Analyzing The GOP Tax Plan: The Reality Of Deficit Reduction

Table of Contents

Projected Economic Growth vs. Actual Outcomes

The GOP argued that substantial tax cuts would stimulate economic growth, ultimately boosting tax revenues and offsetting the initial revenue loss. However, the validity of these projections is questionable. Numerous economic models and expert opinions suggest that the projected growth may be overly optimistic.

- Comparison with historical data: Historical data following similar tax cuts show a mixed bag. While some periods saw increased growth, others experienced minimal or even negative effects on GDP. A simple comparison isn't sufficient; the context of each economic climate must be carefully considered.

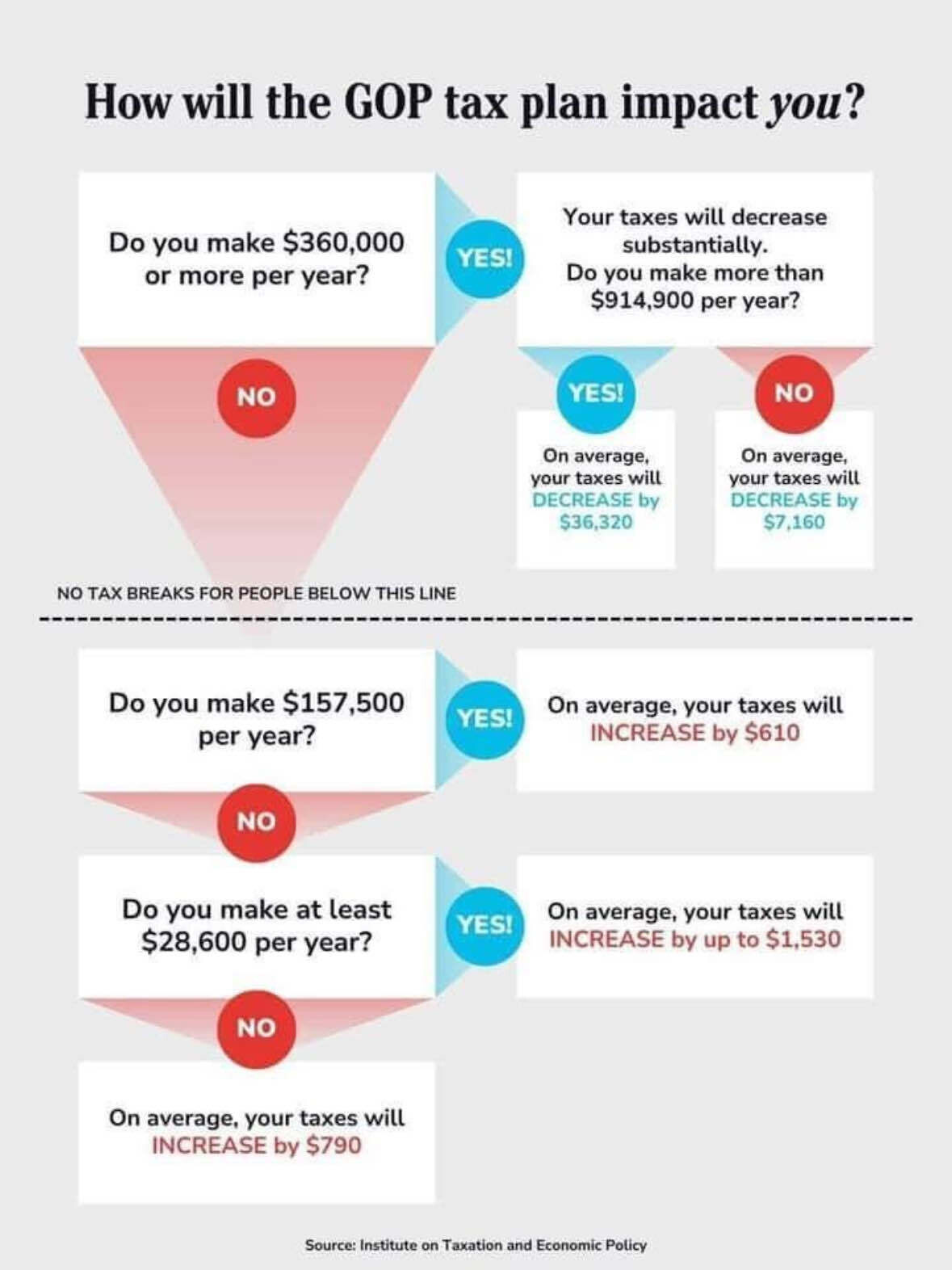

- Increased income inequality: Critics argue that the benefits of such tax cuts disproportionately favor high-income earners, potentially increasing income inequality and hindering broad-based economic growth. This concentration of wealth could stifle overall consumer spending, a key driver of economic expansion.

- The Laffer Curve's limitations: The GOP's argument often relies on the Laffer Curve, suggesting that lower tax rates lead to increased economic activity, ultimately generating higher tax revenues. However, the precise point at which tax rate reductions maximize revenue is highly debated and depends heavily on the elasticity of tax revenue—a factor that's difficult to accurately predict. Applying the Laffer Curve without considering the current economic climate can lead to inaccurate conclusions about GOP Tax Plan Deficit Reduction.

Revenue Projections and Their Reliability

The GOP Tax Plan's revenue projections are crucial to its deficit reduction claims. However, these projections are subject to significant uncertainty and potential bias. The assumptions underlying these projections are often overly optimistic.

- Static vs. Dynamic Scoring: The difference between static and dynamic scoring methodologies is critical. Static scoring assumes no behavioral changes in response to tax cuts, while dynamic scoring accounts for potential changes in work effort, investment, and tax avoidance. The GOP's reliance on dynamic scoring often leads to inflated revenue projections.

- Historical Accuracy: Examining the historical accuracy of similar revenue projections reveals a pattern of overestimation. Past tax cuts often failed to deliver the projected revenue increases due to unforeseen economic factors and behavioral responses. This historical inaccuracy casts doubt on the current projections' reliability concerning GOP Tax Plan Deficit Reduction.

- Potential Loopholes: The complexity of the tax code creates opportunities for loopholes and tax avoidance. These loopholes can significantly reduce actual tax revenue collected, undermining the plan's projected revenue gains and impacting GOP Tax Plan Deficit Reduction.

Impact of Increased Spending and the National Debt

Even if the revenue projections were accurate, increased government spending could offset any potential revenue increases. This increased spending could lead to a larger deficit and a rising national debt.

- Mandatory Spending: Mandatory spending programs like Social Security and Medicare represent a significant portion of the federal budget and are largely unaffected by tax cuts. Increases in these programs will continue driving the deficit, regardless of revenue projections relating to GOP Tax Plan Deficit Reduction.

- Future Interest Rate Hikes: Rising interest rates increase the cost of servicing the national debt, further exacerbating the deficit. The Federal Reserve's actions concerning interest rates will significantly impact the effectiveness of GOP Tax Plan Deficit Reduction.

- Economic Consequences: A rapidly rising national debt can have severe economic consequences, including higher interest rates, reduced investment, and slower economic growth. Ignoring the long-term impact on the national debt undermines any short-term gains from GOP Tax Plan Deficit Reduction.

Alternative Perspectives and Criticisms of the GOP Tax Plan

Many economists and policymakers disagree with the administration's claims regarding GOP Tax Plan Deficit Reduction. They highlight several key criticisms:

- Overly optimistic economic assumptions: Critics argue that the economic assumptions underpinning the plan are overly optimistic and unrealistic. They suggest more moderate growth projections and a greater focus on potential negative consequences.

- Negative impacts on specific demographics: The plan may disproportionately benefit high-income earners while potentially harming lower and middle-income families through reduced social programs or increased costs.

- Counterarguments to GOP justifications: Critics provide counterarguments to the GOP's justifications for the plan, often emphasizing the importance of fiscal responsibility and the long-term consequences of unsustainable fiscal policy.

Conclusion: Assessing the Reality of GOP Tax Plan Deficit Reduction

In conclusion, the GOP Tax Plan's claims of significant deficit reduction appear overly optimistic. The analysis reveals discrepancies between projected economic growth and realistic outcomes, questionable revenue projections, and the potential for increased spending to offset any revenue gains. While economic growth is a complex factor in tax revenue generation, the current plan’s projections might be unrealistic. It's crucial to consider all factors—economic growth, revenue generation, and spending—when assessing fiscal policy. To form your own informed opinion on the GOP Tax Plan Deficit Reduction, explore further resources and analyses from independent economic institutions and organizations. Understanding the intricacies of fiscal policy is crucial for informed civic engagement.

Featured Posts

-

Biografiya Mirry Andreevoy Put K Uspekhu V Mire Bolshogo Tennisa

May 20, 2025

Biografiya Mirry Andreevoy Put K Uspekhu V Mire Bolshogo Tennisa

May 20, 2025 -

Flavio Cobollis Triumph Bucharest Tiriac Open Victory

May 20, 2025

Flavio Cobollis Triumph Bucharest Tiriac Open Victory

May 20, 2025 -

New Texas Bill Aims To Protect Minors From Social Media Harms

May 20, 2025

New Texas Bill Aims To Protect Minors From Social Media Harms

May 20, 2025 -

Fa Cup Rashfords Two Goals Secure Manchester United Win Over Aston Villa

May 20, 2025

Fa Cup Rashfords Two Goals Secure Manchester United Win Over Aston Villa

May 20, 2025 -

Tadic Daytonov Sporazum Koliko Politicko Sarajevo Gubi Njegovim Rusenjem

May 20, 2025

Tadic Daytonov Sporazum Koliko Politicko Sarajevo Gubi Njegovim Rusenjem

May 20, 2025