Analysis: Uber Stock And The Future Of Robotaxi Services

Table of Contents

The ride-hailing market is booming, projected to reach [insert compelling statistic, e.g., a multi-billion dollar valuation by 2030]. Simultaneously, billions are being poured into the development of autonomous vehicle technology, promising a revolution in transportation. However, the stock price of Uber, a key player in this evolving landscape, remains volatile. This analysis delves into the complex relationship between Uber Stock and the Future of Robotaxi Services, exploring its current financial health, the competitive landscape, regulatory hurdles, and the ultimate potential for robotaxi technology to reshape Uber's trajectory. Our aim is to analyze the current state of Uber stock and its potential future performance, deeply intertwined with the success or failure of its ambitious robotaxi program.

H2: Uber's Current Financial Performance and Investment in Autonomous Vehicles

H3: Analyzing Uber's Q[Insert latest quarter, e.g., 4 2023] Earnings Report:

Uber's recent earnings report reveals a mixed picture. While [mention positive aspects, e.g., overall revenue growth], the company continues to report significant losses related to its Advanced Technologies Group (ATG), the division focused on autonomous vehicle development.

- Key figures: [Insert specific data points from the latest earnings report, e.g., revenue figures, net income/loss, R&D spending on ATG].

- Quarter-over-quarter comparison: [Compare key metrics to previous quarters, highlighting trends – growth or decline in specific areas related to the robotaxi program].

- Analyst predictions: [Summarize analyst opinions and predictions regarding Uber's financial future, particularly concerning the profitability of the robotaxi initiative].

H3: The Technological Hurdles Facing Uber's Robotaxi Program:

The path to fully autonomous vehicles is fraught with challenges. Uber, like its competitors, faces significant hurdles:

- Software development: Achieving Level 5 autonomy (fully driverless operation) requires overcoming complex software challenges related to perception, decision-making, and safety in unpredictable environments.

- Regulatory hurdles: Obtaining necessary permits and licenses for testing and deploying autonomous vehicles varies widely across jurisdictions, creating a complex regulatory landscape.

- Safety concerns: Ensuring the safety of autonomous vehicles is paramount. Public trust is crucial, and any accidents involving robotaxis could severely impact Uber's reputation and stock price.

- Infrastructure requirements: The deployment of robotaxis requires robust infrastructure, including high-definition mapping, communication networks, and charging stations.

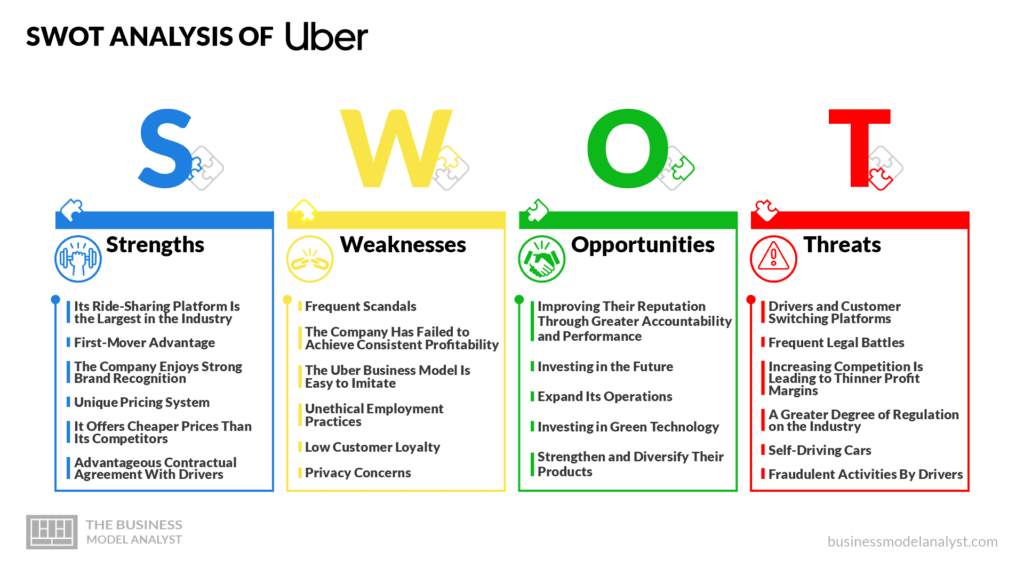

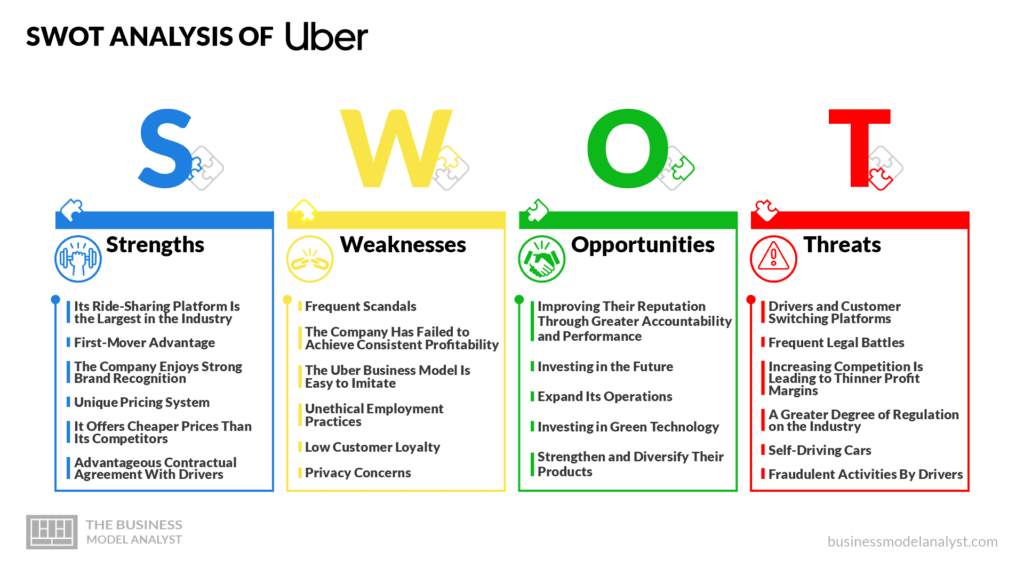

H2: The Competitive Landscape of the Autonomous Vehicle Market

H3: Key Competitors and Their Strategies:

Uber faces stiff competition from established players and ambitious newcomers:

-

Waymo: Google's self-driving technology company possesses a significant technological advantage and extensive testing data.

-

Cruise: General Motors' autonomous vehicle subsidiary is rapidly expanding its operations in select cities.

-

Tesla: Elon Musk's company is integrating its Autopilot system into its vehicles, aiming to achieve full self-driving capabilities.

-

Competitive Analysis: [Compare Uber's ATG with those of its competitors in terms of technology, funding, and market penetration. Highlight strengths and weaknesses].

-

Market share projections: [Cite industry reports providing projections for market share among various players, including Uber].

-

Partnerships and acquisitions: [Mention any significant partnerships or acquisitions that may impact the competitive landscape].

H3: The Impact of Competition on Uber's Stock Price:

The performance of competitors significantly impacts investor sentiment towards Uber. Positive news from competitors can lead to a sell-off in Uber stock, while setbacks can boost investor confidence.

- Market reactions: [Provide examples of how market events (e.g., competitor announcements, successful funding rounds) affected Uber's stock price].

- Investor confidence: [Analyze investor confidence levels based on market trends and news related to the autonomous vehicle sector].

- Potential scenarios: [Outline several possible scenarios for Uber's market position, considering different levels of success for its robotaxi program and its competitors].

H2: Regulatory and Legal Considerations Impacting Robotaxi Deployment

H3: Navigating the Complex Regulatory Landscape:

The regulatory environment for autonomous vehicles varies significantly across different regions:

- State-by-state regulations: The United States lacks a uniform national standard, creating a patchwork of regulations that complicate deployment.

- International regulations: International standards are still evolving, adding another layer of complexity for companies with global ambitions.

- Lobbying efforts: [Discuss Uber's lobbying efforts to influence regulations and promote the adoption of its robotaxi technology].

- Legislative changes: [Analyze potential future legislative changes that could either facilitate or hinder the deployment of autonomous vehicles].

H3: Liability and Insurance Concerns:

Accidents involving autonomous vehicles raise complex liability and insurance questions:

- Insurance costs: The cost of insuring autonomous vehicles is currently high, impacting profitability.

- Potential lawsuits: The legal ramifications of accidents involving robotaxis could be substantial for Uber.

- Legal precedents: [Discuss any existing legal precedents related to accidents involving autonomous vehicles that might influence future cases].

H2: The Long-Term Potential of Robotaxi Services for Uber's Growth

H3: Market Size and Growth Projections for Robotaxi Services:

The potential market for robotaxi services is enormous:

- Market research data: [Cite reputable market research reports providing estimates for the size and growth of the robotaxi market].

- Growth drivers: [Identify key factors that could drive the growth of the robotaxi market, e.g., increasing urbanization, labor shortages].

- Market penetration: [Analyze Uber's potential market share, considering its existing ride-hailing network and technological capabilities].

H3: Potential for Increased Profitability and Efficiency:

Successful robotaxi deployment could significantly boost Uber's profitability:

- Reduced labor costs: Eliminating human drivers represents substantial cost savings.

- Increased efficiency: Optimized routing and scheduling algorithms could lead to increased efficiency and higher utilization rates.

- New revenue streams: Robotaxis could open up new revenue streams, such as subscription services or targeted advertising.

Conclusion:

This analysis reveals a complex picture for Uber Stock and the Future of Robotaxi Services. While Uber faces significant financial and technological challenges, the potential rewards of successful robotaxi deployment are substantial. The competitive landscape is intensely competitive, and navigating the regulatory and legal complexities will be crucial. A cautiously optimistic outlook suggests that Uber's future is inextricably linked to its ability to overcome these challenges and capitalize on the long-term potential of autonomous vehicle technology. Further research into Uber stock performance and industry analysis of the autonomous vehicle sector, perhaps by following leading financial news outlets and analysts specializing in this disruptive technology, is crucial for any investor considering exposure to this dynamic market. Understanding the intricacies of robotaxi services and their impact on Uber's future is essential for informed investment decisions.

Featured Posts

-

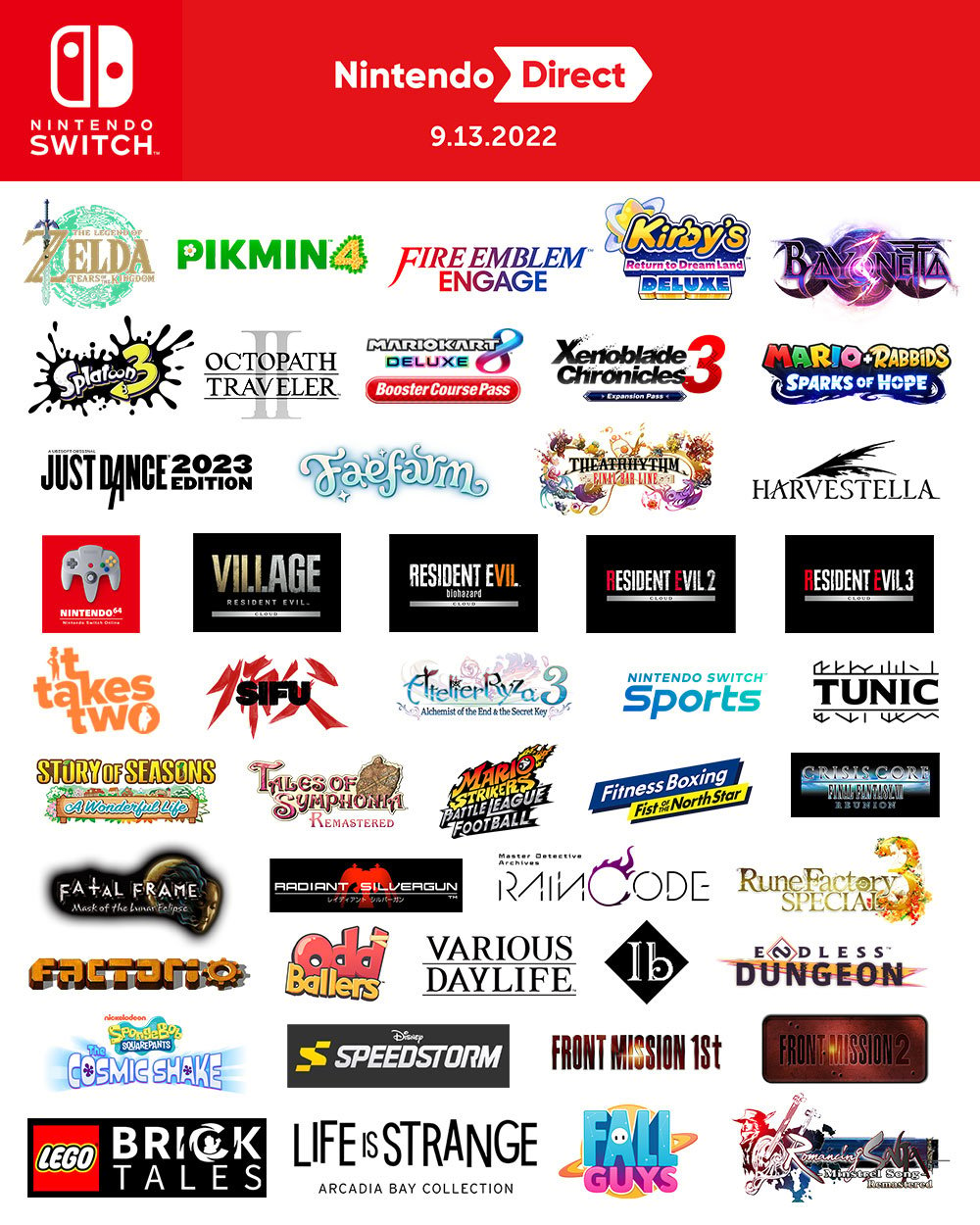

Nintendo Direct March 2025 Ps 5 And Ps 4 Game Announcements A Realistic Look

May 08, 2025

Nintendo Direct March 2025 Ps 5 And Ps 4 Game Announcements A Realistic Look

May 08, 2025 -

School Timing Adjustments Lahore Psl 2024

May 08, 2025

School Timing Adjustments Lahore Psl 2024

May 08, 2025 -

Imminent Benefit Cuts Dwps Planned Changes Explained

May 08, 2025

Imminent Benefit Cuts Dwps Planned Changes Explained

May 08, 2025 -

Stephen King Adaptation The Contest From Hell Trailer Released

May 08, 2025

Stephen King Adaptation The Contest From Hell Trailer Released

May 08, 2025 -

Announced March 2024 Ps Plus Premium And Extra Games

May 08, 2025

Announced March 2024 Ps Plus Premium And Extra Games

May 08, 2025

Latest Posts

-

Bitcoin Madenciliginin Gelecegi Son Mu

May 09, 2025

Bitcoin Madenciliginin Gelecegi Son Mu

May 09, 2025 -

Bitcoin Price Surge Is This A Long Term Rebound

May 09, 2025

Bitcoin Price Surge Is This A Long Term Rebound

May 09, 2025 -

Bitcoin Madenciliginde Yeni Bir Doenem Son Mu Baslangic Mi

May 09, 2025

Bitcoin Madenciliginde Yeni Bir Doenem Son Mu Baslangic Mi

May 09, 2025 -

The Bitcoin Rebound What Investors Need To Know Now

May 09, 2025

The Bitcoin Rebound What Investors Need To Know Now

May 09, 2025 -

Bitcoin Madenciligi Yaklasan Son

May 09, 2025

Bitcoin Madenciligi Yaklasan Son

May 09, 2025