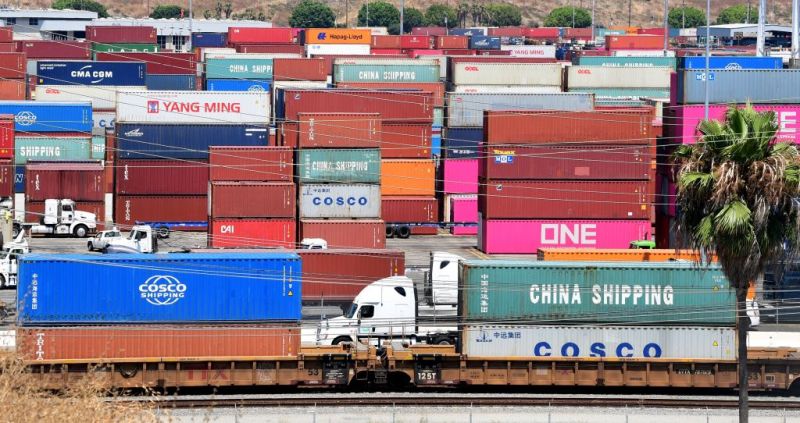

Analysis: Copper Price Increase Linked To China-US Trade Talks

Table of Contents

China's Role in Copper Demand

China is the world's largest consumer of copper, its vast infrastructure projects and booming manufacturing sector driving insatiable demand. This makes the Chinese economy a critical factor in global copper prices. Trade tensions with the US directly impact China's economic growth and, consequently, its copper demand, creating a ripple effect across the commodity market. Fluctuations in Chinese copper imports and the broader Chinese economy significantly influence the overall copper market and commodity prices.

- Reduced Chinese imports due to tariffs: Imposed tariffs can lead to supply shortages in China, driving up prices globally as demand remains high but import costs increase. This creates an upward pressure on the copper price.

- Positive trade developments: Positive developments in trade negotiations between the US and China boost investor confidence, leading to increased demand for copper as businesses feel more secure in their investment strategies and future projections. This increased demand helps to support higher copper prices.

- Infrastructure projects: China's ambitious infrastructure projects, from high-speed rail lines to sprawling urban developments, are massive consumers of copper. Reduced investment in these projects due to trade uncertainty directly impacts copper demand. Conversely, renewed spending on infrastructure translates directly to increased copper consumption.

- Slowdowns in the Chinese economy: Economic slowdowns in China dampen copper demand significantly, exerting downward pressure on prices. This highlights the inherent sensitivity of the copper market to the overall health of the Chinese economy. Monitoring Chinese economic indicators is, therefore, crucial for understanding future copper price movements.

Impact of Trade Uncertainty on Copper Prices

Uncertainty surrounding the China-US trade relationship creates significant volatility in the copper market. Investors react swiftly to news and speculation, resulting in sharp price fluctuations. Hedging strategies employed by businesses to mitigate risk further amplify the price sensitivity to trade developments. This market volatility is a direct consequence of the uncertainty surrounding trade policies.

- Negative trade news: Negative trade news often leads to a flight to safety, with investors moving away from riskier assets like copper. This reduces demand and exerts downward pressure on copper prices.

- Positive trade signals: Conversely, positive trade signals can dramatically boost investor confidence, leading to increased investment in copper and pushing prices upward.

- Increased hedging costs: Volatility in the copper market increases hedging costs for businesses, adding to their overall expenses and potentially impacting their investment decisions regarding copper.

- Market speculation: Market speculation driven by trade news can significantly influence copper prices, sometimes overriding fundamental supply and demand factors.

Alternative Factors Influencing Copper Prices

While China-US trade talks are a major factor, other elements influence copper prices. Global economic growth, supply chain disruptions, and production levels all play significant roles. The increasing demand for copper in the renewable energy and electric vehicle sectors adds another dimension to price forecasting. These are all important to consider when assessing the copper market.

- Global economic slowdowns: Global economic slowdowns reduce overall copper demand, particularly from manufacturing and construction sectors. This leads to lower copper prices.

- Mining production disruptions: Mining production disruptions due to labor disputes, natural disasters, or other unforeseen events can significantly impact copper supply, influencing prices.

- Renewable energy boom: The growing renewable energy sector, reliant on copper for its infrastructure, is a significant and rapidly increasing driver of copper demand, putting upward pressure on prices.

- Electric vehicle revolution: The expansion of the electric vehicle market further contributes to increasing copper demand. Electric vehicles contain significantly more copper than traditional combustion engine vehicles, which is a key factor contributing to the growing demand for the metal.

Conclusion

The recent increase in copper prices is undeniably linked to the ongoing China-US trade negotiations. While other factors influence the copper market, the uncertainty and volatility stemming from trade tensions play a crucial role in shaping investor sentiment and, ultimately, price levels. Understanding these dynamics is essential for navigating the complexities of the global commodities market and making informed decisions about the copper price.

Call to Action: Stay informed about the latest developments in China-US trade talks and their impact on copper price fluctuations. Regularly monitor the copper market and utilize reliable sources for informed decision-making regarding copper investments and trading strategies. For comprehensive copper price analysis and market insights, [link to relevant resource].

Featured Posts

-

Spak Kontroll I Baneses Se Aldes Dhe Xhovanes Nikolli

May 06, 2025

Spak Kontroll I Baneses Se Aldes Dhe Xhovanes Nikolli

May 06, 2025 -

Guelsen Bubikoglu Yesilcam In Unutulmaz Guezeli Buguen Nasil

May 06, 2025

Guelsen Bubikoglu Yesilcam In Unutulmaz Guezeli Buguen Nasil

May 06, 2025 -

Celtics Eastern Conference Semifinals Game Start Date And Predictions

May 06, 2025

Celtics Eastern Conference Semifinals Game Start Date And Predictions

May 06, 2025 -

Fortnites Sabrina Carpenter Skin A Look At The Inappropriate Accusations

May 06, 2025

Fortnites Sabrina Carpenter Skin A Look At The Inappropriate Accusations

May 06, 2025 -

The Met Gala Fashion And Love A Podcast Conversation With Colman Domingo

May 06, 2025

The Met Gala Fashion And Love A Podcast Conversation With Colman Domingo

May 06, 2025