Analyzing The GOP Tax Plan: The Truth About Deficit Reduction

Table of Contents

Projected Revenue Increases vs. Reality

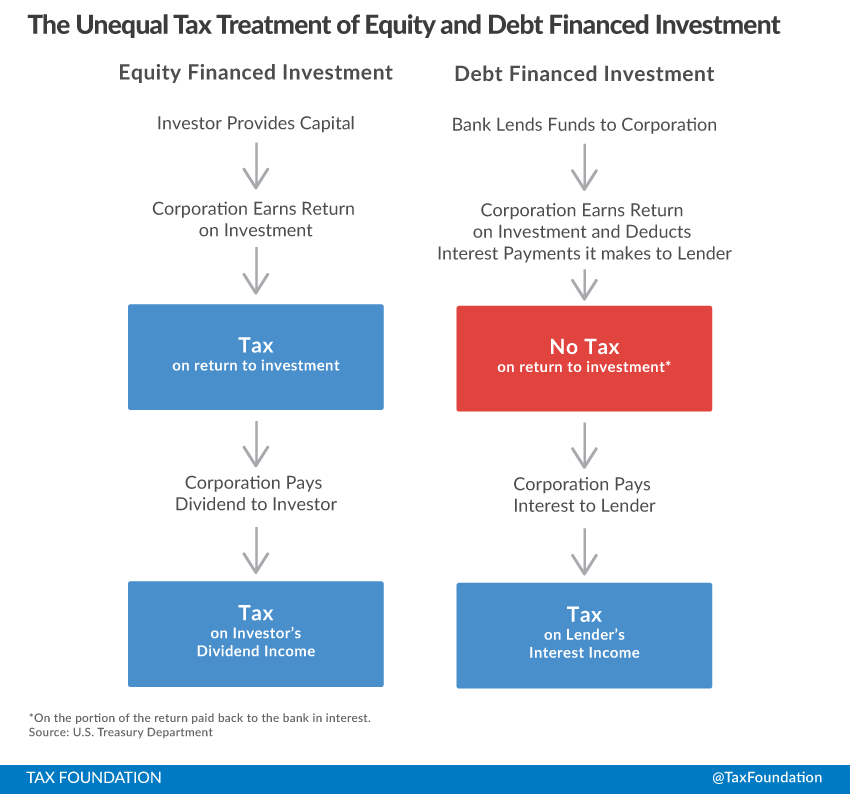

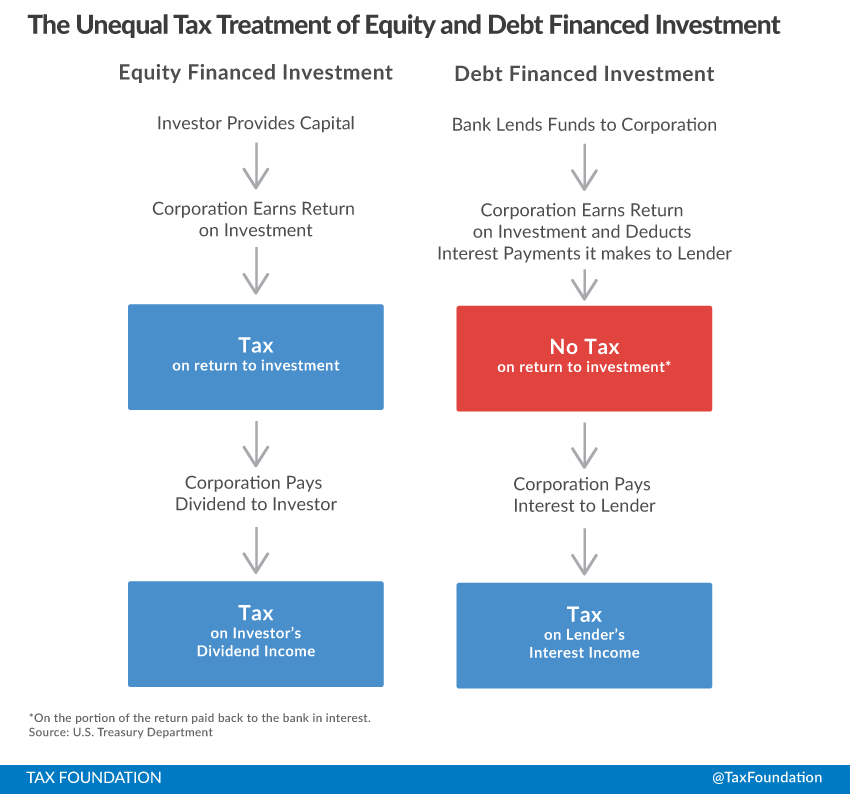

A cornerstone of the GOP's argument for the tax plan was the projected increase in revenue resulting from stimulated economic growth. The theory is that lower tax rates would incentivize businesses to invest more, leading to job creation and higher wages, ultimately boosting tax revenue. However, this projection relies on several crucial assumptions that warrant closer scrutiny.

- Elasticity of Labor Supply: The GOP's projections assume a significant increase in labor supply in response to lower taxes. However, independent analyses suggest this elasticity is far lower than assumed, meaning the increase in work hours and overall economic activity might not be as substantial as predicted.

- Investment Response: Similarly, the projected surge in investment depends on businesses actually using the tax savings to expand operations rather than returning profits to shareholders or engaging in stock buybacks. Empirical evidence on the effectiveness of tax cuts in stimulating investment is mixed.

- Tax Loopholes and Avoidance: The plan's complexity creates numerous opportunities for tax avoidance and exploitation of loopholes. This could significantly reduce the actual tax revenue collected, undermining the projected increases.

(Insert Chart/Graph here comparing projected revenue increases with independent forecasts from sources like the Congressional Budget Office (CBO) or the Tax Policy Center.) The disparity between projected and actual revenue will be clearly visualized.

Spending Cuts and Their Impact

The GOP tax plan, in its original form, did not include significant, offsetting spending cuts to counterbalance the revenue reductions from the tax cuts. This absence of fiscal restraint is a key factor in assessing its impact on the deficit.

- Limited Spending Cuts: While some minor spending cuts were proposed, they were generally insufficient to offset the substantial revenue loss from the tax cuts.

- Impact on the Deficit: The lack of substantial spending cuts means the deficit will likely increase significantly in the short term and potentially long term, depending on the accuracy of revenue projections.

- Negative Consequences: Potential cuts to essential social programs and infrastructure projects could have detrimental long-term consequences for the economy and society. (Further detail examples of potential cuts and their effects.)

(Include budget data and information on the impact of similar spending cuts in the past, comparing it with the proposed plan.) This section should clearly demonstrate the inadequate level of spending cuts to offset the tax cuts.

Dynamic Scoring and its Limitations

The GOP justified its deficit claims partly through the use of dynamic scoring – a method that incorporates the anticipated effects of the tax cuts on economic growth. However, dynamic scoring is fraught with uncertainties and biases.

- Uncertainties and Biases: Predicting future economic growth with accuracy is inherently difficult. Dynamic scoring models rely on assumptions about behavioral responses to tax changes, which are subject to significant uncertainty. Further, there's a risk of political bias influencing model parameters.

- Comparison with Static Scoring: Static scoring, which doesn't consider economic growth, provides a more conservative, and arguably more realistic, estimate of the tax plan's impact on the deficit. Comparing the results of dynamic and static scoring highlights the significant differences in their conclusions.

- Criticisms from Economists: Many economists and policymakers have criticized the use of dynamic scoring, citing its inherent limitations and potential for manipulation.

(Include examples of studies that illustrate the limitations of dynamic scoring and compare results using static scoring.) This comparison should underscore the problematic nature of solely relying on dynamic scoring to justify deficit reduction claims.

Long-Term Fiscal Impact

The long-term consequences of the GOP tax plan on the national debt are substantial and far-reaching. The increased deficit will lead to several negative long-term consequences.

- Interest Payments: The growing national debt will result in higher interest payments, further straining the federal budget and potentially crowding out other essential government spending.

- Future Tax Increases: To address the growing debt, future tax increases or spending cuts will likely be necessary, potentially impacting future generations negatively.

- Intergenerational Equity: The current generation benefits from tax cuts while imposing a greater debt burden on future generations, raising serious questions about intergenerational equity.

(Use long-term projections of the national debt under different scenarios, including one reflecting the GOP tax plan’s projected impact.) Clearly show the long-term debt trajectory and the burden it places on future generations.

Conclusion: Assessing the GOP Tax Plan's Deficit Reduction Claims

Our analysis reveals that the GOP tax plan's claims of deficit reduction are not supported by credible evidence. The reliance on optimistic projections of revenue increases, the absence of substantial offsetting spending cuts, and the problematic use of dynamic scoring all contribute to a picture of unsustainable fiscal policy. While the plan may offer some short-term economic benefits, the long-term consequences for the national debt and future generations are significant. It's crucial to continue analyzing the GOP tax plan and its implications to have a well-informed discussion about fiscal responsibility and long-term economic stability. Further investigate the truth about deficit reduction under the GOP tax plan and critically evaluate the GOP's approach to deficit reduction to ensure a sustainable future.

Featured Posts

-

The Key To The Bruins Future Espns Offseason Breakdown

May 21, 2025

The Key To The Bruins Future Espns Offseason Breakdown

May 21, 2025 -

Southern French Alps Weather Storm Brings Unexpected Snow

May 21, 2025

Southern French Alps Weather Storm Brings Unexpected Snow

May 21, 2025 -

Liverpool Juara Premier League 2024 2025 Analisis Dan Sejarah Juara

May 21, 2025

Liverpool Juara Premier League 2024 2025 Analisis Dan Sejarah Juara

May 21, 2025 -

The 21 Year Old Peppa Pig Enigma Fans Discover The Answer

May 21, 2025

The 21 Year Old Peppa Pig Enigma Fans Discover The Answer

May 21, 2025 -

How To Access Peppa Pig Online Free Streaming And Legal Options

May 21, 2025

How To Access Peppa Pig Online Free Streaming And Legal Options

May 21, 2025