Analyzing The D-Wave Quantum (QBTS) Stock Decline On Thursday

Table of Contents

Main Points: Deconstructing the QBTS Stock Plunge

2.1 Market Sentiment and Investor Reaction

H3: Pre-existing Market Conditions

The D-Wave Quantum (QBTS) stock decline didn't occur in a vacuum. The broader market presented several headwinds. Leading up to the drop, the overall tech sector experienced a downturn, fueled by concerns about rising interest rates and inflation. This general negative sentiment negatively impacted many tech stocks, including QBTS.

- The Nasdaq Composite Index experienced a significant drop in the preceding weeks.

- Increased interest rates made investment in growth stocks, like QBTS, less attractive.

- Concerns about a potential recession dampened investor risk appetite.

H3: News and Announcements

While no single catastrophic news event directly triggered the decline, several factors contributed to the negative sentiment. The absence of major positive announcements regarding technological breakthroughs or significant partnerships likely played a role.

- The lack of substantial new contract announcements could have disappointed investors hoping for accelerated growth.

- Any negative news related to competitor advancements in the quantum computing field may have also influenced the market's perception of D-Wave's competitive position. (Links to relevant news articles should be inserted here).

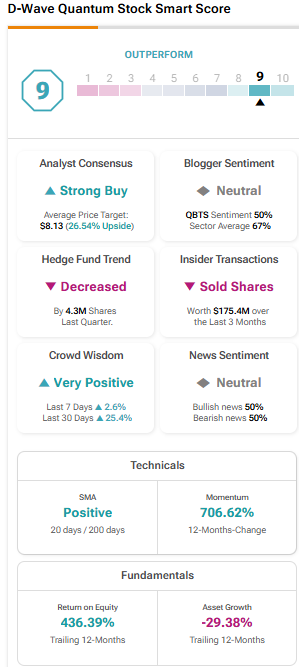

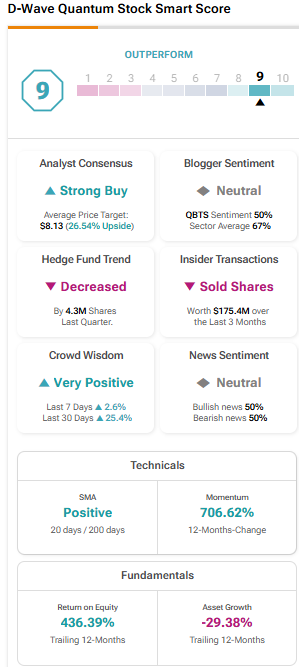

- Analyst downgrades or reduced price targets, if any, would have amplified negative sentiment.

H3: Social Media and Investor Forums

Social media platforms and investor forums reflected the prevailing negative sentiment. Discussions surrounding the QBTS stock price drop often highlighted concerns about the company's financial performance and future prospects.

- Reddit and StockTwits saw increased discussions concerning the QBTS stock decline, with a predominantly negative tone.

- Investor forums showed considerable apprehension regarding the company's ability to maintain its competitive edge.

- The overall sentiment leaned heavily towards pessimism, potentially contributing to further sell-offs.

2.2 Company Performance and Financial Factors

H3: Recent Financial Reports

D-Wave's recent financial reports should be meticulously examined to identify any underlying weaknesses that might have contributed to the decline. Investors closely scrutinize key metrics for signs of financial stress.

- Revenue growth (or lack thereof) is a critical indicator of a company’s health. A slowdown in revenue growth could trigger negative investor sentiment.

- Profitability (or lack thereof) is another key indicator. Consistent losses may erode investor confidence.

- Debt levels and cash flow should be considered. High debt and insufficient cash flow can signify financial vulnerabilities.

H3: Competition and Market Share

The quantum computing industry is highly competitive. The emergence of stronger competitors, or significant advancements by rivals, could impact D-Wave's market share and investor confidence.

- Companies like IBM, Google, and Rigetti Computing are key competitors in the quantum computing space. Their progress and market activities need to be considered.

- Any significant technological breakthroughs by competitors could lead to a reassessment of D-Wave's market position.

- Loss of market share to competitors could be a contributing factor to the QBTS stock decline.

H3: Technological Advancements (or lack thereof)

The pace of technological advancements within D-Wave significantly influences investor perception. A lack of significant breakthroughs, or setbacks in development, can negatively impact investor confidence.

- Any delays in launching new products or services could contribute to negative sentiment.

- Technological setbacks or challenges reported in the media can lead to investor anxieties.

- The absence of significant improvements in the company’s quantum computing technology compared to competitors might concern investors.

2.3 Technical Analysis of the QBTS Stock Chart

H3: Chart Patterns

Technical analysis of the QBTS stock chart can provide insights into the decline. Specific chart patterns often precede significant price movements.

- A head and shoulders pattern, for example, is a bearish reversal pattern that suggests a potential downward trend. (Insert chart here if possible).

- Other bearish patterns like bearish engulfing candlesticks indicate a shift in momentum.

- Identifying such patterns can help understand the dynamics of the decline.

H3: Support and Resistance Levels

Support and resistance levels are crucial in technical analysis. The breaking of key support levels often accelerates downward price movements.

- Identifying the support and resistance levels broken during the decline provides context to the price action.

- Analyzing the volume at these key levels provides further insights into the selling pressure.

- The breach of significant support levels confirms a weakening of the underlying trend.

H3: Volume Analysis

High trading volume during the decline confirms the significance of the price movement. Increased volume suggests stronger investor participation.

- High volume during the price drop indicates strong selling pressure.

- Low volume might suggest a less significant decline and potentially a temporary correction.

- Analyzing volume helps determine the strength and sustainability of the price movement.

Conclusion: Assessing the Future of D-Wave Quantum (QBTS) Stock

The D-Wave Quantum (QBTS) stock decline on Thursday appears to be a confluence of factors, including broader market conditions, lack of significant positive news, and potential concerns about company performance and competition within the quantum computing sector. Technical analysis further supports the bearish trend observed. While the future performance of QBTS stock remains uncertain, continued monitoring of the company's financial reports, technological advancements, and market dynamics is crucial. Investors should conduct thorough research and consider all relevant information before making any investment decisions related to D-Wave Quantum (QBTS) stock and the evolving quantum computing landscape.

Featured Posts

-

El Regreso De Schumacher En 2010 La Charla Reveladora Con Un Amigo

May 20, 2025

El Regreso De Schumacher En 2010 La Charla Reveladora Con Un Amigo

May 20, 2025 -

Tadic Fenerbahce Ye Geliyor Kuluep Tarihinin En Bueyuek Transferlerinden Biri

May 20, 2025

Tadic Fenerbahce Ye Geliyor Kuluep Tarihinin En Bueyuek Transferlerinden Biri

May 20, 2025 -

Ryanair Tariff War Biggest Obstacle To Growth Stock Buyback Planned

May 20, 2025

Ryanair Tariff War Biggest Obstacle To Growth Stock Buyback Planned

May 20, 2025 -

Elections Cameroun 2032 La Position De Macron Face A Un Troisieme Mandat

May 20, 2025

Elections Cameroun 2032 La Position De Macron Face A Un Troisieme Mandat

May 20, 2025 -

Tadic O Daytonskom Sporazumu Nesvjesnost Sarajeva I Potencijalni Gubici

May 20, 2025

Tadic O Daytonskom Sporazumu Nesvjesnost Sarajeva I Potencijalni Gubici

May 20, 2025