Analyzing Palantir's 30% Drop: Is It A Buy?

Table of Contents

Understanding the 30% Drop: Unpacking the Reasons

The 30% plunge in Palantir stock wasn't an isolated event; several factors contributed to this significant decline. Let's break down the key elements:

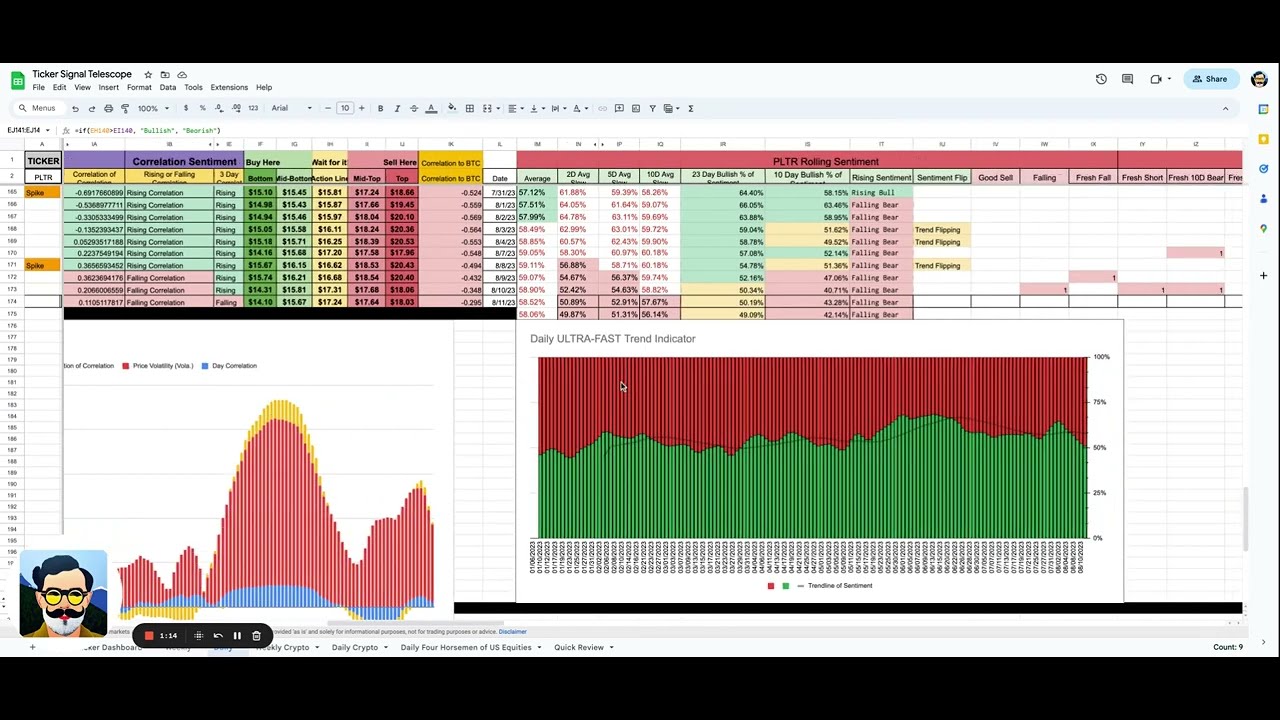

Market Sentiment and Broad Tech Sell-off

The broader tech sector experienced a significant downturn, impacting even the most robust companies. This sell-off was fueled by several macroeconomic factors:

- Inflation and Interest Rate Hikes: Rising inflation and subsequent interest rate hikes by central banks globally dampened investor sentiment and led to a reassessment of growth stock valuations. Companies like Palantir, often valued based on future growth potential, were particularly susceptible.

- Market Volatility: Increased market volatility created uncertainty, prompting investors to reduce exposure to riskier assets, including many technology stocks. This contributed to the widespread sell-off.

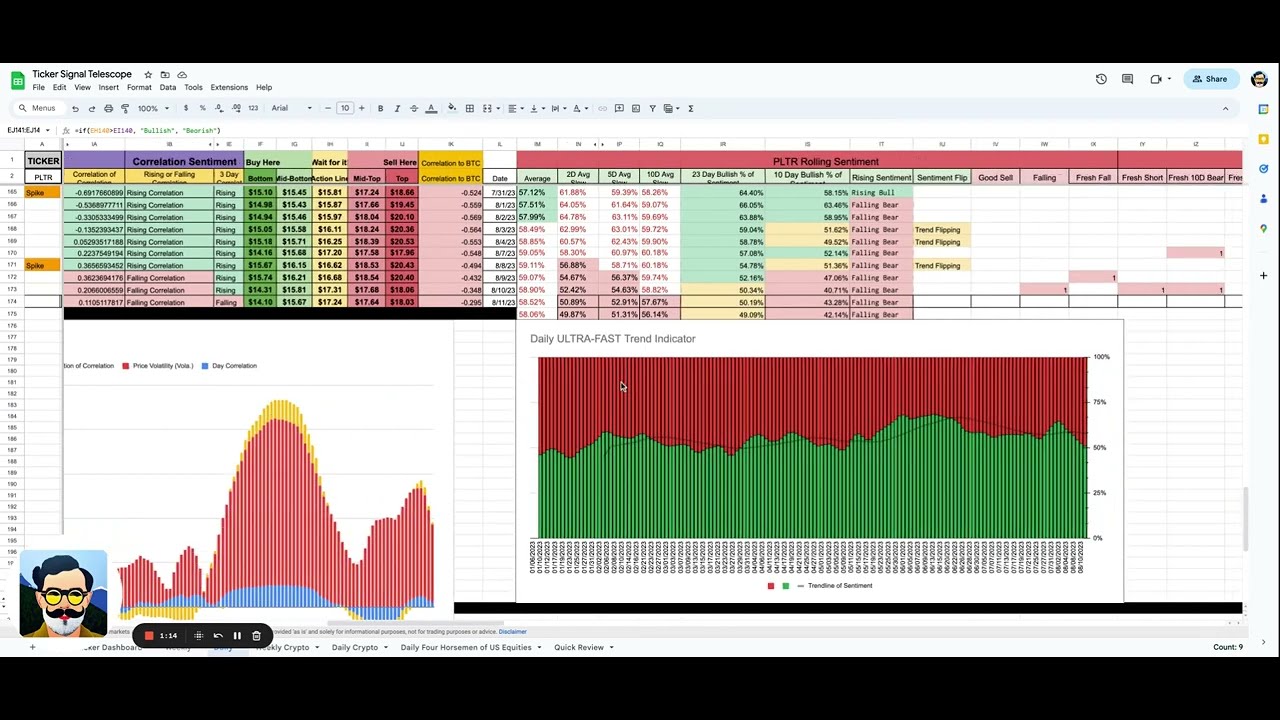

- Correlation with broader Tech Market: Palantir's drop mirrored the decline seen in other technology companies, highlighting the significant impact of the overall market sentiment on PLTR stock performance. The correlation was undeniably strong, indicating that market forces played a major role.

Palantir's Q[Insert Quarter, e.g., 2] Earnings Report

Palantir's [Insert Quarter, e.g., second] quarter earnings report played a crucial role in the stock price decline. While the exact details would need to be inserted here based on the actual report, potential factors contributing to the negative reaction could include:

- Missed Earnings Expectations: If Palantir missed analysts' earnings expectations, this would likely trigger a sell-off.

- Revenue Growth Slowdown: A slowdown in revenue growth compared to previous quarters would raise concerns about the company's future trajectory, impacting investor confidence.

- Negative News or Guidance: Any negative news, whether related to contracts, competition, or future guidance, could contribute to the stock price decline. Analyzing the specific discrepancies between the report and analysts' predictions is crucial to fully understanding the market's reaction.

Concerns Regarding Future Growth and Competition

Concerns regarding Palantir's future growth prospects and the intensifying competitive landscape also contributed to the stock price decline. This includes:

- Competition: The data analytics market is highly competitive, with established players and emerging startups vying for market share. Palantir faces competition from companies like AWS, Microsoft, and Google Cloud.

- Government Contract Reliance: A significant portion of Palantir's revenue comes from government contracts. Changes in government spending or policy could impact the company's future growth.

- Competitive Advantages: However, Palantir possesses considerable competitive advantages such as its highly specialized software and strong relationships with government agencies.

Evaluating Palantir's Current Valuation and Future Potential

To assess whether the current PLTR stock price is justified, we need to evaluate Palantir's valuation and future potential.

Discounted Cash Flow (DCF) Analysis

A simplified DCF analysis can help determine Palantir's intrinsic value. This would involve estimating future cash flows and discounting them back to their present value using a discount rate. [Note: A detailed DCF analysis would require specific financial data and is beyond the scope of this article. This section should include a simplified example or reference to an external source with a detailed analysis.] The results of this analysis can then be compared to the current market price to gauge whether the stock is undervalued or overvalued. Assumptions made in the DCF analysis, such as discount rate and growth rates, will significantly impact the valuation.

Long-Term Growth Opportunities

Despite the recent downturn, Palantir's long-term growth prospects remain promising.

- Data Analytics Market Growth: The overall data analytics market is experiencing robust growth, providing a favorable environment for Palantir's expansion.

- Government Contracts: Continued government investment in data analytics and national security will likely benefit Palantir.

- New Product Launches and Market Expansion: New product launches and expansion into new markets can provide additional growth catalysts. Increased adoption of Palantir's software, particularly in the commercial sector, could significantly boost revenue.

Assessing the Risk and Reward: Should You Buy Palantir Stock?

Investing in Palantir involves both significant risks and potential rewards.

Risk Factors

Several risk factors are associated with PLTR stock:

- High Valuation: Palantir’s valuation historically has been relatively high compared to its earnings, making it susceptible to market corrections.

- Competition: Intense competition in the data analytics market poses a threat to Palantir's market share.

- Dependence on Government Contracts: Overreliance on government contracts can expose Palantir to shifts in government spending or policy.

- Financial Health: Investors should analyze Palantir's financial health, including debt levels and cash flow, to assess its resilience.

Reward Potential

Despite the risks, the potential rewards of investing in Palantir are significant:

- High Growth Potential: Palantir operates in a rapidly growing market with significant potential for future growth.

- Strong Competitive Moat: Palantir's specialized software and strong customer relationships provide a competitive advantage.

- Long-Term Returns: Successful execution of Palantir's strategy could lead to substantial long-term returns for investors.

Conclusion: Is Palantir a Buy After its 30% Drop?

The 30% drop in Palantir's stock price was influenced by a combination of factors, including a broad tech sell-off, concerns about the company's earnings, and apprehension about its future growth and competition. However, Palantir also possesses significant long-term growth potential in the expanding data analytics and government contracting markets. The decision of whether to buy, sell, or hold Palantir stock depends on a thorough assessment of the risks and rewards, considering your individual risk tolerance and investment strategy. A detailed DCF analysis and a deeper dive into the company’s financials are recommended before making any investment decisions. Ultimately, the decision of whether to buy Palantir stock after its recent drop depends on your individual risk tolerance and investment strategy. Conduct thorough research and consider consulting a financial advisor before making any investment decisions regarding Palantir (PLTR).

Featured Posts

-

Oilers Defeat Golden Knights 3 2 But Vegas Secures Playoff Berth

May 10, 2025

Oilers Defeat Golden Knights 3 2 But Vegas Secures Playoff Berth

May 10, 2025 -

West Bengal Madhyamik Result 2025 Merit List And Analysis

May 10, 2025

West Bengal Madhyamik Result 2025 Merit List And Analysis

May 10, 2025 -

From Wolves Discard To European Elite His Journey To Success

May 10, 2025

From Wolves Discard To European Elite His Journey To Success

May 10, 2025 -

Diver Dies Recovering Sunken Superyacht Of Tech Tycoon

May 10, 2025

Diver Dies Recovering Sunken Superyacht Of Tech Tycoon

May 10, 2025 -

Anger Over Caravan Sites Is A Uk City Turning Into A Ghetto

May 10, 2025

Anger Over Caravan Sites Is A Uk City Turning Into A Ghetto

May 10, 2025