Analyzing The 2025 Plunge In BigBear.ai (BBAI) Stock: Key Factors

Table of Contents

Macroeconomic Factors Contributing to a Potential BBAI Stock Decline

Several macroeconomic factors could negatively impact BBAI's stock price in 2025, irrespective of its internal performance.

Impact of General Market Downturn

A broader economic recession or market correction could significantly impact BBAI's stock price. Even successful companies are vulnerable during periods of decreased investor confidence.

- Decreased investor confidence: Fear and uncertainty lead to widespread selling.

- Reduced risk appetite: Investors shift towards safer investments, neglecting growth stocks like BBAI.

- Selling pressure across sectors: A market downturn rarely spares any sector, including technology.

Technology stocks, particularly newer companies like BBAI, are often more susceptible to market corrections due to their higher valuations and growth-dependent nature. A general market downturn could trigger a sell-off, driving down the BBAI stock price regardless of the company's internal performance.

Interest Rate Hikes and Inflation

Rising interest rates present a significant challenge to BBAI's valuation and investor sentiment.

- Increased borrowing costs: Higher rates make it more expensive for BBAI to expand operations and invest in growth.

- Reduced investment in growth stocks: Investors may favor less risky, high-yield investments over growth stocks.

- Potential impact on BBAI's future profitability: Increased borrowing costs and reduced investment could hinder profitability.

High inflation erodes BBAI's profit margins by increasing operational costs without necessarily allowing for commensurate price increases. This can negatively affect growth projections and make the company less attractive to investors. Understanding the interplay between interest rates, inflation, and BBAI stock is critical for accurate investment analysis.

Company-Specific Factors Affecting BBAI Stock Performance in 2025

Internal factors within BigBear.ai could also lead to a decline in its stock price.

Competition and Market Saturation

BigBear.ai operates in a competitive landscape. Market saturation could limit growth opportunities.

- Emerging competitors: New entrants could disrupt the market and erode BBAI's market share.

- Established players gaining market share: Larger, more established companies could aggressively expand, putting pressure on BBAI.

- Challenges in differentiating BBAI's offerings: BBAI needs to consistently innovate and differentiate its services to stay ahead.

Analyzing the competitive threats and BBAI's ability to maintain its market position is crucial for evaluating the long-term viability of the BBAI stock.

Failure to Meet Growth Projections

Falling short of revenue and earnings targets is a major risk.

- Underperformance in key contracts: Failure to secure or successfully execute significant contracts can negatively impact revenue.

- Slower-than-anticipated customer adoption: If BBAI's services don't gain traction as expected, growth will be hampered.

- Challenges in scaling operations: Rapid expansion can strain resources and lead to inefficiencies, hindering growth.

Unmet expectations could severely damage investor confidence, leading to a significant drop in the BBAI stock price.

Changes in Management or Key Personnel

Leadership changes or the loss of key employees can negatively impact BBAI's performance.

- Loss of expertise: Departures of experienced personnel could disrupt operations and innovation.

- Disruption in strategy: Changes in leadership can lead to shifts in strategy, which may not be well-received by the market.

- Negative market reaction to leadership changes: Uncertainty surrounding leadership can trigger investor concerns and selling pressure.

Internal instability can significantly impact the stock valuation, highlighting the importance of monitoring management changes and their potential consequences.

Geopolitical Risks and their Influence on BBAI Stock

Geopolitical factors can significantly influence investor sentiment and the BBAI stock price.

Global Uncertainty and its Effect on Investment

Geopolitical instability can lead to increased market volatility and decreased risk appetite.

- Increased volatility: Uncertainty creates unpredictable market swings, impacting stock prices.

- Decreased risk appetite: Investors might move towards safer assets, neglecting riskier growth stocks.

- Flight to safety in investments: Capital may flow out of the market towards safer havens like government bonds.

Uncertain global conditions can negatively affect technology investments, including BBAI stock.

Impact of Government Regulations

Changes in government regulations or policies could significantly affect BBAI's operations.

- Increased compliance costs: New regulations could increase BBAI's operational expenses.

- Restrictions on data usage: Regulations concerning data privacy and security could limit BBAI's business activities.

- Changes in defense spending: Government decisions on defense budgets could impact demand for BBAI's services.

Policy changes can negatively affect BBAI's operations and profitability, directly impacting its stock price.

Conclusion

A hypothetical 2025 plunge in BigBear.ai (BBAI) stock could result from a confluence of macroeconomic, company-specific, and geopolitical factors. Understanding the interplay between these factors—general market downturns, interest rate hikes, inflation, competition, growth projections, management changes, geopolitical uncertainty, and government regulations—is critical for any investment analysis. Remember, this analysis explores potential risks. The actual performance of BBAI stock will depend on various unpredictable events. Therefore, it's crucial to conduct thorough research and consider these factors when evaluating BBAI stock. Before making any investment decisions related to BBAI stock, conduct your own in-depth analysis. Further reading on stock market analysis and investment analysis can help you better understand the inherent risks involved in investing.

Featured Posts

-

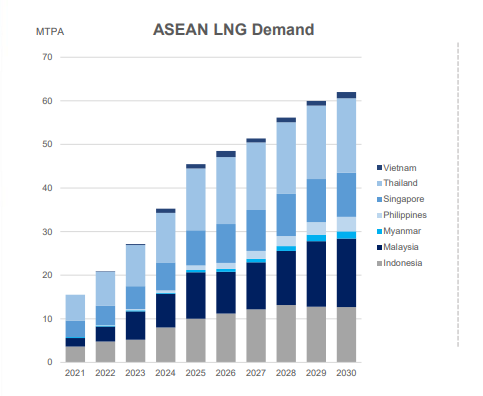

Post Nuclear Taiwan The Growing Demand For Lng Cargoes

May 20, 2025

Post Nuclear Taiwan The Growing Demand For Lng Cargoes

May 20, 2025 -

Hmrc Debt Many Unknowing Individuals Owe Money

May 20, 2025

Hmrc Debt Many Unknowing Individuals Owe Money

May 20, 2025 -

When Colleges Close The Economic Devastation In College Towns

May 20, 2025

When Colleges Close The Economic Devastation In College Towns

May 20, 2025 -

France Eurovision 2024 La Chanson De Louane Revelee

May 20, 2025

France Eurovision 2024 La Chanson De Louane Revelee

May 20, 2025 -

Wwe Raw Results Winners And Grades For May 19 2025

May 20, 2025

Wwe Raw Results Winners And Grades For May 19 2025

May 20, 2025