Analysis: The House's Passage Of The Amended Trump Tax Bill

Table of Contents

Key Amendments Introduced in the Amended Trump Tax Bill

The amended Trump tax bill introduced several crucial changes to the original legislation. These amendments aimed to address criticisms, refine certain provisions, and potentially broaden the bill's overall impact. Understanding these amendments is critical to grasping the full scope of the revised tax code.

-

Changes to Corporate Tax Rates: The amended bill may have adjusted the corporate tax rate, potentially increasing or decreasing it from the original 21%. This change would directly influence corporate profitability and investment strategies. The implications for small businesses and large corporations could differ significantly, leading to varied economic effects.

-

Individual Tax Bracket Adjustments: Modifications to individual tax brackets are another key aspect of the amended bill. This could involve altering the thresholds for different tax brackets, impacting the tax burden on individuals across various income levels. Specific changes to the standard deduction, child tax credit, or other individual tax deductions are also likely to have been included.

-

Reforms to Itemized Deductions: The amended bill might have revised or eliminated certain itemized deductions, potentially affecting taxpayers who previously benefited from these deductions. Understanding which deductions were altered or removed is essential for taxpayers planning their financial strategies. This could include changes to mortgage interest deductions, state and local tax deductions, and charitable contribution deductions.

-

Tax Credits and Incentives: The amendments may have introduced new tax credits or modified existing ones, aiming to incentivize specific economic activities or support particular demographics. These could range from credits for renewable energy investments to expanded child care credits.

These are just a few examples; the specific details of each amendment would need to be carefully examined to assess their full impact. Keywords like "tax reform," "tax cuts," "tax brackets," "corporate tax," and "individual income tax" are central to understanding the changes.

The House Voting Process and Key Players

The House voting process for the amended Trump tax bill unfolded over several weeks, marked by intense debate and lobbying. The timeline involved committee hearings, floor debates, and procedural maneuvers that ultimately led to the final vote.

-

Timeline and Debates: [Insert details about the timeline, key dates, and the nature of the debates. Mention specific legislative hurdles overcome or challenges faced.]

-

Key Players: [Identify influential figures from both parties who played significant roles in supporting or opposing the bill. Note their positions and the arguments they presented. Mention names and political affiliations.]

-

Party Affiliations and Voting Patterns: [Analyze the voting patterns based on party affiliation. Note whether the bill passed with bipartisan support or along strict party lines. Discuss any significant defections within parties.]

Understanding the political dynamics surrounding the bill's passage, using keywords like "House of Representatives," "Congress," "legislation," "political parties," and "bipartisan support," is crucial for a complete analysis.

Economic Implications of the Amended Trump Tax Bill

The economic consequences of the amended Trump tax bill are multifaceted and potentially far-reaching. Analyzing both short-term and long-term effects is necessary for a complete understanding of its impact.

-

Short-Term Effects: [Discuss the potential immediate impacts, such as consumer spending, investment, and inflation.]

-

Long-Term Effects: [Analyze the potential long-term consequences, such as economic growth, job creation, and the national debt. Consider the potential for stimulating investment versus exacerbating inequality.]

-

Criticisms and Downsides: [Address potential negative consequences, such as increased income inequality, inflation, or a rise in the national debt.] Keywords like "economic growth," "GDP," "inflation," "job creation," "fiscal policy," and "national debt" are crucial for this section.

Public Opinion and Political Fallout

Public reaction to the amended Trump tax bill has been diverse and strongly partisan. Media coverage has been extensive, reflecting the wide range of opinions and concerns.

-

Public Reaction: [Summarize public opinion polls and surveys related to the bill's passage. Note the level of support or opposition and how it varied across demographic groups.]

-

Political Ramifications: [Analyze the potential political consequences of the bill's passage for both the ruling and opposing parties. Consider its impact on upcoming elections and future legislative agendas.]

-

Future Legislative Actions: [Speculate about potential future legislation that might result from or react to the amended tax bill. This might include further tax reforms or adjustments based on its economic impact.] Keywords such as "public opinion," "political impact," "media response," "election implications," and "future legislation" are vital here.

Conclusion: Assessing the Long-Term Impact of the Amended Trump Tax Bill Passage

The House's passage of the amended Trump tax bill represents a significant shift in US tax policy. The amendments introduced, the voting process, and the potential economic and political ramifications warrant close scrutiny. While the short-term effects might be varied, the long-term impacts on economic growth, income inequality, and the national debt remain to be seen. This analysis highlighted the key changes, the political maneuvering, and the potential economic consequences. It is crucial to continue monitoring the implementation and effects of this legislation. Stay informed about further developments regarding the amended Trump tax bill and its impact on you and the nation. Seek out reputable sources of information to stay abreast of the latest updates and analysis.

Featured Posts

-

Kartels Security Police Source Explains The Rationale Behind Restrictions In Trinidad And Tobago

May 23, 2025

Kartels Security Police Source Explains The Rationale Behind Restrictions In Trinidad And Tobago

May 23, 2025 -

Razvernutye Goroskopy I Predskazaniya Na Kazhdiy Den

May 23, 2025

Razvernutye Goroskopy I Predskazaniya Na Kazhdiy Den

May 23, 2025 -

How Joe Jonas Handled A Married Couple Fighting Over Him

May 23, 2025

How Joe Jonas Handled A Married Couple Fighting Over Him

May 23, 2025 -

Ser Aldhhb Eyar 21 Fy Qtr Alywm Alithnyn 24 Mars 2024

May 23, 2025

Ser Aldhhb Eyar 21 Fy Qtr Alywm Alithnyn 24 Mars 2024

May 23, 2025 -

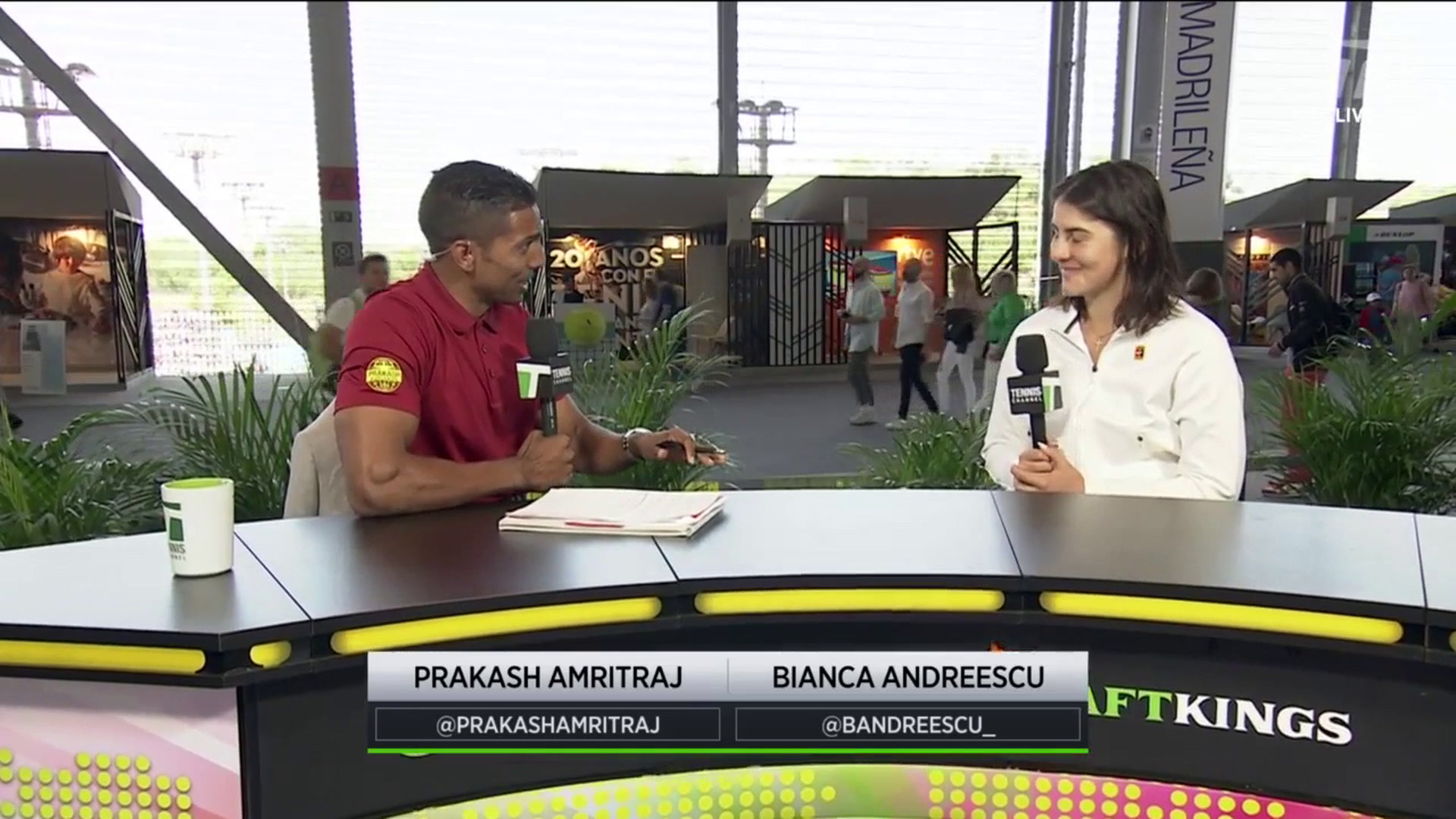

Andreescu Cruises Through To Madrid Open Round Two

May 23, 2025

Andreescu Cruises Through To Madrid Open Round Two

May 23, 2025