Analyzing The Impact Of QBTS Upcoming Earnings On Stock Price

Table of Contents

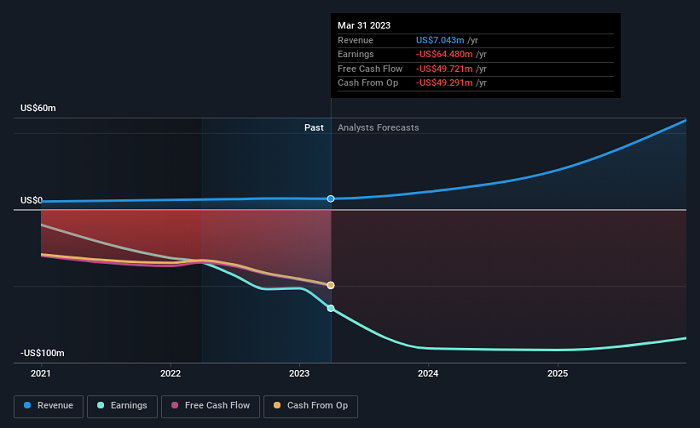

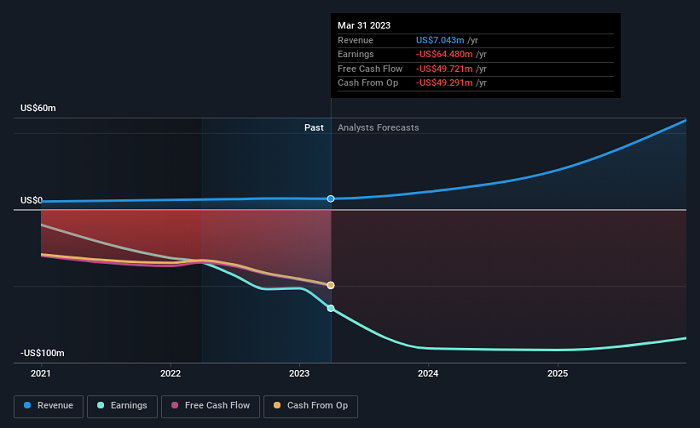

Understanding QBTS's Current Financial Position & Market Sentiment

Recent Performance and Key Financial Indicators

Analyzing QBTS's recent financial performance is crucial to predicting the market's reaction to its upcoming earnings report. We need to look at key indicators to gauge the company's current health.

- Quarterly Revenue Growth: Has QBTS shown consistent revenue growth in recent quarters? A strong track record suggests positive momentum. (Example: Assume a 15% YoY revenue growth in the previous quarter.)

- Earnings Per Share (EPS): Is the EPS trending upwards or downwards? This is a key metric investors watch closely. (Example: EPS of $1.20 in the last quarter, compared to $1.00 in the previous quarter.)

- Profit Margins: Are QBTS's profit margins improving or declining? This indicates efficiency and profitability. (Example: An increase in profit margin from 10% to 12%.)

- Analyst Ratings and Price Targets: What are the leading analysts predicting for QBTS stock? Their ratings and price targets offer valuable insights. (Example: Average price target of $50, with a majority of analysts rating it a "buy".)

Market Sentiment and Investor Expectations

Understanding the prevailing market sentiment towards QBTS is equally important. Is the market generally optimistic or pessimistic about the company's prospects?

- News Articles and Social Media Sentiment: A review of recent news articles and social media discussions about QBTS can reveal the general investor sentiment. (Example: Positive news coverage of a recent product launch.)

- Options Trading Volume and Implied Volatility: High options trading volume and implied volatility often indicate significant investor anticipation and potential price swings after the earnings release. (Example: High options volume suggests significant market expectation for a price move post-earnings.)

Analyzing the Potential Impact of Upcoming Earnings

Beat or Miss Expectations?

The most significant factor influencing the QBTS stock price after the earnings announcement will be whether the company beats, meets, or misses analyst expectations.

- Consensus Analyst Estimates: What are the average earnings per share (EPS) and revenue estimates from analysts covering QBTS? (Example: Consensus EPS estimate is $1.30.)

- Positive Earnings Surprise: If QBTS exceeds expectations, it could trigger a significant price increase, as investors react positively to the better-than-anticipated performance.

- Meeting Expectations: Meeting expectations might result in a relatively flat reaction or a slight price movement, depending on other factors like guidance.

- Negative Earnings Surprise: Missing expectations could lead to a considerable price drop, as investors react negatively to disappointing results.

Guidance for Future Performance

Beyond the current quarter's results, QBTS's forward-looking guidance will heavily influence investor sentiment.

- Sales Growth Projections: What sales growth does QBTS project for the next quarter or year? Strong projections suggest continued growth and a positive outlook.

- New Product Launches: Are there any significant new product launches planned? These could significantly impact future revenue.

- Cost-Cutting Measures: Is QBTS implementing cost-cutting measures to improve profitability? This might be viewed positively by investors.

- Impact of Guidance on Stock Price: Positive guidance typically leads to a price increase, while negative or underwhelming guidance can result in a price decrease.

Risk Factors & Other Considerations

Macroeconomic Factors

External factors beyond QBTS's control can also impact its stock price.

- Inflation and Interest Rates: High inflation and rising interest rates can negatively impact consumer spending and corporate profitability.

- Geopolitical Events: Global geopolitical instability can create uncertainty in the market, affecting even well-performing companies.

Competitive Landscape

QBTS operates within a competitive landscape, and the performance of its rivals can indirectly affect its stock price.

- Key Competitors: Identify QBTS's main competitors and their recent performance. Strong competitor performance might put downward pressure on QBTS's stock price.

- Market Share: Any significant shifts in market share among competitors could influence investor perception of QBTS.

Conclusion: Making Informed Decisions about QBTS Stock Based on Upcoming Earnings

This analysis has examined QBTS's current financial standing, the potential impact of its upcoming earnings report, and relevant risk factors. The key takeaways are that the earnings report itself, the accompanying guidance, and prevailing macroeconomic conditions will all play a crucial role in determining the post-earnings stock price movement. Investors need to consider whether QBTS beats or misses expectations, the company’s future outlook, and external factors affecting the market.

To make informed investment decisions regarding QBTS stock, conduct thorough research, analyze the "QBTS upcoming earnings" report carefully, and assess your risk tolerance. Remember, this analysis is for informational purposes only and should not be considered financial advice. Consult a qualified financial advisor for personalized guidance before making any investment decisions. Remember to always carefully analyze QBTS upcoming earnings and related market information before investing.

Featured Posts

-

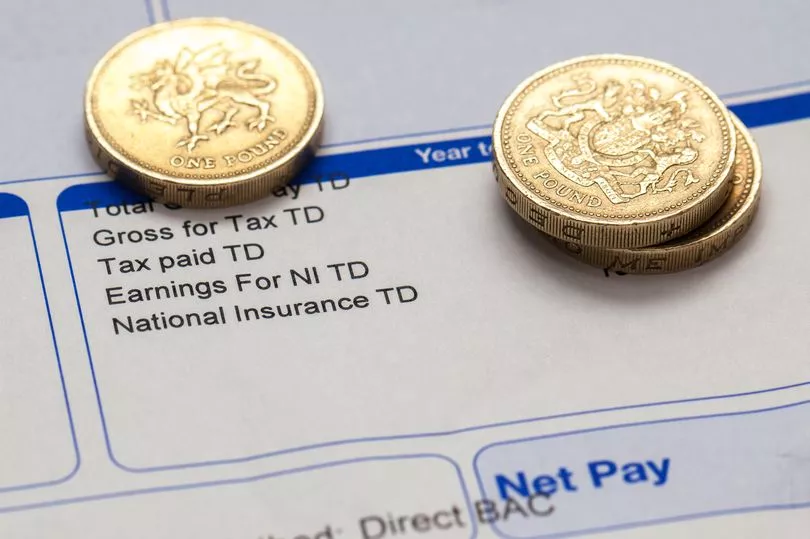

Is Hmrc Owed You Money A Payslip Refund Check

May 20, 2025

Is Hmrc Owed You Money A Payslip Refund Check

May 20, 2025 -

Jennifer Lawrence Aparicao Magra Apos Rumores De Segundo Filho

May 20, 2025

Jennifer Lawrence Aparicao Magra Apos Rumores De Segundo Filho

May 20, 2025 -

Uk Taxpayers Affected By Hmrc Website Crash Accounts Inaccessible

May 20, 2025

Uk Taxpayers Affected By Hmrc Website Crash Accounts Inaccessible

May 20, 2025 -

The Kite Runner In A Nigerian Context A Study Of Pragmatism And Its Consequences

May 20, 2025

The Kite Runner In A Nigerian Context A Study Of Pragmatism And Its Consequences

May 20, 2025 -

Exploring 12 Ai Stocks Popular Choices On Reddit

May 20, 2025

Exploring 12 Ai Stocks Popular Choices On Reddit

May 20, 2025