Analyzing Jim Cramer's Foot Locker (FL) Investment Recommendation

Table of Contents

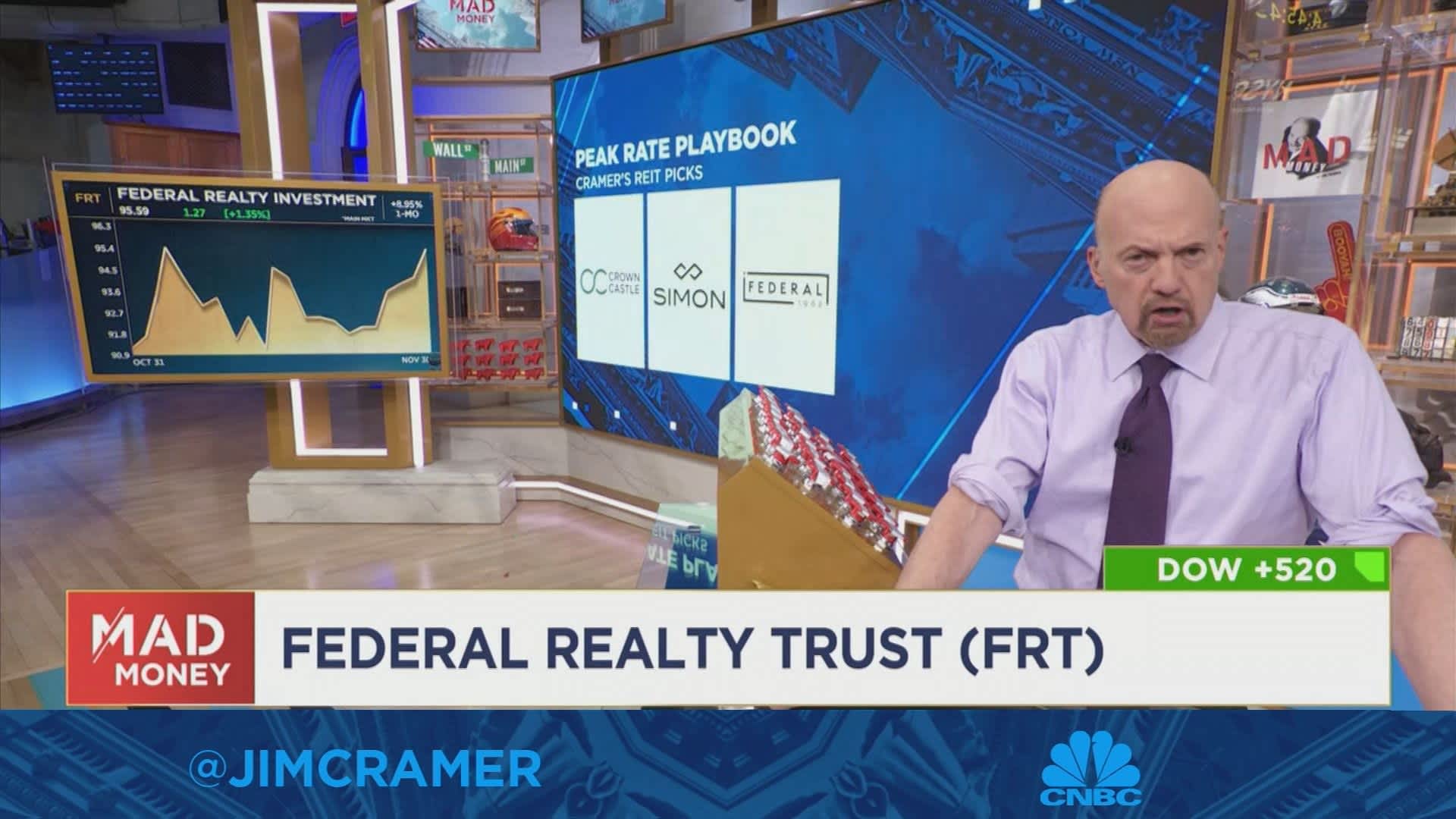

H2: Cramer's Foot Locker (FL) Recommendation: A Deep Dive

To begin our analysis, we need to pinpoint Cramer's specific recommendation on FL. (Insert a link to the original source of Cramer's recommendation here, e.g., a CNBC video or transcript). Let's assume, for the sake of this example, that Cramer issued a "buy" recommendation for Foot Locker in [Date of Recommendation], citing several key arguments.

His rationale likely revolved around several factors:

- Market Trends: Cramer might have pointed to a resurgence in interest in athletic footwear, perhaps driven by [mention specific trends, e.g., a return to in-person activities post-pandemic, a specific fashion trend].

- Company Performance: He may have highlighted positive financial indicators such as [mention specific examples, e.g., improving same-store sales, successful new product launches, effective inventory management strategies].

- Competitive Landscape: Cramer could have assessed Foot Locker's competitive position relative to rivals like Nike, Adidas, and others, suggesting a strong market share or unique brand positioning.

Key factors mentioned by Cramer likely included:

- Specific financial metrics: P/E ratio, revenue growth, earnings per share (EPS), gross profit margin.

- Market analysis: Consumer spending trends in apparel and footwear, market saturation analysis, competitive dynamics.

- Company-specific factors: New product collaborations, expansion into new markets, success of specific marketing campaigns, management team effectiveness, and supply chain resilience.

H2: Foot Locker (FL) Stock Performance Since the Recommendation

(Insert a chart or graph here illustrating FL stock price movements since Cramer's recommendation. Clearly label the axes and indicate the date of the recommendation.)

Comparing FL's performance against relevant benchmarks, such as the S&P 500 and other major retail stocks (e.g., Macy's, Nordstrom), provides valuable context. (Include a brief comparison here, highlighting whether FL outperformed or underperformed the benchmarks.) Any significant events influencing the stock price post-recommendation, like earnings reports or major economic news announcements, should also be noted and discussed. For example, unexpectedly high inflation might negatively impact consumer discretionary spending, impacting Foot Locker’s sales.

H3: Factors to Consider Before Investing in Foot Locker (FL)

Before investing in FL, consider a balanced perspective encompassing both risks and rewards. Thorough due diligence is crucial. Key financial ratios and metrics that investors should scrutinize include:

- Debt-to-equity ratio: Provides insight into the company's financial leverage.

- Return on equity (ROE): Measures the profitability of a company's investments.

- Price-to-earnings (P/E) ratio: Indicates how much investors are willing to pay for each dollar of earnings.

- Current and future growth prospects: Analyze industry trends, competitive landscape, and management's strategic plans.

H2: Alternative Investment Strategies for the Retail Sector

While Foot Locker might be an interesting investment, diversification is key. The retail sector offers other investment opportunities, such as [mention specific companies and their potential advantages/disadvantages]. Consider companies with strong e-commerce presence or unique product offerings. Diversifying your portfolio across different retail segments and even different sectors minimizes risk.

Conclusion: Should You Heed Jim Cramer's Foot Locker (FL) Advice?

Our analysis of Jim Cramer's Foot Locker (FL) recommendation reveals that while his arguments held some merit, the stock's actual performance may or may not have aligned with his prediction. (Summarize your findings here: did FL outperform expectations? Were Cramer's arguments supported by subsequent events?). Remember, this analysis is not financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results. Before making any investment decisions related to Foot Locker (FL) or any other stock, conduct your own thorough research, considering your personal risk tolerance and financial goals. Develop your own Foot Locker investment strategy by analyzing the company's financial statements, understanding industry trends, and evaluating the competitive landscape. For further research, consult reputable financial news websites and investment tools. Remember to always analyze Foot Locker stock based on your individual needs and risk profile.

Featured Posts

-

Roma Monza En Directo Minuto A Minuto

May 16, 2025

Roma Monza En Directo Minuto A Minuto

May 16, 2025 -

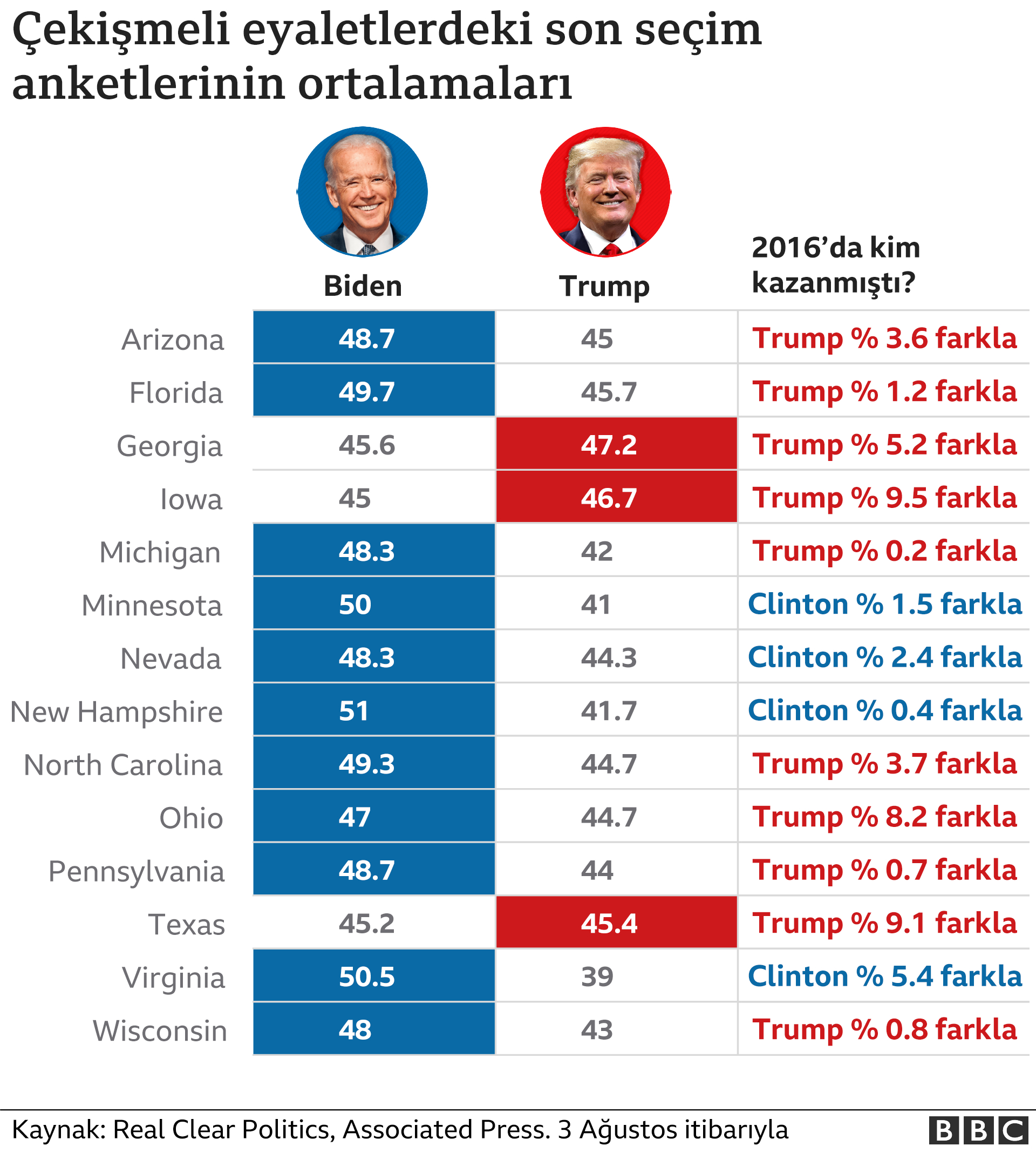

The 2020 Election A Comparison Of Trump And Bidens Platforms

May 16, 2025

The 2020 Election A Comparison Of Trump And Bidens Platforms

May 16, 2025 -

Sigue En Directo El Partido De Futbol Venezia Napoles

May 16, 2025

Sigue En Directo El Partido De Futbol Venezia Napoles

May 16, 2025 -

Biden Health A Former Cnn Journalist Breaks Silence

May 16, 2025

Biden Health A Former Cnn Journalist Breaks Silence

May 16, 2025 -

Greenlands Ice Conceals A U S Nuclear Base History And Discovery

May 16, 2025

Greenlands Ice Conceals A U S Nuclear Base History And Discovery

May 16, 2025