Analyst's Bitcoin Chart (May 6): Signs Point To An Upcoming Rally

Table of Contents

Technical Indicators Suggesting a Bitcoin Price Surge

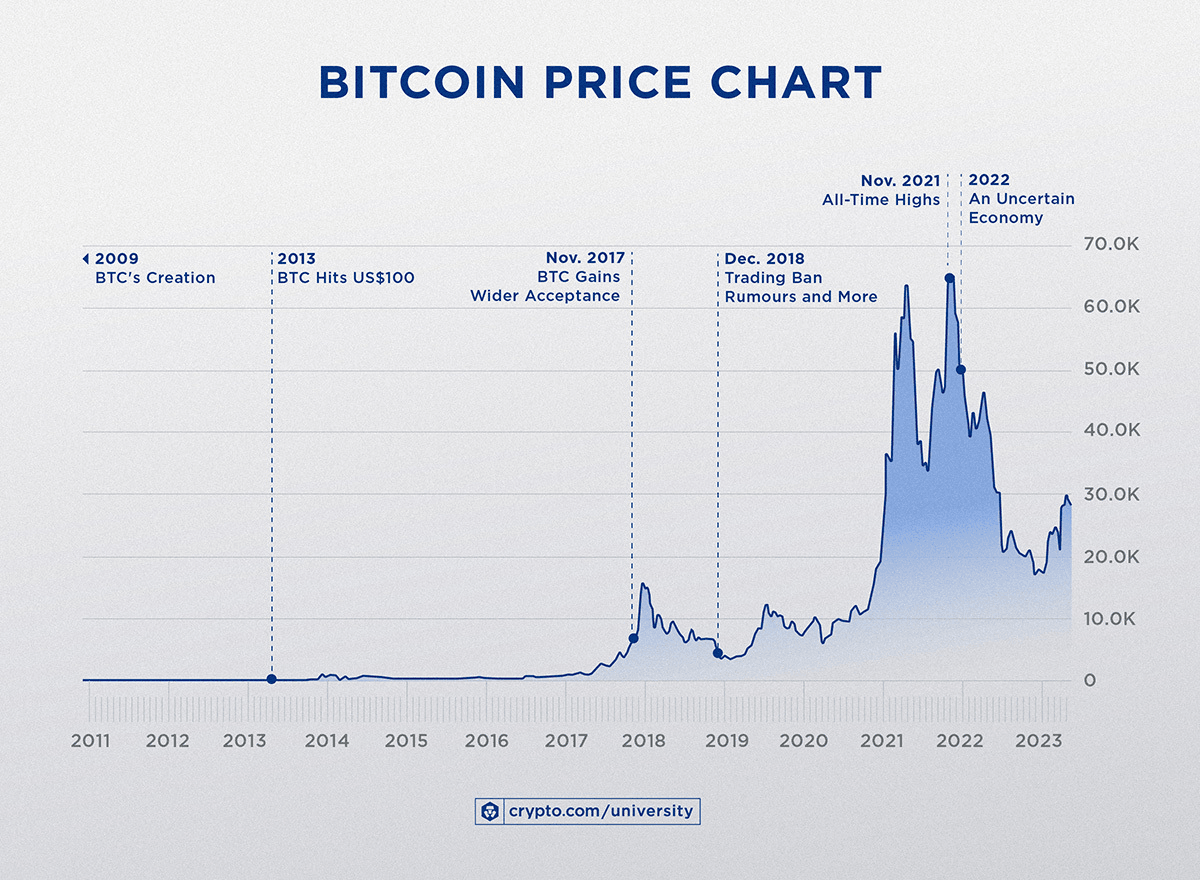

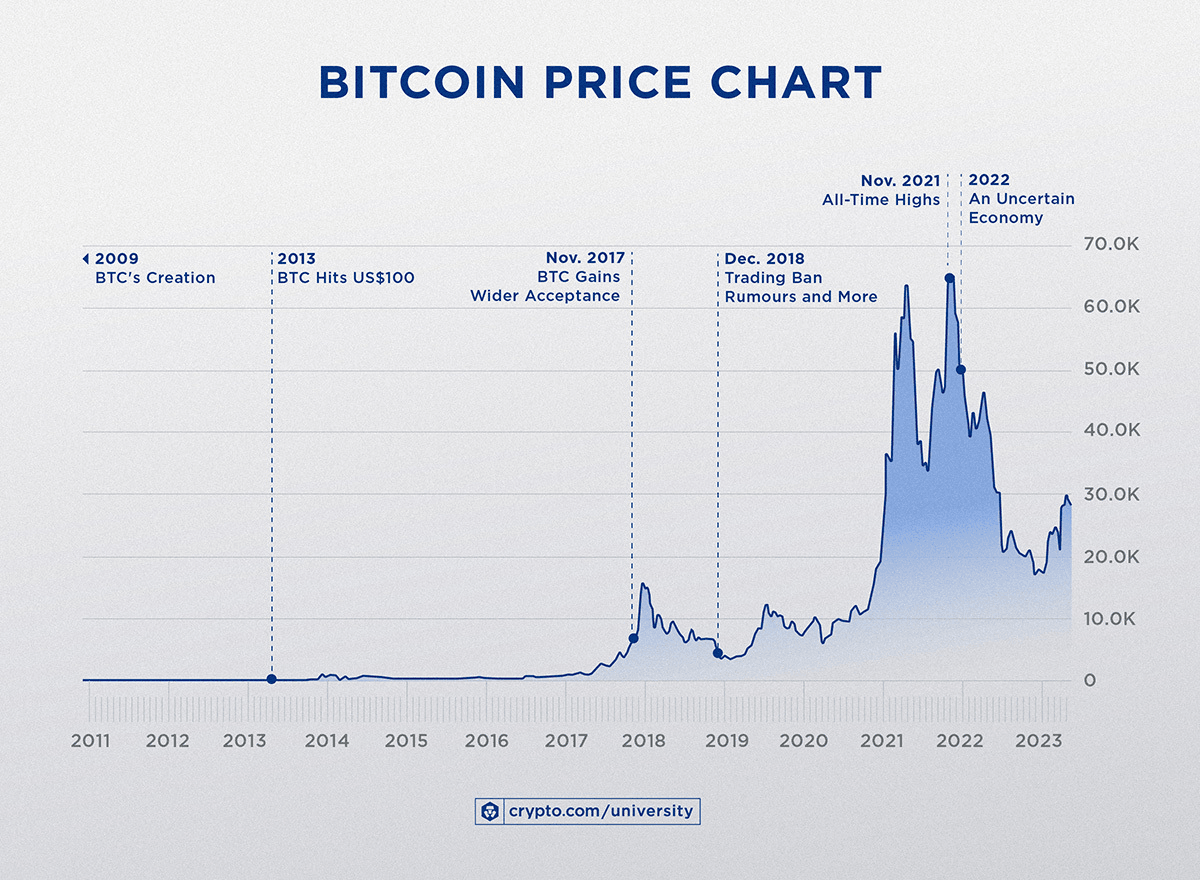

Technical analysis provides valuable insights into potential price movements. Let's examine key indicators from the May 6th Bitcoin chart:

RSI (Relative Strength Index) Analysis

The RSI is a momentum oscillator measuring the magnitude of recent price changes to evaluate overbought or oversold conditions. On May 6th, the Bitcoin RSI showed a reading of [Insert RSI value here – e.g., 55], indicating a move out of oversold territory and suggesting potential upward momentum.

- RSI Value (May 6th): [Insert specific value]

- Overbought/Oversold Zones: Typically, readings above 70 are considered overbought, while readings below 30 are oversold.

- Historical Context: Historically, similar RSI readings have preceded significant price increases in Bitcoin. [Insert example or link to relevant chart]. (Include a chart snippet here showing the RSI)

MACD (Moving Average Convergence Divergence) Analysis

The MACD is another trend-following momentum indicator. On May 6th, the Bitcoin MACD displayed [Insert MACD status here – e.g., a bullish crossover]. This suggests a potential shift from bearish to bullish momentum.

- MACD Line and Signal Line: [Describe the position of the lines and their relationship – e.g., MACD line crossing above the signal line].

- Potential Bullish Crossover: This crossover often signals the beginning of an upward trend.

- Historical Performance: Previous bullish crossovers have been followed by substantial price increases. (Include a chart snippet here showing the MACD)

Support and Resistance Levels

Support and resistance levels are crucial in identifying potential price reversals or breakouts. On May 6th, Bitcoin found support around [Insert Support level] and faced resistance around [Insert Resistance level]. A breakout above the resistance level could trigger a significant price surge.

- Support Level: [Specific price level] – This level has historically held strong support.

- Resistance Level: [Specific price level] – Breaking above this level could signal a strong bullish trend.

- Probability of Price Action: Based on historical data, the probability of a breakout above the resistance is [Insert percentage or qualitative assessment – e.g., high]. (Include a chart snippet here showing support and resistance levels)

On-Chain Data Supporting a Potential Bitcoin Rally

On-chain data provides insights into the underlying network activity and investor behavior. Several indicators on May 6th pointed towards a potential rally:

Increased Bitcoin Network Activity

Increased network activity often precedes price increases. On May 6th, we observed:

- Transaction Volume: [Insert data – e.g., a significant increase compared to the previous week].

- Hash Rate: [Insert data – e.g., a rise in the Bitcoin network's computational power].

- Implication: This heightened activity suggests growing interest and potential upward price pressure.

Whale Accumulation

Whale activity, referring to large-scale transactions by institutional investors, can significantly impact Bitcoin's price. May 6th data suggested:

- Large Transactions: [Describe evidence of large transactions – e.g., significant accumulation of Bitcoin by known whales].

- On-Chain Metrics: [Mention specific on-chain metrics supporting whale accumulation].

- Implications: This accumulation signals strong belief in Bitcoin's future price and provides substantial support.

Macroeconomic Factors Influencing Bitcoin's Price

Macroeconomic conditions play a significant role in Bitcoin's price. On May 6th:

Inflation and Monetary Policy

Inflation and central bank policies influence investor sentiment towards Bitcoin as a hedge against inflation.

- Current Inflation Rates: [Mention current inflation rates and their trends].

- Central Bank Actions: [Discuss any relevant central bank actions and their potential impact on Bitcoin].

- Impact on Bitcoin: Continued inflation and potential monetary easing could drive investors towards Bitcoin as a store of value.

Regulatory Developments

Regulatory clarity or uncertainty can significantly influence Bitcoin's price.

- Regulatory News: [Mention any significant regulatory news or announcements from May 6th].

- Impact on Market Sentiment: [Analyze the potential impact of the news on market sentiment].

- Overall Price Influence: Positive regulatory developments can boost investor confidence and lead to price increases.

Conclusion

The Analyst's Bitcoin Chart (May 6) reveals a confluence of positive signals. Technical indicators such as the RSI and MACD suggest bullish momentum. On-chain data points towards increased network activity and potential whale accumulation. Furthermore, macroeconomic factors, including inflation and regulatory developments, create a favorable environment for a Bitcoin price surge. Based on this analysis, an upcoming Bitcoin rally seems increasingly likely.

Keep an eye on the Bitcoin chart and follow the Analyst's Bitcoin Chart updates for further insights into potential price movements. Stay informed on future Bitcoin price predictions and conduct your own thorough research before making any investment decisions. Remember, this analysis is for informational purposes only and not financial advice.

Featured Posts

-

Kyren Paris Late Homer Secures Rain Soaked Angels Victory Over White Sox

May 08, 2025

Kyren Paris Late Homer Secures Rain Soaked Angels Victory Over White Sox

May 08, 2025 -

Arsenal Manager Arteta Under Fire From Collymore

May 08, 2025

Arsenal Manager Arteta Under Fire From Collymore

May 08, 2025 -

160 Year Old Pierce County House To Become Park

May 08, 2025

160 Year Old Pierce County House To Become Park

May 08, 2025 -

Psg Vence Al Lyon En Su Propio Estadio

May 08, 2025

Psg Vence Al Lyon En Su Propio Estadio

May 08, 2025 -

Champions League Final Owen Hargreaves Arsenal Vs Psg Prediction

May 08, 2025

Champions League Final Owen Hargreaves Arsenal Vs Psg Prediction

May 08, 2025

Latest Posts

-

Superman Sneak Peek Kryptos Attack On The Man Of Steel

May 08, 2025

Superman Sneak Peek Kryptos Attack On The Man Of Steel

May 08, 2025 -

Superman Vs Darkseids Legion July 2025 Dc Comic Book Preview

May 08, 2025

Superman Vs Darkseids Legion July 2025 Dc Comic Book Preview

May 08, 2025 -

James Gunns Daily Planet Photo A Subtle Superman Easter Egg For Jimmy Olsens 85th

May 08, 2025

James Gunns Daily Planet Photo A Subtle Superman Easter Egg For Jimmy Olsens 85th

May 08, 2025 -

Summer Of Superman Kryptos Whistle Worthy Appearance Next Week

May 08, 2025

Summer Of Superman Kryptos Whistle Worthy Appearance Next Week

May 08, 2025 -

Krypto Joins Superman A Whistle Stop Summer Special Next Week

May 08, 2025

Krypto Joins Superman A Whistle Stop Summer Special Next Week

May 08, 2025