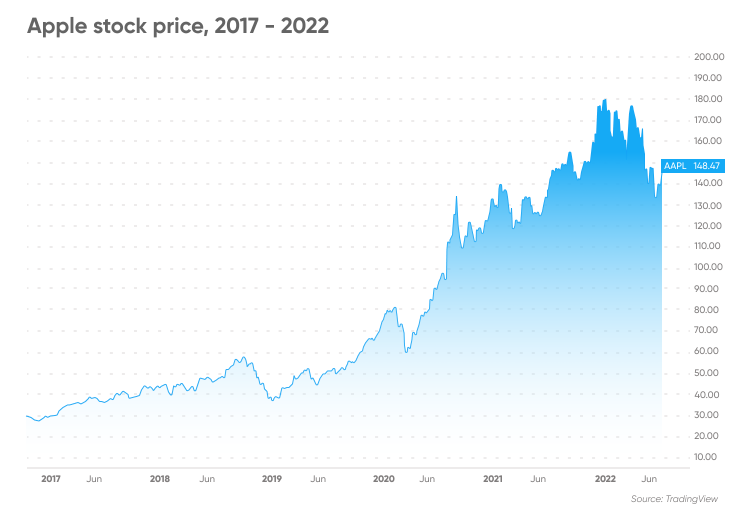

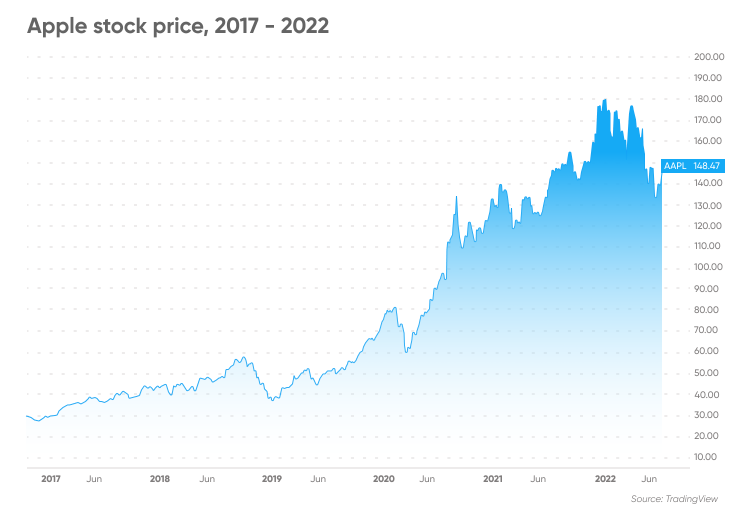

Apple Stock Forecast: Analyst Sees Potential For $254, Is It Time To Invest?

Table of Contents

The Analyst's Prediction and Rationale

A leading analyst from [Analyst Firm Name] has issued a bullish Apple stock price target of $254. Their Apple stock price prediction is based on a thorough fundamental analysis of Apple's performance and future growth prospects. Key factors underpinning this optimistic Apple stock valuation include:

-

Strong iPhone Sales: Despite economic headwinds, iPhone sales remain robust, demonstrating the enduring appeal of Apple's flagship product and its strong brand loyalty. This consistent performance forms a solid base for future revenue projections.

-

Growth in Services Revenue: Apple's services sector (Apple Music, iCloud, Apple TV+, etc.) continues to show impressive growth, becoming increasingly important to Apple's overall profitability. This recurring revenue stream provides stability and predictability to Apple's financial outlook.

-

Expansion into New Markets: Apple is aggressively expanding into new and lucrative markets, including augmented reality (AR) and virtual reality (VR), indicating a proactive approach to long-term growth and innovation.

-

Innovative Product Launches: Consistent innovation, such as the latest generation of Macs with the M2 chip and the ongoing evolution of the Apple Watch, further solidify Apple's position at the forefront of technology and consumer electronics.

-

Potential Risks: While the outlook is generally positive, the analyst acknowledges potential risks including global economic uncertainty and increased competition in certain market segments.

Analyzing Apple's Current Financial Performance

Apple's recent financial statements paint a picture of continued success. Key performance indicators show strong and consistent growth:

-

Revenue Growth: Year-over-year and quarter-over-quarter revenue growth demonstrates a healthy trajectory, surpassing expectations in several recent quarters. This sustained growth is a crucial indicator of Apple's financial strength.

-

Earnings Per Share (EPS): Apple's EPS consistently exceeds analysts' estimates, demonstrating significant profitability and the efficient use of resources.

-

Profit Margins: Apple maintains impressive profit margins, reflecting the premium pricing of its products and efficient operations. This high profitability supports robust future investment and shareholder returns.

-

Market Capitalization: Apple remains one of the world's most valuable companies, reflecting investors’ confidence in its long-term prospects.

-

Debt Levels: Apple's manageable debt levels suggest a sound financial position, minimizing financial risk.

Factors Contributing to Potential Price Increase

Several factors could propel Apple stock to the predicted $254:

-

New Product Releases: Anticipated new product releases, including potential advancements in the iPhone, Mac, and other product lines, are expected to significantly impact sales and boost the Apple stock price.

-

Technological Advancements: Continuous investment in research and development, particularly in areas such as artificial intelligence (AI) and chip technology, promises to further enhance product offerings and maintain Apple’s competitive edge.

-

Market Expansion: Apple's expansion into emerging markets represents significant untapped potential for growth and future revenue generation.

-

Strong Brand Loyalty: Apple's strong brand loyalty and market share dominance create a solid foundation for continued success and investor confidence.

Risks and Potential Downsides of Investing in Apple Stock

While the potential upside is significant, potential investors must acknowledge the risks involved:

-

Market Volatility: The overall stock market is subject to volatility, and even strong companies like Apple can be impacted by broader economic factors and market sentiment.

-

Economic Slowdowns: A global economic downturn could significantly affect consumer spending on electronics, potentially impacting Apple's sales and stock price.

-

Increased Competition: The competitive landscape in the tech industry is fiercely competitive, with other companies constantly innovating and challenging Apple's dominance in various sectors.

-

Supply Chain Disruptions: Geopolitical events and other unforeseen circumstances could disrupt Apple's supply chains, impacting production and potentially affecting financial performance.

-

Geopolitical Uncertainty: Global political instability could negatively impact Apple's operations in various regions.

Should You Invest in Apple Stock Now? A Practical Guide

Deciding whether to invest in Apple stock requires careful consideration of your individual circumstances:

-

Risk Tolerance: Assess your own risk tolerance before investing in any stock, including Apple. Apple stock, while generally considered stable, is still subject to market fluctuations.

-

Investment Goals: Define your investment goals – are you investing for the short term or long term? Apple stock is often viewed as a long-term investment, given its history of consistent growth.

-

Portfolio Diversification: Remember that diversification is key to managing risk. Don’t put all your eggs in one basket. Diversify your portfolio across different asset classes to mitigate risk.

-

Due Diligence: Before investing, conduct thorough due diligence, carefully reviewing Apple's financial statements, news articles, and analyst reports.

-

Seek Professional Advice: If you are unsure about investment decisions, consider seeking advice from a qualified financial advisor.

Conclusion

The analyst's prediction of Apple stock reaching $254 is based on strong fundamental factors, including robust financial performance, consistent innovation, and expansion into new markets. However, potential investors must acknowledge the inherent risks associated with any stock investment, including market volatility and competition. Carefully consider the potential of Apple stock reaching $254 and make an informed decision about whether to invest in AAPL based on your own financial situation and risk tolerance. Remember to conduct your own thorough research before making any investment decisions.

Featured Posts

-

Canada Post Strike Averted Details On The New Contract Offers

May 24, 2025

Canada Post Strike Averted Details On The New Contract Offers

May 24, 2025 -

Broadway Buzz Jonathan Groff On Embodying Bobby Darin In Just In Time

May 24, 2025

Broadway Buzz Jonathan Groff On Embodying Bobby Darin In Just In Time

May 24, 2025 -

Dahilik Ve Burclar Dogustan Gelen Yetenekler

May 24, 2025

Dahilik Ve Burclar Dogustan Gelen Yetenekler

May 24, 2025 -

Jorja Smith Biffy Clyro Blossoms To Headline Bbc Radio 1 Big Weekend

May 24, 2025

Jorja Smith Biffy Clyro Blossoms To Headline Bbc Radio 1 Big Weekend

May 24, 2025 -

Memorial Day 2025 Date History And Three Day Weekend

May 24, 2025

Memorial Day 2025 Date History And Three Day Weekend

May 24, 2025