Amundi MSCI World Catholic Principles UCITS ETF Acc: NAV Analysis And Tracking

Table of Contents

Net Asset Value (NAV) Explained

The Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. Understanding the ETF NAV is crucial for evaluating its performance. It's essentially the total value of the ETF's holdings (stocks, bonds, etc.) minus any liabilities, divided by the number of outstanding shares. Several factors influence the ETF's NAV, including:

- Market Fluctuations: The prices of the companies held within the ETF directly impact its NAV. A rising market generally leads to a higher NAV, and vice versa.

- Currency Exchange Rates: As the ETF invests globally, fluctuations in exchange rates between different currencies can affect the NAV, especially if a significant portion of holdings are denominated in a currency other than the ETF's base currency.

- Dividend Distributions: When the companies held within the ETF pay dividends, the NAV will generally decrease by the amount of the dividend distributed to shareholders.

Finding the daily NAV is straightforward. You can typically access this information through:

- The fund's official fact sheet.

- Reputable financial news websites and investment platforms.

Bullet Points:

- NAV Calculation Methodology: The NAV is calculated daily, typically at the end of the trading day, by summing the market value of all assets, subtracting liabilities, and dividing by the number of outstanding shares.

- Frequency of NAV Updates: The NAV is usually updated daily, reflecting the closing prices of the underlying assets.

- Where to find reliable NAV data: Check the ETF provider's website, major financial news sources (e.g., Bloomberg, Reuters), and your brokerage account.

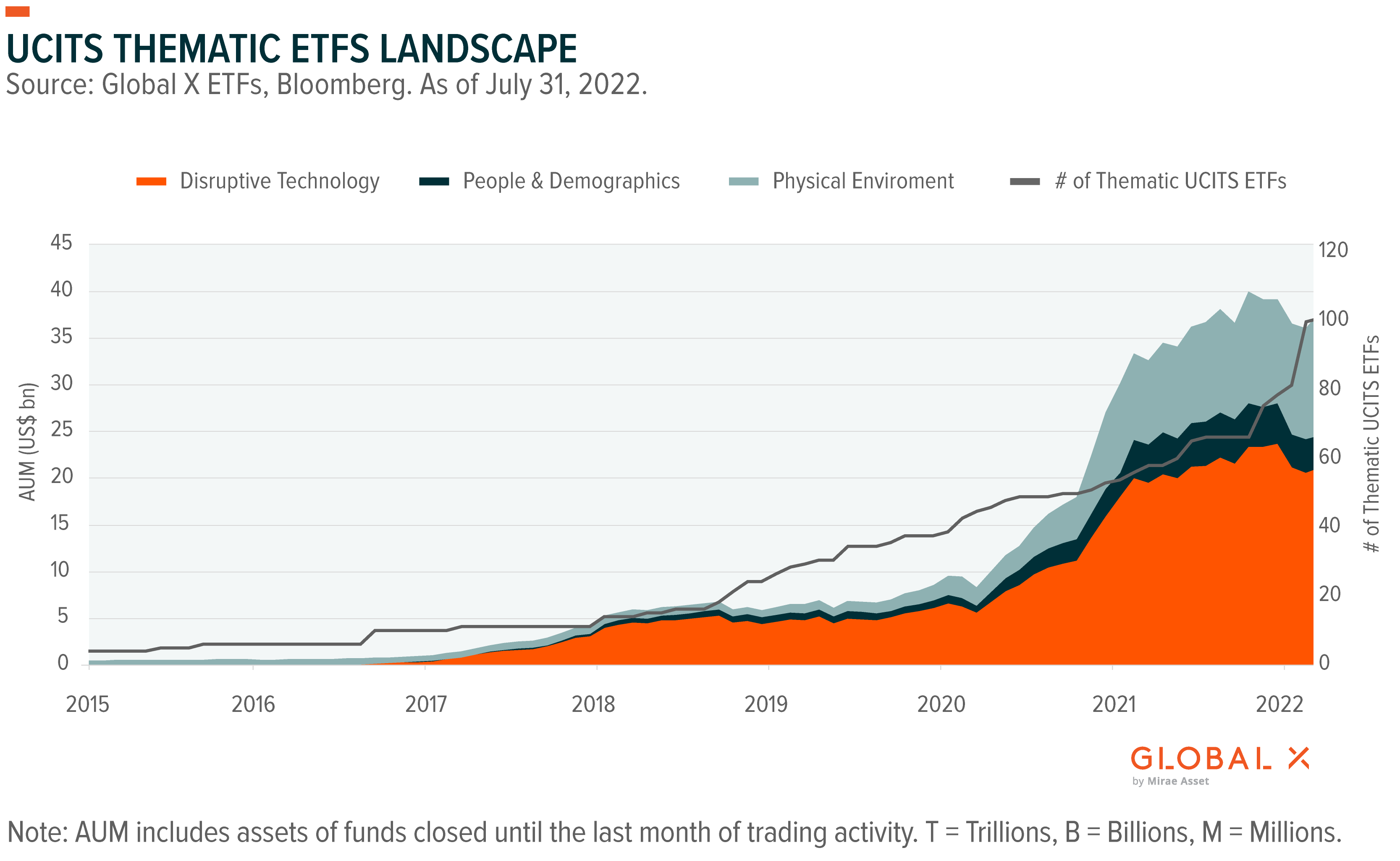

Tracking Performance Analysis

Tracking error measures how closely an ETF's performance mirrors its benchmark index – in this case, the MSCI World Index. A lower tracking error indicates better performance alignment with the index. Analyzing historical tracking performance data is vital in assessing the ETF's efficiency. Differences between the ETF's return and the index's return can stem from various factors:

- Management Fees: These fees, a percentage of the assets under management, directly reduce returns.

- Transaction Costs: Buying and selling securities to maintain the ETF's portfolio incurs costs.

- Index Rebalancing: The MSCI World Index is periodically rebalanced, leading to buying and selling activity and associated transaction costs.

Bullet Points:

- Methods for measuring tracking error: Tracking error is typically measured as the standard deviation of the difference between the ETF's returns and the benchmark index's returns.

- Historical tracking error data visualization: A graph depicting the ETF's performance against the MSCI World Index over time helps visualize the tracking error. (Insert a chart or graph here)

- Comparison of tracking performance to similar ETFs: Comparing the tracking error of this Catholic ETF to other MSCI World Index-tracking ETFs will help illustrate its relative efficiency.

Catholic Principles and Investment Strategy

The Amundi MSCI World Catholic Principles UCITS ETF Acc distinguishes itself through its commitment to Catholic social principles. These principles guide its investment strategy, influencing stock selection and portfolio construction. The ETF screens companies based on criteria reflecting these principles, aiming to exclude companies involved in activities deemed ethically objectionable.

Bullet Points:

- List of key Catholic principles incorporated: These may include respect for human life, promotion of the common good, social justice, and stewardship of creation. Specific exclusion criteria, such as involvement in weapons manufacturing, pornography, or abortion, will be defined by the fund's prospectus.

- Description of the screening methodology: The ETF employs a robust screening process, potentially involving both negative and positive screening, to identify companies aligned with the stated Catholic principles. Negative screening excludes companies involved in harmful activities, while positive screening might favor those promoting sustainable practices.

- Potential trade-offs between ethical investing and financial returns: While aiming for ethical alignment, it's important to understand that adherence to Catholic principles may lead to some trade-offs in terms of potential financial returns compared to a purely market-based index fund.

Fees and Expenses

Understanding the cost structure of any ETF is essential. The Amundi MSCI World Catholic Principles UCITS ETF Acc has an expense ratio, representing the annual cost of managing the fund, expressed as a percentage of assets.

Bullet Points:

- Expense ratio details: The precise expense ratio should be readily available in the ETF's prospectus and on the fund provider's website.

- Comparison with competitor ETFs: Compare this ETF’s expense ratio to similar ETFs tracking the MSCI World Index, both those adhering to ethical principles and those that do not.

- Long-term impact of fees on investment growth: Even seemingly small expense ratios can significantly impact long-term investment growth due to the compounding effect.

Conclusion: Making Informed Decisions about the Amundi MSCI World Catholic Principles UCITS ETF Acc

Analyzing the Amundi MSCI World Catholic Principles UCITS ETF Acc requires a thorough understanding of its NAV, tracking performance, and underlying investment philosophy. The ETF's NAV reflects the market value of its holdings, while tracking performance indicates how effectively it replicates the MSCI World Index. Its unique commitment to Catholic social principles influences both its investment strategy and potential return profile. Remember to carefully consider the expense ratio and compare it to similar ETFs.

Before investing in the Amundi MSCI World Catholic Principles UCITS ETF Acc or any other investment, thorough research and potentially consultation with a qualified financial advisor is crucial. This analysis should help you make informed decisions aligned with your financial goals and ethical preferences. Remember to regularly monitor the ETF’s NAV and tracking performance to ensure it continues to meet your expectations. Consider exploring further resources on the Amundi MSCI World Catholic Principles UCITS ETF Acc to make an informed investment decision.

Featured Posts

-

Understanding The Controversy Surrounding Thames Water Executive Bonuses

May 24, 2025

Understanding The Controversy Surrounding Thames Water Executive Bonuses

May 24, 2025 -

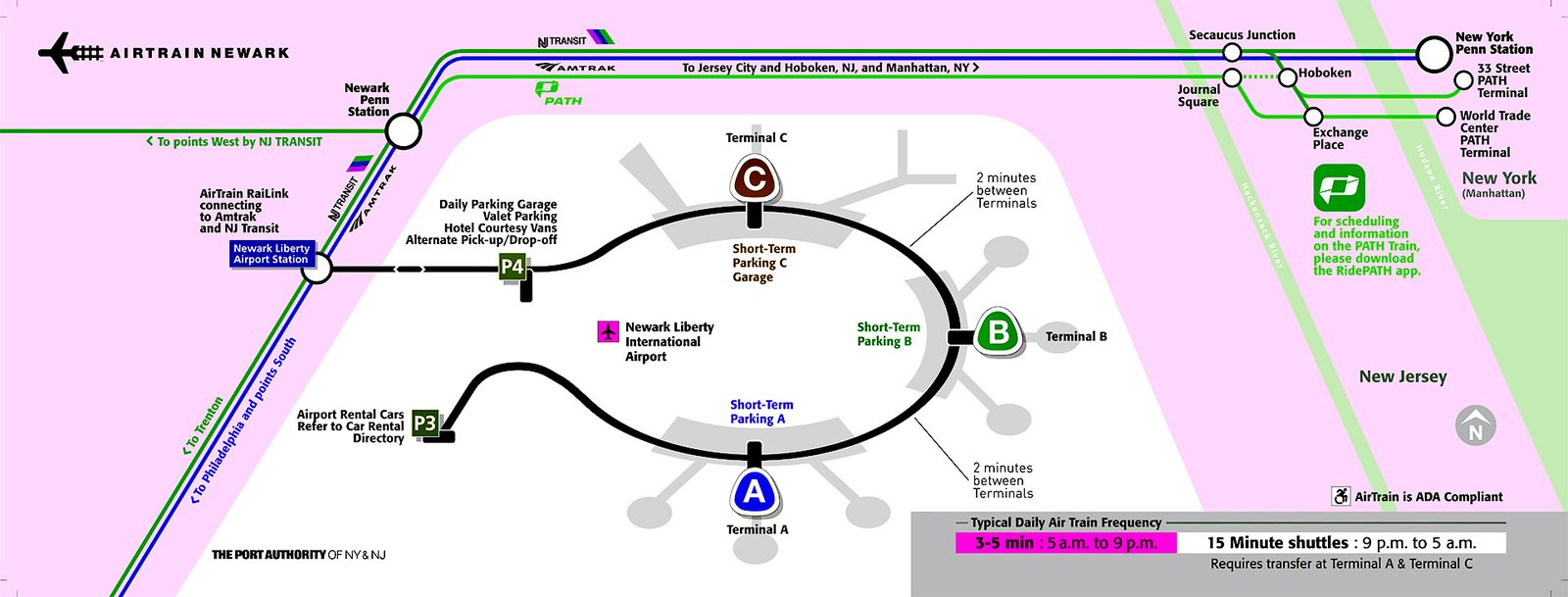

Failed Air Traffic Control Policy Newark Airports Ongoing Crisis

May 24, 2025

Failed Air Traffic Control Policy Newark Airports Ongoing Crisis

May 24, 2025 -

Hawaii Keiki Memorial Day Poster Contest Sew A Lei Show Your Talent

May 24, 2025

Hawaii Keiki Memorial Day Poster Contest Sew A Lei Show Your Talent

May 24, 2025 -

Solve The Nyt Mini Crossword April 8 2025 Tuesday Puzzle

May 24, 2025

Solve The Nyt Mini Crossword April 8 2025 Tuesday Puzzle

May 24, 2025 -

Italian Citizenship New Law On Great Grandparent Claims

May 24, 2025

Italian Citizenship New Law On Great Grandparent Claims

May 24, 2025