Apple Stock (AAPL) Price Prediction: Identifying Crucial Support And Resistance

Table of Contents

Identifying Crucial Support Levels for Apple Stock (AAPL)

A support level represents a price range where buying pressure is strong enough to prevent a further price decline. Historically, when AAPL's price falls to a support level, it often bounces back up, indicating strong buyer interest.

-

Significant Historical Support Levels:

- $130 - $140: This range acted as robust support during the market correction of [Insert date range and relevant news event, e.g., early 2023, following concerns about inflation]. (Include chart/graph here illustrating this support level).

- $100 - $110: This lower support level was tested during [Insert date range and relevant news event, e.g., the pandemic market crash in 2020]. The rebound from this level demonstrated significant resilience in Apple stock. (Include chart/graph here illustrating this support level).

-

Potential Future Support Levels Based on Technical Indicators:

- 200-day Moving Average: The 200-day moving average is a key indicator often used to identify long-term support and trend changes. Currently, it sits around [Insert current 200-day MA value]. A drop below this level could signal further downward pressure.

- Fibonacci Retracement: Applying Fibonacci retracement levels to a recent AAPL price swing (e.g., from a high to a low), we identify potential support around [Insert Fibonacci retracement level, e.g., 38.2% or 50% retracement]. This level offers a potential area for buyers to step in. (Include chart/graph here illustrating Fibonacci retracement levels).

Keywords: AAPL support levels, Apple stock support, technical indicators, Apple stock chart, Fibonacci retracement, moving average.

Pinpointing Key Resistance Levels for Apple Stock (AAPL)

Resistance levels, conversely, represent price ranges where selling pressure outweighs buying pressure, halting upward price momentum. Breakouts above resistance levels often signal significant bullish trends.

-

Significant Historical Resistance Levels:

- $180 - $190: This range acted as a significant resistance point during [Insert date range and relevant news event, e.g., the latter half of 2022], preventing a further price surge. (Include chart/graph here illustrating this resistance level).

- $160 - $170: This level acted as a resistance in [Insert date range and relevant news event, e.g., early 2022], before a subsequent breakout. (Include chart/graph here illustrating this resistance level).

-

Potential Future Resistance Levels Based on Technical Indicators:

- Previous Highs: The previous all-time high for AAPL is [Insert value]. This level often acts as a psychological resistance. A sustained break above this level would signal strong bullish momentum.

- Moving Averages: The 50-day moving average often acts as short-term resistance. Currently at [Insert value], a sustained move above this level would signal strengthening upward momentum. (Include chart/graph here illustrating moving averages).

Keywords: AAPL resistance levels, Apple stock resistance, technical indicators, Apple stock chart, previous highs.

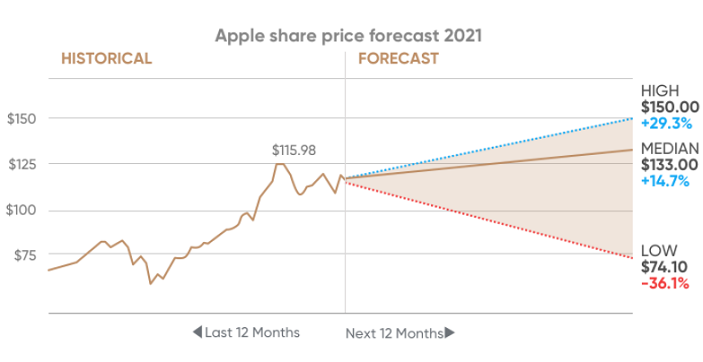

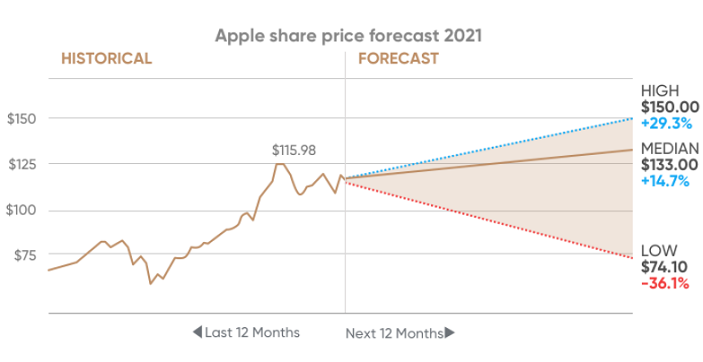

Apple Stock (AAPL) Price Prediction: A Technical Analysis Perspective

Based on the identified support and resistance levels and technical indicators, our mid-term (6-12 month) price prediction for AAPL is a range of $165 to $195.

This prediction is based on:

- The potential for the stock price to find support around the 200-day moving average and Fibonacci retracement levels.

- The possibility of a breakout above the $180-$190 resistance level, driven by positive company news or broader market sentiment.

- The acknowledgement that macroeconomic factors and unforeseen events can significantly impact the actual price.

Factors Influencing the Apple Stock (AAPL) Price Prediction

Several factors beyond pure technical analysis influence the AAPL stock price prediction:

- Macroeconomic Factors: Interest rate hikes and inflation directly impact investor sentiment and market valuations, affecting Apple stock market performance.

- Company-Specific News: New product launches (like the iPhone 15), financial reports exceeding expectations, or any significant developments directly influence AAPL's performance.

- Investor Sentiment: Overall market sentiment and investor confidence in Apple's future prospects play a crucial role.

Keywords: AAPL price prediction, Apple stock forecast, technical analysis, Apple stock outlook, AAPL target price, Apple stock market, macroeconomic factors, investor sentiment, Apple product launches, Apple financials.

Conclusion: Making Informed Decisions About Apple Stock (AAPL)

We have identified key support levels around [mention key support levels] and resistance levels around [mention key resistance levels] for Apple Stock (AAPL). Our mid-term price prediction suggests a range of $165 to $195, but this is just a projection based on technical analysis and current market conditions. Remember, the actual price can be significantly influenced by unforeseen events and macroeconomic factors. Thorough research, understanding individual risk tolerance, and considering diversification are crucial aspects of any investment strategy. Therefore, conduct your own due diligence and use the insights from this analysis to inform your Apple stock (AAPL) investment strategy. Remember to always consider factors such as risk management and diversification in your investment approach. Keywords: Apple stock investment, AAPL stock analysis, Apple stock trading, informed investment decisions.

Featured Posts

-

Neal Mc Donough A Leading Role In The Last Rodeo

May 24, 2025

Neal Mc Donough A Leading Role In The Last Rodeo

May 24, 2025 -

Pts Riviera Blue Porsche 911 S T For Sale A Collectors Dream

May 24, 2025

Pts Riviera Blue Porsche 911 S T For Sale A Collectors Dream

May 24, 2025 -

Essen And Nrw Diese Eis Sorte Ist Der Absolute Renner

May 24, 2025

Essen And Nrw Diese Eis Sorte Ist Der Absolute Renner

May 24, 2025 -

Dahilik Ve Burclar Dogustan Gelen Yetenekler

May 24, 2025

Dahilik Ve Burclar Dogustan Gelen Yetenekler

May 24, 2025 -

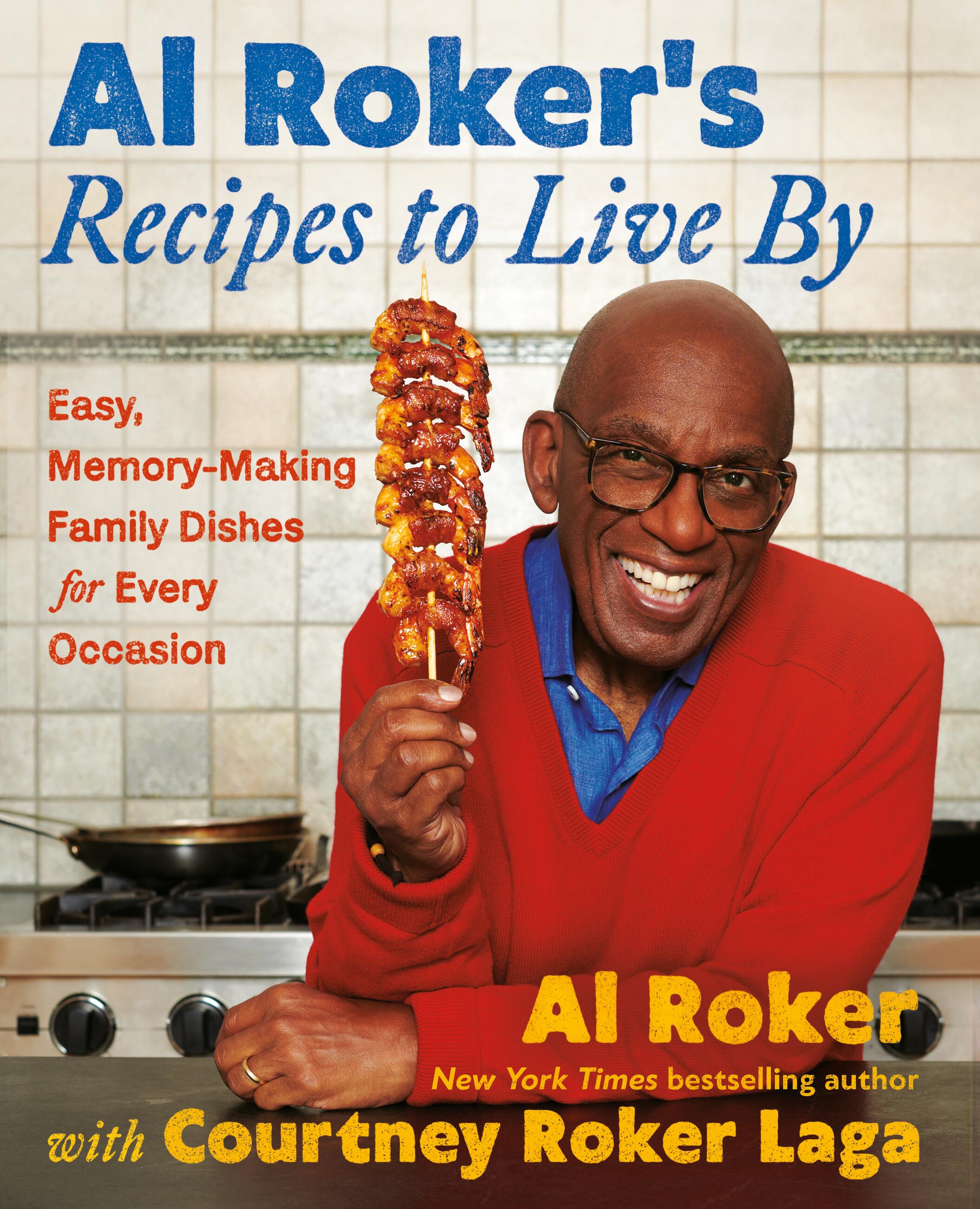

Controversy On Today Al Rokers Off The Record Comments Spark Dispute With Co Host

May 24, 2025

Controversy On Today Al Rokers Off The Record Comments Spark Dispute With Co Host

May 24, 2025