Analyzing XRP (Ripple): Risks And Rewards For Potential Investors

Table of Contents

Understanding XRP (Ripple) and its Technology

XRP is a cryptocurrency designed to facilitate fast and low-cost cross-border payments. Unlike Bitcoin, which uses a proof-of-work consensus mechanism, XRP utilizes a unique consensus mechanism that makes transactions significantly faster and more energy-efficient. It's crucial to understand the difference between XRP and Ripple Labs, the company behind the technology. Ripple Labs develops the RippleNet payment network, while XRP is the native cryptocurrency used within that network.

-

Speed and Low Transaction Fees: XRP transactions are processed in a matter of seconds, compared to minutes or even hours for some other cryptocurrencies. The transaction fees are also significantly lower, making it a cost-effective solution for large-scale payments.

-

Facilitating Cross-Border Payments: RippleNet is designed to help banks and financial institutions send and receive money across borders more quickly and efficiently than traditional methods. This is a key driver of XRP's potential value.

-

Decentralized Nature (with nuances): While XRP is often described as decentralized, the reality is more nuanced. Ripple Labs holds a significant portion of XRP, leading to some concerns about its level of decentralization compared to other cryptocurrencies.

-

Energy-Efficient Consensus Mechanism: XRP's consensus mechanism, known as the XRP Ledger, is significantly more energy-efficient than proof-of-work systems like Bitcoin's, making it a more environmentally friendly option.

The Potential Rewards of Investing in XRP (Ripple)

Investing in XRP could offer substantial rewards, but it's crucial to remember that this is a highly volatile asset.

High Growth Potential

XRP's price has historically shown periods of significant appreciation, although it has also experienced substantial downturns. Its potential for future growth hinges on several factors:

-

Past Price Performance (with caution): While past performance is not indicative of future results, analyzing XRP's price history can provide insight into its volatility and potential for growth.

-

Partnerships and Collaborations: Ripple Labs has formed partnerships with numerous banks and financial institutions globally, boosting the adoption of XRP and RippleNet. These partnerships are crucial for driving future growth.

-

Market Capitalization and Potential Expansion: XRP's relatively large market capitalization compared to some other cryptocurrencies suggests it has already established itself as a prominent player in the market. However, its future expansion depends heavily on market adoption and regulatory developments.

Utility and Real-World Applications

XRP's value lies in its utility. Its primary use case is facilitating fast and efficient cross-border payments, offering a significant advantage over traditional banking systems.

-

Existing Partnerships with Banks: Numerous major banks around the world are using RippleNet, highlighting XRP's real-world application in the financial sector.

-

Impact on Remittance Costs and Speeds: XRP has the potential to drastically reduce the cost and time required for international money transfers, benefiting both businesses and individuals.

-

Emerging Use Cases: Beyond cross-border payments, XRP is being explored for various applications, including supply chain finance and other financial transactions.

The Risks Associated with XRP (Ripple) Investment

Despite the potential rewards, investing in XRP involves substantial risks.

Regulatory Uncertainty

The ongoing legal battles faced by Ripple Labs, particularly the SEC lawsuit, represent a significant risk factor for XRP investors.

-

The SEC Lawsuit and Potential Outcomes: The SEC's claim that XRP is an unregistered security could significantly impact XRP's price and future. Different outcomes could have vastly different consequences.

-

Implications of Different Regulatory Scenarios: The outcome of the SEC lawsuit will have a major impact on the future of XRP and its legal status in various jurisdictions.

-

Impact on the Broader Cryptocurrency Market: Regulatory actions against Ripple could set precedents that affect other cryptocurrencies.

Market Volatility

Cryptocurrencies are inherently volatile assets, and XRP is no exception. Its price can fluctuate dramatically based on various factors:

-

Factors Influencing XRP's Price: News events, market sentiment, and overall cryptocurrency market trends can all significantly impact XRP's price.

-

Risks of Investing in a Highly Speculative Asset: XRP is a speculative investment; therefore, investors need to be prepared for substantial price swings.

-

Importance of Portfolio Diversification: Never invest more than you can afford to lose, and always diversify your investment portfolio to mitigate risk.

Technological Risks

While the XRP Ledger is generally considered secure, it's still susceptible to certain technological risks.

-

Potential Security Risks: Like any technology, the XRP Ledger could be vulnerable to security breaches. Secure storage is crucial for protecting your XRP holdings.

-

Scalability of the XRP Ledger: As adoption increases, the scalability of the XRP Ledger will need to keep pace to handle the increased transaction volume.

-

Competitive Threats: XRP faces competition from other cryptocurrencies and payment systems aiming to disrupt the financial industry.

Conclusion

Investing in XRP (Ripple) presents both exciting opportunities and significant risks. While its potential for growth and real-world applications are undeniable, the regulatory uncertainty and market volatility cannot be ignored. Before making any XRP (Ripple) investment, thoroughly research the project, understand the risks involved, and carefully consider your own risk tolerance. Diversification is key. Remember, this analysis is not financial advice; conduct your own due diligence before investing in XRP (Ripple) or any other cryptocurrency. Make informed decisions about your XRP (Ripple) investment strategy.

Featured Posts

-

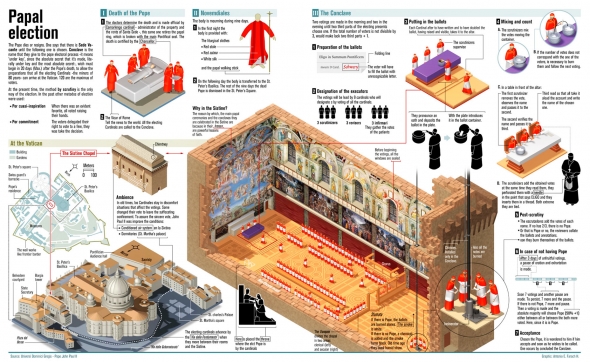

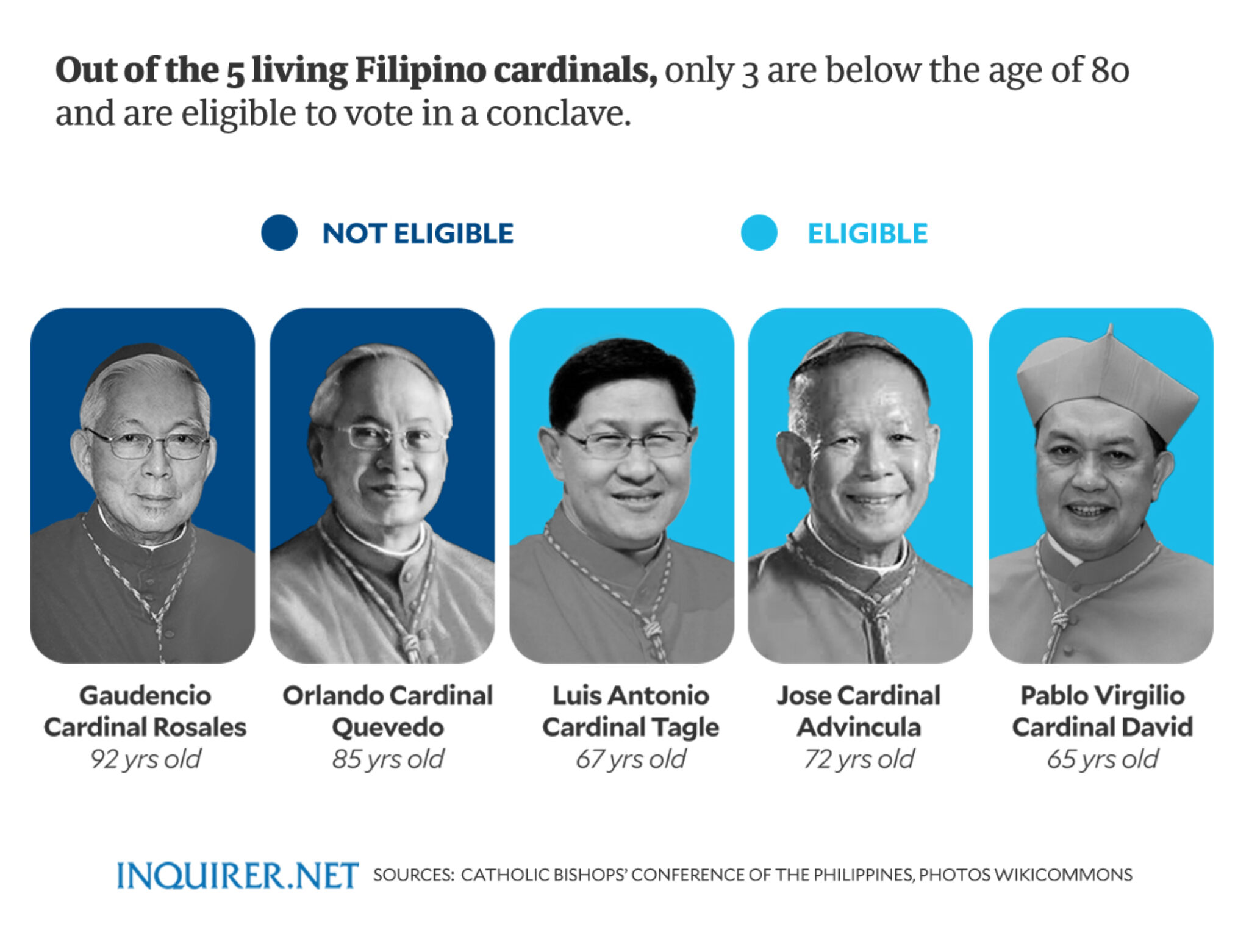

Conclave Process How Cardinals Elect The Next Pope

May 07, 2025

Conclave Process How Cardinals Elect The Next Pope

May 07, 2025 -

Celtics Cavaliers Rivalry A Star Players Perspective And Lessons

May 07, 2025

Celtics Cavaliers Rivalry A Star Players Perspective And Lessons

May 07, 2025 -

Ouagadougou Film Festival Royal Air Maroc Continues Its Support

May 07, 2025

Ouagadougou Film Festival Royal Air Maroc Continues Its Support

May 07, 2025 -

Anthony Edwards Vulgar Comment To Fan Results In 50 000 Nba Fine

May 07, 2025

Anthony Edwards Vulgar Comment To Fan Results In 50 000 Nba Fine

May 07, 2025 -

Understanding The Conclave The Process Of Selecting The Pope

May 07, 2025

Understanding The Conclave The Process Of Selecting The Pope

May 07, 2025