Apple Stock: Dan Ives' Long-Term Bullish Prediction After Price Target Reduction

Table of Contents

Dan Ives' Rationale Behind the Long-Term Bullish Prediction for Apple Stock

Ives' bullish stance on Apple stock isn't solely based on gut feeling; it's grounded in a solid understanding of the company's strengths and future prospects. His confidence stems from several key factors.

Sustained Growth in Services Revenue

Apple's services sector is no longer just a supplementary revenue stream; it's becoming a powerful engine of growth and profitability. The App Store, iCloud, Apple Music, Apple TV+, and other subscription services are generating substantial recurring revenue, providing a stable and predictable income stream. This "Apple recurring revenue" is crucial for long-term stability and growth.

- High-Growth Service Areas: Apple Music boasts a rapidly expanding subscriber base, while iCloud storage and AppleCare+ continue to demonstrate consistent growth.

- Future Service Expansion: Apple's foray into original content with Apple TV+ and its expansion into fitness and gaming services showcase their commitment to expanding their services ecosystem.

- Competitive Advantages: Apple's strong brand loyalty and seamless integration across its devices provide a significant competitive advantage in the services market, driving user adoption and retention. This contributes significantly to the overall "Apple Services revenue".

Potential for Further Innovation & New Product Categories

Apple's history is replete with disruptive innovations. From the iPod to the iPhone, Apple has consistently redefined entire industries. Ives believes this innovative spirit will continue to drive future growth. Potential new product categories, like AR/VR headsets and electric vehicles, represent enormous opportunities, greatly impacting the "Apple future products" pipeline.

- Past Successes: The success of the iPhone, iPad, and Apple Watch demonstrates Apple's ability to create and launch game-changing products that capture significant market share.

- New Product Market Analysis: The AR/VR market is poised for significant expansion, and Apple's entry could significantly reshape it. Similarly, an Apple electric vehicle could disrupt the automotive industry.

- Competitive Landscape: While competition exists, Apple's brand recognition, design expertise, and integrated ecosystem provide a compelling advantage in these new markets. "Apple AR/VR" and "Apple electric vehicle" are exciting prospects for future growth.

Strong Brand Loyalty & Customer Base

Apple's unparalleled brand loyalty is a cornerstone of its success. Customers demonstrate remarkable commitment to the Apple ecosystem, creating a high barrier to entry for competitors. This "Apple brand loyalty" translates to consistent sales and repeat purchases, ensuring a stable and predictable customer base.

- Brand Loyalty Statistics: Studies consistently show high customer satisfaction and retention rates for Apple products.

- Customer Satisfaction Surveys: Apple consistently ranks high in customer satisfaction surveys, reflecting strong brand loyalty and positive customer experiences.

- Future Customer Acquisition Strategies: Apple's focus on user experience and ecosystem integration is expected to continue attracting new customers and bolstering its existing base. Analyzing "Apple customer base" dynamics is key to understanding future performance.

Addressing the Price Target Reduction for Apple Stock

While Ives maintains a long-term bullish outlook, he recently lowered his price target for Apple stock. This adjustment reflects short-term headwinds, largely due to macroeconomic factors like inflation and potential supply chain disruptions. These are primarily near-term concerns that don't undermine the fundamentally strong long-term prospects of the company.

- Factors Contributing to Adjustment: Concerns about consumer spending amidst economic uncertainty and potential impacts from global supply chain issues influenced the price target reduction.

- Comparison with Other Analyst Predictions: While Ives lowered his target, his bullish outlook remains comparatively optimistic compared to many other analysts covering Apple stock. "Apple stock analysts" offer varying perspectives.

- Short-Term vs. Long-Term: Ives emphasizes the importance of differentiating between short-term market fluctuations and the long-term growth potential of Apple. This distinction is crucial when analyzing the "Apple stock price target."

Risk Factors and Potential Challenges for Apple Stock

Despite the bullish outlook, it's crucial to acknowledge potential risks and challenges.

- Competition: Intense competition in the smartphone, tablet, and wearable markets presents an ongoing challenge for Apple.

- Supply Chain Issues: Global supply chain disruptions can impact production and availability of Apple products. "Apple supply chain" vulnerabilities remain a significant risk factor.

- Economic Downturns: Macroeconomic factors, such as economic recessions, can impact consumer spending and demand for Apple products. Understanding "Apple stock risks" requires considering these broader economic factors.

Conclusion: Investing in Apple Stock – A Long-Term Perspective

Dan Ives' long-term bullish prediction for Apple stock is supported by several key factors: sustained growth in services revenue, potential for further innovation, and a fiercely loyal customer base. While acknowledging short-term challenges and risks, Ives’ analysis paints a positive picture for the future of Apple. Considering both short-term market volatility and the long-term potential, investing in "Apple stock investment" could offer attractive returns for those with a long-term investment horizon and appropriate risk tolerance. Remember to conduct thorough research and consider your personal investment strategy before making any investment decisions. This analysis of the "long-term Apple stock outlook" should inform, but not dictate, your investment choices.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Featured Posts

-

From Scatological Data To Podcast Insights Ai Digest For Repetitive Documents

May 24, 2025

From Scatological Data To Podcast Insights Ai Digest For Repetitive Documents

May 24, 2025 -

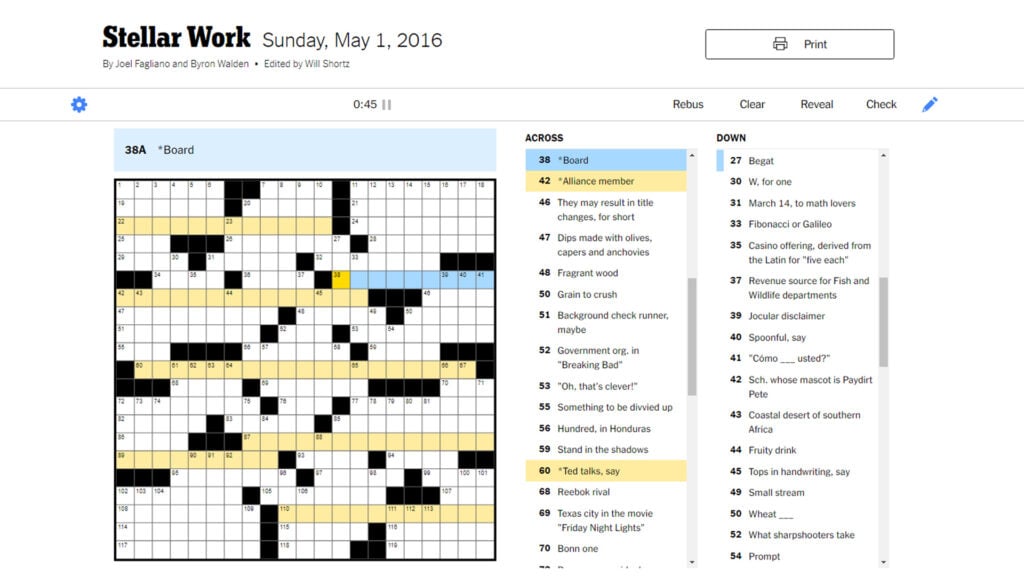

Nyt Mini Crossword Answers Today March 12 2025 Hints And Clues

May 24, 2025

Nyt Mini Crossword Answers Today March 12 2025 Hints And Clues

May 24, 2025 -

Riviera Blue Porsche 911 S T Exceptional Condition Rare Find

May 24, 2025

Riviera Blue Porsche 911 S T Exceptional Condition Rare Find

May 24, 2025 -

Picture This 2023 Complete Soundtrack List And Where To Find It

May 24, 2025

Picture This 2023 Complete Soundtrack List And Where To Find It

May 24, 2025 -

Joy Crookes Releases New Song I Know You D Kill

May 24, 2025

Joy Crookes Releases New Song I Know You D Kill

May 24, 2025