Analyzing The Dow Futures: Impact Of China's Economic Policies On The Stock Market

Table of Contents

Understanding the Interconnectedness of the US and Chinese Economies

The US and Chinese economies are deeply intertwined through complex trade relationships, substantial investment flows, and extensively interwoven supply chains. Economic shifts in one country inevitably trigger reactions in the other, creating a high degree of interdependence. This interconnectedness makes understanding China's economic policies crucial for anyone analyzing Dow Futures or the US stock market in general.

- Significant bilateral trade volume impacting various sectors: The sheer volume of trade between the US and China means that fluctuations in Chinese demand or policy directly impact numerous US industries, from agriculture to technology. Changes in Chinese import tariffs, for example, can significantly impact US businesses' profitability and stock prices, affecting Dow Futures.

- Interdependence in supply chains for numerous goods: Many US companies rely on Chinese manufacturing for components or finished goods. Disruptions to Chinese production, due to policy changes or economic slowdowns, can cause supply chain bottlenecks, impacting US companies' ability to meet demand and negatively affecting their stock prices, which influences Dow Futures.

- Chinese investment in US assets and vice versa: Significant cross-border investment exists between the two countries. Changes in Chinese investment policies or economic conditions can affect capital flows into US markets, impacting asset valuations and consequently Dow Futures.

- Impact of Chinese consumer spending on US businesses: Chinese consumers are increasingly important to global brands. A slowdown in the Chinese economy can reduce consumer spending, impacting the revenue of US companies with significant exposure to the Chinese market and, subsequently, Dow Futures.

How Specific Chinese Economic Policies Affect Dow Futures

Analyzing the impact of China's economic policies on Dow Futures requires examining specific policy areas and their cascading effects. Monetary policy, trade policy, and regulatory changes all play significant roles in shaping the relationship between China's economy and the Dow Futures market.

- Monetary Policy: Changes in China's interest rates and reserve requirements significantly influence investor sentiment and global capital flows. A tightening of monetary policy, for instance, might draw investment away from riskier assets, potentially leading to a decline in Dow Futures. Conversely, easing monetary policy could boost global liquidity, potentially pushing Dow Futures higher. The impact depends on the scale of the policy change and the overall global economic context.

- Trade Policy: Tariffs, trade wars, and trade agreements between the US and China have a direct and immediate impact on US companies with significant exposure to the Chinese market. Escalation of trade tensions often leads to uncertainty and volatility in the markets, directly affecting Dow Futures. Trade agreements, conversely, can foster stability and predictability, positively influencing Dow Futures.

- Regulatory Changes: Changes in regulations impacting foreign investment in China, or regulations affecting domestic Chinese companies, can ripple through global markets. Increased regulation might deter foreign investment, impacting US companies' profitability in China and consequently influencing Dow Futures. Conversely, deregulation could boost business activity, leading to a positive impact on Dow Futures.

- Real Estate Market Fluctuations: China's massive real estate sector is a significant driver of its economy. A downturn in the Chinese real estate market can have severe global consequences, impacting investor confidence and, consequently, Dow Futures. This is due to the interconnectedness of global finance and the significant role China plays in the global economy.

Analyzing Recent Trends and Case Studies

Examining recent case studies illuminates the relationship between Chinese economic policies and Dow Futures performance. By analyzing specific policy changes and their impact, investors can gain valuable insights into predicting future market movements.

- Case Study 1: For example, in [Insert Year], when China unexpectedly raised interest rates, the Dow Futures experienced a significant drop in the immediate aftermath. This demonstrates how monetary policy changes in China can quickly influence investor sentiment and impact US markets. (Include relevant data and charts to support this analysis).

- Case Study 2: The trade disputes between the US and China during [Insert period] caused significant volatility in Dow Futures, illustrating the impact of trade policy on the market. Periods of escalating tensions saw Dow Futures fluctuate dramatically, while periods of de-escalation were often marked by relative stability. (Include relevant data and charts to support this analysis).

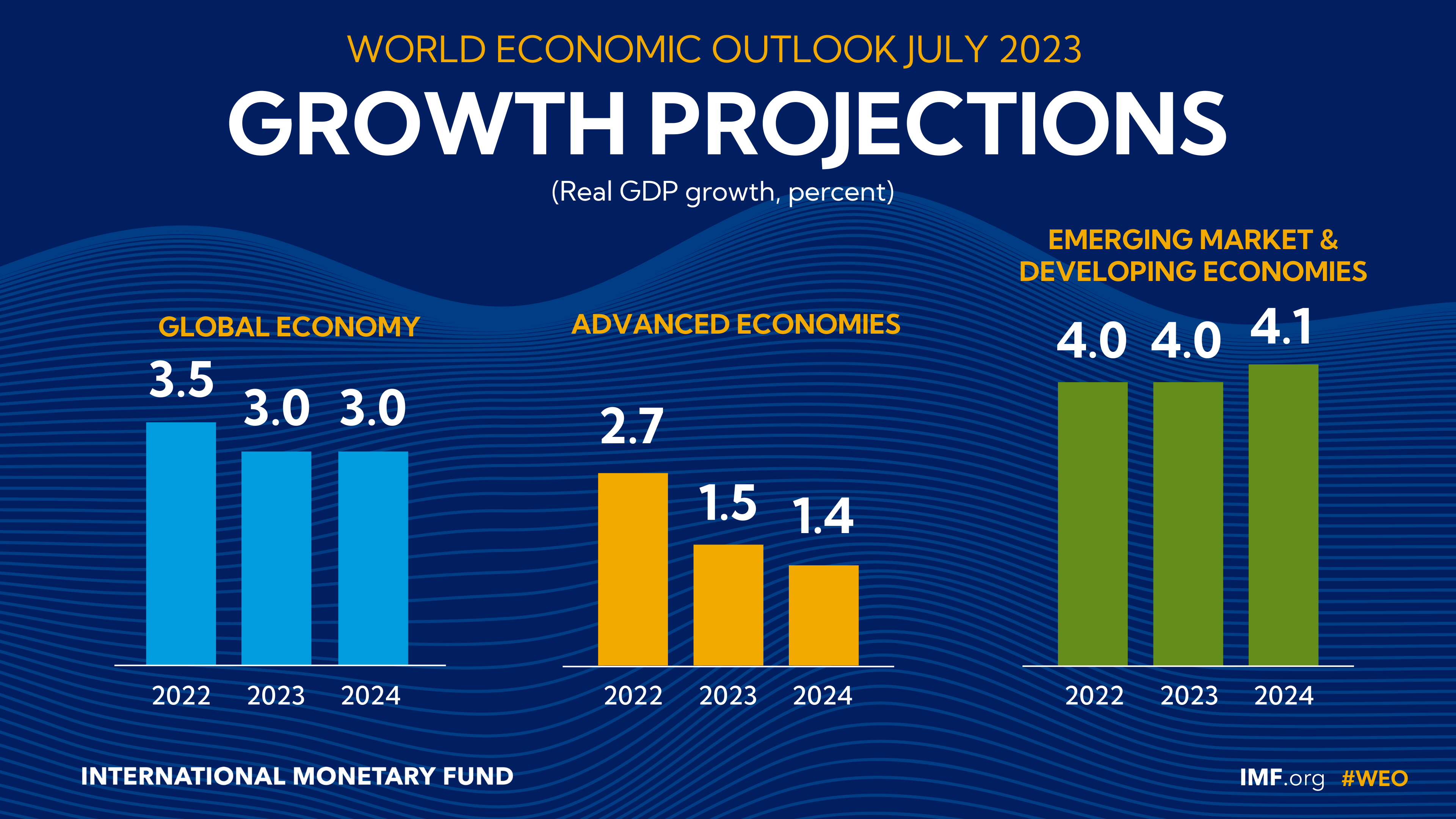

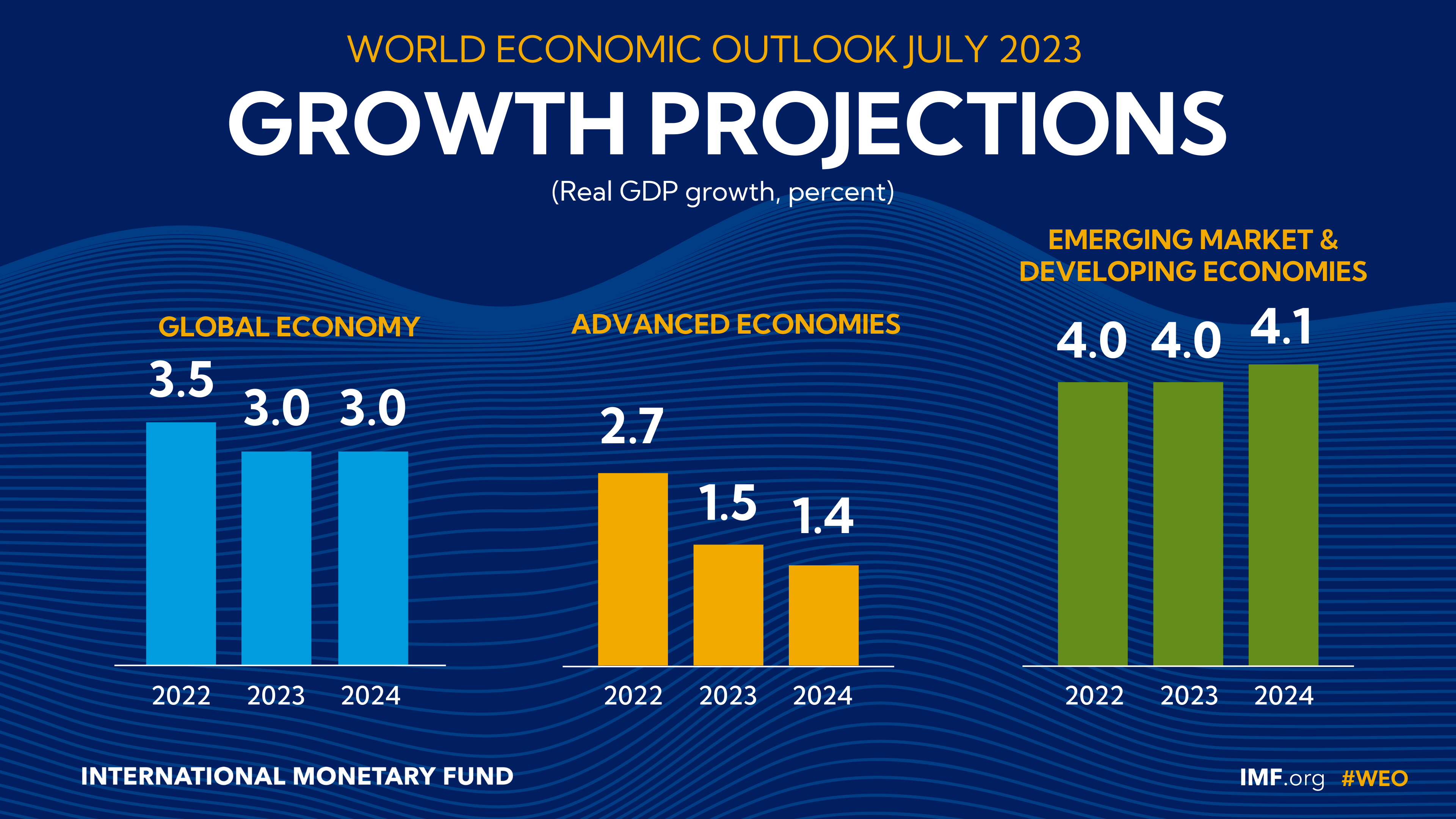

- Correlation Analysis: A statistical analysis revealing the correlation between key Chinese economic indicators (e.g., GDP growth, inflation, industrial production) and Dow Futures movements can provide further evidence of the relationship. This analysis can help identify leading indicators of future Dow Futures movements based on Chinese economic data.

Utilizing Technical Analysis for Predicting Dow Futures Movement Based on Chinese Policy

Technical analysis can be a powerful tool when combined with an understanding of Chinese economic policies to enhance predictions regarding Dow Futures. By identifying patterns and trends in the Dow Futures charts, and correlating them to significant Chinese policy announcements, investors can improve their market predictions.

- Identifying key support and resistance levels: Specific Chinese policy announcements often correspond to significant shifts in Dow Futures pricing. By identifying historical support and resistance levels around these events, traders can anticipate potential price reactions to future policy decisions.

- Using moving averages and other indicators: Technical indicators such as moving averages, relative strength index (RSI), and Bollinger Bands can help confirm emerging trends and identify potential entry and exit points for Dow Futures trading based on anticipated reactions to Chinese policy.

- Importance of risk management: Trading Dow Futures based on geopolitical events like policy shifts in China inherently carries higher risk. Implementing robust risk management strategies, including stop-loss orders and position sizing, is crucial to mitigate potential losses.

Conclusion

China's economic policies exert a significant and multifaceted impact on the Dow Futures market due to the strong economic interdependence between the US and China. Understanding these linkages is crucial for investors aiming to navigate the complexities of global financial markets. Analyzing monetary policy, trade relations, and regulatory changes in China provides valuable insights into potential future movements of Dow Futures. Utilizing both fundamental analysis (understanding the underlying economic forces) and technical analysis (analyzing price charts and trends) enhances the precision of forecasting.

Call to Action: Stay informed about China's economic policies and their potential effects on the Dow Futures market to make well-informed investment decisions. Regularly monitor key economic indicators and analyze the Dow Futures market using technical analysis techniques to better understand the impact of China's economic policies. Continue your research into Dow Futures and China’s economic influence to refine your trading strategies and mitigate risk.

Featured Posts

-

Green Bay Welcomes Nfl Draft First Round Preview

Apr 26, 2025

Green Bay Welcomes Nfl Draft First Round Preview

Apr 26, 2025 -

Exploring Florida With A Cnn Anchor His Top Pick

Apr 26, 2025

Exploring Florida With A Cnn Anchor His Top Pick

Apr 26, 2025 -

Cassidy Hutchinsons Memoir Key Jan 6 Witness Details Her Experiences

Apr 26, 2025

Cassidy Hutchinsons Memoir Key Jan 6 Witness Details Her Experiences

Apr 26, 2025 -

A Conservative View On Harvards Challenges And Solutions

Apr 26, 2025

A Conservative View On Harvards Challenges And Solutions

Apr 26, 2025 -

Anchor Brewing Company Closes After 127 Years The End Of An Era

Apr 26, 2025

Anchor Brewing Company Closes After 127 Years The End Of An Era

Apr 26, 2025