Apple Stock Investment: Weighing A $254 Prediction Against Current Prices

Table of Contents

Current Apple Stock Price Analysis

Understanding the current landscape of Apple stock (AAPL) is paramount before evaluating any prediction. As of [Insert Today's Date], the Apple stock price stands at [Insert Current Price]. This represents a [Insert Percentage Change] change compared to [Insert Timeframe, e.g., yesterday's closing price, the previous week's closing price, the previous month's closing price]. Recent performance has been influenced by a variety of factors, including broader market trends, investor sentiment, and Apple's own financial performance.

Factors influencing the current price include:

- Market Trends: The overall health of the stock market significantly impacts individual stock prices. A bullish market generally lifts all boats, while a bearish market can lead to widespread declines.

- Economic Conditions: Macroeconomic factors like inflation, interest rates, and consumer confidence play a significant role. Strong economic growth usually benefits tech giants like Apple.

- Company News: Apple's own news—product launches, earnings reports, and any significant announcements—directly influence investor perception and stock price. For instance, the launch of a highly anticipated new product line often boosts the stock price.

Key financial indicators to consider when analyzing Apple stock include:

- P/E Ratio: [Insert Current P/E Ratio] – This shows how much investors are willing to pay for each dollar of Apple's earnings.

- Dividend Yield: [Insert Current Dividend Yield]% – This reflects the annual dividend payment relative to the stock price.

- Market Capitalization: [Insert Current Market Cap] – This represents the total value of all outstanding Apple shares.

For up-to-date information, refer to reliable sources like [link to Yahoo Finance] and [link to Google Finance].

The $254 Apple Stock Price Prediction: A Deep Dive

The $254 Apple stock price prediction originates from [Source of Prediction – Analyst report, news article, etc., with link if available]. The rationale behind this prediction likely involves several factors, such as:

- Projected Revenue Growth: The analyst likely considered Apple's projected revenue growth based on anticipated sales of existing and new products.

- Market Share Expansion: Predictions may factor in Apple's potential to expand its market share in key sectors like smartphones, wearables, and services.

- Innovation and New Product Launches: The potential success of future product launches plays a significant role in such predictions.

However, it's crucial to acknowledge the limitations of any prediction:

- Unforeseen Events: The prediction might not account for unforeseen events, such as global economic downturns, supply chain disruptions, or unexpected competition.

- Underlying Assumptions: The prediction relies on certain assumptions about future market conditions and Apple's performance, which may not materialize.

- Analyst Bias: Individual analysts may have their own biases or perspectives that influence their predictions.

Key arguments supporting the $254 prediction might include [Summarize key arguments]. However, potential downsides include [mention potential risks and downsides].

Comparing the Prediction to Current Market Realities

Let's compare the $254 prediction to the current Apple stock price:

| Prediction | Current Price | Difference | |

|---|---|---|---|

| Apple Stock Price | $254 | [Insert Current Price] | [Calculate Difference] |

| Upside Potential | [Calculate] | ||

| Downside Risk | [Calculate] |

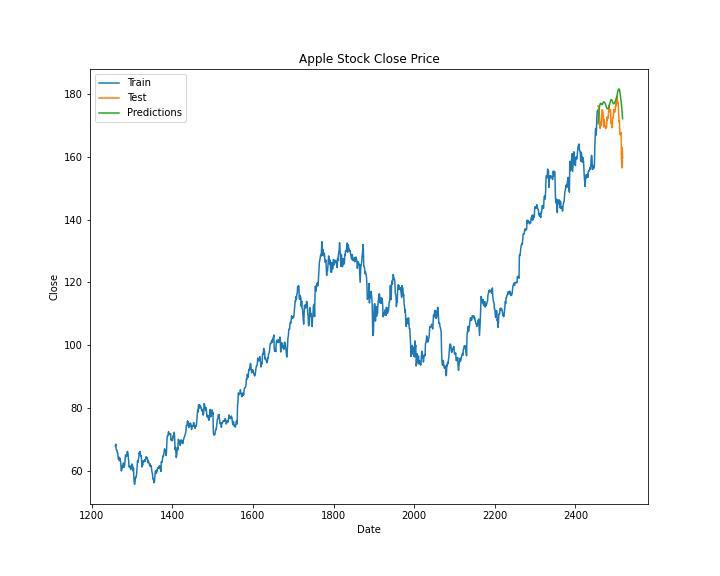

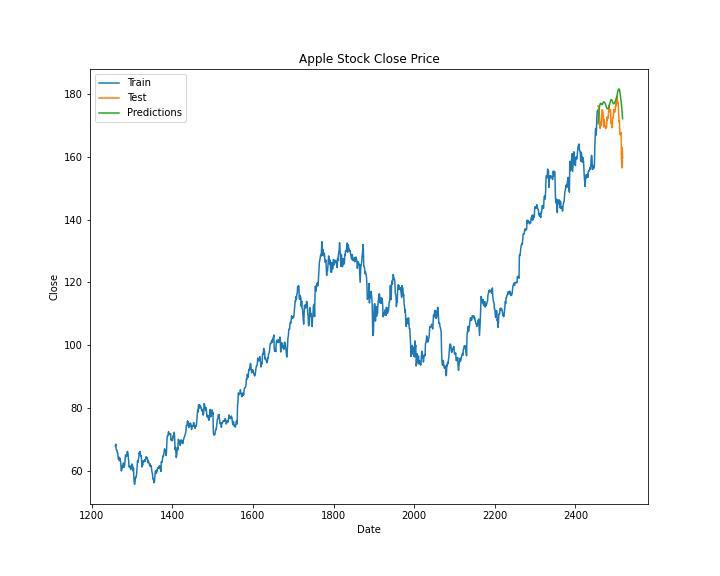

[Consider incorporating a chart visually representing the price comparison over time.]

The $254 prediction likely represents a [Short-term/Long-term] target, meaning it's important to consider the timeframe involved. A long-term prediction holds different implications than a short-term one.

Factors to Consider Before Investing in Apple Stock

Before committing to an Apple stock investment, consider several key aspects:

- Broader Market Conditions: The overall state of the economy and the stock market significantly impacts Apple's performance. A recession, for example, could negatively affect consumer spending and thus Apple's sales.

- Apple's Financial Health: Review Apple's financial reports, including revenue growth, profitability, and debt levels.

- Competitive Landscape: Apple faces strong competition from other tech companies. Consider their strategies and market share.

- Risk Tolerance: Investing in individual stocks always carries risk. Determine your personal risk tolerance before investing a significant portion of your portfolio.

- Diversification: It's crucial to diversify your investments across different asset classes to mitigate risk. Don't put all your eggs in one basket.

Key considerations before investing in Apple stock:

- Thoroughly research Apple's financial performance and future prospects.

- Assess your risk tolerance and diversify your investment portfolio.

- Stay updated on market trends and relevant news affecting Apple.

- Seek professional financial advice if needed.

Conclusion: Making Informed Decisions on Your Apple Stock Investment

This analysis compared the $254 Apple stock price prediction with the current market price, considering various factors influencing Apple's stock value. While the $254 prediction presents a potentially lucrative opportunity, realizing such gains is not guaranteed. Thorough research and a realistic assessment of risk are essential. Before investing in Apple stock or adopting any Apple stock investment strategy, carefully consider your individual financial goals and risk tolerance. Diversification is crucial in any investment portfolio. Remember, the stock market is dynamic; continuous monitoring and adjustment of your Apple stock portfolio are necessary. Make informed decisions regarding your Apple stock investment, and don't hesitate to seek professional advice when necessary.

Featured Posts

-

From Scatological Data To Podcast Insights Ai Digest For Repetitive Documents

May 24, 2025

From Scatological Data To Podcast Insights Ai Digest For Repetitive Documents

May 24, 2025 -

Understanding The Controversy Surrounding Thames Water Executive Bonuses

May 24, 2025

Understanding The Controversy Surrounding Thames Water Executive Bonuses

May 24, 2025 -

Maryland Softball Edges Delaware In Thrilling 5 4 Contest

May 24, 2025

Maryland Softball Edges Delaware In Thrilling 5 4 Contest

May 24, 2025 -

Auto Legendas F1 Motorral Szerelt Porsche Koezuti Verzioja

May 24, 2025

Auto Legendas F1 Motorral Szerelt Porsche Koezuti Verzioja

May 24, 2025 -

Memorial Day Weekend Fueling Up For Less

May 24, 2025

Memorial Day Weekend Fueling Up For Less

May 24, 2025