Apple Stock (AAPL): Where Will The Price Go Next? Key Levels Explained

Table of Contents

Current Market Conditions and their Impact on AAPL

The current market sentiment is a crucial factor influencing Apple Stock (AAPL). While recent economic data may show a [insert current market sentiment - e.g., slightly bearish trend], several factors could impact Apple's stock price. Analyzing economic indicators like inflation, interest rates, and consumer confidence is essential.

- Impact of Inflation on Consumer Spending: High inflation can reduce consumer spending on discretionary items like Apple products, potentially impacting AAPL's revenue growth. This is particularly true for higher-priced products such as iPhones and Macs.

- Effect of Interest Rate Hikes: Increased interest rates generally lead to a decrease in investor appetite for growth stocks like AAPL, as investors seek safer, higher-yield investments. This can put downward pressure on the Apple stock price.

- Geopolitical Risks and Supply Chain Disruptions: Global events, such as trade wars or political instability in key manufacturing regions, can disrupt Apple's supply chain, impacting production and ultimately the AAPL stock price. Diversification of manufacturing locations is key for mitigating these risks.

Analyzing Apple's Financials and Future Growth Potential

Examining Apple's recent financial reports provides insights into its current performance and future prospects. Apple's [insert recent financial data – e.g., Q3 2023 earnings report] showed [insert key financial data – e.g., strong revenue growth driven by iPhone sales and robust services revenue].

- Key Performance Indicators (KPIs): Investors should closely monitor KPIs such as revenue growth, earnings per share (EPS), profit margins, and free cash flow to gauge AAPL's financial health and future potential.

- Expansion into New Markets and Services: Apple's continued expansion into new markets (e.g., emerging economies) and its growing services segment (Apple Music, iCloud, Apple TV+) are significant growth drivers for the company.

- Competitive Landscape: While Apple dominates the premium smartphone market, competition from companies like Samsung and Google in the Android ecosystem remains fierce. The ongoing battle for market share in areas like wearables and augmented reality will also influence AAPL's future performance.

Key Support and Resistance Levels for AAPL Stock

Understanding support and resistance levels is vital for technical analysis of Apple Stock (AAPL). Support levels represent price points where buying pressure is strong enough to prevent further price declines, while resistance levels mark price points where selling pressure prevents further price increases.

- Technical Indicators: Moving averages (e.g., 50-day, 200-day), Fibonacci retracements, and relative strength index (RSI) are commonly used technical indicators to identify support and resistance levels for AAPL.

- Key Price Levels: Historically, [insert specific price levels – e.g., $150, $170, $200] have acted as significant support or resistance levels for Apple Stock (AAPL). (Include a chart here visually showing these levels).

- Breakout Scenarios: A break above a key resistance level could signal a bullish trend, while a break below a key support level could indicate a bearish trend. These scenarios should be considered in conjunction with fundamental analysis.

Risk Factors and Potential Downsides for Investing in AAPL

Investing in Apple stock (AAPL), like any stock, carries inherent risks.

- Supply Chain Disruptions: Reliance on global supply chains exposes Apple to risks from geopolitical instability, natural disasters, and pandemics. This can impact production and lead to lower-than-expected revenue.

- Single-Stock Risk: Investing heavily in a single stock like AAPL can be risky. Diversification across different asset classes is recommended to mitigate risk.

- Regulatory Risks: Increased government regulation in areas like data privacy, antitrust, and taxation could negatively impact Apple's operations and profitability.

Apple Stock (AAPL): Making Informed Investment Decisions

In conclusion, analyzing Apple Stock (AAPL) requires a comprehensive approach combining fundamental analysis (financial performance, growth prospects) and technical analysis (support/resistance levels, chart patterns). While the potential for future growth in Apple Stock (AAPL) is significant, investors should carefully consider the identified risks and key support and resistance levels before making any investment decisions. Remember to conduct your own thorough research and consider consulting a financial advisor before investing in Apple Stock (AAPL) or any other security. Continue monitoring Apple stock (AAPL) price movements and market analysis to stay informed and adapt your investment strategy accordingly.

Featured Posts

-

Escape To The Country Overcoming Common Challenges

May 24, 2025

Escape To The Country Overcoming Common Challenges

May 24, 2025 -

Nyi Rafdrifinni Porsche Macan Allt Sem T Hu T Harft Ad Vita

May 24, 2025

Nyi Rafdrifinni Porsche Macan Allt Sem T Hu T Harft Ad Vita

May 24, 2025 -

Glastonbury 2025 Lineup Confirmed Olivia Rodrigo The 1975 And More

May 24, 2025

Glastonbury 2025 Lineup Confirmed Olivia Rodrigo The 1975 And More

May 24, 2025 -

Aex Stijgt Positief Beurzenherstel Na Trumps Aankondiging

May 24, 2025

Aex Stijgt Positief Beurzenherstel Na Trumps Aankondiging

May 24, 2025 -

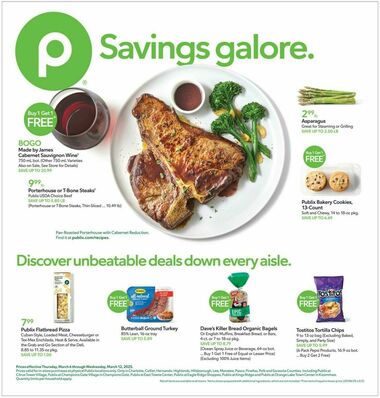

Florida Store Hours Memorial Day 2025 Publix And More

May 24, 2025

Florida Store Hours Memorial Day 2025 Publix And More

May 24, 2025