Analyzing Principal Financial Group (PFG): Insights From 13 Analysts

Table of Contents

PFG's Financial Performance: A Review of Key Metrics

Revenue Growth and Trends

Principal Financial Group generates revenue from diverse streams, primarily insurance, asset management, and retirement services. Analyzing year-over-year growth against industry benchmarks reveals important trends. While specific numbers would need to be sourced from analyst reports (and would vary depending on the reporting period), we can generally expect to see variations in revenue growth across these sectors. For example, strong growth in retirement services might be offset by slower growth in certain insurance segments.

- Key Revenue Drivers: Strong performance in retirement plan offerings, growth in the asset management division through successful investment strategies, and competitive pricing in insurance products are potential drivers.

- Potential Challenges: Increased competition from fintech companies offering digital retirement planning tools, shifts in demographics influencing insurance demand, and market volatility impacting asset management returns are key challenges to consider. (Note: This section would ideally include charts and graphs illustrating revenue growth trends across different segments.)

Profitability and Margins

Profitability metrics like profit margins and Return on Equity (ROE) are essential indicators of PFG's financial health. Comparing PFG's profitability to its competitors within the financial services industry provides valuable context. Again, specific data drawn from the 13 analyst reports would be necessary to create a truly comprehensive picture.

- Analyst Opinions on Profitability: Analyst reports may highlight areas of strength (e.g., high margins in a particular sector) and weakness (e.g., pressure on margins due to increased competition). A summary of these differing opinions is crucial for a balanced view.

- Key Metrics: Close examination of net income, operating income, and profit margin trends will offer further insight into profitability. (This section would benefit from inclusion of tables comparing PFG's key profitability metrics to those of its competitors.)

Debt and Leverage

Analyzing PFG's debt levels and leverage ratios helps assess its financial stability and risk profile. High debt levels can increase vulnerability to economic downturns. Analyst opinions on the sustainability of PFG's debt load are crucial.

- Leverage Ratios: Examining debt-to-equity ratios, times interest earned, and other relevant leverage metrics provides a quantitative assessment of risk. Comparison to industry averages offers valuable context.

- Analyst Concerns: Analyst reports may express concerns about the level of debt or potential implications for future profitability if debt levels aren't managed effectively. (Data tables comparing PFG’s leverage ratios to industry benchmarks would be highly beneficial here.)

Growth Prospects and Future Outlook: Analyst Predictions for PFG

Growth Strategies and Initiatives

PFG's strategic initiatives for future growth, such as mergers and acquisitions, new product development, and expansion into new markets, are crucial factors in predicting its future performance.

- Analyst Views on Growth Potential: Analysts' predictions concerning the success of these growth strategies are vital in assessing the long-term outlook. Consider the consensus view on PFG's potential to achieve projected growth targets.

- Specific Initiatives: Detailed discussion of any specific mergers, acquisitions, or product launches would provide richer context and improve the overall analysis.

Market Opportunities and Challenges

Analyzing the current market environment and identifying opportunities and challenges facing PFG is critical. Macroeconomic factors, such as interest rate changes and regulatory shifts, significantly impact performance.

- Market Share Growth: Analyst predictions regarding PFG's potential for market share growth in its various sectors are important to consider.

- Macroeconomic Factors: Discussion of the potential impact of economic conditions, inflation, and geopolitical events on PFG's growth trajectory is necessary.

Analyst Price Targets and Ratings

Summarizing the consensus price target from the 13 analysts, along with the distribution of buy, hold, and sell ratings, offers a valuable perspective on the investment sentiment surrounding PFG stock.

- Distribution of Ratings: Presenting the number of analysts with buy, hold, and sell ratings helps investors understand the range of opinions and the overall market sentiment. A visual representation (e.g., a pie chart) would be beneficial.

- Price Target Range: A clear presentation of the range of price targets provides a better understanding of the potential upside and downside scenarios for PFG stock.

Risk Factors and Potential Downside: Assessing PFG's Vulnerabilities

Interest Rate Risk

Fluctuations in interest rates can significantly impact PFG's profitability, particularly within its insurance and investment management divisions. Understanding the extent of this risk is crucial.

- Mitigation Strategies: Exploring how PFG actively manages interest rate risk, such as using hedging strategies, is vital.

- Analyst Concerns: Analyst reports may highlight vulnerabilities and potential losses if interest rates move adversely.

Competition and Market Share

The competitive landscape within the financial services sector is intense. Analyzing PFG's market position and competitive advantages provides insights into its ability to maintain profitability and market share.

- Competitive Advantages: Identifying PFG's unique strengths, such as strong brand recognition or a wide product portfolio, is important in assessing its resilience against competition.

- Analyst Opinions on Competition: Analyst views on the competitive threats facing PFG and its ability to fend off rivals should be presented.

Regulatory and Legal Risks

Changes in regulations and legal challenges can impact PFG's operations and profitability. Understanding potential regulatory headwinds is crucial.

- Potential Regulatory Headwinds: Identifying upcoming regulatory changes or potential legal issues that might impact PFG provides a more comprehensive risk assessment.

- Analyst Concerns: Analyst opinions on the potential impact of regulatory changes and legal challenges are important considerations for investors.

Conclusion: Final Thoughts on Principal Financial Group (PFG) and a Call to Action

This analysis, based on the insights of 13 financial analysts, provides a multi-faceted view of Principal Financial Group (PFG). While PFG possesses strengths in diverse revenue streams and established market presence, it also faces challenges including interest rate sensitivity and intense competition. The overall investment outlook appears balanced, with a range of price targets and analyst ratings reflecting this nuanced picture. Conduct your own thorough research before investing in Principal Financial Group (PFG). Consider consulting with a financial advisor to determine if PFG aligns with your investment strategy and risk tolerance.

Featured Posts

-

Evaluating The Mavericks Losses Jalen Brunsons Exit Vs The Potential Luka Doncic Trade

May 17, 2025

Evaluating The Mavericks Losses Jalen Brunsons Exit Vs The Potential Luka Doncic Trade

May 17, 2025 -

Canadas New Tariffs On Us Goods Plummet Near Zero Rates And Key Exemptions

May 17, 2025

Canadas New Tariffs On Us Goods Plummet Near Zero Rates And Key Exemptions

May 17, 2025 -

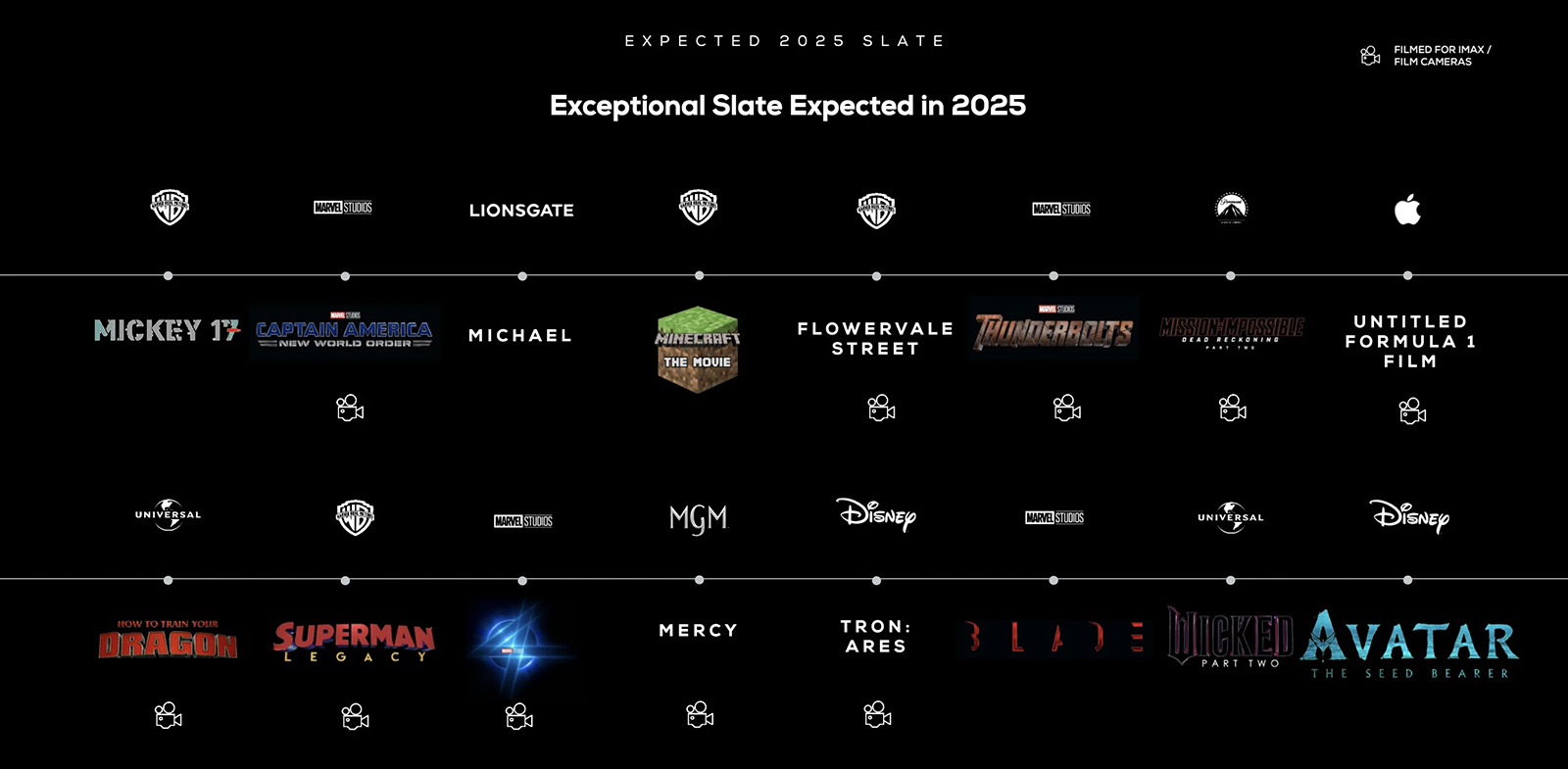

Warner Bros Unveils 2025 Slate At Cinema Con Key Announcements

May 17, 2025

Warner Bros Unveils 2025 Slate At Cinema Con Key Announcements

May 17, 2025 -

The Geopolitics Of Rare Earth Minerals A Looming Cold War

May 17, 2025

The Geopolitics Of Rare Earth Minerals A Looming Cold War

May 17, 2025 -

Best Online Casinos New Zealand Expert Reviews And Ratings

May 17, 2025

Best Online Casinos New Zealand Expert Reviews And Ratings

May 17, 2025

Latest Posts

-

The Impact Of Multiple Affairs And Sexual Misconduct Accusations On Donald Trumps Political Career

May 17, 2025

The Impact Of Multiple Affairs And Sexual Misconduct Accusations On Donald Trumps Political Career

May 17, 2025 -

Did Allegations Of Multiple Affairs And Sexual Misconduct Impact Donald Trumps Presidential Bid

May 17, 2025

Did Allegations Of Multiple Affairs And Sexual Misconduct Impact Donald Trumps Presidential Bid

May 17, 2025 -

I Megaloprepis Teleti I Episimi Ypodoxi Toy Proedroy Tramp

May 17, 2025

I Megaloprepis Teleti I Episimi Ypodoxi Toy Proedroy Tramp

May 17, 2025 -

I Saoydiki Aravia Ypodexetai Ton Tramp Mia Meleti Protokolloy Kai Dynamis

May 17, 2025

I Saoydiki Aravia Ypodexetai Ton Tramp Mia Meleti Protokolloy Kai Dynamis

May 17, 2025 -

Donald Trumps Scandals How Multiple Affairs And Sexual Misconduct Accusations Failed To Derail His Presidency

May 17, 2025

Donald Trumps Scandals How Multiple Affairs And Sexual Misconduct Accusations Failed To Derail His Presidency

May 17, 2025