Analyzing The Bank Of Canada's Response To Trump Tariffs In April

Table of Contents

The imposition of Trump tariffs in April 2018 sent shockwaves through the Canadian economy, creating significant uncertainty and threatening key industries. This article analyzes the Bank of Canada's Response to Trump Tariffs, specifically examining the central bank's actions and their effectiveness in mitigating the negative impacts of these trade measures. We will delve into the economic fallout caused by the tariffs, the Bank of Canada's policy responses, and ultimately assess the success of its interventions.

H2: The Economic Impact of Trump Tariffs in April 2018

The Trump administration's tariffs, particularly those targeting Canadian lumber and aluminum, inflicted considerable damage on the Canadian economy.

H3: Impact on Canadian Exports: Canadian exports, a vital engine of economic growth, suffered significantly. The lumber industry, already facing challenges, bore the brunt of the tariffs, with substantial job losses and mill closures reported across the country. Aluminum producers also experienced reduced demand and lower prices.

- Export Decline: Statistics Canada reported a [Insert percentage]% decline in lumber exports to the US in [Month, Year], representing a loss of [Dollar amount] in revenue.

- Job Losses: Estimates suggest that [Number] jobs were lost in the lumber industry alone due to the tariffs (Source: [Link to relevant government report or news article]).

- Business Closures: Several smaller lumber mills were forced to close permanently, exacerbating the economic hardship in affected communities. (Source: [Link to relevant news article]).

H3: Inflationary Pressures: The tariffs contributed to inflationary pressures as the cost of imported goods increased. This impacted consumer spending and raised concerns about a potential wage-price spiral.

- Price Increases: The cost of lumber and aluminum-based products rose significantly, impacting construction costs and the price of various consumer goods.

- Impact on Consumer Spending: Reduced consumer purchasing power, due to higher prices, dampened economic growth.

- Wage-Price Spiral Risk: The inflationary pressures increased the risk of a wage-price spiral, where rising prices lead to increased wages, further fueling inflation.

H3: Currency Fluctuations: The uncertainty caused by the tariffs led to fluctuations in the Canadian dollar's exchange rate against the US dollar. A weaker Canadian dollar, while potentially benefiting some exporters, also increased the cost of imports and contributed to inflation.

- CAD/USD Fluctuations: Charts illustrating the CAD/USD exchange rate during April 2018 would visually demonstrate the impact of the tariff announcement (Include chart here if possible).

- Impact on Businesses: Canadian businesses reliant on imports saw their costs increase due to the weaker dollar, while exporters faced fluctuating revenues.

- Import Costs: The weaker loonie exacerbated the impact of higher import prices due to the tariffs.

H2: The Bank of Canada's Monetary Policy Response

In response to the economic uncertainty created by the Trump tariffs, the Bank of Canada employed a multi-pronged approach.

H3: Interest Rate Decisions: The Bank of Canada maintained its key interest rate at [Interest Rate Percentage]% in April 2018, citing the need to monitor the economic impact of the tariffs. [Insert quote from a Bank of Canada statement explaining the rationale behind the decision].

- Rate Stability: The decision to hold interest rates steady aimed to avoid exacerbating the economic slowdown caused by the tariffs.

- Monitoring the Situation: The Bank emphasized its close monitoring of the situation, signaling its readiness to adjust monetary policy if necessary.

- Forward Guidance: The Bank provided clear forward guidance to the markets, signaling its willingness to act should conditions warrant.

H3: Quantitative Easing (QE) Measures: The Bank of Canada did not implement quantitative easing (QE) measures in direct response to the April 2018 tariffs. However, it maintained its accommodative monetary policy stance, providing ample liquidity to the financial system.

- Liquidity Provision: The Bank ensured sufficient liquidity in the financial system to prevent a credit crunch.

- No QE in April: The situation didn't require drastic measures like QE at the time.

- Contingency Planning: The Bank likely had contingency plans in place in case the economic situation worsened.

H3: Communication Strategy: The Bank of Canada employed a transparent communication strategy, regularly updating the public and financial markets about its assessment of the economic situation and its policy intentions.

- Press Releases and Statements: Numerous press releases and statements clarified the Bank's views on the tariffs and their economic effects.

- Governor's Speeches: The Governor's speeches provided further insight into the Bank's thinking and policy response.

- Transparency and Open Communication: Open communication helped reduce uncertainty and mitigate market volatility.

H2: Effectiveness of the Bank of Canada's Response

Evaluating the effectiveness of the Bank of Canada's response requires a nuanced assessment of both successes and shortcomings.

H3: Successes: The Bank's measured approach helped prevent a more severe economic downturn. The maintenance of liquidity and transparent communication helped to stabilize financial markets and maintain business confidence.

- Stable Financial Markets: Financial markets remained relatively stable, avoiding a major crisis.

- Moderate Economic Slowdown: The economic slowdown was less severe than initially feared.

- Resilience of Canadian Economy: The Canadian economy demonstrated resilience to the economic shock.

H3: Shortcomings: Critics argued that the Bank's response was insufficient to fully offset the negative impacts of the tariffs. The reliance on monitoring and gradual adjustments might have been too slow in addressing the immediate economic challenges.

- Slow Response: Some argued that a quicker and more decisive response would have been beneficial.

- Limited Tools: Monetary policy has limitations in addressing trade-related shocks.

- Regional Disparities: The impact of the tariffs was not uniform across all regions, highlighting the limitations of a national monetary policy response.

H3: Long-Term Implications: The Trump tariffs and the Bank of Canada's response had long-term implications for the Canadian economy, affecting investment decisions, trade relationships, and industrial diversification efforts. The experience highlighted the vulnerability of Canadian exports to trade disputes and the importance of economic diversification.

- Increased Trade Uncertainty: The tariffs contributed to increased uncertainty in the trading relationship with the US.

- Investment Decisions: Businesses were more cautious in their investment decisions due to the trade uncertainty.

- Diversification Efforts: The experience underscored the need for greater economic diversification to reduce dependence on the US market.

Conclusion: Assessing the Bank of Canada's Actions Against the Trump Tariffs

The Bank of Canada's response to the April 2018 Trump tariffs involved a careful balancing act. While the measured approach prevented a significant economic crisis, it also faced criticisms for being perhaps too slow or insufficient to fully counteract the negative economic impacts. Understanding the Bank of Canada's Response to Trump Tariffs is crucial to grasping the dynamics of international trade and monetary policy's limitations and capabilities in handling such external shocks. The Bank’s actions highlighted the importance of continuous monitoring, proactive communication, and the need for adaptable monetary policy in a world of increasing trade uncertainty. To learn more about the Bank of Canada’s monetary policy decisions and their rationale, we encourage you to explore resources available on the Bank of Canada website.

Featured Posts

-

Sony Play Station Christmas Voucher Glitch Users Receive Free Credit Compensation

May 02, 2025

Sony Play Station Christmas Voucher Glitch Users Receive Free Credit Compensation

May 02, 2025 -

Official Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 02, 2025

Official Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 02, 2025 -

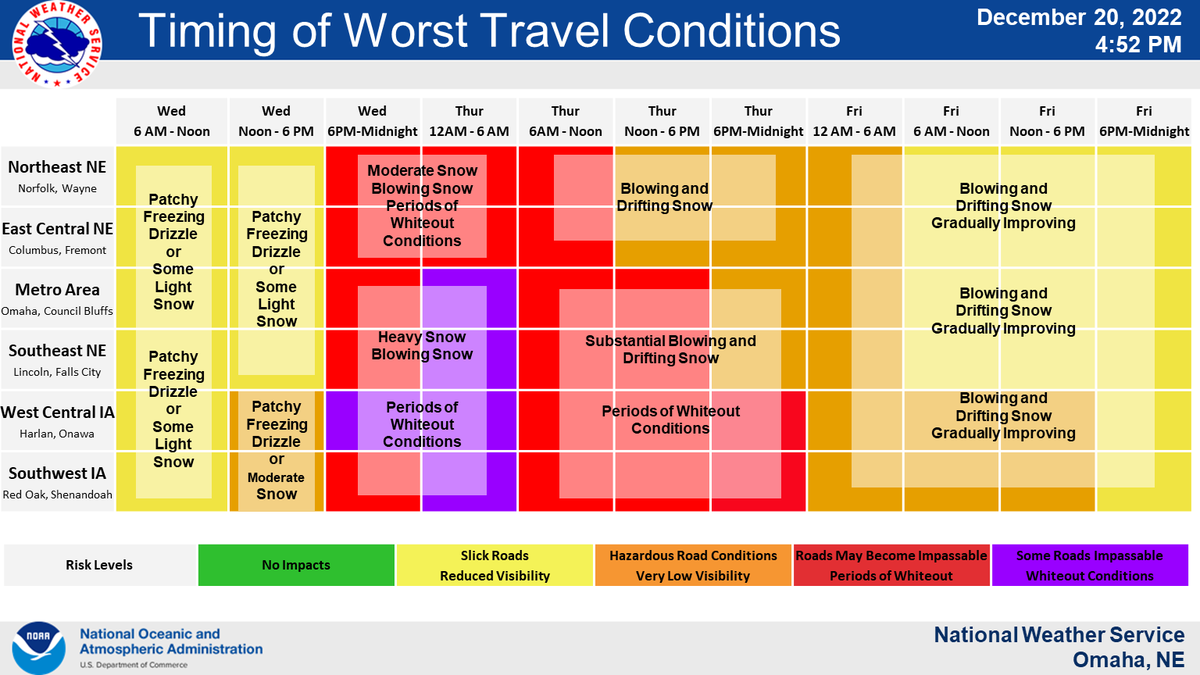

Near Blizzard Conditions Predicted For Tulsa Nws Update

May 02, 2025

Near Blizzard Conditions Predicted For Tulsa Nws Update

May 02, 2025 -

Fortnite Item Shop Update The Return Of Beloved Skins After 1000 Days

May 02, 2025

Fortnite Item Shop Update The Return Of Beloved Skins After 1000 Days

May 02, 2025 -

Canadian Dollar Rises After Trumps Comments On Carney Deal

May 02, 2025

Canadian Dollar Rises After Trumps Comments On Carney Deal

May 02, 2025