Analyzing The Challenges: Why XRP ETFs May Underperform Expectations

Table of Contents

Regulatory Uncertainty and Legal Battles

The regulatory environment surrounding XRP and, consequently, XRP ETFs, is fraught with uncertainty. This uncertainty presents a major headwind for investors expecting consistent, positive returns.

SEC Scrutiny

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) looms large over the future of XRP. The SEC's classification of XRP as an unregistered security is a significant impediment to the widespread adoption and acceptance of XRP ETFs.

- Uncertainty surrounding XRP's classification as a security: A negative ruling could severely impact XRP's price and potentially lead to delisting from major exchanges.

- Potential for trading halts or delisting from exchanges: This would significantly disrupt the liquidity of any XRP ETFs and could result in substantial losses for investors.

- Impact of future regulatory decisions on ETF approval and trading: The SEC's actions will heavily influence the approval process for XRP ETFs and the overall regulatory framework governing their trading. Further regulatory scrutiny could delay or even prevent the launch of XRP ETFs entirely.

Varying Regulatory Landscapes

The regulatory landscape for cryptocurrencies varies significantly across different jurisdictions. This creates a complex and challenging environment for launching and trading XRP ETFs globally.

- Navigating diverse regulatory frameworks in various countries: Fund managers need to comply with different rules and regulations in each market, increasing operational complexity and costs.

- Potential for regional limitations on XRP ETF trading: Some jurisdictions may prohibit or restrict the trading of XRP ETFs, limiting their accessibility and market reach.

- Increased complexity for fund managers in managing regulatory compliance: This added complexity could increase operational costs and potentially reduce profitability for XRP ETF providers.

Market Volatility and Price Fluctuations

The cryptocurrency market is inherently volatile, and XRP is no exception. This volatility translates directly into significant risk for investors in XRP ETFs.

Crypto Market Instability

XRP's price is susceptible to sharp swings driven by various factors, both internal and external. This makes predicting its long-term price trajectory incredibly challenging.

- High susceptibility to market-wide corrections and crashes: Broader cryptocurrency market downturns can severely impact XRP's price, leading to substantial losses for ETF investors.

- Influence of broader macroeconomic factors on XRP's price: Global economic events and regulatory changes can significantly influence XRP's price, creating uncertainty for investors.

- Difficulty in accurately predicting long-term price movements: The inherent unpredictability of the crypto market makes accurate long-term forecasting extremely difficult, increasing investment risk.

Lack of Price Discovery

XRP's relatively young age and limited trading history compared to more established assets hamper the development of a reliable price discovery mechanism. This vulnerability can lead to increased price manipulation and volatility within ETFs.

- Thin trading volumes in certain markets: Lower trading volumes make XRP more susceptible to manipulation by large market players.

- Vulnerability to pump-and-dump schemes and market manipulation: The lack of robust price discovery mechanisms increases the risk of artificial price inflation followed by sharp corrections.

- Challenges in accurately valuing XRP for ETF pricing: Inconsistencies in pricing across different exchanges add to the difficulty of accurately valuing XRP for ETF purposes.

Limited Adoption and Practical Use Cases

Despite its intended purpose as a cross-border payment solution, XRP's real-world adoption lags behind other cryptocurrencies. This limits its potential for growth and attracts less investor interest compared to other, more widely adopted cryptocurrencies.

Real-World Applications

While XRP has found some use cases in cross-border payments, it faces stiff competition from faster, more established, and often more regulated payment solutions.

- Competition from other faster, more established payment solutions: XRP needs to overcome the dominance of existing players in the payments industry to achieve mainstream adoption.

- Limited integration with mainstream financial systems: The lack of widespread integration with traditional financial systems hinders XRP's practical usability.

- Slow adoption by businesses and consumers: The lack of widespread understanding and trust in XRP limits its practical applications.

Lack of Diversification

Investing in an XRP ETF concentrates your investment in a single, relatively volatile asset. This lack of diversification increases the overall risk of your portfolio.

- Reduced risk mitigation compared to diversified investment portfolios: Concentrated investments like XRP ETFs do not provide the same level of risk mitigation as a diversified portfolio.

- Higher susceptibility to negative XRP-specific events: Any negative news or events related to XRP will disproportionately affect the value of the ETF.

- Importance of considering a well-diversified investment strategy: A diversified portfolio can help mitigate the risks associated with investing in a single, potentially volatile asset like XRP.

Conclusion

While the prospect of XRP ETFs is enticing, investors should carefully consider the considerable challenges outlined above. The regulatory uncertainty, market volatility, and limited real-world adoption of XRP all pose significant risks that could lead to underperformance. Before investing in XRP ETFs, it’s crucial to conduct thorough research and understand the potential downsides. Don't let the hype overshadow the inherent risks associated with XRP ETFs. A well-informed investment strategy is paramount when considering any investment in the volatile cryptocurrency market, especially those involving assets like XRP and related ETFs. Diversify your portfolio and conduct thorough due diligence before investing.

Featured Posts

-

Official Sony Unveils Significant Ps 5 Pro Improvements

May 08, 2025

Official Sony Unveils Significant Ps 5 Pro Improvements

May 08, 2025 -

Analyzing The Biggest Oscars Snubs Why These Moments Matter

May 08, 2025

Analyzing The Biggest Oscars Snubs Why These Moments Matter

May 08, 2025 -

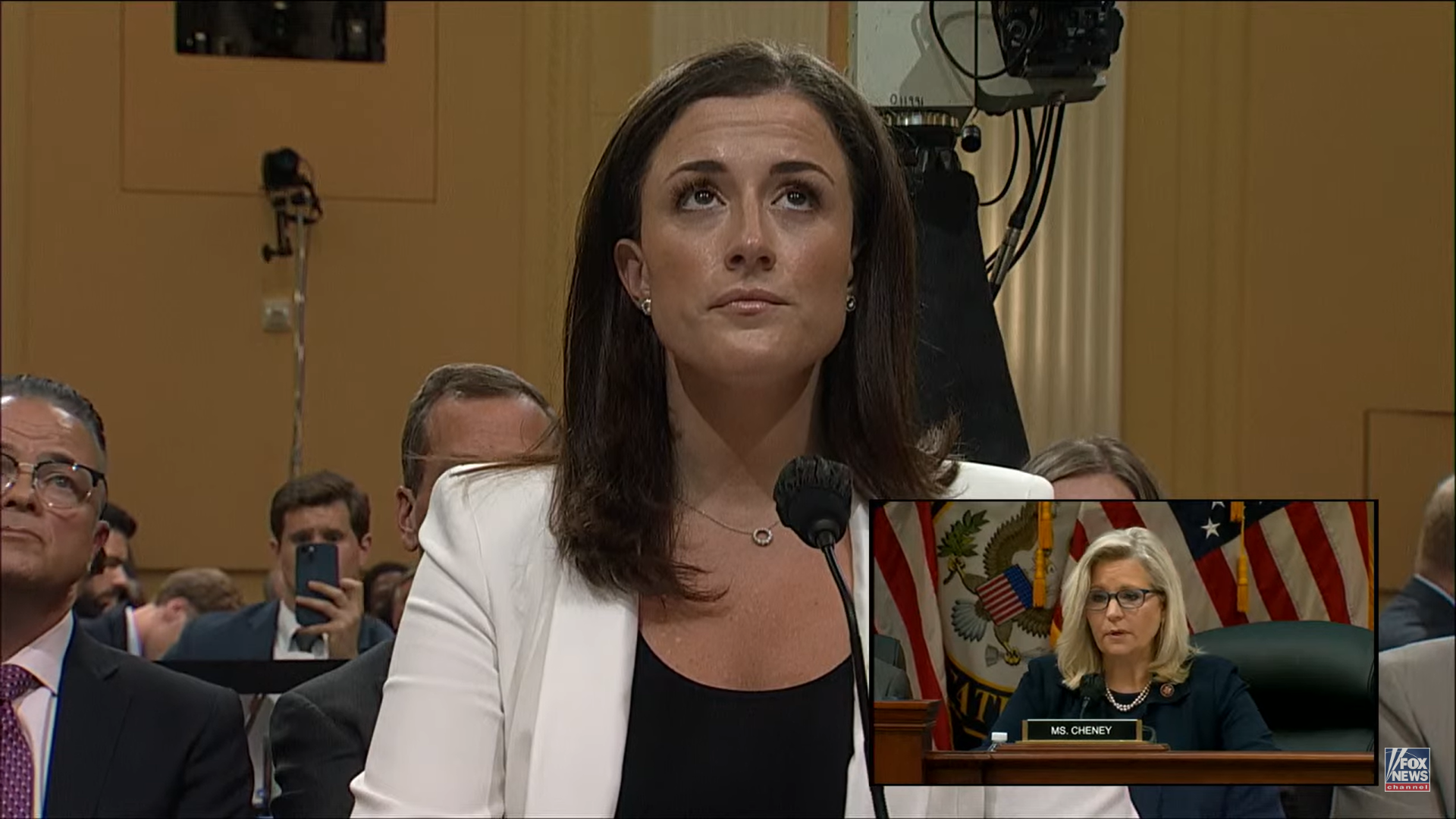

Cassidy Hutchinsons Account Of January 6th A Forthcoming Memoir

May 08, 2025

Cassidy Hutchinsons Account Of January 6th A Forthcoming Memoir

May 08, 2025 -

Assassins Creed Shadows Ps 5 Pros Ray Tracing Upgrade Analyzed

May 08, 2025

Assassins Creed Shadows Ps 5 Pros Ray Tracing Upgrade Analyzed

May 08, 2025 -

Goli I Vetem Si Psg Siguroi Fitoren Minimale

May 08, 2025

Goli I Vetem Si Psg Siguroi Fitoren Minimale

May 08, 2025

Latest Posts

-

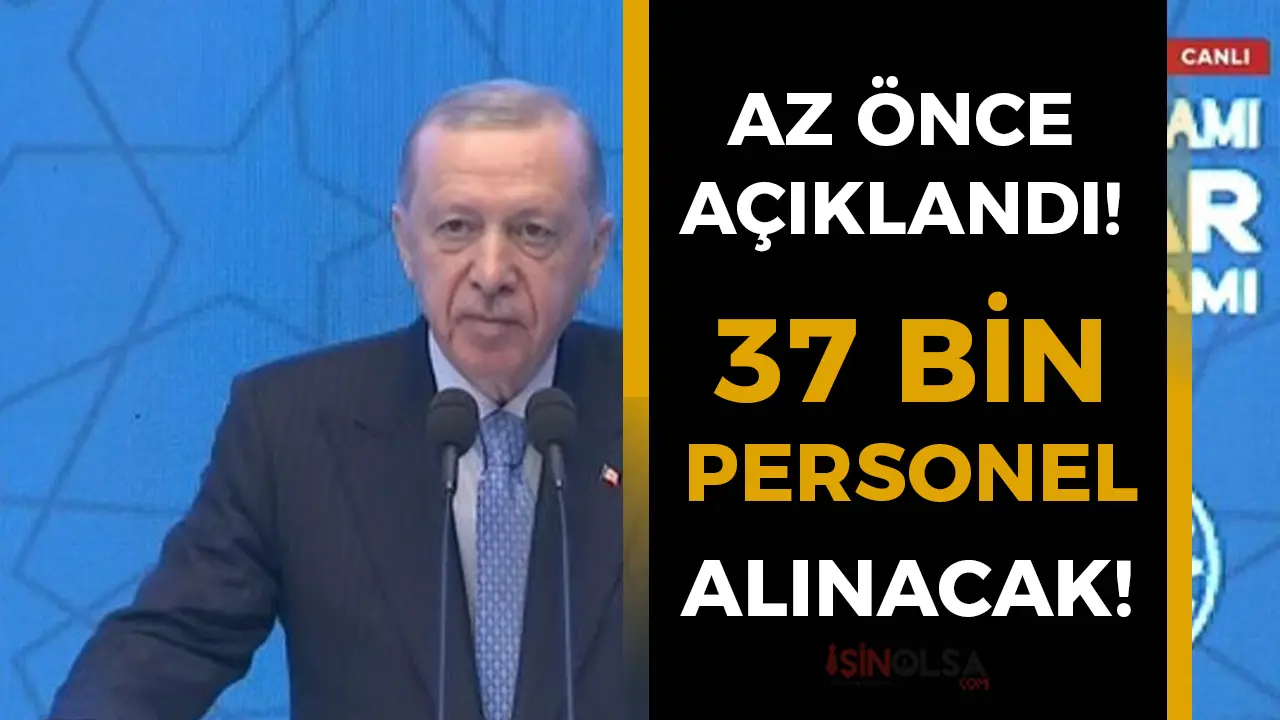

Saglik Bakanligi Personel Alimi 2024 37 Bin Hekim Disi Pozisyon Icin Basvuru Rehberi

May 08, 2025

Saglik Bakanligi Personel Alimi 2024 37 Bin Hekim Disi Pozisyon Icin Basvuru Rehberi

May 08, 2025 -

Saglik Bakanligi 37 Bin Personel Alimi Son Dakika Bilgileri Ve Basvuru Sartlari

May 08, 2025

Saglik Bakanligi 37 Bin Personel Alimi Son Dakika Bilgileri Ve Basvuru Sartlari

May 08, 2025 -

Pakstan Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Mnayy Jaye Gy

May 08, 2025

Pakstan Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Mnayy Jaye Gy

May 08, 2025 -

Aym Aym Ealm 12 Wyn Brsy Ky Tqrybat Ka Aghaz

May 08, 2025

Aym Aym Ealm 12 Wyn Brsy Ky Tqrybat Ka Aghaz

May 08, 2025 -

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Ke Mwqe Pr Khswsy Prwgram

May 08, 2025

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Ke Mwqe Pr Khswsy Prwgram

May 08, 2025