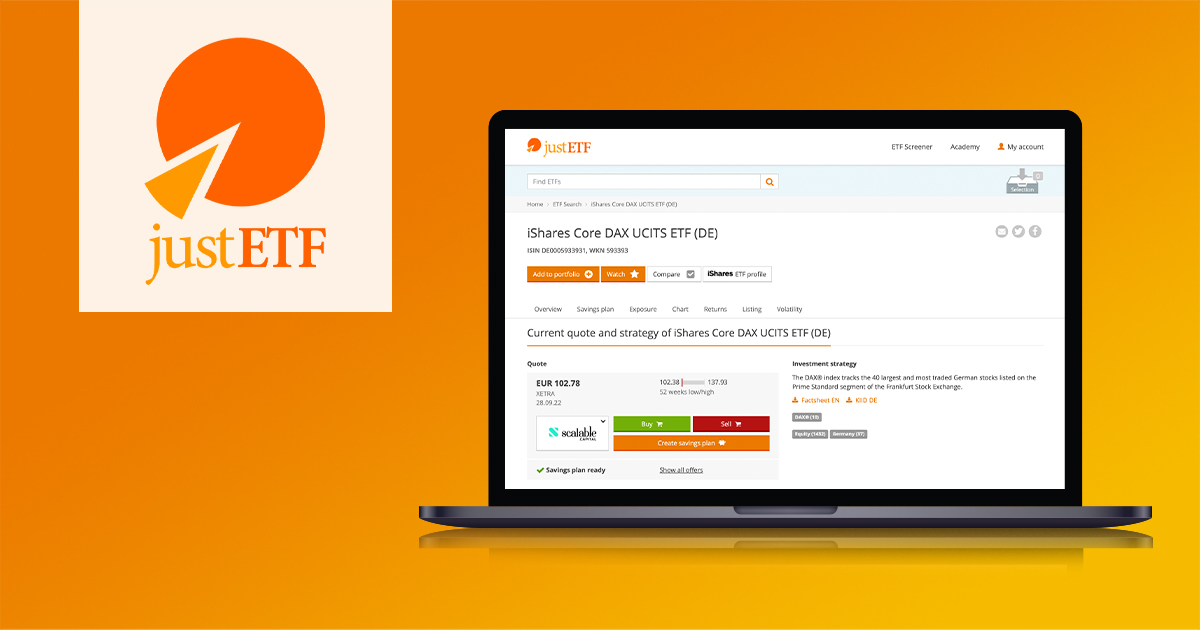

Finding the daily NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is straightforward. You can typically access this information through several channels:

- Amundi's official website: The fund manager, Amundi, usually publishes the daily NAV on its website dedicated to this specific ETF.

- Financial news sources: Many financial news websites and data providers (e.g., Bloomberg, Yahoo Finance) list ETF NAVs, including that of the Amundi MSCI All Country World UCITS ETF USD Acc.

- Brokerage platforms: If you hold the ETF through a brokerage account, the platform will usually display the current NAV alongside the market price.

NAV updates are typically available at the end of each trading day, though there might be slight delays depending on the source. It’s important to remember that the NAV is a snapshot of the fund's value at a specific point in time.

Why is NAV Important for Amundi MSCI All Country World UCITS ETF USD Acc Investors?

Understanding the NAV of your Amundi MSCI All Country World UCITS ETF USD Acc is vital for effective investment management. It provides crucial information for:

- Performance evaluation: Tracking the NAV over time allows you to assess the fund's growth and performance.

- Calculating returns on investment: By comparing the current NAV to your purchase price, you can calculate your returns, taking into account any reinvested dividends.

- Making informed buy/sell decisions: Observing NAV trends can help you determine whether to buy more shares, sell some, or hold your existing investment.

Practical uses of NAV information include:

- Performance evaluation: Compare your ETF's performance against its benchmark (MSCI All Country World Index).

- Comparing to benchmarks: Assess how well the ETF is tracking its benchmark index.

- Tax implications: NAV is often used to determine capital gains or losses for tax purposes.

- Portfolio rebalancing: Monitor the NAV to ensure your portfolio maintains your desired asset allocation.

NAV vs. Market Price: Understanding the Difference

While the NAV reflects the intrinsic value of the Amundi MSCI All Country World UCITS ETF USD Acc, the market price is the price at which the ETF trades on the exchange. These prices can differ due to:

- Liquidity: High trading volume generally leads to a market price closer to the NAV. Low liquidity can create a wider spread between the bid and ask prices.

- Trading volume: High trading volume typically results in a smaller difference between market price and NAV.

- Market sentiment: Investor sentiment can cause temporary deviations between market price and NAV.

This difference is reflected in the bid-ask spread – the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). When buying or selling, your actual transaction price will be within this spread.

Impact of Currency Fluctuations on NAV (USD Acc)

The "USD Acc" designation means the NAV is calculated and reported in US dollars. Fluctuations in exchange rates between the USD and other currencies represented in the underlying assets of the ETF will directly impact the reported NAV in USD. For instance, a strengthening USD against other currencies will generally lead to a lower NAV (in USD terms), while a weakening USD will result in a higher NAV (in USD terms). This currency exposure presents both risks and opportunities for investors. Understanding this relationship is crucial for managing your investment effectively.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is fundamental to successful investing. Regularly monitoring the NAV allows you to track performance, assess your returns, and make informed buy/sell decisions. By understanding the factors influencing the NAV and its relationship to the market price, you can better manage your investment in this global ETF. Stay informed about your investment with regular NAV checks. Learn more about the Amundi MSCI All Country World UCITS ETF USD Acc and Net Asset Value today!

Featured Posts

-

Strengthening Ties The 2nd Edition Of Best Of Bangladesh In Europe

May 24, 2025

Strengthening Ties The 2nd Edition Of Best Of Bangladesh In Europe

May 24, 2025 -

Philips 2025 Agm A Summary Of Important Announcements

May 24, 2025

Philips 2025 Agm A Summary Of Important Announcements

May 24, 2025 -

M62 Resurfacing Westbound Closure From Manchester To Warrington

May 24, 2025

M62 Resurfacing Westbound Closure From Manchester To Warrington

May 24, 2025 -

Piazza Affari Oggi Fed Banche E L Andamento Di Italgas

May 24, 2025

Piazza Affari Oggi Fed Banche E L Andamento Di Italgas

May 24, 2025 -

8 Stock Market Increase On Euronext Amsterdam Following Tariff Announcement

May 24, 2025

8 Stock Market Increase On Euronext Amsterdam Following Tariff Announcement

May 24, 2025