Apple Stock's Critical Q2 Report: Current Price Levels Analyzed

Table of Contents

H2: Q2 Earnings Report Deep Dive

Apple's Q2 2024 report offered a mixed bag for investors. While some areas exceeded expectations, others fell short, contributing to the observed price fluctuations in Apple stock.

H3: Revenue Analysis:

Overall revenue figures showed a slight deceleration compared to the previous quarter, yet still exceeded many analysts' predictions.

- Key Revenue Streams: The iPhone remained the dominant revenue generator, although its growth rate slowed compared to previous years. Services continued their robust performance, showcasing the strength of Apple's ecosystem. Mac sales experienced a slight dip, potentially reflecting the saturated market and economic downturn. Wearables showed consistent growth.

- Year-over-Year Growth: Revenue increased by approximately X% year-over-year, a figure lower than Apple's average growth in recent years. This slower growth is likely attributable to a combination of factors.

- Influencing Factors: Global economic uncertainty, particularly in key markets, significantly impacted consumer spending and, consequently, Apple's revenue. Supply chain disruptions, while less severe than in previous periods, still posed challenges.

H3: Earnings Per Share (EPS):

EPS for Q2 2024 came in at [insert actual or estimated figure], slightly below analyst consensus estimates.

- Significance for Investors: EPS is a vital indicator of profitability and is a key factor used in evaluating a company's stock price. A lower-than-expected EPS often leads to a negative market reaction.

- Surprises and Deviations: The slight miss on EPS expectations mainly stemmed from increased operating costs and slightly lower-than-projected sales in certain product categories.

- Impact on Stock Price: The slightly lower-than-expected EPS contributed to the initial dip in Apple stock price following the report's release.

H3: Key Financial Metrics:

Beyond revenue and EPS, other critical metrics provided further insight into Apple's financial health.

- Gross Margin: Apple maintained a healthy gross margin, indicating efficient cost management despite supply chain challenges.

- Operating Income and Net Income: Both operating and net income figures reflected the overall revenue performance, showing growth but at a slower pace compared to previous quarters. This data points to the need for further strategic planning by Apple.

- Overall Financial Health: Despite the slight slowdown in growth, Apple's financial position remains robust, with substantial cash reserves and a strong balance sheet.

H2: Factors Influencing Apple Stock Price

Apple stock price is influenced not only by its financial performance but also by broader market dynamics and investor sentiment.

H3: Market Sentiment:

The overall market sentiment played a significant role in shaping Apple stock's reaction to the Q2 report.

- Macroeconomic Factors: Concerns about inflation, rising interest rates, and a potential recession contributed to a cautious market mood, impacting investor confidence in tech stocks generally.

- Competitor Performance: The performance of competitors in the smartphone and technology markets also influenced investor sentiment regarding Apple's future prospects.

- News Coverage: Negative news coverage surrounding the slowdown in growth contributed to the sell-off.

H3: Analyst Ratings and Predictions:

Following the Q2 report, several analysts adjusted their ratings and price targets for Apple stock.

- Analyst Ratings: Some analysts maintained a "Buy" rating, emphasizing Apple's long-term growth potential and strong fundamentals. Others issued "Hold" ratings, expressing caution about the short-term outlook. Few, if any, issued "Sell" ratings.

- Price Target Predictions: Price targets ranged from [insert range] indicating a divergence in analyst opinion regarding the future stock price.

- Consensus View: While a consensus view is difficult to ascertain, the prevailing sentiment among analysts suggests cautious optimism, reflecting a belief in Apple's long-term prospects while acknowledging near-term challenges.

H3: Future Growth Prospects:

Apple's future growth prospects hinge on several factors, including successful product launches and continued innovation.

- Upcoming Product Launches: The anticipated launch of new iPhones, along with upgrades to other products in Apple's ecosystem, could significantly boost future revenue and earnings.

- Growth Potential of Key Product Categories: The Services segment is expected to continue its strong growth, driven by subscription services and increased user engagement.

- Long-Term Growth Strategy: Apple's ongoing investments in research and development, along with its expansion into new markets, suggest a long-term focus on sustained growth.

H2: Current Apple Stock Price Analysis

Analyzing the current Apple stock price requires considering both technical and fundamental factors.

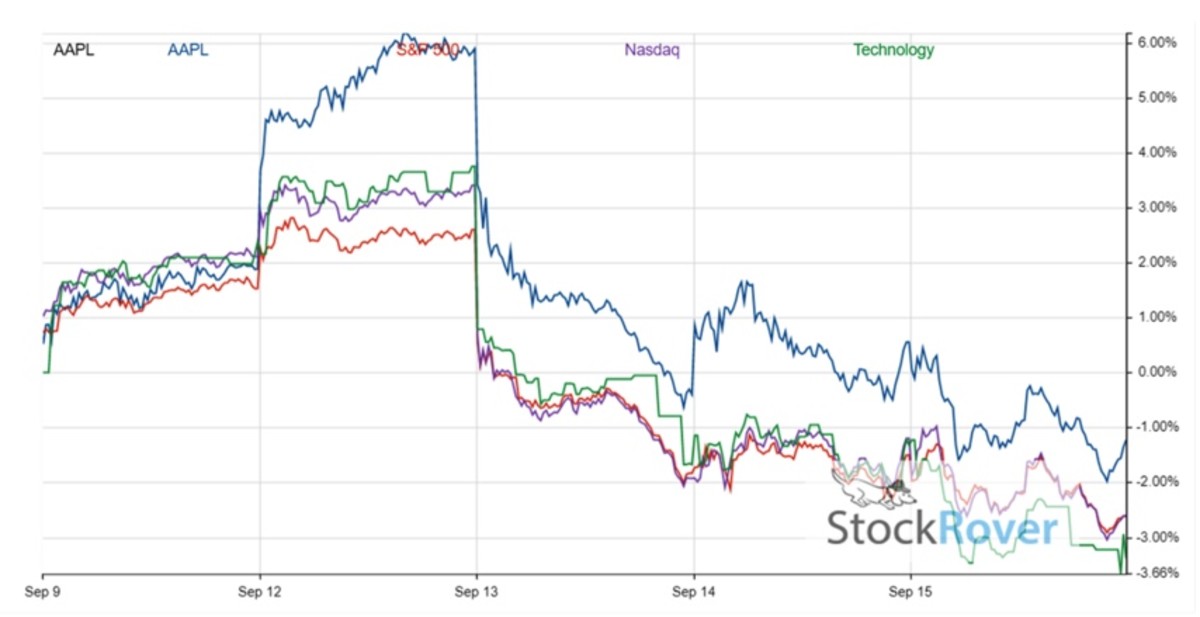

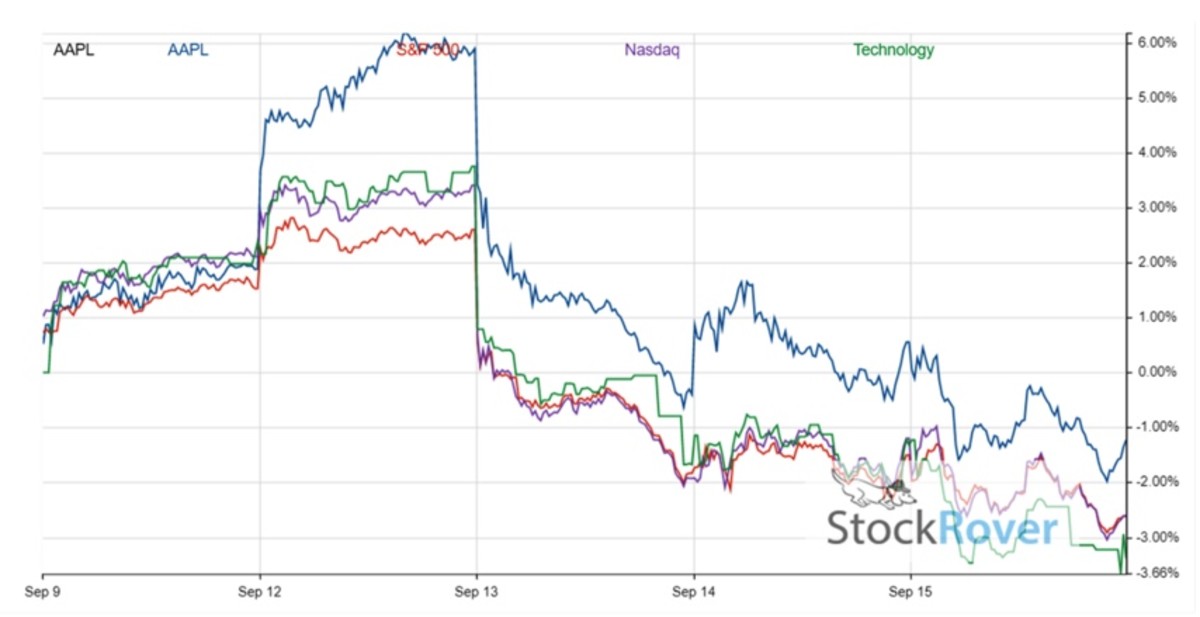

H3: Technical Analysis:

Technical indicators, such as moving averages and support/resistance levels, offer insights into potential price trends. [Optional: Briefly mention specific technical indicators and their implications].

H3: Fundamental Analysis:

Fundamental analysis focuses on the company's financial health and future prospects, which have been discussed earlier in this article. The overall picture, while showing some slowdown, remains positive for Apple's future.

H3: Valuation:

Apple's current valuation, considering metrics such as the Price-to-Earnings ratio, needs to be compared to historical valuations and valuations of competitors to determine if the stock is currently undervalued, overvalued, or fairly valued. [Optional: Briefly mention valuation metrics and their implications].

3. Conclusion:

Apple Stock's Critical Q2 Report revealed a period of slower growth for the company, influencing the current Apple stock price. While revenue and EPS exceeded some expectations, concerns about the global economy and slowing growth led to a cautious market response. Key takeaways include a need to watch for new product launches, observe shifting market sentiment, and monitor macroeconomic factors. Despite the slowdown, Apple's strong fundamentals and long-term growth prospects remain largely intact.

Stay informed about future Apple stock performance by regularly reviewing market analysis and the company's official releases. Understanding Apple Stock's performance is key to successful investing.

Featured Posts

-

Glastonbury Festival 2025 Complete Lineup Confirmed How To Buy Tickets

May 24, 2025

Glastonbury Festival 2025 Complete Lineup Confirmed How To Buy Tickets

May 24, 2025 -

Tasarruf Konusunda En Basarili 3 Burc

May 24, 2025

Tasarruf Konusunda En Basarili 3 Burc

May 24, 2025 -

Hemen Intikam Alan 3 Burc Ihanet Edildiginde Ne Yaparlar

May 24, 2025

Hemen Intikam Alan 3 Burc Ihanet Edildiginde Ne Yaparlar

May 24, 2025 -

The Jonas Brothers Joe And The Hilarious Fan Fight

May 24, 2025

The Jonas Brothers Joe And The Hilarious Fan Fight

May 24, 2025 -

Dax Steady At Frankfurt Stock Market Opening Following Record Run

May 24, 2025

Dax Steady At Frankfurt Stock Market Opening Following Record Run

May 24, 2025