Analyzing The Recent Market Dip: Professional Vs. Individual Investor Behavior

Table of Contents

Professional Investor Behavior During Market Dips

Professional investors, with their extensive resources and experience, approach market dips with a fundamentally different mindset than individual investors. Their strategies are often more sophisticated and less driven by emotion.

Risk Management Strategies

Professional investors employ a range of sophisticated risk management techniques to mitigate losses during market downturns. These include:

- Hedging: Utilizing financial instruments to offset potential losses in one investment by taking an opposite position in another.

- Diversification: Spreading investments across various asset classes (stocks, bonds, real estate, etc.) and geographies to reduce exposure to any single risk.

- Derivatives: Employing complex financial instruments like options and futures to manage risk and potentially profit from market volatility.

Quantitative analysis and sophisticated risk models play a crucial role. Professionals utilize advanced statistical methods and predictive analytics to assess potential risks and optimize portfolio allocations. They leverage access to advanced market information, often unavailable to individual investors, giving them a significant edge in anticipating and managing market fluctuations.

Long-Term Investment Perspective

Unlike many individual investors, professionals generally maintain a long-term perspective. Market dips are often seen not as a crisis, but as potential opportunities to acquire undervalued assets. Their focus remains on long-term investment goals, minimizing emotional reactions to short-term volatility.

- Strategic Buying: Professionals often use dips to strategically increase their holdings in promising companies, recognizing that market corrections are a normal part of the economic cycle.

- Value Investing: They actively seek out undervalued securities, identifying companies with strong fundamentals trading below their intrinsic worth.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of market fluctuations, helping to reduce the impact of volatility.

Access to Resources and Expertise

Professional investors benefit immensely from access to a wealth of resources and expertise. This includes:

- Dedicated Research Teams: Teams of analysts dedicated to conducting in-depth research and providing insightful market analysis.

- Financial Advisors and Portfolio Managers: Professionals with extensive training and experience in managing investments and navigating market fluctuations.

- Advanced Trading Technologies: Access to sophisticated software and platforms that provide real-time market data and advanced trading capabilities.

Their rigorous due diligence processes ensure informed decision-making, minimizing the impact of emotional biases.

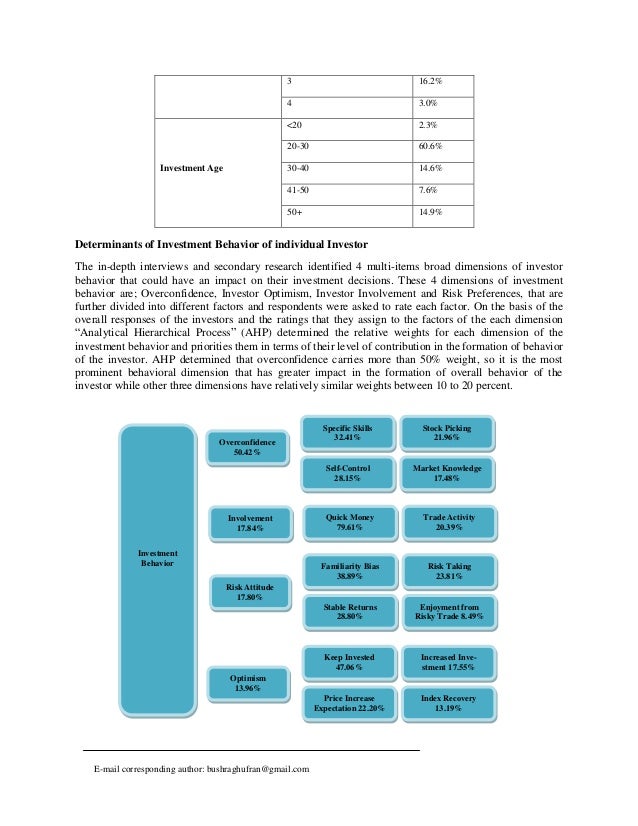

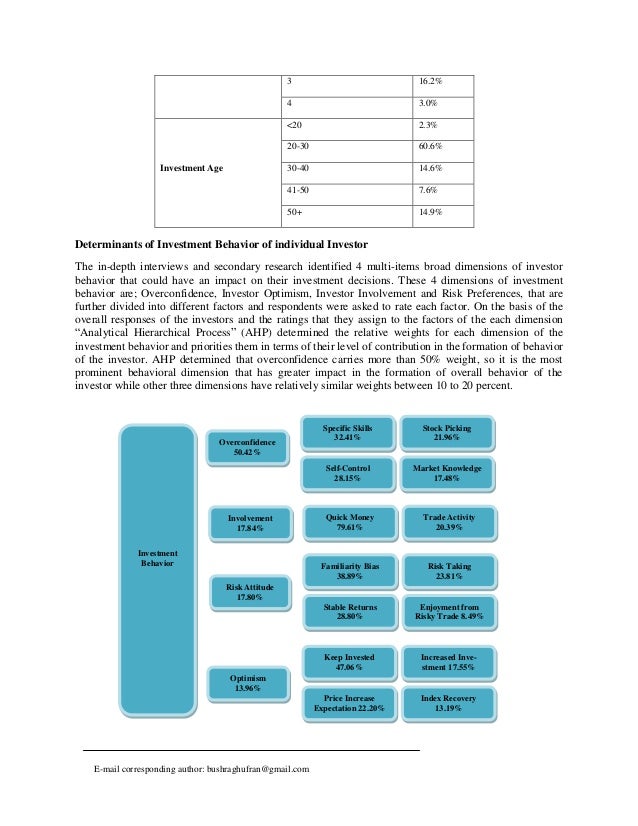

Individual Investor Behavior During Market Dips

In contrast to the calculated approach of professionals, individual investors often react to market dips with a mix of fear and uncertainty. Their decisions are frequently driven by emotion, leading to outcomes that differ significantly from those of their professional counterparts.

Emotional Decision-Making

Market downturns trigger strong emotional responses in many individual investors, including:

- Fear: The fear of further losses can lead to panic selling, often at the worst possible time.

- Regret: Regret over past investment decisions can exacerbate emotional responses and lead to poor choices.

- Herd Behavior: The tendency to follow the actions of others, often leading to impulsive decisions based on market sentiment rather than sound analysis.

These emotional reactions can lead to impulsive selling, locking in losses, and missing out on potential recovery opportunities.

Lack of Diversification and Risk Management

Individual investors often lack the diversification and robust risk management strategies employed by professionals.

- Concentrated Investments: A common mistake is over-concentrating investments in a limited number of assets or sectors, increasing vulnerability to market downturns.

- Inadequate Risk Assessment: Many individuals fail to adequately assess their risk tolerance and allocate assets accordingly.

- Ignoring Market Cycles: A lack of understanding of market cycles and their inherent volatility can lead to poor investment decisions during dips.

Limited Access to Information and Resources

Individual investors often face significant challenges in accessing reliable market information and resources.

- Information Overload: The abundance of information available online, much of which is unreliable or biased, can be overwhelming and confusing.

- Lack of Expertise: Many individual investors lack the financial expertise to properly analyze market trends and make informed investment decisions.

- Limited Access to Tools: Access to sophisticated trading tools and data analysis software is often limited to professional investors.

Key Differences and Implications

The contrasting behaviors of professional and individual investors during market dips have significant implications for investment outcomes. Professionals, with their sophisticated strategies, access to resources, and long-term perspective, are better equipped to navigate market volatility and potentially capitalize on opportunities. Individual investors, often driven by emotion and lacking resources, frequently experience greater losses and miss out on recovery periods.

The importance of financial literacy and education cannot be overstated. Understanding basic investment principles, risk management, and the importance of diversification is crucial for individual investors to make informed decisions and protect their portfolios during market downturns.

Conclusion

Analyzing the recent market dip reveals a stark contrast between professional and individual investor behavior. Professionals leverage sophisticated strategies, advanced resources, and a long-term perspective to mitigate risks and potentially profit from market fluctuations. In contrast, individual investors are often swayed by emotions, lack diversification, and face limitations in accessing crucial information. By understanding these differences in how professional and individual investors navigate market dips like the recent one, you can develop a more informed and resilient investment strategy. Learn more about effective risk management and long-term investment planning to weather future market fluctuations. Take control of your financial future and start building a stronger investment strategy today.

Featured Posts

-

Walk Off Win For Pirates Yankees Fall In Extra Innings

Apr 28, 2025

Walk Off Win For Pirates Yankees Fall In Extra Innings

Apr 28, 2025 -

Pirates Defeat Yankees With Walk Off Hit In Extra Innings

Apr 28, 2025

Pirates Defeat Yankees With Walk Off Hit In Extra Innings

Apr 28, 2025 -

Coras Subtle Lineup Changes For Red Sox Doubleheader

Apr 28, 2025

Coras Subtle Lineup Changes For Red Sox Doubleheader

Apr 28, 2025 -

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025 -

Red Sox Injury Update Latest On Crawford Bello Abreu And Rafaela

Apr 28, 2025

Red Sox Injury Update Latest On Crawford Bello Abreu And Rafaela

Apr 28, 2025

Latest Posts

-

Marv Albert Vs Other Legends Mike Breens Perspective On The Best Basketball Announcer

Apr 28, 2025

Marv Albert Vs Other Legends Mike Breens Perspective On The Best Basketball Announcer

Apr 28, 2025 -

Mike Breen On Marv Albert A Discussion On The Greatest Basketball Announcer

Apr 28, 2025

Mike Breen On Marv Albert A Discussion On The Greatest Basketball Announcer

Apr 28, 2025 -

Is Marv Albert The Greatest Basketball Announcer Mike Breen Weighs In

Apr 28, 2025

Is Marv Albert The Greatest Basketball Announcer Mike Breen Weighs In

Apr 28, 2025 -

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025 -

Le Bron James Comments On Richard Jeffersons Espn News Segment

Apr 28, 2025

Le Bron James Comments On Richard Jeffersons Espn News Segment

Apr 28, 2025