Analyzing Your Proxy Statement (Form DEF 14A): A Step-by-Step Approach

Table of Contents

Understanding the Purpose of a Proxy Statement (DEF 14A)

A DEF 14A, or proxy statement, is a crucial document filed by publicly traded companies with the Securities and Exchange Commission (SEC). Its primary purpose is to solicit votes from shareholders on important matters related to the company's operations and governance. The information contained within is vital for making informed decisions about your investments and participating in the democratic process of corporate governance. Ignoring your DEF 14A means missing out on a critical opportunity to influence the direction of your investments.

- Provides information on upcoming shareholder meetings: The proxy statement will detail the date, time, and location (physical or virtual) of the shareholder meeting.

- Outlines proposals up for shareholder vote: This includes significant decisions like electing board members, approving mergers and acquisitions, authorizing stock issuances, and ratifying auditor appointments. Understanding these proposals is fundamental to a successful Proxy Statement (DEF 14A) Analysis.

- Discloses details about executive compensation: The DEF 14A provides a detailed breakdown of executive salaries, bonuses, stock options, and other compensation elements. This allows shareholders to assess the fairness and reasonableness of executive pay in relation to company performance.

- Contains crucial information for evaluating corporate governance: The document sheds light on board composition, committee structures, and internal controls, providing valuable insights into the company's governance practices.

Key Sections to Analyze in Your DEF 14A

Analyzing a DEF 14A requires a methodical approach. Focusing on these key sections will significantly enhance your understanding and empower informed decision-making.

Executive Compensation

This section details the compensation packages of company executives. A thorough Proxy Statement (DEF 14A) Analysis in this area involves:

- Analyzing the compensation structure against company performance: Compare executive pay to the company's financial results, stock performance, and overall achievements. Look for alignment between executive incentives and shareholder value creation.

- Comparing executive compensation to industry benchmarks: Examine how the company's executive pay compares to similar companies in the same industry. This helps identify potential overpayment or discrepancies.

- Identifying any potential conflicts of interest: Scrutinize any potential conflicts of interest that may influence executive compensation decisions.

Board of Directors

The composition and effectiveness of the board of directors are crucial aspects of corporate governance. Your Proxy Statement (DEF 14A) Analysis should include:

- Looking for potential conflicts of interest among board members: Assess whether any board members have relationships or affiliations that could compromise their objectivity.

- Evaluating the board's committees and their effectiveness: Review the function and activities of key board committees, such as the audit, compensation, and nominating committees.

- Assessing the board's oversight of management: Determine whether the board effectively monitors management's performance and holds them accountable.

Shareholder Proposals

Shareholder proposals offer an opportunity for investors to influence company direction. A diligent Proxy Statement (DEF 14A) Analysis of this section involves:

- Identifying proposals that align with your investment goals: Carefully review each proposal and determine whether it supports your investment objectives.

- Analyzing the potential impact of each proposal on the company: Consider the potential financial, operational, and strategic consequences of each proposed resolution.

Mergers and Acquisitions

If a merger or acquisition is proposed, this section requires particularly close scrutiny. Your Proxy Statement (DEF 14A) Analysis should include:

- Analyzing the financial implications of the deal for shareholders: Understand the terms of the transaction, including the exchange ratio, valuation, and potential risks.

- Assessing the strategic rationale for the merger or acquisition: Evaluate whether the deal aligns with the company's strategic objectives and creates long-term value for shareholders.

Tools and Resources for Proxy Statement (DEF 14A) Analysis

Several resources can significantly aid your analysis.

SEC Edgar Database

The SEC's EDGAR database (www.sec.gov/edgar/searchedgar/companysearch.html) is the primary source for locating DEF 14A filings. Learning to navigate this database is a cornerstone of effective Proxy Statement (DEF 14A) Analysis.

Proxy Voting Services

Many proxy voting services offer tools and resources to simplify the analysis process. These services often provide summaries and analysis of proxy statements, making it easier to understand complex information.

Financial News and Analysis

Reputable financial news websites and analytical platforms provide additional context and insights into company performance, industry trends, and the implications of shareholder proposals.

- Useful Websites: Bloomberg, Yahoo Finance, Google Finance, and Seeking Alpha.

Conclusion

Thoroughly analyzing your proxy statement (DEF 14A) is a crucial step in responsible investing and active shareholder participation. By understanding the key sections, utilizing available resources, and critically evaluating the information presented, you can make informed decisions that align with your investment objectives and contribute to good corporate governance. Don't just passively receive your proxy statement; actively engage by conducting a thorough Proxy Statement (DEF 14A) Analysis. Take control of your investments and start analyzing your DEF 14A today!

Featured Posts

-

Kaitlyn Chens Wnba Draft A Momentous Achievement For Taiwanese Americans

May 17, 2025

Kaitlyn Chens Wnba Draft A Momentous Achievement For Taiwanese Americans

May 17, 2025 -

Chicago Showdown Hailey Van Lith And Angel Reeses Complex Relationship

May 17, 2025

Chicago Showdown Hailey Van Lith And Angel Reeses Complex Relationship

May 17, 2025 -

Canadian Online Casino Guide 2025 7 Bit Casino And Its Competitors

May 17, 2025

Canadian Online Casino Guide 2025 7 Bit Casino And Its Competitors

May 17, 2025 -

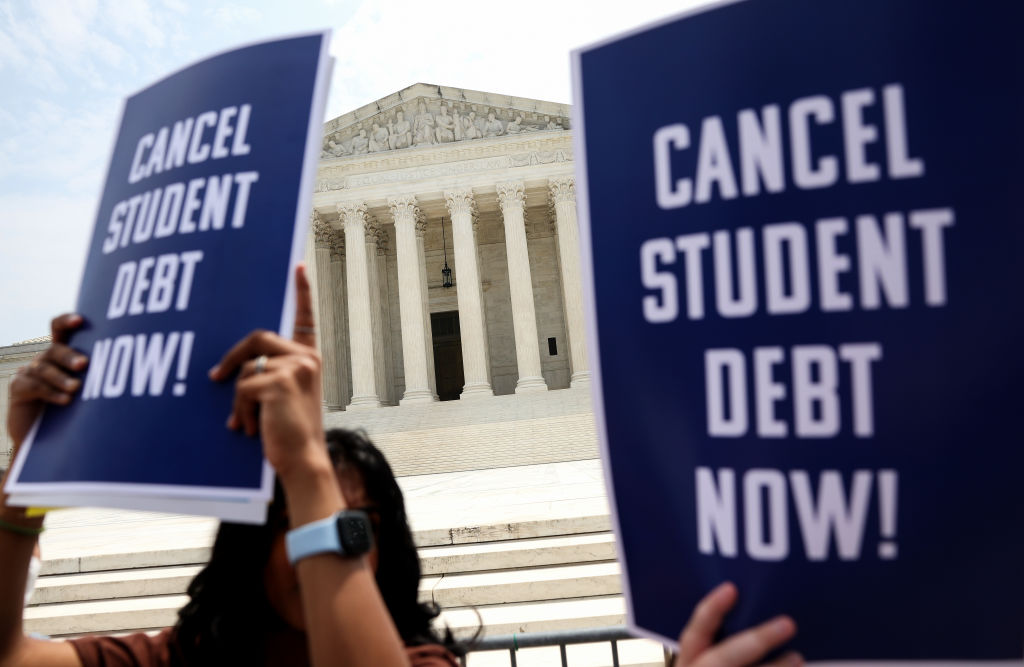

Que Espera A Los Deudores De Prestamos Estudiantiles Con Trump En El Poder

May 17, 2025

Que Espera A Los Deudores De Prestamos Estudiantiles Con Trump En El Poder

May 17, 2025 -

Are Highly Requested Fortnite Skins Returning To The Item Shop 1000 Days Later

May 17, 2025

Are Highly Requested Fortnite Skins Returning To The Item Shop 1000 Days Later

May 17, 2025

Latest Posts

-

Donald Trumps Family Tree A New Generation With Tiffany And Michaels Baby

May 17, 2025

Donald Trumps Family Tree A New Generation With Tiffany And Michaels Baby

May 17, 2025 -

I Megaloprepis Ypodoxi Toy Tramp Stin Saoydiki Aravia Xrysa Spathia Kai F 15

May 17, 2025

I Megaloprepis Ypodoxi Toy Tramp Stin Saoydiki Aravia Xrysa Spathia Kai F 15

May 17, 2025 -

Berlin Prosvjed Protiv Tesle Razlozi I Posljedice Upada U Izlozbeni Prostor

May 17, 2025

Berlin Prosvjed Protiv Tesle Razlozi I Posljedice Upada U Izlozbeni Prostor

May 17, 2025 -

The Trump Family Grows Tiffany Trumps Son Alexander And The Family Lineage

May 17, 2025

The Trump Family Grows Tiffany Trumps Son Alexander And The Family Lineage

May 17, 2025 -

Upad U Teslin Showroom U Berlinu Prosvjednici I Poruka O Planetarnoj Prijetnji

May 17, 2025

Upad U Teslin Showroom U Berlinu Prosvjednici I Poruka O Planetarnoj Prijetnji

May 17, 2025