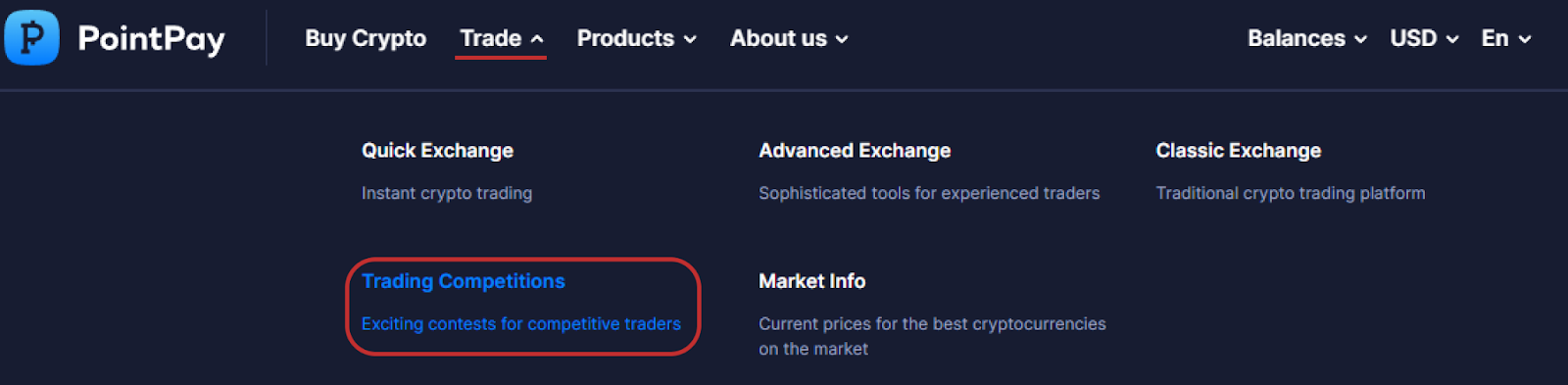

Analyzing AIMSCAP's Participation In The World Trading Tournament (WTT)

Table of Contents

AIMSCAP's Trading Strategies and Tactics at the WTT

AIMSCAP's approach to the WTT involved a multifaceted trading strategy, incorporating elements of both long-term and short-term trading. Their performance highlights the complexities of balancing these approaches within a high-pressure competitive environment. The effectiveness of their strategies varied depending on market conditions.

- Long-Term Strategies: AIMSCAP demonstrated a calculated approach to long-term investments, focusing on fundamental analysis and identifying undervalued assets. This strategy yielded consistent, albeit slower, gains.

- Short-Term Strategies: AIMSCAP employed short-term strategies, including scalping, to capitalize on short-term market fluctuations. This proved more volatile, leading to both substantial profits and losses.

- Risk Management: A crucial aspect of AIMSCAP's strategy was their rigorous risk management protocols. They consistently used stop-loss orders to limit potential losses on individual trades, mitigating overall risk exposure.

Successful Trades: Several successful trades stemmed from accurately predicting market corrections, utilizing fundamental analysis to identify undervalued assets poised for growth.

Unsuccessful Trades: Losses were primarily attributed to misjudging short-term market volatility and attempting aggressive scalping strategies in highly unpredictable conditions.

Comparative Analysis: Compared to competitors who heavily favored aggressive short-term strategies, AIMSCAP's balanced approach minimized extreme risk, resulting in a more stable overall performance.

AIMSCAP's Team Composition and Collaboration during the WTT

AIMSCAP fielded a team comprised of specialists with diverse backgrounds in quantitative analysis, fundamental analysis, and risk management. This diversity was a significant strength. However, the effectiveness of teamwork and communication could have been improved.

- Team Composition: The team included experts in various aspects of trading, fostering a well-rounded approach to market analysis. However, a lack of experience in high-pressure competitive environments was apparent at times.

- Collaboration: While individual team members performed well, instances of miscommunication and coordination issues hampered overall performance. Real-time collaboration and information sharing could be enhanced.

Areas for Improvement: Despite the team’s expertise, improved communication protocols and a more robust real-time information sharing system are needed to optimize team performance in future competitions.

Quantitative Analysis of AIMSCAP's WTT Results

Analyzing AIMSCAP's numerical performance reveals both promising results and areas needing improvement. The following key metrics provide a clear picture:

- Overall Profit/Loss: AIMSCAP ended the WTT with a modest overall profit, exceeding their initial projected target despite several setbacks.

- Average Trade Size: Their average trade size was moderate, reflecting their risk-averse strategy.

- Win/Loss Ratio: While their win/loss ratio was slightly below the average of top-performing teams, it was still considerably higher than many participants.

- Risk-Reward Ratio: AIMSCAP maintained a conservative risk-reward ratio, prioritizing the preservation of capital.

(Insert Chart/Graph here visualizing the above metrics compared to other WTT participants)

This data illustrates AIMSCAP's successful implementation of a risk-management-focused strategy. While not the highest-earning team, their consistent approach mitigated substantial losses often seen in more aggressive strategies.

Qualitative Assessment of AIMSCAP's WTT Experience

The WTT provided AIMSCAP with invaluable experience and highlighted areas for future development.

- Strengths: AIMSCAP's risk management approach and diversified team expertise proved to be key strengths.

- Weaknesses: Coordination issues within the team and reliance on a balanced strategy (limiting high-reward high-risk trades) resulted in lower peak gains compared to more aggressive competitors.

Lessons Learned: The experience reinforced the importance of robust communication systems and collaborative decision-making in high-pressure trading environments. Further development of short-term trading strategies, while incorporating enhanced risk management, is crucial. Analyzing competitor strategies and adapting to fast-changing market conditions will be paramount for future success.

Conclusion: Key Takeaways and Future Implications of AIMSCAP's WTT Participation

AIMSCAP's participation in the WTT showcased a team with solid fundamental skills but needing to hone its collaborative strategies and adapt to high-pressure competition. Their risk-averse approach ensured stable performance, but optimizing communication and potentially incorporating more calculated high-risk/high-reward strategies could boost future results. The lessons learned from this participation will undoubtedly shape AIMSCAP’s future performance. Stay tuned for further analysis on AIMSCAP's future performance in the World Trading Tournament and their evolving trading strategies.

Featured Posts

-

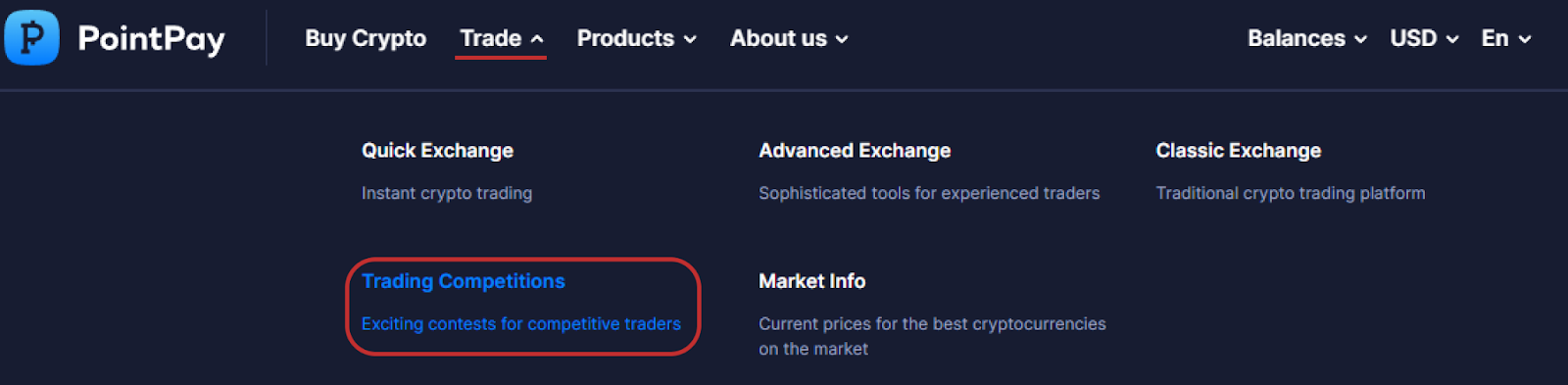

Fastest Cross Australia Foot Race New Record Set

May 21, 2025

Fastest Cross Australia Foot Race New Record Set

May 21, 2025 -

Itineraires Cyclistes Loire Vignoble Nantais And Estuaire 5 Idees De Parcours

May 21, 2025

Itineraires Cyclistes Loire Vignoble Nantais And Estuaire 5 Idees De Parcours

May 21, 2025 -

Watch Peppa Pig Cartoons Online Free Streaming Sites And Apps

May 21, 2025

Watch Peppa Pig Cartoons Online Free Streaming Sites And Apps

May 21, 2025 -

Video Susan Luccis Water Prank On Michael Strahan

May 21, 2025

Video Susan Luccis Water Prank On Michael Strahan

May 21, 2025 -

Huuhkajat Mm Karsinnoissa Uusi Valmennusstrategia

May 21, 2025

Huuhkajat Mm Karsinnoissa Uusi Valmennusstrategia

May 21, 2025