Analyzing The Bond Market's Response To Tariff Increases

Table of Contents

Tariff increases are a significant economic event with far-reaching consequences, impacting global markets and investor strategies. This article analyzes how the bond market, a crucial indicator of economic health, responds to these policy changes. We will explore the complex relationship between tariffs, interest rates, inflation, bond yields, and the performance of various bond types. Understanding this response is critical for investors seeking to navigate the complexities of the fixed-income market and make informed decisions regarding their investment portfolios.

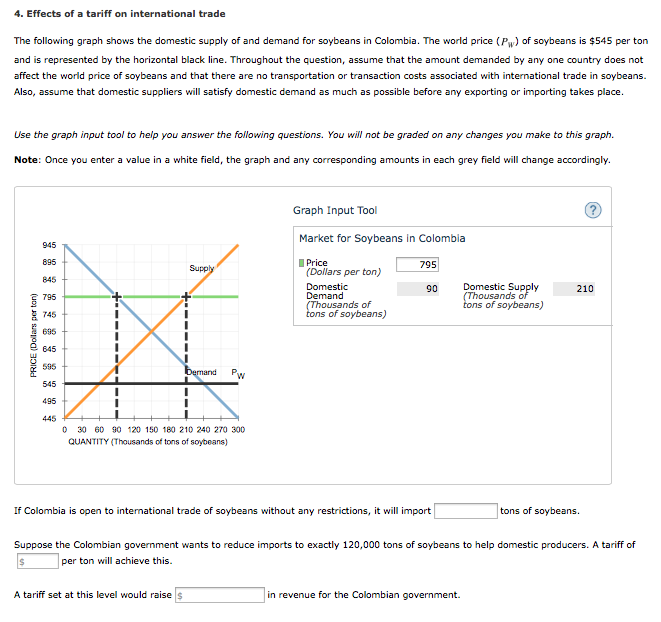

The Immediate Impact of Tariff Increases on Bond Yields

Tariff increases immediately create ripples throughout the financial system, significantly impacting bond yields. This impact manifests in two primary ways: increased inflationary pressure and heightened uncertainty leading to risk aversion.

Increased Inflationary Pressure

Tariffs often lead to higher consumer prices, fueling inflation. This inflationary pressure forces central banks to consider raising interest rates to cool down the economy and curb inflation. This has a direct impact on bond yields:

- Higher interest rates generally lead to lower bond prices (inverse relationship): When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive. This decreased demand pushes down the price of existing bonds.

- Increased inflation erodes the purchasing power of fixed-income investments: Inflation diminishes the real value of future bond payments, making them less appealing to investors seeking to preserve capital.

- Investors may shift from bonds to other assets perceived as inflation hedges (e.g., commodities, real estate): In an inflationary environment, investors often seek assets that tend to appreciate in value when prices rise, leading to capital outflow from the bond market.

Uncertainty and Risk Aversion

The uncertainty surrounding the long-term economic impact of tariffs often increases risk aversion among investors. This can lead to significant shifts in the bond market:

- Investors may flee to safer assets like government bonds, driving up demand and lowering yields: Government bonds, perceived as less risky, become more attractive during times of uncertainty, increasing demand and pushing yields down.

- Demand for corporate bonds may decrease, potentially increasing their yields: The increased risk associated with corporate bonds during economic uncertainty can lead to lower demand, resulting in higher yields to attract investors.

- Flight to safety could cause a flattening or inversion of the yield curve: A yield curve inversion, where short-term yields exceed long-term yields, can be a strong predictor of an upcoming recession, highlighting the significant impact of tariff-induced uncertainty.

Long-Term Effects on the Bond Market

The long-term consequences of tariff increases on the bond market extend beyond the immediate impact on yields. These lasting effects are primarily driven by slower economic growth and currency fluctuations.

Economic Growth Slowdown

Prolonged tariff disputes can stifle economic growth by disrupting supply chains, increasing business costs, and reducing consumer spending. This slowdown negatively impacts corporate profitability and increases the risk of defaults:

- This could negatively impact the performance of corporate bonds and high-yield bonds: Companies facing reduced profitability are more likely to default on their debt obligations, increasing the risk associated with their bonds.

- Government bond yields may fall further as investors seek safety: As investors seek the safety of government bonds, demand increases, pushing yields even lower.

- Credit spreads (the difference between corporate and government bond yields) may widen, reflecting increased risk: The widening credit spread signifies a heightened perception of risk in the corporate bond market.

Currency Fluctuations

Tariff disputes often cause fluctuations in currency exchange rates, adding complexity for international bond investors:

- Changes in currency values can significantly impact returns for investors holding foreign bonds: A weakening domestic currency can reduce the value of returns from foreign bonds when converted back to the investor's home currency.

- Hedging strategies become more important to mitigate currency risk: Investors may employ hedging strategies, such as currency forwards or options, to protect themselves against adverse currency movements.

- Investors may shift allocations towards domestically issued bonds: To minimize currency risk, investors might favor bonds issued in their home currency.

Analyzing Different Bond Types' Responses

The impact of tariff increases varies across different bond types, reflecting their inherent risk profiles and sensitivities to economic conditions.

Government Bonds

Government bonds, considered safe-haven assets, generally see increased demand during periods of economic uncertainty and increased risk aversion. Their yields typically fall as investors seek refuge in their perceived safety.

Corporate Bonds

Corporate bonds are more sensitive to economic growth and corporate profitability. During periods of uncertainty following tariff increases, their yields tend to rise as investors demand higher returns to compensate for increased risk. High-yield corporate bonds (junk bonds) are particularly vulnerable.

Municipal Bonds

Municipal bonds are influenced by the local economic conditions and the creditworthiness of the issuing municipality. The impact of tariffs on municipal bonds will vary depending on the geographic location and the municipality’s sensitivity to trade.

Conclusion

The bond market's reaction to tariff increases is multifaceted and depends on various interacting factors, including the scale of the tariffs, the overall economic climate, investor sentiment, and the specific type of bond. Understanding the interplay between inflation, interest rates, risk aversion, and currency fluctuations is crucial for navigating the complexities of the fixed-income market. By analyzing the impact on different bond types and considering the long-term economic consequences, investors can develop more robust and effective investment strategies. To stay informed about the ever-evolving relationship between tariff increases and the bond market, continue researching the latest economic news and consult with financial professionals. Make informed decisions about your fixed-income investments by carefully analyzing the impact of tariff increases on bond yields and the broader economic landscape.

Featured Posts

-

Highlander Reboot Henry Cavill To Star In Amazon Series

May 12, 2025

Highlander Reboot Henry Cavill To Star In Amazon Series

May 12, 2025 -

John Wick 5 Is This The End For Keanu Reeves Baba Yaga

May 12, 2025

John Wick 5 Is This The End For Keanu Reeves Baba Yaga

May 12, 2025 -

Sydney Mc Laughlin Levrones Miami 400m Hurdle Performance A New World Lead

May 12, 2025

Sydney Mc Laughlin Levrones Miami 400m Hurdle Performance A New World Lead

May 12, 2025 -

Resistance To Ev Mandates Intensifies Car Dealers Push Back

May 12, 2025

Resistance To Ev Mandates Intensifies Car Dealers Push Back

May 12, 2025 -

Rockys Emotional Core Stallones Favorite Movie

May 12, 2025

Rockys Emotional Core Stallones Favorite Movie

May 12, 2025