Analysis: The Trump White House And The Nippon-U.S. Steel Transaction

Table of Contents

The Transaction's Details and Context

The NSSMC acquisition involved the purchase of specific U.S. Steel assets, a transaction that unfolded against the backdrop of escalating trade tensions, particularly with China, during the Trump presidency. The timing of the deal, coinciding with the imposition of tariffs and other trade restrictions, added a layer of complexity to the situation. The precise financial terms were not publicly disclosed in full, but the acquisition undoubtedly involved a significant capital investment by NSSMC.

- Specific assets acquired: While the exact assets varied, the deal likely encompassed various steel production facilities, potentially including mills, processing plants, and related infrastructure.

- Total value of the transaction: The final valuation remained undisclosed, highlighting the private nature of certain aspects of this major steel transaction. However, industry analysts offered various estimations at the time, reflecting the significant financial commitment.

- Key players: Besides NSSMC and U.S. Steel, key players involved included various government officials within the Trump administration, particularly those involved in trade policy and national security reviews.

The deal's significance extended beyond mere corporate acquisition, becoming intertwined with the larger narrative of the Trump administration's economic and trade policies.

The Trump Administration's Response and Policy

The Trump White House's response to the Nippon Steel-U.S. Steel transaction was a critical aspect of the deal. While the administration publicly championed protecting American industries, its response to this foreign acquisition required careful consideration to maintain international relations while advancing its "America First" objectives. The Committee on Foreign Investment in the United States (CFIUS) played a pivotal role in reviewing the transaction, scrutinizing potential national security implications.

- Official Statements: Public statements from President Trump and Commerce Secretary Wilbur Ross, among others, offered insights into the administration's official stance and priorities. These statements would often emphasize the importance of American jobs and the need for a fair and balanced trade relationship.

- Investigations and Reviews: CFIUS's review process would have included investigations into potential risks to national security, including assessments of the impact on domestic steel production and supply chains.

- Impact of Tariffs: The pre-existing trade policies, particularly the tariffs imposed on steel imports, heavily influenced the economic landscape within which the transaction took place. These tariffs had the potential to either facilitate or hinder the deal, depending on their precise application.

The administration’s approach reflected a delicate balancing act between promoting free markets and protecting domestic interests.

Economic and Geopolitical Implications

The economic consequences of the Nippon Steel-U.S. Steel transaction were multifaceted, affecting both the American and Japanese steel industries. The geopolitical ramifications extended to US-Japan relations and the global steel market, raising significant questions about national security and supply chain resilience.

- Job Creation/Loss: The impact on US steel industry jobs was a key concern. While the deal potentially secured some existing jobs through continued operations, the long-term effects on employment remained a topic of ongoing debate.

- Global Steel Prices: The transaction likely influenced global steel prices, potentially impacting competitiveness in various markets.

- US Steel Competitiveness: The acquisition's impact on the competitiveness of the US steel industry was a central concern for policymakers and industry experts alike.

- Shifts in Global Steel Production: The deal shifted global steel production capacity, subtly altering the balance of power and influencing international trade dynamics.

These impacts underscore the intertwined nature of economic and geopolitical considerations in major steel transactions.

Comparative Analysis with Other Steel Transactions

To fully understand the Trump administration's approach, it is essential to compare the Nippon Steel-U.S. Steel transaction to other similar acquisitions during that period. Examining both domestic and international steel mergers and acquisitions provides valuable context.

- Comparable Transactions: Identifying similar deals across various countries allows for a comparative analysis of regulatory scrutiny, market impacts, and government responses.

- Differences in Regulatory Treatment: Comparing the regulatory pathways across different steel transactions reveals patterns and variances in the application of trade laws and national security reviews.

- Comparison of Market Outcomes: Assessing the outcomes of comparable transactions reveals whether the Trump administration's actions in the Nippon Steel case were consistent with its broader policy towards steel industry acquisitions.

Such a comparison helps evaluate the Trump administration's steel transaction policy within a broader global framework.

Conclusion

The Nippon Steel & Sumitomo Metal Corporation's acquisition of U.S. Steel assets during the Trump administration was a complex transaction with significant economic and geopolitical ramifications. The Trump White House's response, the involvement of CFIUS, and the existing trade policies all contributed to shaping the outcome. This analysis highlights the delicate balance between promoting free markets and protecting national interests in the global steel industry. Key takeaways include the significant impact on the US and Japanese steel industries, the complex interplay of trade policy and national security concerns, and the lasting effects on global steel market dynamics. Further research could explore the long-term consequences of this transaction, examining its ripple effects across various aspects of the global economy. To understand the full impact of the Trump era on US trade policy, further investigation into other similar "Trump White House and [company] transactions" is crucial.

Featured Posts

-

Zheng Qinwen Reaches Italian Open Semifinals Analysis And Highlights

May 26, 2025

Zheng Qinwen Reaches Italian Open Semifinals Analysis And Highlights

May 26, 2025 -

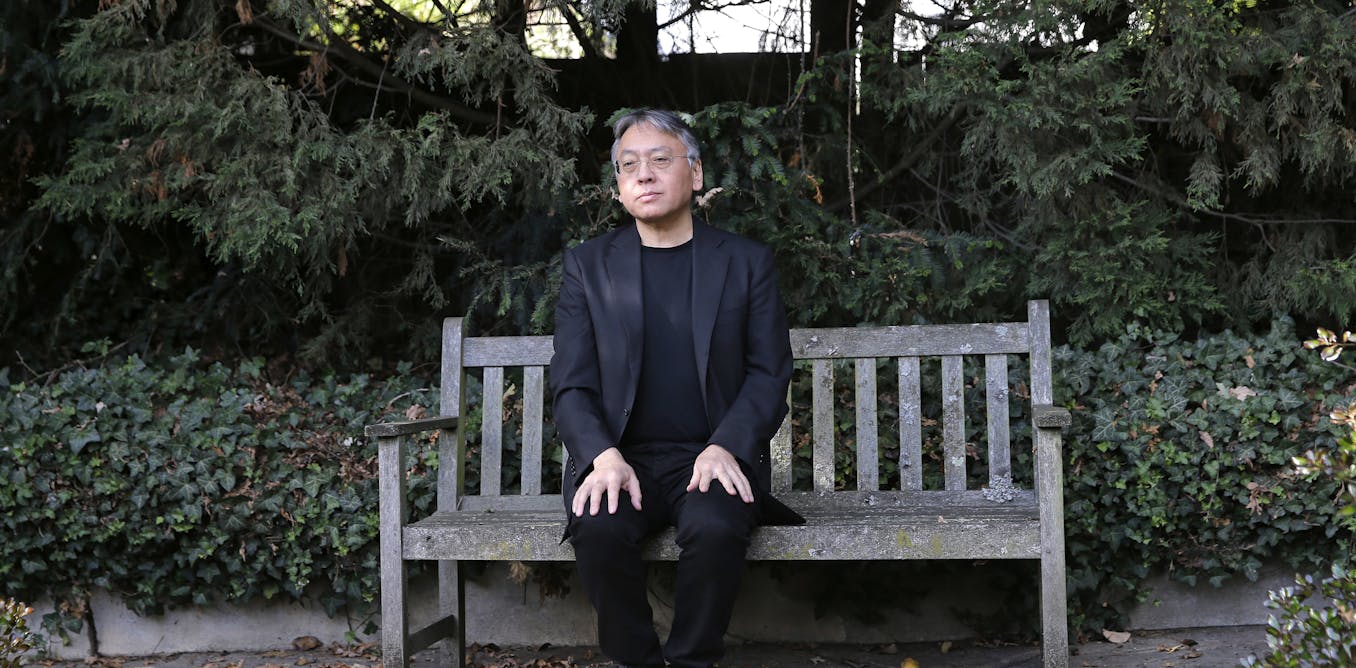

Remembering And Forgetting In The Works Of Kazuo Ishiguro

May 26, 2025

Remembering And Forgetting In The Works Of Kazuo Ishiguro

May 26, 2025 -

Is Naomi Campbell Banned From The 2025 Met Gala A Look At The Anna Wintour Conflict

May 26, 2025

Is Naomi Campbell Banned From The 2025 Met Gala A Look At The Anna Wintour Conflict

May 26, 2025 -

Le Reseau X D Elon Musk Plateforme De Diffusion Pour L Extreme Droite Europeenne

May 26, 2025

Le Reseau X D Elon Musk Plateforme De Diffusion Pour L Extreme Droite Europeenne

May 26, 2025 -

Best Ways To Watch The Monaco Grand Prix 2025 Online And On Tv

May 26, 2025

Best Ways To Watch The Monaco Grand Prix 2025 Online And On Tv

May 26, 2025