Amundi MSCI World Ex-US UCITS ETF Acc: Understanding Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the intrinsic value of a single share in an ETF like the Amundi MSCI World ex-US UCITS ETF Acc. It's calculated by taking the total market value of all the underlying assets held within the ETF (stocks, bonds, etc.) and subtracting any liabilities, such as management fees and expenses. This calculation is performed daily, providing a snapshot of the ETF's value at the close of the market.

- NAV represents the intrinsic value of each ETF share. This is the theoretical price of one share if the ETF were liquidated.

- NAV fluctuates based on the market value of the underlying assets. As the market prices of the stocks within the ETF change, so does its NAV.

- Understanding NAV helps investors track the ETF's performance. By monitoring the daily NAV, investors can gauge the overall growth or decline of their investment.

How NAV Impacts Amundi MSCI World ex-US UCITS ETF Acc Investors

Daily changes in the Amundi MSCI World ex-US UCITS ETF Acc NAV directly impact the ETF's share price. While the two figures often track closely, discrepancies can occur due to market forces. The difference between the NAV and the trading price reflects the supply and demand for the ETF shares.

- Monitoring NAV helps assess investment gains or losses. Comparing the current NAV to your initial investment allows you to easily calculate your profit or loss.

- Comparing NAV to the share price indicates potential buying/selling opportunities. If the share price trades at a discount to the NAV, it might signal a potential buying opportunity. Conversely, a premium may suggest considering a sale.

- Regularly checking NAV contributes to informed investment decisions. This allows you to adjust your investment strategy based on market trends and your financial goals.

Accessing Amundi MSCI World ex-US UCITS ETF Acc NAV Information

Finding the daily NAV for the Amundi MSCI World ex-US UCITS ETF Acc is straightforward. Several sources provide this crucial information.

- Amundi's official website is a primary source for accurate NAV data. Look for investor resources or fact sheets on their site.

- Reputable financial websites often provide real-time or delayed NAV information. Many financial news platforms display ETF NAVs, often with a slight delay.

- Always verify data from multiple reliable sources. Cross-referencing information ensures accuracy and helps to avoid potential errors. You should always prioritize official sources.

NAV vs. Share Price: Understanding the Difference

While closely related, NAV and the market price of the Amundi MSCI World ex-US UCITS ETF Acc shares are not always identical. The market price reflects the current supply and demand for the ETF shares on the exchange, influenced by various factors like investor sentiment and trading volume. The bid-ask spread, the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask), also contributes to the discrepancy.

- NAV represents the theoretical value, while the share price is the actual market price. The NAV is a calculated value, whereas the share price reflects live market trading activity.

- Supply and demand influence the share price, leading to variations from NAV. High demand may push the share price above the NAV (a premium), while low demand might lead to a price below the NAV (a discount).

- Understanding this difference allows for more informed trading strategies. By analyzing the relationship between NAV and share price, investors can potentially identify undervalued or overvalued opportunities.

Conclusion

Understanding the Amundi MSCI World ex-US UCITS ETF Acc NAV is vital for making informed investment decisions. Regularly monitoring the NAV, in conjunction with the share price, allows you to track performance, assess potential gains or losses, and adjust your investment strategy accordingly. Remember to utilize reliable sources like Amundi's official website and reputable financial news platforms to obtain accurate NAV information. By actively monitoring the Amundi MSCI World ex-US UCITS ETF Acc NAV and its relationship to the share price, you can optimize your portfolio's performance and achieve your investment goals. For further information on ETF investing and NAV, explore resources available from your financial advisor or reputable investment websites.

Featured Posts

-

Positive Sentiment In European Markets Following Trumps Tariff Statements

May 24, 2025

Positive Sentiment In European Markets Following Trumps Tariff Statements

May 24, 2025 -

Jonathan Groff And Just In Time A Tony Awards Prediction

May 24, 2025

Jonathan Groff And Just In Time A Tony Awards Prediction

May 24, 2025 -

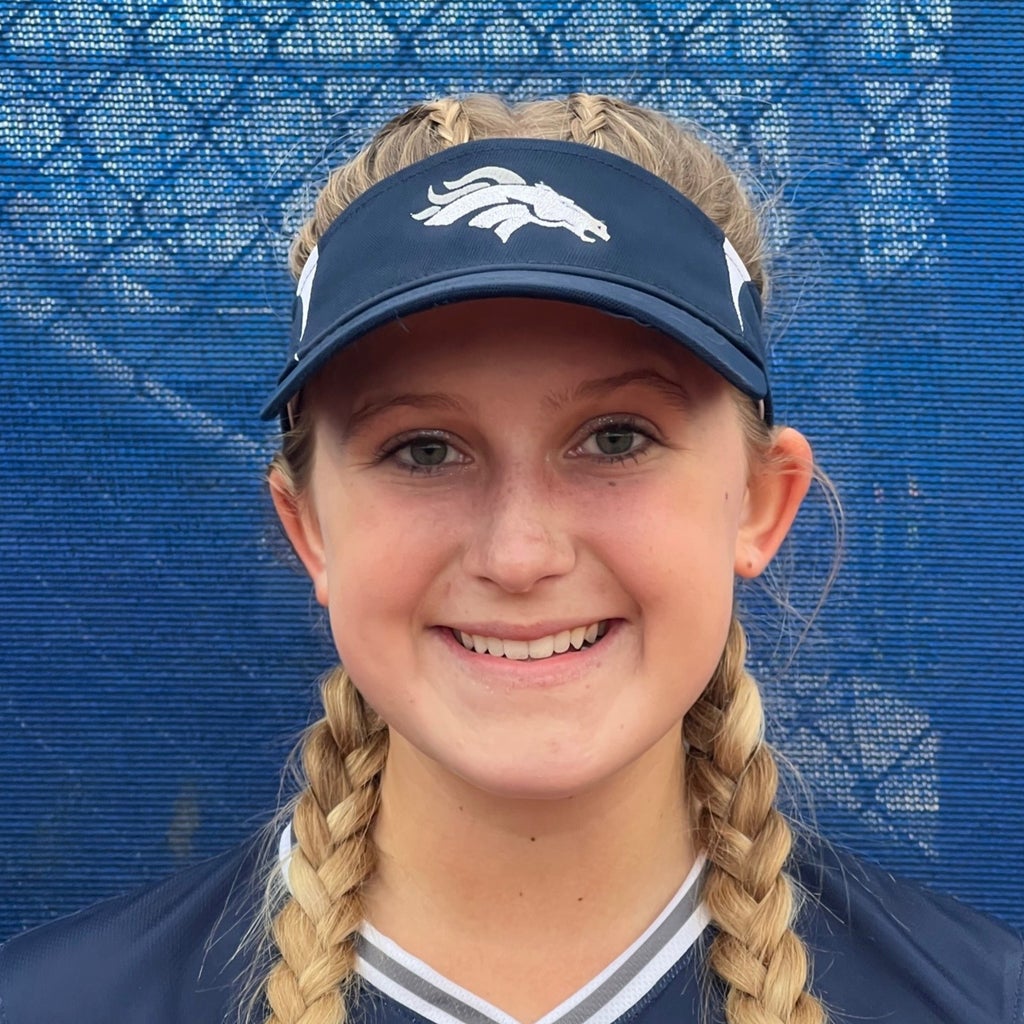

Maryland Softballs Aubrey Wurst Shines In 11 1 Win Against Delaware

May 24, 2025

Maryland Softballs Aubrey Wurst Shines In 11 1 Win Against Delaware

May 24, 2025 -

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025 -

Escape To The Countryside A Comprehensive Guide For Beginners

May 24, 2025

Escape To The Countryside A Comprehensive Guide For Beginners

May 24, 2025