Analyzing Uber's (UBER) Investment Potential

Table of Contents

Uber's Financial Performance and Recent Trends

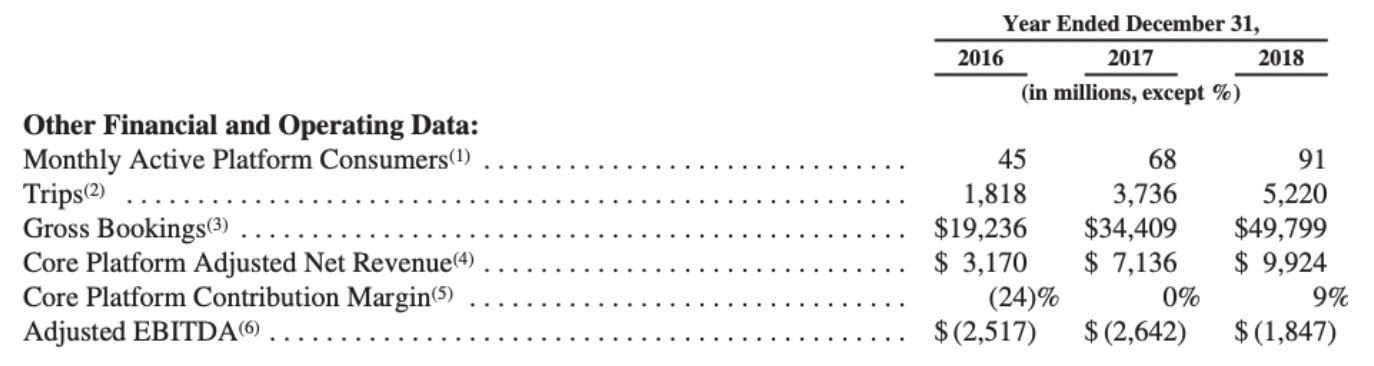

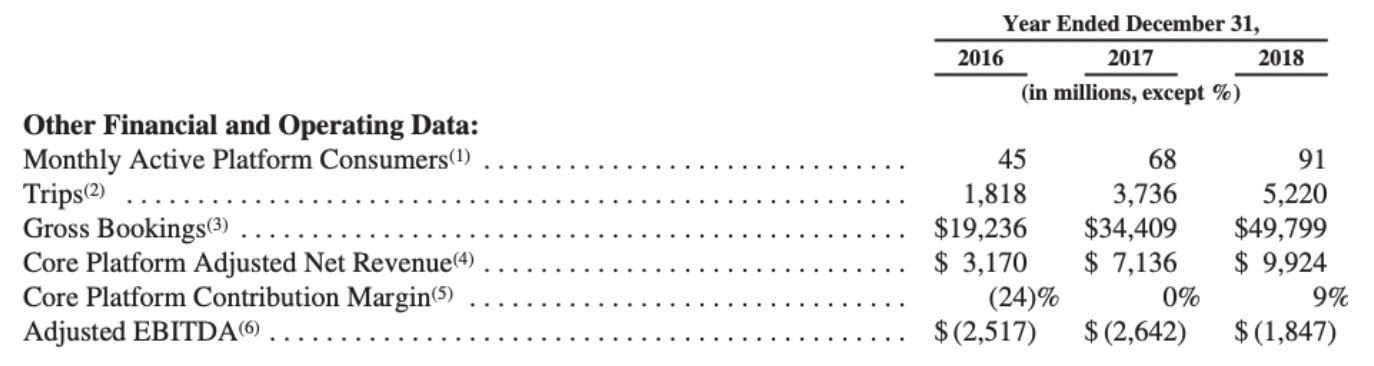

Analyzing Uber's financial health is crucial for assessing its investment potential. Key metrics like revenue growth, profitability, earnings per share (EPS), operating margin, and debt levels provide a strong foundation for understanding the company's financial trajectory.

-

Revenue Growth Across Segments: Uber's revenue streams are diversified across ride-sharing, food delivery (Uber Eats), and freight. Analyzing the growth rate of each segment is crucial. Recent reports indicate strong growth in Uber Eats, partially offsetting slower growth in ride-sharing in some markets. Examining this granular data offers a clearer picture of Uber's overall financial health and future projections.

-

Profitability Trends: While Uber has demonstrated substantial revenue growth, achieving consistent profitability remains a key challenge. Investors should closely monitor metrics like EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and net income. A consistent increase in profitability would signal a positive trend in Uber's financial performance.

-

Debt Levels and Financial Obligations: Uber, like many rapidly expanding companies, carries a significant amount of debt. Assessing the company's ability to manage its debt load and meet its financial obligations is vital. High debt levels can increase financial risk and impact future growth potential. Analyzing the debt-to-equity ratio and interest coverage ratio can provide valuable insights.

-

Operating Margins: Analyzing operating margins reveals the efficiency of Uber's operations. Improvements in operating margins suggest better cost management and increased profitability. Tracking changes in operating margins across different segments can highlight areas of strength and weakness within the company.

(Include relevant charts and graphs visualizing key financial data here)

Growth Potential and Market Opportunities

Uber's growth potential hinges on several factors, including market share expansion, geographical reach, and technological innovation.

-

Market Share Dominance: Uber holds significant market share in ride-sharing and food delivery in many regions globally. However, competition remains fierce. Analyzing Uber's market share against key competitors like Lyft, DoorDash, and regional players is crucial.

-

International Expansion: Untapped markets present significant growth opportunities for Uber. Expanding into new geographic regions with high growth potential can significantly boost revenue and market capitalization. Successful expansion strategies often involve adapting to local market conditions and regulatory requirements.

-

Technological Innovation: Uber's investment in autonomous vehicles and advanced mapping technology positions it for future growth. The successful deployment of autonomous vehicles could significantly reduce operating costs and enhance efficiency. However, the technological challenges and regulatory hurdles associated with autonomous vehicles present significant risks.

-

Competitive Landscape: The ride-sharing and food delivery sectors are highly competitive. Assessing the competitive landscape and identifying potential threats from rivals is vital. This includes considering new entrants, disruptive technologies, and pricing wars.

-

Long-Term Sector Growth: The long-term outlook for the ride-sharing and food delivery sectors remains positive, driven by increasing urbanization, changing consumer preferences, and technological advancements. This overall positive sector trend supports Uber’s future growth prospects.

Assessing the Risks Associated with Investing in UBER

Investing in Uber involves inherent risks that potential investors must carefully consider.

-

Regulatory Hurdles: Uber faces significant regulatory challenges globally, including licensing issues, labor disputes, and data privacy concerns. Changes in regulations can negatively impact Uber's operations and profitability.

-

Intense Competition: The competitive landscape is intense, with established players and new entrants constantly vying for market share. Pricing wars and intense competition can squeeze profit margins.

-

Economic Downturn Vulnerability: Uber's business model is susceptible to economic downturns. During economic recessions, consumer spending on discretionary services like ride-sharing and food delivery tends to decline.

-

Technological Disruption: Rapid technological advancements could disrupt Uber's business model. The emergence of new technologies or business models could render Uber's current services obsolete or less competitive.

-

Growth Stock Risk: Investing in growth-oriented technology companies inherently involves higher risk compared to investing in established, stable companies. Uber's stock price can experience significant volatility.

Valuation and Investment Strategy

Evaluating Uber's stock valuation requires a comprehensive analysis using various metrics and methodologies.

-

Valuation Metrics: Common valuation metrics include the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio. Comparing Uber's valuation to its competitors and industry benchmarks can help assess whether the stock is overvalued or undervalued.

-

Discounted Cash Flow (DCF) Analysis: A DCF analysis projects Uber's future cash flows and discounts them to their present value to estimate the intrinsic value of the stock. This provides a more in-depth valuation compared to simple ratios.

-

Investment Strategies: Investors can employ various strategies, including long-term buy-and-hold strategies, short-term trading, or incorporating UBER into a diversified portfolio. The chosen strategy should align with individual risk tolerance and investment goals.

-

Buy/Hold/Sell Recommendation: Based on the analysis conducted, a potential buy, hold, or sell recommendation can be provided. (Clearly state that this is not financial advice.) A comprehensive analysis will incorporate the factors discussed above to generate an informed recommendation.

Conclusion

This analysis has explored Uber's (UBER) investment potential, considering its financial performance, growth prospects, and associated risks. While Uber shows strong growth in key areas, notably Uber Eats, careful consideration of market competition, regulatory challenges, and inherent risks associated with growth stocks is crucial before investing. The company's profitability remains a significant area of focus for investors.

Call to Action: Ultimately, the decision of whether to invest in Uber (UBER) rests on your individual risk tolerance and investment goals. Conduct thorough due diligence, consult with a qualified financial advisor before making any investment decisions related to Uber's (UBER) stock, and continue researching the Uber (UBER) investment potential to stay informed about the company's evolving landscape.

Featured Posts

-

Los Angeles Angels Win 1 0 Jose Sorianos Stellar Performance

May 18, 2025

Los Angeles Angels Win 1 0 Jose Sorianos Stellar Performance

May 18, 2025 -

Doom The Dark Ages A Game For All Players

May 18, 2025

Doom The Dark Ages A Game For All Players

May 18, 2025 -

Stake Casino Alternatives A Comprehensive Guide To The Best Replacements

May 18, 2025

Stake Casino Alternatives A Comprehensive Guide To The Best Replacements

May 18, 2025 -

Mike Myers And Colin Mochrie Toronto Charity Comedy Show

May 18, 2025

Mike Myers And Colin Mochrie Toronto Charity Comedy Show

May 18, 2025 -

Unveiling Bin Laden A Netflix Series Exposes A Crucial Phone Call

May 18, 2025

Unveiling Bin Laden A Netflix Series Exposes A Crucial Phone Call

May 18, 2025

Latest Posts

-

Find The Daily Lotto Results Monday April 28 2025

May 18, 2025

Find The Daily Lotto Results Monday April 28 2025

May 18, 2025 -

28 April 2025 Daily Lotto Results Winning Numbers Announced

May 18, 2025

28 April 2025 Daily Lotto Results Winning Numbers Announced

May 18, 2025 -

Check Daily Lotto Results For Monday April 28 2025

May 18, 2025

Check Daily Lotto Results For Monday April 28 2025

May 18, 2025 -

29 April 2025 Daily Lotto Results Winning Numbers Announced

May 18, 2025

29 April 2025 Daily Lotto Results Winning Numbers Announced

May 18, 2025 -

Daily Lotto 29 April 2025 Results

May 18, 2025

Daily Lotto 29 April 2025 Results

May 18, 2025