Analyzing The Impact Of Trump Tariffs On Fintech IPOs: The Affirm Example

Table of Contents

The Rise of Affirm and the Pre-Tariff Fintech Landscape

Affirm's Business Model and Market Position Before the Tariffs

Affirm, a buy-now-pay-later (BNPL) fintech company, carved a niche in the consumer finance market by offering flexible payment options at the point of sale. Before the implementation of Trump's tariffs, Affirm experienced:

- Rapid growth: Significant expansion in merchant partnerships and consumer adoption.

- Strong market positioning: Becoming a major player in the burgeoning BNPL sector.

- Innovative technology: Utilizing advanced data analytics for risk assessment and customer acquisition.

- Competitive advantage: Differentiating itself from traditional credit cards through its transparent pricing and user-friendly platform.

Affirm's key competitors included PayPal's Credit and Klarna. While precise market share figures pre-tariff are difficult to pinpoint due to the rapidly evolving landscape, Affirm was establishing itself as a significant force.

The Global Fintech Market and Tariff Vulnerability

The global fintech market is highly interconnected, with companies relying on international supply chains for technology, infrastructure, and talent. Trump's tariffs created significant vulnerabilities:

- Increased component costs: Tariffs on imported technology and equipment directly increased operational expenses for fintech firms.

- Disrupted supply chains: Delays and uncertainty in global shipping impacted the delivery of essential goods and services.

- Hindered international expansion: Tariffs made it more expensive and complex for fintech companies to expand into new markets.

- Regulatory uncertainty: The fluctuating trade environment created regulatory uncertainty, potentially impacting licensing and compliance for international operations.

Direct and Indirect Impacts of Trump Tariffs on Affirm

Direct Impact: Increased Costs and Reduced Margins

The Trump tariffs directly impacted Affirm's operational costs. While precise figures are not publicly available, increased costs on imported server hardware, software licenses, and other technological components likely reduced profit margins. This increased cost of doing business needed to be absorbed or passed onto consumers, impacting competitiveness and potentially slowing growth.

Indirect Impact: Investor Sentiment and Market Volatility

The uncertainty surrounding the Trump administration's trade policies created considerable market volatility. This uncertainty negatively impacted investor confidence in the Fintech sector, including Affirm:

- Reduced investor appetite: Investors became more risk-averse, leading to lower valuations for Fintech IPOs.

- Increased market volatility: Fluctuations in the stock market made it harder to predict the success of Fintech IPOs.

- Geopolitical risk premium: Investors demanded a higher return to compensate for the increased geopolitical risk associated with tariff uncertainty. This reduced valuations for companies like Affirm.

Affirm's IPO and Post-Tariff Performance

IPO Valuation and Market Response

Affirm's IPO faced a challenging market environment shaped by the ongoing tariff disputes. While the IPO was successful in raising capital, the valuation might have been lower than it would have been in a more stable, less protectionist trade environment. A direct comparison to other Fintech IPOs during the same period is needed for a more comprehensive analysis, taking into account the unique circumstances of each company.

Post-IPO Adaptation Strategies

In response to the tariffs and market challenges, Affirm likely implemented various adaptation strategies, including:

- Supply chain diversification: Seeking alternative suppliers to mitigate reliance on tariff-affected regions.

- Cost optimization: Implementing cost-cutting measures to improve profitability.

- Focus on domestic growth: Prioritizing growth in the domestic market to reduce reliance on international trade.

The effectiveness of these strategies in mitigating the negative impact of tariffs on Affirm's long-term growth requires further investigation and analysis of their financial reports.

Broader Implications for the Fintech Sector

Lessons Learned from Affirm's Experience

Affirm's experience highlights the vulnerability of Fintech companies to protectionist trade policies. The case study underscores the need for:

- Supply chain resilience: Fintech firms need to diversify their supply chains to reduce reliance on any single region.

- Risk management: Incorporating geopolitical and trade policy risks into their business planning.

- Strategic flexibility: Developing the ability to adapt quickly to changes in the trade environment.

Long-Term Impacts on Fintech Investment and Growth

The Trump tariffs likely had a chilling effect on Fintech investment and growth. Increased uncertainty made it riskier for investors, potentially slowing innovation and hindering the expansion of promising startups. The long-term implications for the sector remain significant and require further study to fully understand the lasting effects of this period of trade protectionism.

Conclusion: Understanding the Impact of Trump Tariffs on Fintech IPOs – Key Takeaways and Future Outlook

The Trump-era tariffs had a multifaceted impact on Affirm's IPO and the broader Fintech sector. Directly, they increased operational costs and potentially reduced margins. Indirectly, they fueled investor uncertainty, leading to market volatility and lower valuations. Analyzing the effects of trade wars on Fintech requires a nuanced understanding of both direct cost impacts and the indirect influence on investor sentiment.

The future of Fintech IPOs depends, in part, on the stability of global trade policies. A return to more predictable and less protectionist trade relations would likely foster greater investor confidence and stimulate innovation. We encourage further research into the impact of international trade policies on Fintech IPOs to fully grasp the long-term consequences of protectionist measures on this vital sector. Continue exploring analyzing the effects of trade wars on Fintech to gain a complete understanding of the intricate relationship between global trade and Fintech growth.

Featured Posts

-

Mirka I Rodzer Federer Porodica I Cetiri Blizanca

May 14, 2025

Mirka I Rodzer Federer Porodica I Cetiri Blizanca

May 14, 2025 -

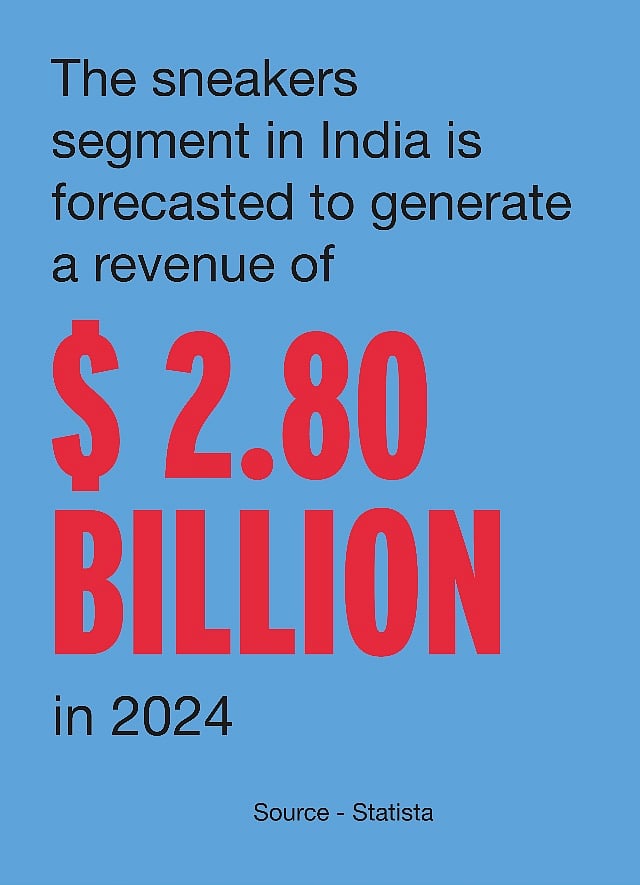

Swiss Sneaker Company Sees Stock Surge Following Increased Global Sales

May 14, 2025

Swiss Sneaker Company Sees Stock Surge Following Increased Global Sales

May 14, 2025 -

Mine Responsable Comment Eramet Grande Cote Gere Les Plaintes Des Communautes Locales

May 14, 2025

Mine Responsable Comment Eramet Grande Cote Gere Les Plaintes Des Communautes Locales

May 14, 2025 -

Jaettipotti Raejaehti 4 8 Miljoonaa Euroa Eurojackpotissa Suomeen

May 14, 2025

Jaettipotti Raejaehti 4 8 Miljoonaa Euroa Eurojackpotissa Suomeen

May 14, 2025 -

Liverpool Transfer News Teammate Confirms Impending Move

May 14, 2025

Liverpool Transfer News Teammate Confirms Impending Move

May 14, 2025