Analyzing The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

The Net Asset Value of the Amundi Dow Jones Industrial Average UCITS ETF is primarily driven by the performance of its underlying assets: the 30 constituent stocks of the Dow Jones Industrial Average. A rise in the Dow generally translates to a higher NAV for the ETF, while a fall leads to a decrease.

However, other factors also play a crucial role:

-

Dow Jones Industrial Average Performance: This is the most significant factor. Strong performance by the index's components directly increases the ETF's NAV, while poor performance has the opposite effect. Analyzing the individual stock performances within the Dow can provide a deeper understanding of NAV fluctuations.

-

Currency Fluctuations: For international investors, currency exchange rates between their local currency and the US dollar (USD) significantly influence the NAV. A strengthening USD against the investor's currency will decrease the NAV in their local currency, even if the Dow itself remains stable. Conversely, a weakening USD will increase the NAV.

-

Expense Ratios and Management Fees: The ETF's expense ratio and management fees are deducted from the assets under management, gradually reducing the NAV over time. These fees are a recurring cost that investors need to consider when evaluating the ETF's overall performance.

-

Dividend Distributions: The constituent companies of the Dow Jones Industrial Average distribute dividends. These dividends are typically reinvested back into the ETF, leading to a positive impact on the NAV. However, the timing and amount of these distributions can create temporary fluctuations.

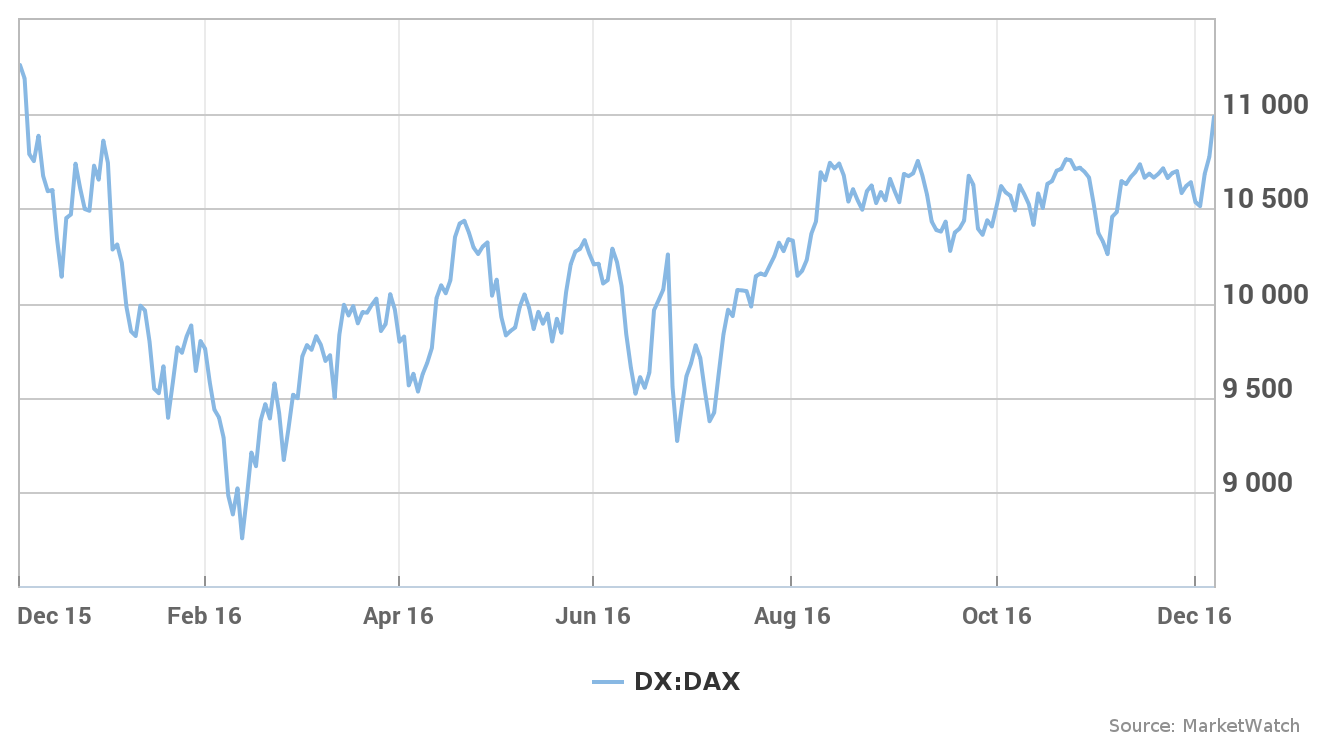

Analyzing Historical NAV Data for the Amundi Dow Jones Industrial Average UCITS ETF

Analyzing historical NAV data is crucial for understanding the long-term performance and identifying trends of the Amundi Dow Jones Industrial Average UCITS ETF. This historical data provides valuable insights into the ETF’s volatility and growth potential.

-

Accessing Historical NAV Data: You can typically access historical NAV data through the Amundi ETF's website, reputable financial news websites (like Yahoo Finance or Google Finance), and dedicated financial data providers.

-

Visualizing NAV Trends: Using charts and graphs is an effective way to visualize NAV movements over time. This allows you to quickly identify significant upward or downward trends. Line graphs are particularly useful for showing the NAV's evolution.

-

Technical Indicators: Employing technical analysis tools such as moving averages (e.g., 50-day, 200-day) can help smooth out short-term fluctuations and identify potential support and resistance levels within the NAV's historical data.

Comparing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF to Competitors

To make a fully informed investment decision, it's essential to compare the Amundi Dow Jones Industrial Average UCITS ETF's NAV performance with that of similar ETFs tracking the same index.

-

Identifying Competitors: Several other ETFs track the Dow Jones Industrial Average. Researching these competitors helps determine which one aligns best with your investment goals and risk tolerance.

-

Expense Ratio Comparison: A key factor to consider when comparing ETFs is the expense ratio. Lower expense ratios translate to higher returns over time.

-

Tracking Error Analysis: Tracking error measures how closely the ETF's performance mirrors the index's performance. A lower tracking error indicates better adherence to the index.

-

Liquidity and Trading Volume: Higher trading volume generally indicates greater liquidity, which can be crucial for buying and selling shares at favorable prices.

Practical Implications of Understanding the Amundi Dow Jones Industrial Average UCITS ETF's NAV

Understanding the Amundi Dow Jones Industrial Average UCITS ETF's NAV is fundamental to effective investment management.

-

Investment Decisions: Monitoring the NAV allows you to make informed decisions about buying, selling, or holding the ETF. Regularly reviewing the NAV, in conjunction with your overall investment strategy, helps to ensure appropriate asset allocation.

-

Return Calculation: The NAV is critical for accurately calculating returns on your investment. Tracking the change in NAV helps assess whether your investment is meeting your expected performance targets.

-

Portfolio Performance Evaluation: Comparing the ETF's NAV performance against benchmarks, such as the Dow Jones Industrial Average itself, provides insights into the overall performance of your portfolio.

Conclusion: Mastering Net Asset Value (NAV) Analysis for the Amundi Dow Jones Industrial Average UCITS ETF

Mastering the analysis of the Amundi Dow Jones Industrial Average UCITS ETF's NAV is key to successful investing. By understanding the factors influencing the NAV, analyzing historical data, and comparing it to competitors, you can make informed decisions aligned with your investment goals. Remember to regularly monitor the Net Asset Value and use the information gleaned to optimize your investment strategy. Continue your research on the Amundi Dow Jones Industrial Average UCITS ETF's NAV and its implications for your investment strategy. Regularly monitor the Net Asset Value to maximize your investment potential.

Featured Posts

-

Thlyl Adae Daks Alalmany Tjawz Dhrwt Mars Wmadha Yeny Dhlk Llmstthmryn

May 24, 2025

Thlyl Adae Daks Alalmany Tjawz Dhrwt Mars Wmadha Yeny Dhlk Llmstthmryn

May 24, 2025 -

Ray Epps Sues Fox News For Defamation The Jan 6th Allegations

May 24, 2025

Ray Epps Sues Fox News For Defamation The Jan 6th Allegations

May 24, 2025 -

Stoxx Europe 600 Ve Dax 40 Ta Gerileme Avrupa Piyasalarinda Duesues 16 Nisan 2025

May 24, 2025

Stoxx Europe 600 Ve Dax 40 Ta Gerileme Avrupa Piyasalarinda Duesues 16 Nisan 2025

May 24, 2025 -

The Mia Farrow Trump Standoff Deportations And Calls For Arrest

May 24, 2025

The Mia Farrow Trump Standoff Deportations And Calls For Arrest

May 24, 2025 -

Sterke Aex Prestaties Ten Opzichte Van Onrustige Amerikaanse Beurs

May 24, 2025

Sterke Aex Prestaties Ten Opzichte Van Onrustige Amerikaanse Beurs

May 24, 2025