Analysis: PBOC's Reduced Yuan Support And Market Reactions

Table of Contents

The People's Bank of China (PBOC)'s recent shift in its approach to managing the Yuan, marked by a noticeable reduction in its support for the currency, has sent ripples through global financial markets. This strategic move has significant implications for the Chinese economy and international trade. This analysis delves into the PBOC's actions, exploring the underlying motivations and examining the subsequent market reactions, focusing on exchange rates, foreign investment flows, and the overall impact on economic stability. Understanding PBOC's Yuan support, or lack thereof, is crucial for navigating the complexities of the current global economic landscape.

H2: The PBOC's Reduced Intervention

H3: Decreased Yuan Buying

The PBOC's reduced intervention in the foreign exchange market is evident in its decreased purchasing of Yuan. This shift signifies a departure from the previous policy of actively managing the Yuan's exchange rate against major currencies like the US dollar. The PBOC has subtly altered its trading bands, allowing for greater fluctuation in the Yuan's value. While explicit statements from the PBOC have been measured, the actions speak volumes.

- Specific examples of reduced intervention: Data from the last quarter shows a significant decrease in the PBOC's forex market activity compared to the previous year. Detailed analysis of daily trading volumes reveals a clear trend of reduced intervention.

- Dates of significant policy changes: While no single date marks a dramatic shift, a gradual easing of intervention began around [Insert Date/Month/Year], culminating in a more pronounced change around [Insert Date/Month/Year].

- References to official PBOC announcements: Although direct announcements on reducing Yuan support have been limited, statements regarding a more market-oriented approach to exchange rate management can be interpreted as a confirmation of this shift. [Insert links to relevant PBOC publications or news articles]. These indirect pronouncements highlight the nuanced nature of the PBOC's strategy. The focus is on a managed float rather than a rigidly controlled exchange rate.

H3: Shifting Priorities

The PBOC's decision to reduce Yuan intervention reflects a shift in its priorities. Maintaining sufficient foreign exchange reserves remains a concern, but other factors now take precedence. Supporting domestic economic growth without relying on artificial currency manipulation is paramount. The PBOC is likely prioritizing combating inflationary pressures and fostering a more sustainable, market-driven economic environment.

- Economic indicators pointing to the need for less intervention: Rising inflation, alongside a strengthening domestic economy, lessens the need for aggressive Yuan support. [Insert relevant economic data and charts].

- Analysis of the PBOC's changing priorities: The PBOC's focus is shifting from short-term exchange rate stability to long-term economic health. This suggests a greater willingness to accept short-term volatility in the Yuan's value in exchange for sustainable economic growth.

- Potential risks of continued heavy intervention: Prolonged artificial support for the Yuan could deplete foreign exchange reserves and distort market mechanisms, hindering long-term economic stability.

H2: Market Reactions to Reduced Yuan Support

H3: Yuan Depreciation

The reduced PBOC Yuan intervention has resulted in a measurable depreciation of the Yuan against major currencies. [Insert chart showing USD/CNY, EUR/CNY, and JPY/CNY exchange rates over the relevant period]. The Yuan's value has experienced increased volatility, reflecting the market's adjustment to the new policy.

- Yuan exchange rate fluctuations: The range of fluctuations has widened significantly since the PBOC's shift, indicating a more responsive market.

- Comparison with historical data: The current depreciation is [Insert percentage] compared to the average over the previous [Insert timeframe]. This highlights the magnitude of the change.

- Analysis of short-term and long-term trends: While short-term fluctuations are expected, the long-term trend will depend on various factors, including global economic conditions and domestic economic performance.

H3: Impact on Foreign Investment

The PBOC's actions have had a mixed impact on foreign investment in China. While some investors may be hesitant due to the increased Yuan volatility, others see opportunities in a more market-driven exchange rate system. The impact on FDI and portfolio investment is complex and requires further observation.

- Changes in FDI flows: Early indications suggest [Insert data on FDI inflows and outflows]. Further data is needed for conclusive analysis.

- Impact on stock markets: The Chinese stock market has shown [Insert description of market reaction – increase, decrease, or volatility].

- Analysis of investor sentiment: Investor sentiment is currently [Insert description of investor sentiment – positive, negative, or cautious]. This is influenced by several factors beyond PBOC's Yuan support.

H3: Implications for Global Markets

The PBOC's decision has global implications, influencing international trade and financial markets. A weaker Yuan could benefit Chinese exports, impacting global trade balances and potentially causing adjustments in other economies.

- Impact on global trade balances: The reduced PBOC Yuan support could lead to increased Chinese exports, potentially affecting trade balances in other countries.

- Potential ripple effects in other economies: Currency fluctuations often have ripple effects throughout the global economy. The impact on other countries will depend upon their individual trade relationships with China.

- Implications for international monetary policy: The PBOC's actions could prompt reactions from other central banks managing their own exchange rates.

3. Conclusion:

The PBOC's reduced Yuan support marks a significant shift in China's monetary policy. This decision, motivated by factors such as maintaining sufficient reserves and fostering sustainable economic growth, has led to Yuan depreciation, impacting foreign investment flows and causing ripple effects across global markets. The long-term implications remain to be seen, but this move signals a more market-oriented approach to exchange rate management. It's crucial to monitor these developments closely, as PBOC's Yuan support, or the lack thereof, will continue to shape the global economic landscape. To stay updated on the ongoing analysis of PBOC's Yuan support and its evolving consequences, subscribe to our newsletter [insert link] for continuous insights and expert commentary.

Featured Posts

-

Microsoft Job Cuts A Detailed Analysis Of The 6 000 Layoffs

May 15, 2025

Microsoft Job Cuts A Detailed Analysis Of The 6 000 Layoffs

May 15, 2025 -

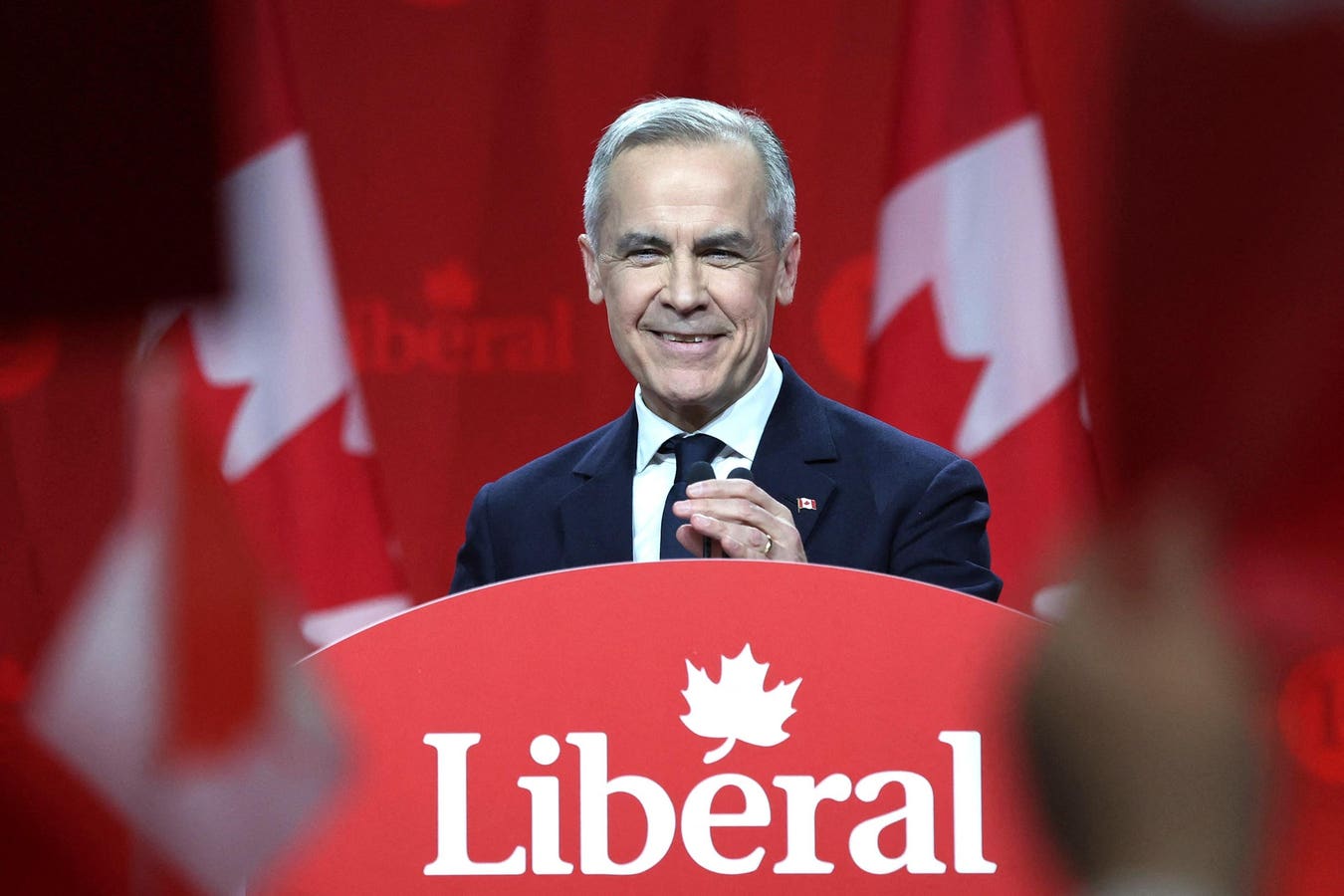

Mark Carney And The Bulldog Banker Reshaping Canadas Resources

May 15, 2025

Mark Carney And The Bulldog Banker Reshaping Canadas Resources

May 15, 2025 -

Pley Off N Kh L Gol Ovechkina Ne Predotvratil Porazhenie Vashingtona

May 15, 2025

Pley Off N Kh L Gol Ovechkina Ne Predotvratil Porazhenie Vashingtona

May 15, 2025 -

Angstcultuur Bij De Npo Tientallen Medewerkers Spreken Zich Uit Tegen Baas

May 15, 2025

Angstcultuur Bij De Npo Tientallen Medewerkers Spreken Zich Uit Tegen Baas

May 15, 2025 -

Update Georgia Southwestern State University Campus Incident Concluded

May 15, 2025

Update Georgia Southwestern State University Campus Incident Concluded

May 15, 2025