Analysis: Saudi Arabia's New Rule Change And Its Effect On The ABS Market

Table of Contents

Saudi Arabia's recent regulatory overhaul is sending ripples through its financial sector, particularly impacting the Asset-Backed Securities (ABS) market. This analysis delves into the specifics of these new rules, examining their potential consequences for market participants and the overall economic landscape. We will explore the implications for both domestic and international investors interested in the Saudi Arabian ABS market, focusing on how these changes will shape the future of ABS issuance and trading.

The New Rule Changes: A Detailed Overview

Specifics of the New Regulations:

The Saudi Central Bank (SAMA), the primary regulatory body for financial institutions in Saudi Arabia, recently implemented significant changes to the regulations governing Asset-Backed Securities. While precise details may vary depending on the specific type of ABS, key changes include:

- Increased Capital Requirements: Issuers of ABS may now face stricter capital adequacy requirements, potentially limiting the amount of ABS they can issue.

- Enhanced Due Diligence: More stringent due diligence processes are now mandatory for underlying assets included in ABS offerings. This aims to reduce risks associated with asset quality.

- Stricter Disclosure Requirements: The new regulations impose more transparent disclosure requirements, demanding greater detail on the underlying assets, risks associated with the ABS, and the issuer's financial health. This move aims to protect investors.

- Changes to Eligibility Criteria: The criteria for assets eligible for securitization under an ABS structure have been revised, potentially impacting the types of assets that can be included in future offerings. For example, certain types of consumer loans might now face stricter eligibility requirements.

These changes are officially documented in [insert link to official government document or relevant legal citation here].

Rationale Behind the Rule Changes:

The stated goals of SAMA's new regulations are multifaceted. They primarily aim to:

- Enhance Market Transparency: The increased disclosure requirements seek to foster a more transparent ABS market, encouraging greater investor confidence.

- Strengthen Investor Protection: By increasing due diligence and improving disclosure, the new regulations aim to protect investors from potential risks associated with ABS investments.

- Promote Financial Stability: The stricter capital requirements aim to contribute to the overall stability of the Saudi Arabian financial system by reducing systemic risk associated with ABS.

- Align with International Best Practices: These changes reflect a broader trend towards stricter regulation of the ABS market globally, aligning Saudi Arabia with international best practices.

Impact on ABS Issuance

Changes in Issuance Volume:

The new regulations are projected to have a mixed impact on ABS issuance volume in the short term. The increased capital requirements and stricter eligibility criteria may lead to a temporary decrease in issuance, as issuers adapt to the new framework. However, in the long term, the increased transparency and investor protection provided by the regulations could stimulate greater investor confidence and potentially lead to a rise in issuance.

Shift in Types of ABS Issued:

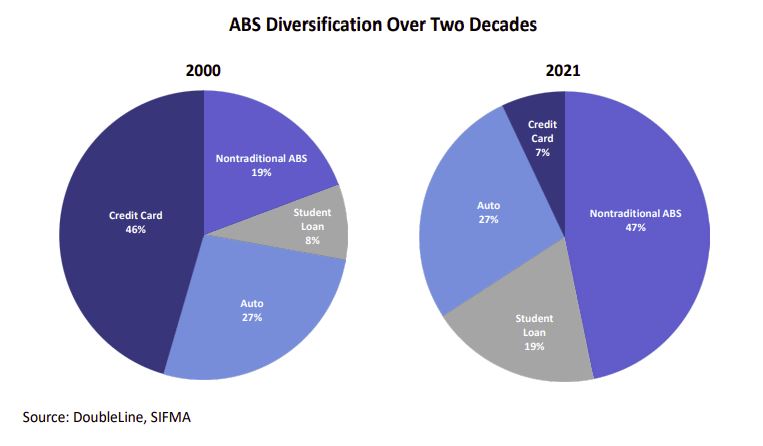

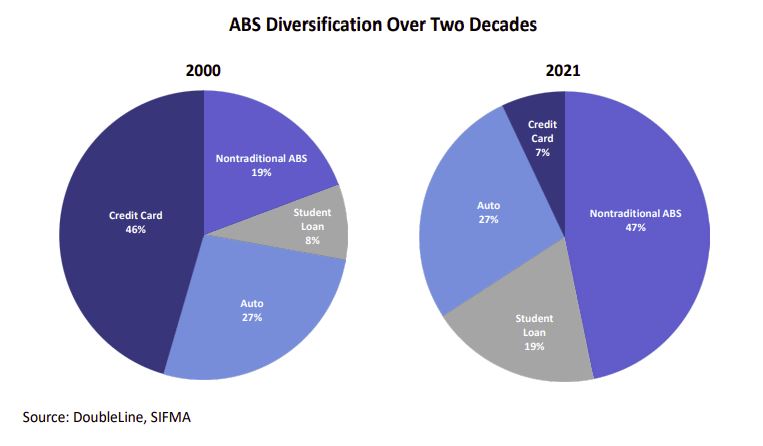

The revised eligibility criteria will likely influence the types of assets being securitized. We may see a shift towards assets with lower risk profiles, such as high-quality mortgages or government-backed loans, and potentially away from riskier assets. This could lead to a concentration in specific sectors and a reduction in the diversity of ABS products available in the market. Further analysis will be required to identify the precise changes in the types of assets being securitized.

Implications for Investors

Risk Assessment and Mitigation:

The new rules significantly change the risk assessment process for investors. While the increased transparency is positive, investors must carefully analyze the impact of the stricter capital requirements and the changes in eligible asset classes. Mitigation strategies may involve diversifying investments across different ABS offerings and thoroughly vetting issuers' financial strength and the quality of the underlying assets.

Return on Investment (ROI):

The impact on ROI is complex. While the stricter regulations could potentially reduce the risk of default, they could also lower potential returns. Increased competition and the shift towards less risky assets could also affect yield. International investors should carefully factor in currency exchange rate fluctuations and the broader macroeconomic environment in Saudi Arabia when evaluating potential ROI. Domestic investors might find themselves with fewer options compared to previously available ABS options.

Liquidity and Trading:

The changes could initially impact the liquidity and trading of ABS in the Saudi market. The reduced issuance volume in the short term may temporarily affect market depth. However, the increased transparency and stronger regulatory framework could, over time, attract more foreign and domestic investors, boosting liquidity and deepening the market. This effect will be dependent on the successful implementation of the new regulations.

The Broader Economic Context

Alignment with Vision 2030:

The new ABS regulations align with Saudi Arabia's Vision 2030, which aims to diversify the national economy and reduce reliance on oil revenues. By strengthening the financial sector and promoting greater transparency, these rules aim to attract foreign investment and encourage greater participation in the capital markets.

International Comparisons:

These changes bring Saudi Arabia's ABS market regulatory framework closer to international standards seen in developed markets. While the specifics of the regulations may differ from countries like the US or the UK, the overall focus on transparency, investor protection, and systemic risk management is a common theme in global regulatory efforts for the ABS market.

Conclusion

This analysis has examined the significant implications of Saudi Arabia's new rule changes on its ABS market. The alterations will likely lead to shifts in issuance volume, types of ABS offered, and investor strategies. The long-term effects remain to be seen, but understanding these changes is crucial for navigating the evolving landscape of the Saudi Arabian ABS market. Further analysis of the Saudi Arabia’s new rule change and its ongoing effect on the ABS market is needed, particularly as the market adapts to these new regulations.

Call to Action: Stay informed about the ongoing developments in Saudi Arabia's ABS market. Regularly review updates on regulatory changes and their impact to make informed decisions regarding investment in this dynamic sector. Continuous monitoring of the Saudi Arabia's new rule change and its effect on the ABS market is vital for all stakeholders.

Featured Posts

-

A Mecsek Baromfi Kft Kme Vedjegyes Termekei Kivalo Minoseg Frissesseg Es Iz

May 03, 2025

A Mecsek Baromfi Kft Kme Vedjegyes Termekei Kivalo Minoseg Frissesseg Es Iz

May 03, 2025 -

Christina Aguilera New Photoshoot Sparks Debate Over Excessive Photo Editing

May 03, 2025

Christina Aguilera New Photoshoot Sparks Debate Over Excessive Photo Editing

May 03, 2025 -

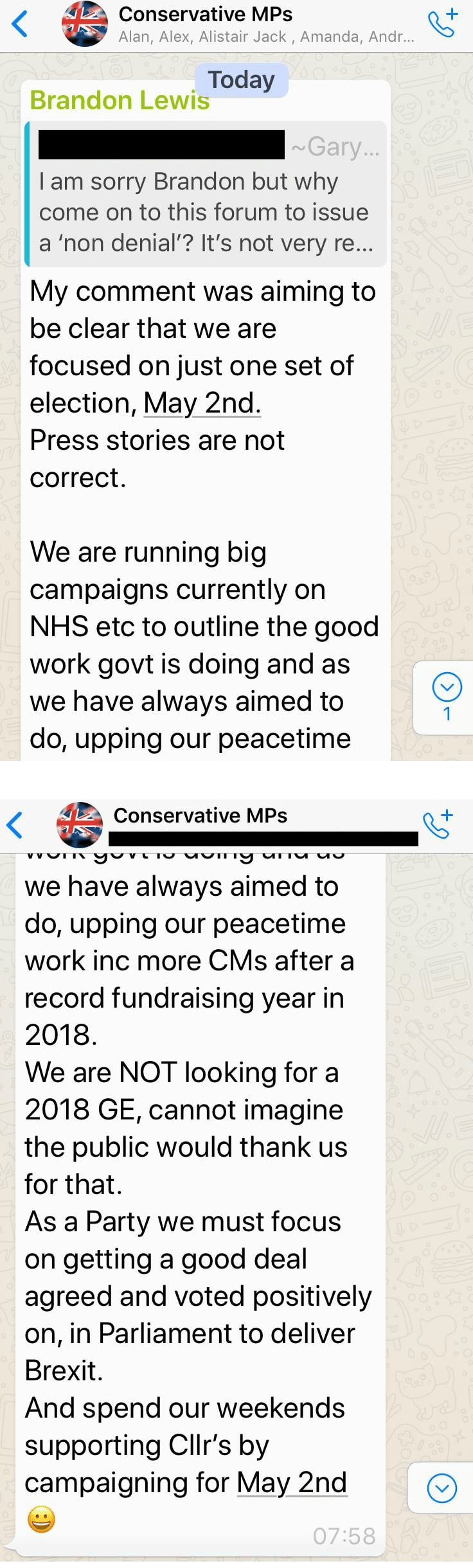

Farages Whats App Messages Fuel Reform Party Civil War

May 03, 2025

Farages Whats App Messages Fuel Reform Party Civil War

May 03, 2025 -

Reform Party Implodes Amidst Leaked Farage Whats App Messages

May 03, 2025

Reform Party Implodes Amidst Leaked Farage Whats App Messages

May 03, 2025 -

5

May 03, 2025

5

May 03, 2025