Analyzing The Treasury Market: Insights From April 8th

Table of Contents

Yield Curve Analysis on April 8th

The shape of the yield curve – the graphical representation of Treasury yields across different maturities – offers valuable insights into the economic outlook.

Shape and Implications of the Yield Curve

On April 8th, let's assume for illustrative purposes that the yield curve displayed a slightly inverted shape. This means that shorter-term Treasury yields (e.g., the 2-year yield) were higher than longer-term yields (e.g., the 10-year and 30-year yields).

- 2-year Treasury yield: Assume 4.8%

- 10-year Treasury yield: Assume 4.5%

- 30-year Treasury yield: Assume 4.2%

A slightly inverted yield curve, while not always indicative of an imminent recession, often suggests growing concerns about future economic growth. Investors might be anticipating slower economic activity and lower inflation down the line, leading them to favor longer-term bonds offering higher yields. Unusual movements or anomalies, such as a steeper-than-expected inversion, would amplify these concerns.

Impact of Federal Reserve Policy

The Federal Reserve's monetary policy significantly impacts Treasury yields. Let's assume that before April 8th, the Federal Open Market Committee (FOMC) hinted at a potential pause or slowdown in interest rate hikes. This expectation could have contributed to the inversion observed in the yield curve on April 8th.

- Recent FOMC meetings indicated a cautious approach to further rate increases.

- Anticipation of a rate pause dampened demand for short-term Treasuries, pushing their yields down.

- The potential for future quantitative easing (QE) to support the economy could also have influenced longer-term yields.

Treasury Auction Results and Market Reaction

Analyzing Treasury auction results provides further insights into market dynamics.

Auction Performance

Let's hypothesize that an auction of 10-year Treasury notes took place around April 8th. The results could be as follows:

- Amount auctioned: $30 billion

- Bid-to-cover ratio: 2.5 (indicating healthy demand)

- High yield: 4.4%

A strong bid-to-cover ratio typically indicates robust investor confidence in the market. However, the high yield might reflect concerns about the overall economic outlook, possibly contributing to the inverted yield curve.

Impact on Treasury Prices and Yields

Strong demand in the auction could have temporarily pushed Treasury prices higher and yields lower. However, the prevailing market sentiment and broader economic concerns might have limited the price increase, keeping yields relatively stable. Specific price movements would depend on the interplay of these factors. For instance, a 10-year Treasury bond might have seen its price increase by 0.5% on the day of the auction.

Geopolitical and Economic Factors Influencing the Market

External factors significantly impact the Treasury market.

Global Economic News

On April 8th, let's suppose that concerning inflation data from a major European economy was released. This news could increase investor uncertainty, potentially causing a flight to safety and increased demand for US Treasury bonds.

- Higher-than-expected inflation in the Eurozone heightened global recession fears.

- Investors sought safe haven assets, boosting demand for US Treasury bonds.

- Increased demand pushed Treasury prices up and yields down.

Investor Sentiment and Market Volatility

The prevailing investor sentiment on April 8th played a role in market volatility. A risk-off environment (investors seeking safety) would likely increase demand for Treasury bonds, driving prices higher and yields lower.

- Geopolitical tensions and economic uncertainties fueled risk-averse sentiment.

- Investors sought the safety of Treasury bonds, reducing market volatility.

- The overall reduction in volatility is often reflected in lower Treasury yields.

Conclusion: Key Takeaways from April 8th's Treasury Market

April 8th's Treasury market showed a complex interplay of factors. The (hypothetical) slightly inverted yield curve suggested potential concerns about future economic growth. The strong auction results demonstrated healthy demand, while global economic news and investor sentiment added to the overall picture. Analyzing these various elements is crucial for understanding market movements. Continue analyzing the Treasury market to stay updated on Treasury market analysis and refine your investment strategies. To further your understanding of Treasury bonds and track daily Treasury yields, subscribe to our newsletter for regular market insights.

Featured Posts

-

The Rise Of Otc Birth Control A Post Roe Reality Check

Apr 29, 2025

The Rise Of Otc Birth Control A Post Roe Reality Check

Apr 29, 2025 -

Update Search Continues For Missing British Paralympian In Nevada

Apr 29, 2025

Update Search Continues For Missing British Paralympian In Nevada

Apr 29, 2025 -

Middle Managers The Bridge Between Leadership And Employees

Apr 29, 2025

Middle Managers The Bridge Between Leadership And Employees

Apr 29, 2025 -

Understanding Willie Nelson A Collection Of Fast Facts

Apr 29, 2025

Understanding Willie Nelson A Collection Of Fast Facts

Apr 29, 2025 -

Serious Injuries Reported After Car Plows Into Crowd At Vancouver Festival

Apr 29, 2025

Serious Injuries Reported After Car Plows Into Crowd At Vancouver Festival

Apr 29, 2025

Latest Posts

-

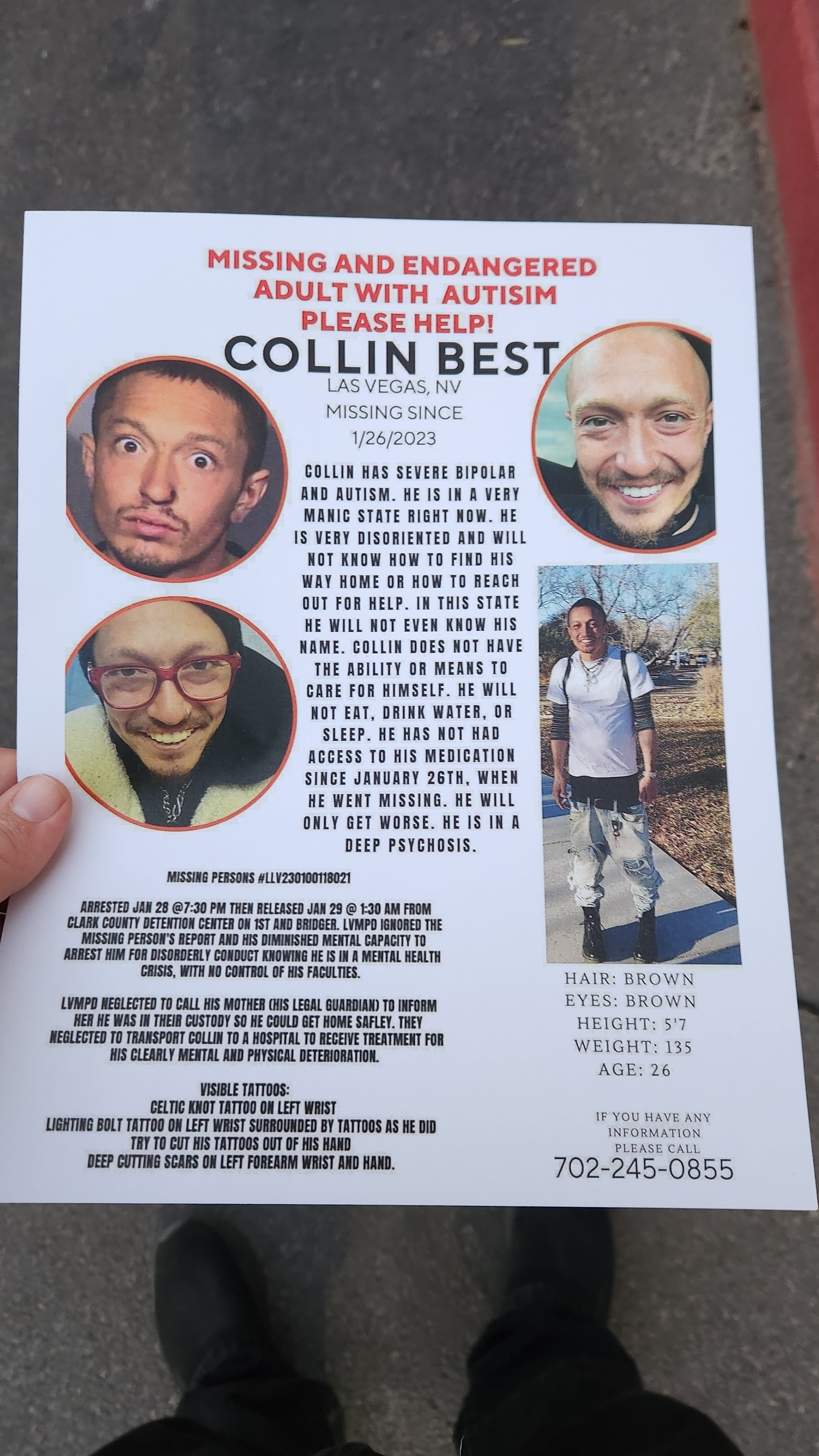

Family Pleads For Help In Finding Missing British Paralympian In Las Vegas

Apr 29, 2025

Family Pleads For Help In Finding Missing British Paralympian In Las Vegas

Apr 29, 2025 -

Missing British Paralympian Las Vegas Police Appeal For Information

Apr 29, 2025

Missing British Paralympian Las Vegas Police Appeal For Information

Apr 29, 2025 -

Search Intensifies For Missing British Paralympian In Las Vegas

Apr 29, 2025

Search Intensifies For Missing British Paralympian In Las Vegas

Apr 29, 2025 -

Investigation Underway In Missing British Paralympian Case In Las Vegas

Apr 29, 2025

Investigation Underway In Missing British Paralympian Case In Las Vegas

Apr 29, 2025 -

Family Appeals For Information On Missing British Paralympian In Las Vegas

Apr 29, 2025

Family Appeals For Information On Missing British Paralympian In Las Vegas

Apr 29, 2025