Analyzing Live Nation Entertainment (LYV): Options And Investment Potential

Table of Contents

Live Nation's Business Model and Market Dominance

Live Nation's core business is built on three interconnected pillars: ticketing, venues, and artist management. Ticketmaster, its ticketing subsidiary, controls a massive share of the primary ticket market globally. This dominance allows Live Nation to leverage its platform for its own venues and artist promotions, creating a powerful synergistic effect. Their portfolio includes thousands of venues worldwide, ranging from small clubs to massive stadiums, giving them unparalleled reach and diversification. This integrated model provides significant competitive advantages.

- Global reach and diverse portfolio of venues: From intimate concerts to large-scale festivals, Live Nation caters to a broad spectrum of audience preferences.

- Dominant ticketing platform (Ticketmaster): Ticketmaster's market share provides pricing power and valuable data insights into consumer behavior.

- Strategic partnerships with artists and promoters: These partnerships secure exclusive access to high-demand events and talent.

- Data-driven approach to event promotion and pricing: Live Nation uses data analytics to optimize marketing campaigns and ticket pricing strategies.

However, this dominance isn't without challenges. Competition from smaller promoters and venues, as well as regulatory scrutiny regarding antitrust concerns related to Ticketmaster, pose potential threats to their continued market leadership. The company also faces ongoing concerns about ticket pricing and scalping.

Financial Performance and Growth Prospects of LYV Stock

Live Nation's financial performance has been significantly impacted by the COVID-19 pandemic. However, the post-pandemic recovery has seen a strong rebound in live events, driving revenue growth. Analyzing LYV stock requires a careful examination of its recent financials.

- Review of LYV's revenue streams and profitability: Revenue streams come from ticket sales, venue rentals, artist management fees, and sponsorship deals. Profitability is highly sensitive to event attendance and overall economic conditions.

- Analysis of key financial ratios (e.g., P/E ratio, debt-to-equity ratio): These ratios provide insights into the company's valuation, profitability, and financial health. Comparing these to industry averages and historical trends is crucial.

- Discussion of potential risks to future growth (e.g., economic downturns, changing consumer preferences): Economic downturns can significantly impact consumer spending on discretionary entertainment. Shifting preferences toward streaming and virtual events also present a potential headwind.

- Mention historical stock performance and future price predictions (with appropriate disclaimers): Past performance is not indicative of future results. Any future price predictions should be treated with caution and viewed as speculative.

Investment Options and Strategies for Live Nation Entertainment

Investors have several options for gaining exposure to Live Nation Entertainment.

- Buying LYV stock directly: This offers direct ownership and potential for higher returns, but also carries higher risk.

- Options trading (calls and puts): Options trading provides leverage and allows for more sophisticated strategies, but it's also considerably riskier than simply buying shares.

- ETFs (Exchange Traded Funds): ETFs that include LYV offer diversification and lower risk, but returns might be more modest.

Analyzing LYV Stock Valuation

Several valuation methods can be applied to assess LYV's intrinsic value. Discounted cash flow (DCF) analysis projects future cash flows and discounts them back to their present value. Comparable company analysis compares LYV's valuation multiples (such as P/E ratio) to those of its peers in the entertainment industry.

- Explanation of relevant valuation metrics: Understanding metrics like P/E ratio, Price-to-Sales ratio, and Enterprise Value-to-EBITDA is crucial for comparative analysis.

- Comparison of LYV's valuation to industry peers: How does LYV's valuation compare to other companies in the live entertainment sector? Is it trading at a premium or discount?

- Discussion of potential undervaluation or overvaluation: Based on the valuation analysis, is LYV currently undervalued, fairly valued, or overvalued?

Risks and Considerations for Investing in LYV

Investing in Live Nation carries several risks.

- Impact of economic recessions on consumer spending on entertainment: Live events are often considered discretionary spending, making them vulnerable during economic downturns.

- The competitive landscape and potential new entrants: The live entertainment industry is competitive, with the potential for new players to emerge.

- Regulatory risks related to antitrust concerns (Ticketmaster): Ongoing regulatory scrutiny and potential antitrust lawsuits could negatively impact Ticketmaster's operations and profitability.

- Unforeseen events (like future pandemics) and their potential impact: The COVID-19 pandemic demonstrated the vulnerability of the live entertainment sector to unforeseen global events.

Conclusion:

Live Nation Entertainment (LYV) presents a compelling investment case due to its market dominance, growth potential, and diverse business model. However, potential investors should carefully consider the risks associated with the company and its stock before making any investment decisions. Thorough analysis of LYV's financial performance, valuation, and future prospects, along with a well-defined investment strategy aligned with your risk tolerance, is crucial before including Live Nation Entertainment in your portfolio. Conduct further research and consider consulting a financial advisor before investing in Live Nation Entertainment (LYV) or any other stock. Remember to always diversify your portfolio to mitigate risk.

Featured Posts

-

Ielan Rsmy Antqal Mdafe Lyfrkwzn Lnad Jdyd

May 29, 2025

Ielan Rsmy Antqal Mdafe Lyfrkwzn Lnad Jdyd

May 29, 2025 -

Arets Redaktor Aftenposten Profil Hedret

May 29, 2025

Arets Redaktor Aftenposten Profil Hedret

May 29, 2025 -

Argentinian Moto Gp Honda Targets Strong Start

May 29, 2025

Argentinian Moto Gp Honda Targets Strong Start

May 29, 2025 -

Will There Be A Malcolm In The Middle Revival

May 29, 2025

Will There Be A Malcolm In The Middle Revival

May 29, 2025 -

Aragon El Reto De Las 58 Escuelas Con Mas Solicitudes Que Plazas

May 29, 2025

Aragon El Reto De Las 58 Escuelas Con Mas Solicitudes Que Plazas

May 29, 2025

Latest Posts

-

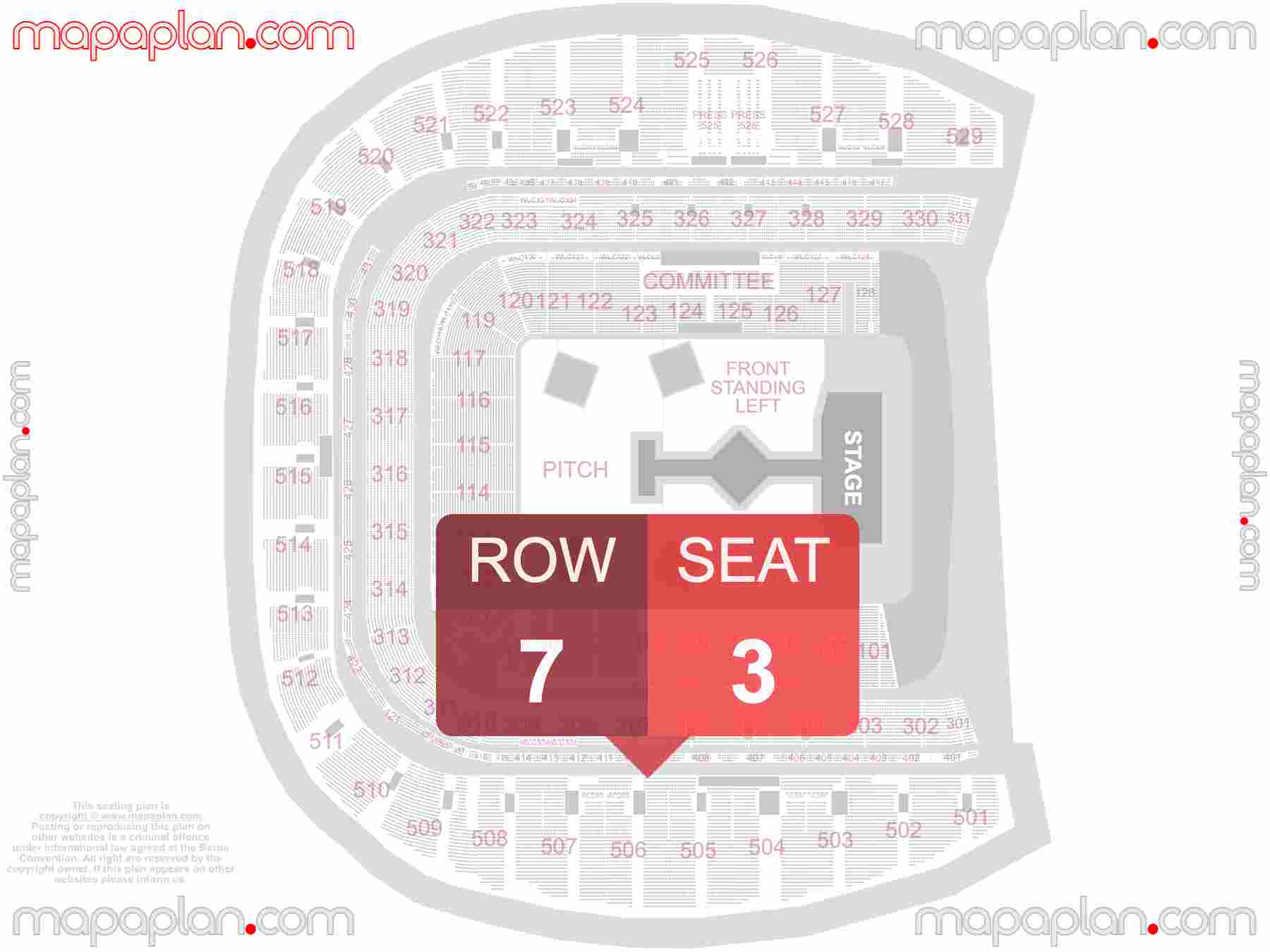

Metallicas Glasgow Hampden Park Concert World Tour Stop Announced

May 30, 2025

Metallicas Glasgow Hampden Park Concert World Tour Stop Announced

May 30, 2025 -

Musikgeschichte Hautnah Mozarts Clavierkonzert In Augsburg

May 30, 2025

Musikgeschichte Hautnah Mozarts Clavierkonzert In Augsburg

May 30, 2025 -

Ist Der Trainerwechsel In Augsburg Die Richtige Entscheidung Eine Kritische Betrachtung

May 30, 2025

Ist Der Trainerwechsel In Augsburg Die Richtige Entscheidung Eine Kritische Betrachtung

May 30, 2025 -

Mozarts Clavierkonzert In Augsburg Ein Erlebnis Fuer Musikliebhaber

May 30, 2025

Mozarts Clavierkonzert In Augsburg Ein Erlebnis Fuer Musikliebhaber

May 30, 2025 -

June 2026 Metallicas Dublin Aviva Stadium Concert Dates Announced

May 30, 2025

June 2026 Metallicas Dublin Aviva Stadium Concert Dates Announced

May 30, 2025