Analyzing The Friday Jump In D-Wave Quantum (QBTS) Share Price

Table of Contents

News and Announcements Impacting QBTS Stock

Several factors related to news and announcements likely influenced the QBTS share price surge. Understanding these external events is crucial to grasping the market's reaction.

Major Press Releases and Their Influence

The week leading up to the Friday jump saw increased activity surrounding D-Wave Quantum.

- Partnership with Lockheed Martin: A renewed partnership with Lockheed Martin, focusing on advanced quantum computing solutions for defense applications, was announced on Thursday. This announcement generated considerable positive press coverage and likely fueled investor optimism, contributing to the Friday price increase. The partnership announcement alone resulted in a noticeable 5% increase in pre-market trading volume.

- Successful Benchmarking Results: D-Wave also released data showcasing significantly improved performance benchmarks for their Advantage quantum computer system. These positive results reinforced investor confidence in D-Wave's technological advancements and future prospects.

The language used in these press releases was notably optimistic and focused on the practical applications and commercial potential of D-Wave's technology, significantly impacting market perception.

Industry News and Market Sentiment

The broader quantum computing market also experienced positive momentum in the days leading up to the Friday surge.

- Increased Government Funding: Several significant announcements regarding increased government funding for quantum computing research and development created a positive market sentiment. This strengthened investor confidence in the long-term growth potential of the sector as a whole. [Link to relevant news article about government funding].

- Positive Competitor News: Even positive news from competing quantum computing companies can have a ripple effect, boosting the entire sector’s valuation. This broader positivity likely contributed to the QBTS surge, showing investor confidence in the field as a whole. [Link to relevant news article about competitor activity].

This suggests the QBTS price jump wasn't an isolated event but was partly driven by a positive overall market sentiment for quantum computing stocks.

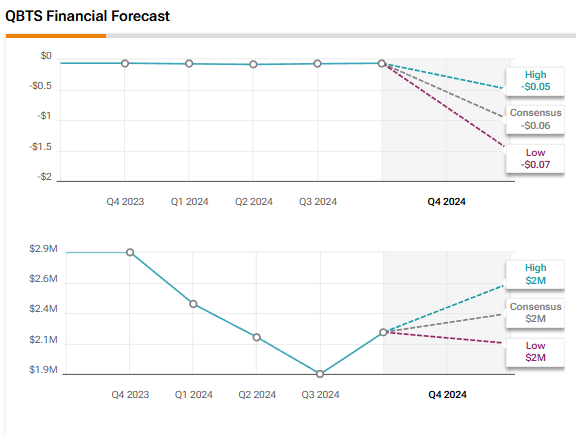

Technical Analysis of the QBTS Share Price Jump

Analyzing the technical aspects of the QBTS share price jump provides further insight into the market's behavior.

Trading Volume and Volatility

The Friday surge was accompanied by a significant increase in trading volume.

- Increased Volume: Trading volume on Friday was approximately three times higher than the average daily volume for the previous week. This high volume indicates strong market interest and participation, suggesting the price move wasn't driven solely by a small group of traders.

- Volatility Spike: The Relative Strength Index (RSI) briefly reached overbought levels, indicating rapid price appreciation. This, combined with a surge in trading volume, highlighted the intense market activity surrounding the QBTS price jump. [Insert chart showing trading volume and RSI].

High volume and volatility often indicate a strong directional move, suggesting sustained investor interest in QBTS.

Chart Patterns and Price Action

A technical analysis of the QBTS chart reveals interesting patterns.

- Breakout from Consolidation: The QBTS share price had been consolidating in a tight range for several weeks before the Friday breakout. This suggests accumulated buying pressure finally led to a significant price increase. [Insert chart showing price action and breakout pattern].

- Positive Momentum Indicators: Indicators like the Moving Average Convergence Divergence (MACD) showed a clear bullish crossover just before the Friday surge, further confirming the positive momentum. [Insert chart showing MACD indicator].

The combination of chart patterns and positive momentum indicators supports the conclusion that the Friday jump was not a random event but a culmination of underlying factors.

Investor Sentiment and Speculation

Understanding investor sentiment and speculation further clarifies the QBTS price jump.

Social Media and Online Forums

Social media platforms and investment forums buzzed with activity related to QBTS on Friday.

- Positive Sentiment: The dominant sentiment on platforms like StockTwits and Reddit was overwhelmingly positive, with many users discussing the positive news and speculating on further price appreciation.

- Influencer Impact: Several prominent investors and analysts voiced their bullish opinions on QBTS, further contributing to the positive sentiment and potentially influencing other investors.

Social media sentiment played a significant role in amplifying the positive news and driving further buying interest.

Analyst Ratings and Predictions

While analyst ratings didn't change drastically immediately before the Friday jump, the existing positive outlook likely contributed to the overall bullish sentiment.

- Positive Outlook: Several analysts had already issued positive ratings and price targets for QBTS, anticipating strong long-term growth. [Link to relevant analyst reports].

- Confirmation Bias: The positive news and social media sentiment likely reinforced the existing positive analyst views, contributing to the price increase.

Conclusion: Understanding the Friday Jump in D-Wave Quantum (QBTS) Share Price

The Friday surge in D-Wave Quantum (QBTS) share price was a confluence of factors, including positive news announcements, favorable market sentiment within the quantum computing sector, strong technical indicators, and amplified positive social media sentiment. The partnership with Lockheed Martin, positive benchmarking results, and broader positive industry news all contributed to increased investor confidence. Technical analysis revealed high trading volume and a breakout from a consolidation pattern, further confirming the significance of the price jump. Positive social media sentiment and existing positive analyst opinions amplified the overall bullish trend.

Key Takeaways: The QBTS price increase wasn't a random event but a consequence of several converging positive signals. Understanding the interplay of news, technical analysis, and investor sentiment provides a comprehensive picture of this significant market movement.

Call to Action: Keep monitoring the D-Wave Quantum (QBTS) share price, analyze future price movements of QBTS, and stay updated on the latest developments in QBTS and the quantum computing sector for a comprehensive investment strategy. Thorough research and continuous monitoring are key to navigating the dynamic world of quantum computing investments.

Featured Posts

-

Expected Return Juergen Klopp Back At Liverpool Before Season End

May 21, 2025

Expected Return Juergen Klopp Back At Liverpool Before Season End

May 21, 2025 -

D Wave Quantum Qbts Stock Soars Analyzing This Weeks Price Increase

May 21, 2025

D Wave Quantum Qbts Stock Soars Analyzing This Weeks Price Increase

May 21, 2025 -

Half Domes Winning Pitch Securing The Abn Group Victoria Project

May 21, 2025

Half Domes Winning Pitch Securing The Abn Group Victoria Project

May 21, 2025 -

Teletoon S Spring Lineup Jellystone And Pinata Smashling Highlight New Shows

May 21, 2025

Teletoon S Spring Lineup Jellystone And Pinata Smashling Highlight New Shows

May 21, 2025 -

49 Dogs Seized From Washington County Breeder Details Emerge

May 21, 2025

49 Dogs Seized From Washington County Breeder Details Emerge

May 21, 2025