Analysis Of The Proposed Trump Tax Cuts From House Republicans

Table of Contents

Individual Income Tax Changes

The proposed Trump Tax Cuts from House Republicans included substantial changes to the individual income tax system. These alterations aimed to simplify the tax code and stimulate economic growth through tax reductions.

Proposed Changes to Tax Brackets and Rates

The plan proposed significant alterations to tax brackets and marginal tax rates. Compared to existing legislation, these changes resulted in lower rates for many taxpayers.

- Bracket 1 (0-10%): The proposed plan might have slightly altered the lower-income bracket threshold. Further research into specific bill language is required to confirm exact changes.

- Bracket 2 (10-12%): This bracket likely experienced an increase in its upper limit, reflecting an expansion of the lower tax rate range.

- Higher Brackets (Above 12%): The higher income tax brackets saw reductions in their marginal tax rates, offering substantial tax relief for high earners. However, the precise percentage changes are dependent on the specific legislative proposal being considered. It's crucial to consult official government documents for precise figures.

Standard Deduction and Exemptions

The House Republican Trump Tax Cuts also aimed to simplify the tax code by adjusting the standard deduction and personal exemptions.

- Increased Standard Deduction: The standard deduction was significantly increased, potentially eliminating the need for itemized deductions for many taxpayers. This simplification aims to streamline tax filing for middle and lower-income individuals.

- Elimination of Personal Exemptions: Personal exemptions were eliminated, offsetting the benefits of the increased standard deduction to a certain degree. This shift intended to make the tax code more efficient. The net effect on tax liability varied significantly based on family size and income.

- Impact on Tax Liability: The combined effects of these changes resulted in lower tax liabilities for many, but the impact varied greatly depending on individual circumstances and income levels.

Impact on Child Tax Credits and Other Deductions

Changes to family-related tax benefits formed a significant aspect of the proposed Trump Tax Cuts.

- Enhanced Child Tax Credit: The child tax credit was potentially expanded, offering greater tax relief to families with children.

- Other Deductions: Other deductions, such as those for dependent care and education expenses, may have faced adjustments. These modifications, though potentially beneficial, also likely had varying impacts across different socioeconomic groups. More specific analysis is needed to determine these effects with certainty.

Corporate Tax Rate Reductions

A cornerstone of the House Republican tax plan was a dramatic reduction in the corporate tax rate. This change aimed to boost business investment, job creation, and overall economic growth.

Proposed Corporate Tax Rate

The proposed cut to the corporate tax rate was substantial, representing a significant departure from prior tax policies.

- Rate Reduction: The proposed reduction lowered the corporate tax rate considerably, making the US more competitive in the global marketplace, at least according to proponents.

- Impact on Competitiveness: The decrease intended to improve the US's global competitiveness by reducing the tax burden on businesses.

- International Implications: The lower rate also had potential implications for multinational corporations and international taxation, impacting US-based investments and foreign investments into the US.

Impact on Corporate Tax Revenue

The reduction in the corporate tax rate was expected to significantly affect government tax revenue.

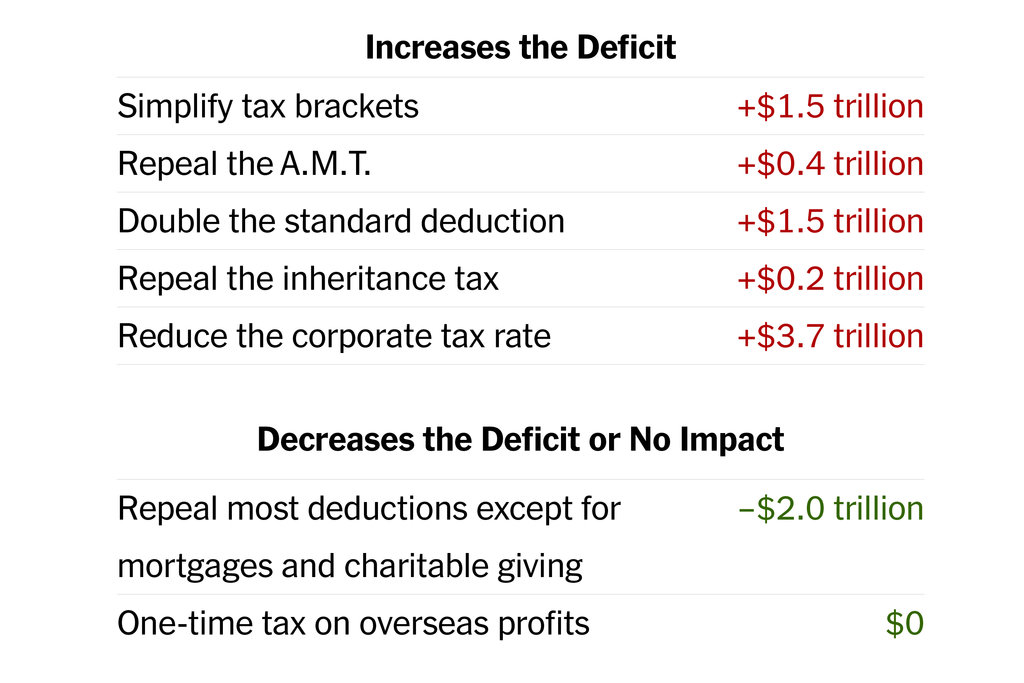

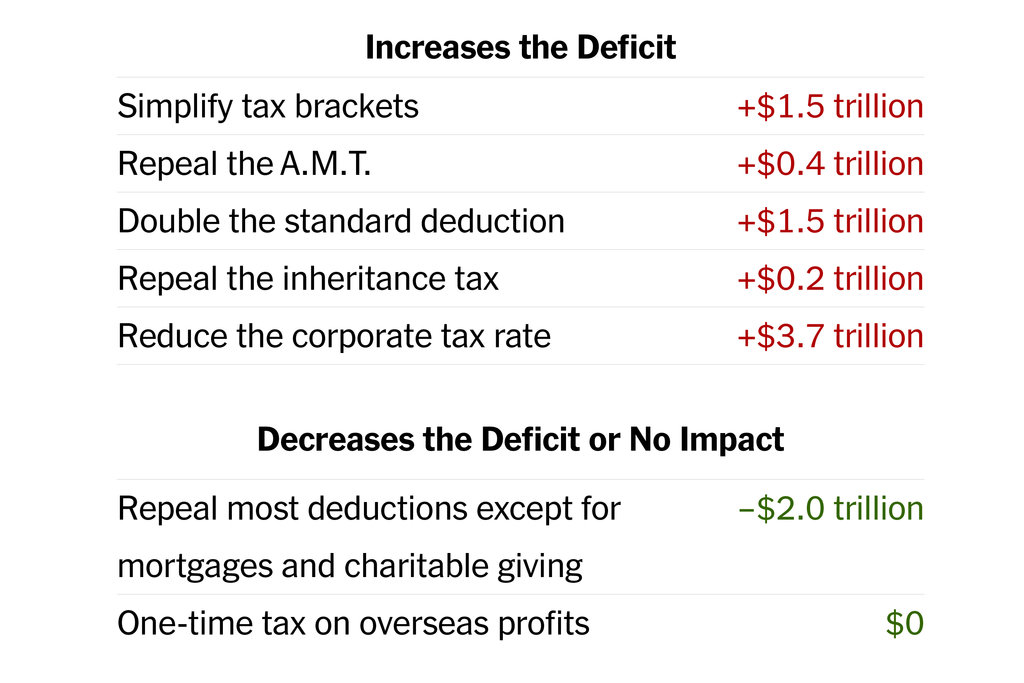

- Reduced Revenue: Lower rates invariably lead to less tax revenue collected, resulting in a potential impact on the federal budget deficit.

- Offsetting Measures: While advocates argued that economic growth stimulated by the lower tax rates would offset some of the lost revenue, the degree of offsetting is a matter of ongoing debate and economic modeling.

- Fiscal Implications: The long-term fiscal consequences of these tax cuts remained a major point of contention, particularly concerning the national debt.

Economic Analysis and Potential Consequences

The economic ramifications of the House Republican Trump Tax Cuts were extensively debated.

Projected Economic Growth

Supporters of the tax cuts projected robust economic growth stimulated by increased business investment and consumer spending.

- Stimulus Effect: The proponents argued that tax cuts would act as an economic stimulus, leading to increased GDP growth.

- Economic Models: Various economic models were employed to predict the effects, but these models differed widely in their projections.

- Uncertainty: The actual level of economic growth, if any, resulting from the tax changes remains a significant area of uncertainty.

Potential for Increased National Debt

The lower tax rates were projected to increase the national debt due to the substantial reduction in government revenue.

- Debt Increase: The reduction in tax revenue directly contributed to a larger budget deficit and an escalating national debt.

- Fiscal Sustainability: Questions regarding the long-term fiscal sustainability of this policy received significant attention.

- Long-Term Impact: The long-term impact on the national debt and the economy, under various economic scenarios, was a hotly debated subject.

Distributional Effects of the Tax Cuts

The proposed Trump Tax Cuts were criticized for disproportionately benefiting higher-income earners.

- Income Inequality: The tax cuts were accused of worsening income inequality by providing significantly more tax relief to wealthier individuals and corporations.

- Regressive Effects: Critics argued that the plan had regressive effects, benefiting those at the top while offering less relief to low- and middle-income families.

- Fairness Concerns: The distributional effects raised considerable concerns about tax fairness and equity.

Conclusion: Evaluating the Long-Term Effects of the House Republican Trump Tax Cuts

The House Republican Trump Tax Cuts represent a complex and multifaceted policy initiative with potentially significant and far-reaching consequences. While proponents argued for increased economic growth and job creation, critics raised concerns about rising national debt and increased income inequality. The actual economic impact and distributional effects remain subjects of ongoing debate and analysis. Further research and ongoing monitoring are essential to accurately assess the long-term effects of these tax changes. To form your own informed opinion on the Trump's proposed tax cuts, we urge you to delve deeper into the available data from reputable sources such as the Congressional Budget Office and the Tax Policy Center. Understanding the intricacies of the Republican tax plan analysis is vital for informed participation in the political process.

Featured Posts

-

Dominasi Persipura Menang Telak 8 0 Atas Rans Fc Di Playoff Liga 2

May 13, 2025

Dominasi Persipura Menang Telak 8 0 Atas Rans Fc Di Playoff Liga 2

May 13, 2025 -

Zad Kamerata 10 Aktori Spasili Zhivot V Realniya Zhivot

May 13, 2025

Zad Kamerata 10 Aktori Spasili Zhivot V Realniya Zhivot

May 13, 2025 -

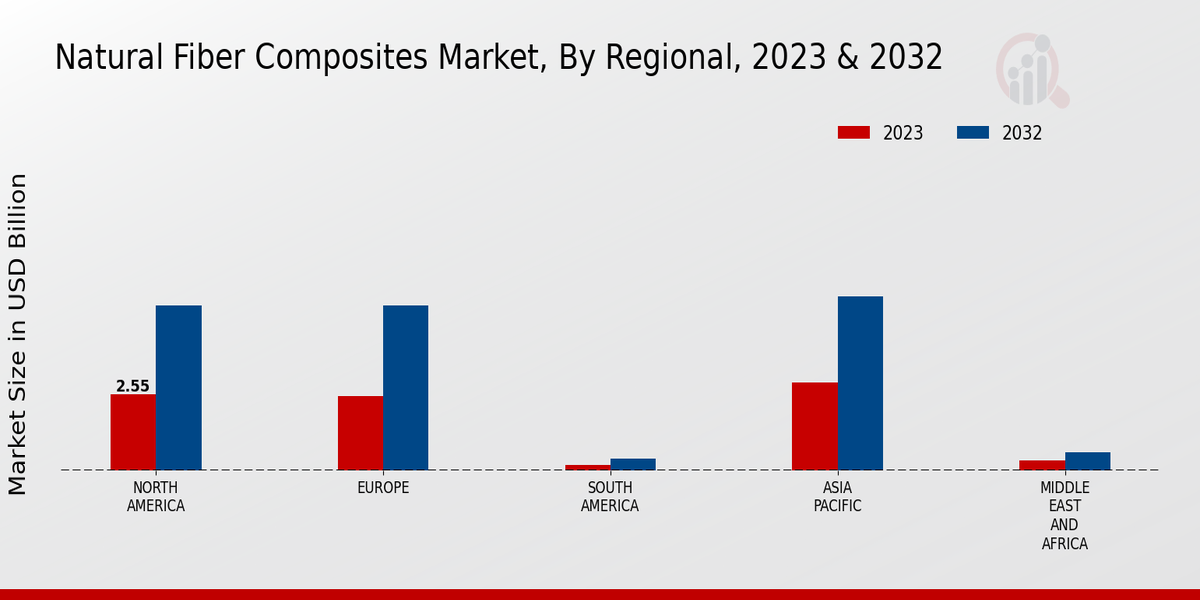

Growth Opportunities In The Global Natural Fiber Composites Market To 2029

May 13, 2025

Growth Opportunities In The Global Natural Fiber Composites Market To 2029

May 13, 2025 -

Leonardo Di Caprio Hatalmas Gazsija A Mozik Pusztulasa

May 13, 2025

Leonardo Di Caprio Hatalmas Gazsija A Mozik Pusztulasa

May 13, 2025 -

Ver Atalanta Vs Bologna Online Serie A Fecha 32 En Tn

May 13, 2025

Ver Atalanta Vs Bologna Online Serie A Fecha 32 En Tn

May 13, 2025