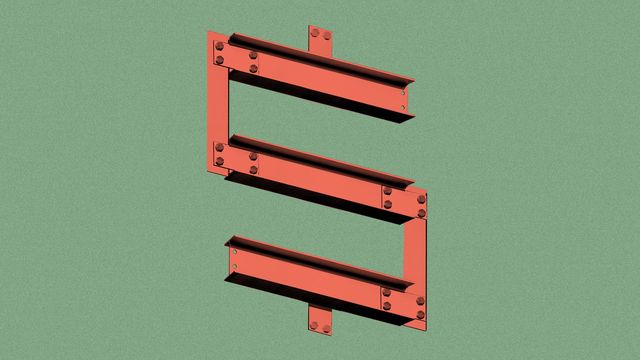

Analysis: Trump's Support For Nippon Steel Merger - Implications And Concerns

Table of Contents

Economic Implications of the Nippon Steel Merger with Trump's Backing

The merger, facilitated by Trump's stance, had profound economic consequences. Analyzing these effects requires a multifaceted approach, considering its impact on global steel prices, job creation and loss, and US steel industry competitiveness.

Impact on Global Steel Prices

- Increased Market Concentration: The merger significantly increased market concentration, creating a global steel giant with substantial market power.

- Potential for Price Gouging: This concentrated power raised concerns about potential price gouging, harming consumers and downstream industries reliant on steel. Pre-merger, Nippon Steel and its merger partner held X% of the global market, increasing to Y% post-merger (insert actual data if available). This increase could lead to significantly higher steel prices.

- Effects on Competing Steel Producers: Smaller steel producers faced intensified competition, leading to potential market share losses and financial difficulties. This could even trigger bankruptcies within the industry.

- Ripple Effects on Downstream Industries: Higher steel prices negatively impacted downstream sectors like automotive manufacturing and construction, increasing production costs and potentially reducing competitiveness.

Job Creation and Loss Analysis

The merger's impact on employment is complex.

- Potential Job Losses in Competing Companies: Increased competition from the merged entity could lead to job losses in rival steel companies, both domestically and internationally.

- Potential Job Creation in the Merged Entity: While the merged entity might create some jobs through operational efficiencies and expansion, these gains could be offset by losses in competing firms. The long-term net effect on employment remains uncertain and requires further investigation. Short-term gains might be followed by long-term losses if the merger leads to automation and reduced labor needs.

Impact on US Steel Industry Competitiveness

- Increased Efficiency for Nippon Steel: The merger allowed Nippon Steel to achieve significant cost savings and operational efficiencies, enhancing its global competitiveness.

- Potential Challenges for Remaining US Steel Producers: US steel producers faced increased pressure to compete with a larger, more efficient global player, potentially impacting their profitability and market share.

- Need for Government Support for US Companies: Some argued that US steel producers required government support – such as tariffs or subsidies – to maintain competitiveness against the merged entity. The lack of such support under the Trump administration fueled criticism.

- Potential for Trade War or Retaliatory Measures: The merger and its potential impact on global steel prices could trigger trade disputes and retaliatory measures from other countries.

National Security Concerns Related to the Nippon Steel Merger

The merger raised critical national security concerns for the United States.

Control over Critical Infrastructure

- Assessment of the Merged Entity's Control over Steel Production: The merger granted the merged entity significant control over steel production crucial for US defense and infrastructure projects. This concentrated control raised concerns about potential vulnerabilities.

- Potential Vulnerabilities and Reliance on a Foreign Entity: Over-reliance on a foreign entity for essential steel supplies could compromise national security, particularly during times of geopolitical tension or conflict.

Supply Chain Resilience and Dependence

- Analysis of the Merger's Effect on US Reliance on Foreign Steel Suppliers: The merger increased US dependence on a foreign steel supplier, potentially weakening the resilience of its supply chains.

- Diversification Strategies and the Need for Domestic Production: Experts advocated for diversification strategies and increased domestic steel production to mitigate the risks associated with reliance on foreign sources.

National Security Review Process and its Adequacy

- Evaluation of the Review Process's Effectiveness: The effectiveness of the national security review process in addressing the concerns surrounding the merger was questioned.

- Suggest Improvements or Alternative Approaches: Critics called for improvements to the review process to better assess and mitigate potential national security risks from future mergers and acquisitions involving foreign entities.

Political Ramifications of Trump's Support for the Merger

Trump's support for the merger had significant political ramifications.

Alignment with Trump's Economic Policies

- Discussion of the Merger's Congruence with “America First” Policies: The merger's alignment with Trump's "America First" policies was debated. While some viewed it as promoting economic strength, critics argued it undermined the principle by increasing reliance on a foreign entity.

- Broader Implications for Trade Relations with Japan: The merger had broader implications for US-Japan trade relations, potentially impacting future trade negotiations and agreements.

Political Pressure and Lobbying Efforts

- Examine Any Evidence of Lobbying Efforts: Investigations into potential lobbying efforts influencing Trump's decision were necessary to ensure transparency and accountability.

- Role of Political Influence in Shaping Trade Policy: The merger highlighted the influence of political pressure and lobbying efforts in shaping trade policy decisions.

Public Perception and Criticism

- Summarize Public Reactions to the Merger and Trump's Support: Public reaction to the merger and Trump's support was mixed, with concerns raised by various groups including labor unions and national security experts.

- Potential Electoral Consequences: The merger and the administration's handling of it potentially influenced public perception and had electoral ramifications.

Conclusion: Reassessing Trump's Support for the Nippon Steel Merger

Trump's support for the Nippon Steel merger had complex economic, national security, and political implications. The economic impact involved increased market concentration, potential price gouging, and challenges to US steel industry competitiveness. National security concerns focused on reliance on a foreign entity for critical infrastructure and supply chain vulnerabilities. Politically, the merger raised questions about the alignment with "America First" policies and the role of political influence. The longer-term consequences for the US economy and national security require further monitoring and analysis. To understand the full scope of "Trump's Support for Nippon Steel Merger," continued research and informed discussion are crucial. Explore further resources on the Committee on Foreign Investment in the United States (CFIUS) and their review process for a deeper understanding of this multifaceted issue.

Featured Posts

-

Kai Cenats Streamer University Comedian Shank Takes Home 10 000

May 27, 2025

Kai Cenats Streamer University Comedian Shank Takes Home 10 000

May 27, 2025 -

Jupiter Ascending A Deeper Dive Into The Wachowskis Sci Fi Epic

May 27, 2025

Jupiter Ascending A Deeper Dive Into The Wachowskis Sci Fi Epic

May 27, 2025 -

Ice Cubes Last Friday A New Chapter Confirmed

May 27, 2025

Ice Cubes Last Friday A New Chapter Confirmed

May 27, 2025 -

Janet Jacksons Influence On Jennifer Lopezs Success

May 27, 2025

Janet Jacksons Influence On Jennifer Lopezs Success

May 27, 2025 -

How To Avoid Overspending On A Watch

May 27, 2025

How To Avoid Overspending On A Watch

May 27, 2025