Analysis Of Arkema's AMF CP 2025E1027752 Filing

Table of Contents

We will define key terms, explain the regulatory context, and interpret the filing's data, providing actionable insights for informed decision-making. We'll also show you how to access and interpret similar Arkema financial reports, empowering you to stay updated on the company's progress.

Understanding the AMF and its Regulatory Role in France

The Autorité des marchés financiers (AMF) is France's financial markets authority. It's responsible for regulating the securities market, protecting investors, and ensuring the transparency and stability of financial markets. Compliance with AMF regulations is paramount for companies like Arkema, ensuring public confidence and adherence to high standards of corporate governance. Failure to comply can result in significant penalties. Key legislation governing financial disclosures in France includes, but isn't limited to, the European Union's Market Abuse Regulation (MAR) and the French Code Monétaire et Financier.

- Overview of AMF's powers and responsibilities: The AMF oversees market operations, investigates misconduct, enforces regulations, and protects investor interests.

- Key regulations governing financial disclosures in France: These regulations mandate regular reporting of financial performance, significant events, and corporate governance practices.

- Penalties for non-compliance: These can range from fines to suspension of trading and even criminal prosecution.

Key Information Disclosed in Arkema's AMF CP 2025E1027752 Filing

This section requires access to the actual AMF CP 2025E1027752 filing to extract and summarize the specific data. The following is a hypothetical example, demonstrating the type of information one would find and analyze. Always refer to the official document for accurate information.

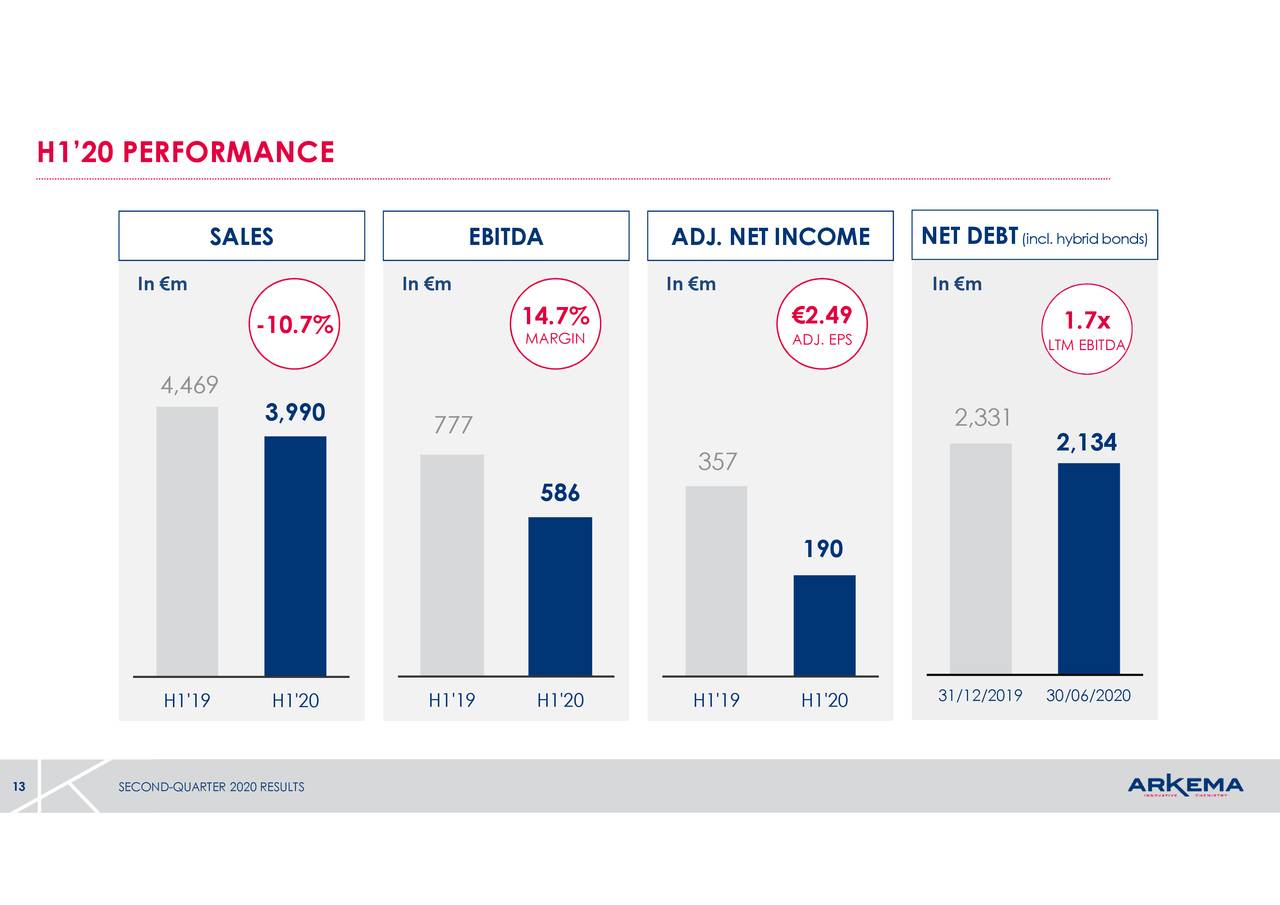

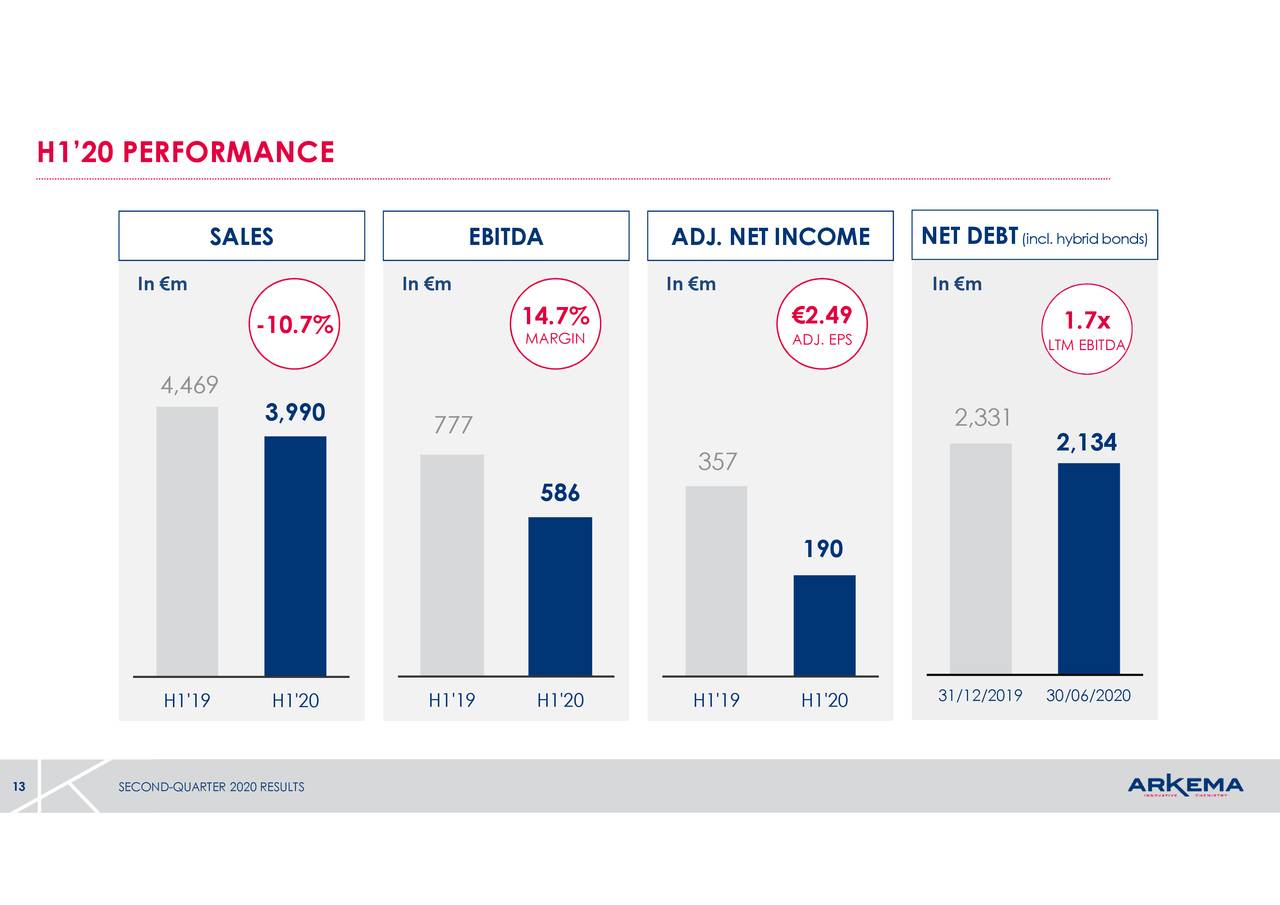

Financial Performance

- Revenue: (Insert hypothetical data from the filing, e.g., €X billion, showing a Y% increase/decrease compared to the previous year)

- Profits: (Insert hypothetical data, e.g., €Z million net income, with analysis of profit margins)

- Key financial ratios: (Insert hypothetical data for key ratios like Return on Equity (ROE), Debt-to-Equity ratio, etc., with analysis of their trends)

- Trends: (Discuss any significant trends observed in the financial data, e.g., growth in specific segments, cost-cutting measures, etc.)

Strategic Initiatives

- New products: (Describe any new product launches or developments mentioned in the filing, including their potential market impact.)

- Market expansion plans: (Detail any geographic expansion or diversification strategies outlined in the filing.)

- R&D investments: (Analyze the level of R&D investment and its focus areas, highlighting potential future growth drivers.)

Corporate Governance and Risk Management

- Board composition and structure: (Describe the board's makeup, including independent directors and committee structures.)

- Executive compensation: (Analyze executive compensation packages and their alignment with company performance.)

- Risk factors: (Summarize the key risk factors identified by Arkema, including financial, operational, and regulatory risks.)

Environmental, Social, and Governance (ESG) Factors

- Sustainability reports: (Mention the availability and key highlights of any sustainability reports included or referenced in the filing.)

- Environmental impact data: (Analyze any environmental performance data disclosed, such as carbon emissions or waste reduction initiatives.)

Analysis of the Filing’s Implications for Arkema

The data presented in the AMF CP 2025E1027752 filing (hypothetical data used here) suggests [insert your interpretation based on the hypothetical data]. This could positively or negatively influence investor sentiment and the company's stock price. A comparison with previous filings and industry competitors’ performance will provide further context.

- Short-term and long-term implications for Arkema: (Analyze potential short-term and long-term impacts on Arkema's operations, profitability, and market position.)

- Potential market reaction to the disclosed information: (Discuss the potential market response based on the information revealed in the filing.)

- Comparison with industry competitors' performance: (Compare Arkema's performance with that of its key competitors to assess its relative strength and position in the market.)

Accessing and Interpreting Similar Arkema Filings

To stay informed about Arkema's financial performance and strategic direction, regularly review its AMF filings and other investor relations materials.

- Steps to access Arkema's filings on the AMF website: (Provide clear step-by-step instructions on how to locate the filings on the AMF website.)

- Tips for understanding complex financial information: (Offer guidance on interpreting financial statements, including key ratios and metrics.)

- Resources for interpreting financial statements: (Recommend relevant websites, publications, or courses that can help investors understand financial information.)

Conclusion: Actionable Insights from Arkema's AMF CP 2025E1027752 Filing

Analyzing Arkema's AMF filings is crucial for understanding its financial health, strategic plans, and overall performance. This detailed analysis of the AMF CP 2025E1027752 filing (or whichever filing is being reviewed), though hypothetical in this example, highlights the importance of regularly reviewing such documents for informed investment decisions and overall market understanding. Understand Arkema's AMF disclosures to make better-informed decisions. Stay updated on Arkema's financial reports by regularly visiting the AMF website and Arkema's investor relations page. Analyze Arkema's filings to gain a comprehensive understanding of this important player in the specialty chemicals sector.

Featured Posts

-

Fourth Law Firm Agrees To Pro Bono Trump Work To Protect Government Clients

Apr 30, 2025

Fourth Law Firm Agrees To Pro Bono Trump Work To Protect Government Clients

Apr 30, 2025 -

Car Crash At After School Camp Results In Four Deaths

Apr 30, 2025

Car Crash At After School Camp Results In Four Deaths

Apr 30, 2025 -

Where To Watch Ru Pauls Drag Race Season 17 Episode 9 Without Paying

Apr 30, 2025

Where To Watch Ru Pauls Drag Race Season 17 Episode 9 Without Paying

Apr 30, 2025 -

Schneider Electrics Sustainability Leadership Winning The Worlds Most Sustainable Corporation Award

Apr 30, 2025

Schneider Electrics Sustainability Leadership Winning The Worlds Most Sustainable Corporation Award

Apr 30, 2025 -

Kynyda Myn Eam Antkhabat Tyaryan Mkml

Apr 30, 2025

Kynyda Myn Eam Antkhabat Tyaryan Mkml

Apr 30, 2025