Apple Stock Performance: Exceeding Q2 Expectations

Table of Contents

Strong Revenue Growth Across Key Product Lines

Apple's Q2 success wasn't driven by a single product; rather, it reflects strong performance across its diverse portfolio. This diversification is a key factor in Apple's resilience and a significant contributor to its exceeding expectations.

iPhone Sales Remain a Dominant Force

- Record iPhone sales: While precise figures vary depending on the source, reports indicate iPhone sales significantly exceeded initial predictions for Q2.

- Strong demand: This robust performance comes despite ongoing supply chain challenges that have impacted the tech industry as a whole, showcasing the persistent demand for Apple's flagship product.

- New iPhone models: The release of new iPhone models (if applicable in Q2) likely played a role in boosting sales figures and market share.

- Market share dominance: Apple continues to maintain a significant portion of the smartphone market share, indicating its strong brand loyalty and competitive edge.

The impact of iPhone pricing strategies on profitability should also be considered. While some may perceive higher prices as a barrier, Apple's premium positioning and strong brand loyalty often justify these price points, leading to higher profit margins.

Services Revenue Continues its Upward Trajectory

Apple's services ecosystem is becoming increasingly crucial to its overall financial health, providing a reliable stream of recurring revenue.

- Significant growth: Apple Music, iCloud, the App Store, and other services reported substantial revenue growth in Q2.

- Recurring revenue streams: The increasing reliance on subscriptions ensures a predictable income flow, mitigating the volatility associated with hardware sales.

- New service offerings: The introduction of new services or significant updates to existing ones (mention specifics if applicable) further contributed to this growth.

The long-term growth potential of Apple's services segment is immense. As the ecosystem expands and user engagement deepens, this segment is poised to become an even more significant contributor to Apple's overall financial stability.

Wearables, Home, and Accessories Show Impressive Growth

The "Wearables, Home, and Accessories" segment continues its impressive upward trend, demonstrating Apple's ability to successfully diversify its revenue streams beyond its core products.

- Apple Watch and AirPods sales: Both the Apple Watch and AirPods contributed significantly to the segment's growth, driven by both increased adoption and new product releases.

- High growth rate: This segment often shows the highest growth rate within Apple's business, demonstrating market expansion and the successful identification of high-demand product categories.

- Market expansion: New product launches and increasing adoption within existing markets are key drivers of the segment's success.

This segment is strategically important for Apple, allowing diversification beyond its reliance on the iPhone and iPad, while tapping into rapidly growing markets for smartwatches and wireless earbuds.

Positive Outlook for Future Growth

Apple's strong Q2 performance isn't just a snapshot; it points towards a positive outlook for future growth, driven by several key factors.

Innovation as a Key Driver

Apple's consistent investments in research and development (R&D) fuel its ability to innovate and remain competitive.

- Significant R&D spending: Apple consistently dedicates significant resources to research and development, underlining its commitment to innovation.

- Upcoming product launches: Anticipated future launches, potentially including advancements in augmented reality/virtual reality (AR/VR) or new chip technologies, promise further growth.

- Competitive advantage: This sustained innovation forms a key part of Apple's competitive advantage, ensuring continued market relevance and demand for its products.

Global Market Expansion Opportunities

Apple continues to explore opportunities for growth in emerging markets and less saturated regions worldwide.

- Emerging markets strategy: Apple is actively expanding its presence in several emerging markets, aiming to capture a greater share of the global consumer base.

- Geographical expansion: Further expansion into new geographical regions provides access to untapped potential customer bases.

- Market penetration: Strategies aimed at increasing market penetration in existing regions also play a key role in Apple's global growth strategy.

However, navigating the complexities and potential challenges of these markets requires careful planning and adaptation. Cultural differences, regulatory landscapes, and infrastructure limitations all present obstacles that need to be addressed.

Strong Financial Position and Resilience

Apple's strong financial foundation provides stability and resilience in the face of economic uncertainty.

- Substantial cash reserves: Apple boasts significant cash reserves, providing a financial safety net during challenging economic times.

- Low debt levels: Its relatively low debt levels further enhance its financial strength and flexibility.

- Economic downturn resilience: This robust financial position allows Apple to weather economic downturns more effectively than many of its competitors.

This financial strength is a major factor influencing investor confidence and contributes significantly to the positive outlook for Apple stock.

Analyzing Apple Stock Performance: Implications for Investors

Understanding Apple's Q2 performance and its implications for investors requires examining the stock's movement and considering potential risks and challenges.

Stock Price Movement and Analyst Ratings

The Q2 earnings report had a positive impact on Apple's stock price, with a subsequent increase (mention percentage if possible). Analyst ratings have generally been upgraded following the positive results.

Potential Risks and Challenges

Despite the positive outlook, investors need to consider potential risks that could affect Apple's future performance.

- Global economic uncertainty: Global macroeconomic factors, such as inflation and recessionary concerns, could impact consumer spending and demand for Apple products.

- Supply chain disruptions: Continued supply chain constraints could affect production and availability of Apple products.

- Increased competition: The increasing competitiveness within the tech industry, especially in the smartphone market, presents a challenge for maintaining market share.

- Regulatory pressures: Increased regulatory scrutiny in various markets could affect Apple's operations and profitability.

These factors must be carefully considered when evaluating the investment potential of Apple stock.

Long-Term Investment Prospects

Considering the company's Q2 performance, strong financial position, and future growth potential, Apple stock presents compelling long-term investment prospects. The company’s continued innovation, diverse product portfolio, and focus on expanding its services ecosystem contribute to a positive outlook. However, always remember to conduct thorough due diligence and consult with a financial advisor before making any investment decisions.

Conclusion

Apple's Q2 performance significantly exceeded expectations, demonstrating the strength and resilience of its diverse product portfolio and business model. Strong revenue growth across key product lines, a positive outlook for future innovation, and a solid financial position all contribute to a bullish outlook for Apple stock. While potential risks exist, the company's ability to adapt and innovate positions it for continued success. Investors interested in robust and reliable growth should consider adding Apple stock to their portfolio. Conduct thorough research and consult a financial advisor before making any investment decisions related to Apple stock or any other investment. Remember to carefully evaluate your risk tolerance and investment goals before investing in Apple stock or any other security.

Featured Posts

-

Exclusive Trump Tells European Leaders Putin Wont End War

May 24, 2025

Exclusive Trump Tells European Leaders Putin Wont End War

May 24, 2025 -

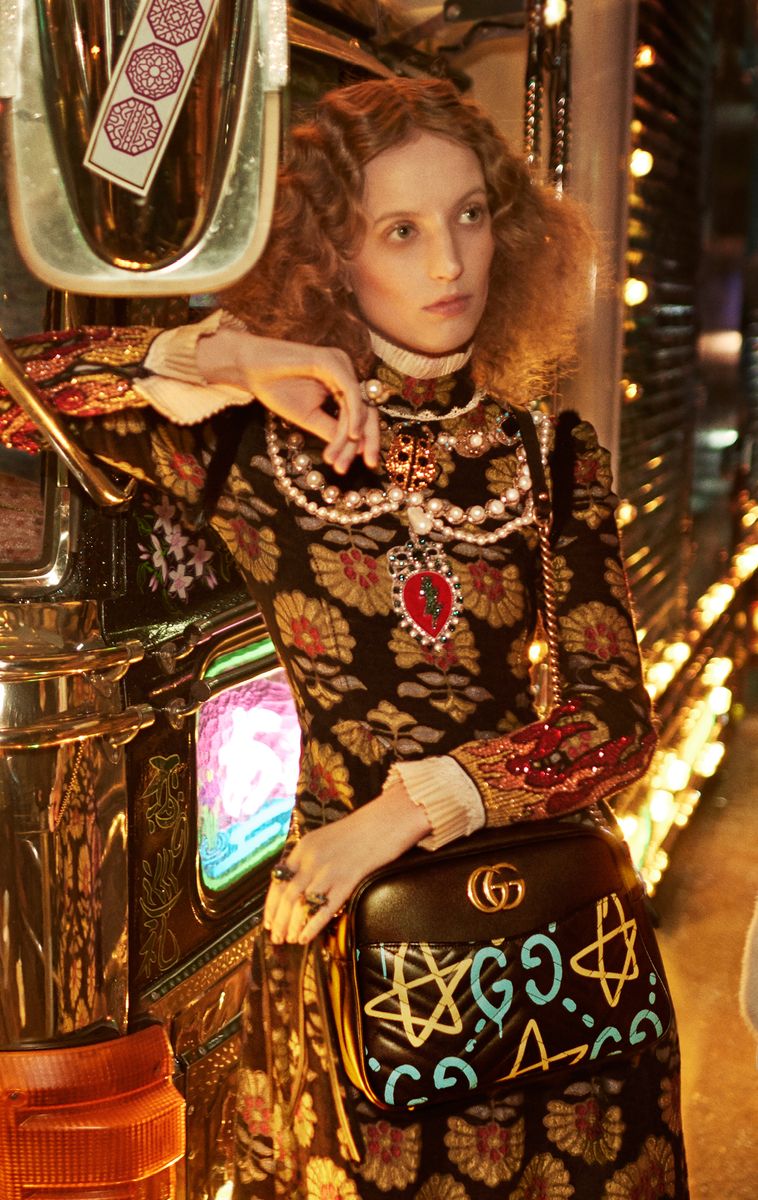

A Deep Dive Into Demna Gvasalias Gucci Designs

May 24, 2025

A Deep Dive Into Demna Gvasalias Gucci Designs

May 24, 2025 -

Jonathan Groffs Just In Time Opening Lea Michele And Friends Celebrate

May 24, 2025

Jonathan Groffs Just In Time Opening Lea Michele And Friends Celebrate

May 24, 2025 -

Understanding Dylan Dreyer And Brian Ficheras Lasting Marriage

May 24, 2025

Understanding Dylan Dreyer And Brian Ficheras Lasting Marriage

May 24, 2025 -

April 14 2025 Horoscope Forecasts For 5 Fortunate Signs

May 24, 2025

April 14 2025 Horoscope Forecasts For 5 Fortunate Signs

May 24, 2025