Analyzing The Euro's Rise: Insights From Swissquote Bank

Table of Contents

Economic Indicators Fueling the Euro's Rise

Strong economic data from the Eurozone has played a pivotal role in the Euro's recent appreciation. Positive economic indicators signal a healthy and growing economy, boosting investor confidence and increasing demand for the Euro.

-

Improved GDP Growth Figures: The Eurozone has witnessed robust GDP growth figures in recent quarters, exceeding expectations and demonstrating economic resilience. This positive trend reflects increased production, consumption, and overall economic activity. Swissquote Bank's analysis highlights the significant contribution of key Eurozone economies like Germany and France to this growth.

-

Lower Unemployment Rates: Falling unemployment rates in several Eurozone countries indicate a strengthening labor market. This signifies increased consumer spending and a more robust economy, further bolstering the Euro's value. Swissquote Bank's reports consistently track these unemployment figures, providing valuable insights into the overall health of the Eurozone economy.

-

Increased Consumer Confidence: Rising consumer confidence indicates a positive outlook on the economy, leading to increased spending and investment. This positive sentiment translates into higher demand for the Euro, contributing to its rise. Swissquote Bank uses various consumer confidence indices to gauge market sentiment and its effect on the Euro.

-

Positive Inflation Trends (excluding excessive inflation): While high inflation can be detrimental, a controlled and gradually decreasing inflation rate suggests that the Eurozone economy is managing price pressures effectively. This stability encourages investor confidence and supports the Euro's rise. Swissquote Bank closely monitors inflation data and its impact on the currency markets.

These positive economic indicators collectively influence investor confidence and significantly increase the demand for the Euro in the foreign exchange market. The combination of strong growth, low unemployment, increasing consumer confidence, and controlled inflation creates a positive feedback loop, strengthening the Euro's position.

Geopolitical Factors and the Euro's Strength

Geopolitical events significantly impact currency markets, and the Euro is no exception. Recent events have influenced the Euro's strength in complex and often unpredictable ways.

-

The War in Ukraine and its Effects on Energy Prices and the Euro: The ongoing conflict in Ukraine has had a substantial impact on energy prices across Europe. While initially causing volatility, the Eurozone's managed response and diversification efforts have, in part, contributed to a degree of stabilization and ultimately strengthened the Euro against some other currencies. Swissquote Bank's analysis regularly assesses the impact of geopolitical risks on the Euro's value.

-

The Role of the European Union's Response to Geopolitical Instability: The EU's cohesive response to geopolitical challenges has demonstrated strength and unity, indirectly bolstering investor confidence in the Euro. Swissquote Bank highlights the importance of the EU's coordinated actions in mitigating risks and maintaining stability.

-

Shifts in Global Power Dynamics Impacting the Euro: Changes in global power dynamics and relationships between major world powers can influence the relative strength of currencies, including the Euro. Swissquote Bank's experts analyze these shifts and assess their potential consequences for the Euro's value.

Market Sentiment and Speculation

Market sentiment plays a crucial role in driving the Euro's price. Positive investor sentiment translates directly into increased demand, pushing the Euro's value higher.

-

Positive Investor Sentiment Boosts Euro Demand: When investors perceive the Eurozone economy as stable and prosperous, they tend to invest more heavily in Euro-denominated assets, increasing demand and pushing the Euro's value upward. Swissquote Bank's market analysis incorporates indicators of investor sentiment.

-

The Influence of Currency Traders and Speculation: Currency traders and speculators can significantly influence the Euro's price through their trading activities. Large-scale buying or selling of Euros can create short-term volatility but also contribute to long-term trends. Swissquote Bank offers insights into the actions of major market players.

-

Significant Market Trends Observed by Swissquote Bank: Swissquote Bank's market analysts track various factors that indicate the overall market sentiment towards the Euro, including news events, economic data releases and trader behavior. These observations often foreshadow shifts in the Euro's value. (Include charts and graphs if available from Swissquote Bank's public resources).

Swissquote Bank's Perspective and Trading Strategies

Swissquote Bank offers valuable insights and perspectives on the Euro's rise, providing crucial information for traders and investors.

-

Swissquote's Forecasts and Predictions Regarding the Future Euro Exchange Rate: Swissquote Bank publishes regular analyses and forecasts on the Euro's future exchange rate, taking into account the various factors discussed above. (Include links to relevant Swissquote Bank research reports.)

-

Suggested Trading Strategies Based on Swissquote Bank's Expertise: Swissquote Bank's experts provide suggested trading strategies based on their analysis of the Euro's current trends and potential future movements. (Link to relevant Swissquote Bank resources, such as educational materials or trading platform information).

-

Risk Management Advice Provided by Swissquote Bank: Swissquote Bank emphasizes responsible risk management in all trading activities and provides valuable advice on mitigating potential losses. (Refer to Swissquote Bank's risk management resources).

Understanding Risk and Volatility

Trading the Euro, like any currency trading, involves inherent risks and volatility.

-

Potential Downsides and Volatility: While the Euro has shown strength recently, it’s crucial to acknowledge that its value can fluctuate significantly due to various economic and geopolitical factors. Understanding potential downsides is critical to responsible trading.

-

Importance of Careful Risk Management: Implementing a robust risk management strategy, including setting stop-loss orders and diversifying investments, is essential to protect against potential losses.

-

Need for Informed Decision-Making: Informed decisions based on thorough analysis, such as that provided by Swissquote Bank, are crucial for successful Euro trading.

Conclusion

This analysis reveals that the Euro's recent rise is a complex phenomenon driven by a combination of strong economic indicators, evolving geopolitical situations, and prevailing market sentiment. Swissquote Bank's insights provide valuable context for understanding these factors and developing informed trading strategies. To stay informed about the Euro's future trajectory and capitalize on the opportunities it presents, visit Swissquote Bank's website for in-depth analysis and expert insights on the Euro's rise and other market trends. Learn more about optimizing your trading strategies based on fluctuations in the Euro's value.

Featured Posts

-

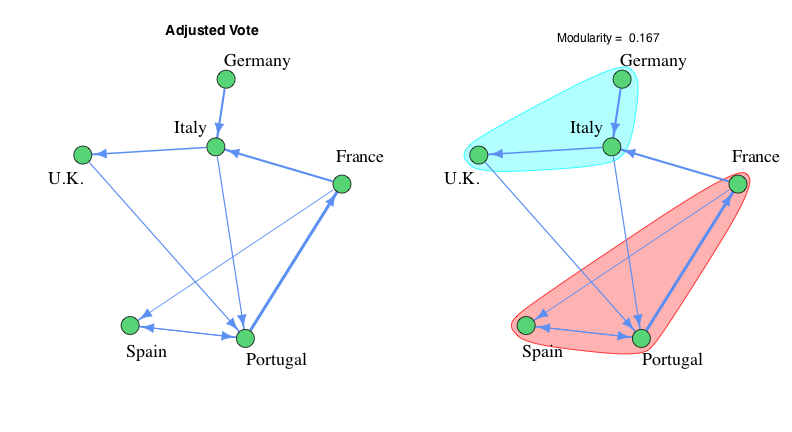

A Simple Guide To Eurovisions Voting Procedures

May 19, 2025

A Simple Guide To Eurovisions Voting Procedures

May 19, 2025 -

Ufc 313 Mairon Santos Acknowledges Francis Marshalls Win

May 19, 2025

Ufc 313 Mairon Santos Acknowledges Francis Marshalls Win

May 19, 2025 -

High Flying Tequila Brands Challenges And Opportunities Ahead

May 19, 2025

High Flying Tequila Brands Challenges And Opportunities Ahead

May 19, 2025 -

Instalaciones Del Cne Blindadas Por La Policia Nacional En La Capital

May 19, 2025

Instalaciones Del Cne Blindadas Por La Policia Nacional En La Capital

May 19, 2025 -

Atp 500 Hamburgo Comesana Se Abre Paso En El Cuadro

May 19, 2025

Atp 500 Hamburgo Comesana Se Abre Paso En El Cuadro

May 19, 2025