Apple Vs. Trump Tariffs: Will Buffett's Top Tech Stock Crack?

Table of Contents

This article analyzes the potential impact of Trump-era tariffs on Apple, a cornerstone holding of Warren Buffett's Berkshire Hathaway. We'll examine how these trade policies affected Apple's profitability, supply chain, and overall stock performance, ultimately exploring whether these challenges threatened its position as a top tech stock. The imposition of tariffs represented a significant geopolitical and economic event, and understanding its effect on a company as influential as Apple is crucial for investors and business analysts alike.

The Impact of Tariffs on Apple's Manufacturing and Supply Chain

Keywords: Apple Supply Chain, China Manufacturing, Tariff Impact on Manufacturing, Global Supply Chain, Production Costs

Apple's immense success is intrinsically linked to its global supply chain, with a significant portion of its manufacturing based in China. This reliance, while historically beneficial due to lower production costs and skilled labor, made Apple particularly vulnerable to the Trump administration's tariffs on Chinese goods. These tariffs, implemented as part of a broader trade war, significantly increased the cost of importing components and finished goods.

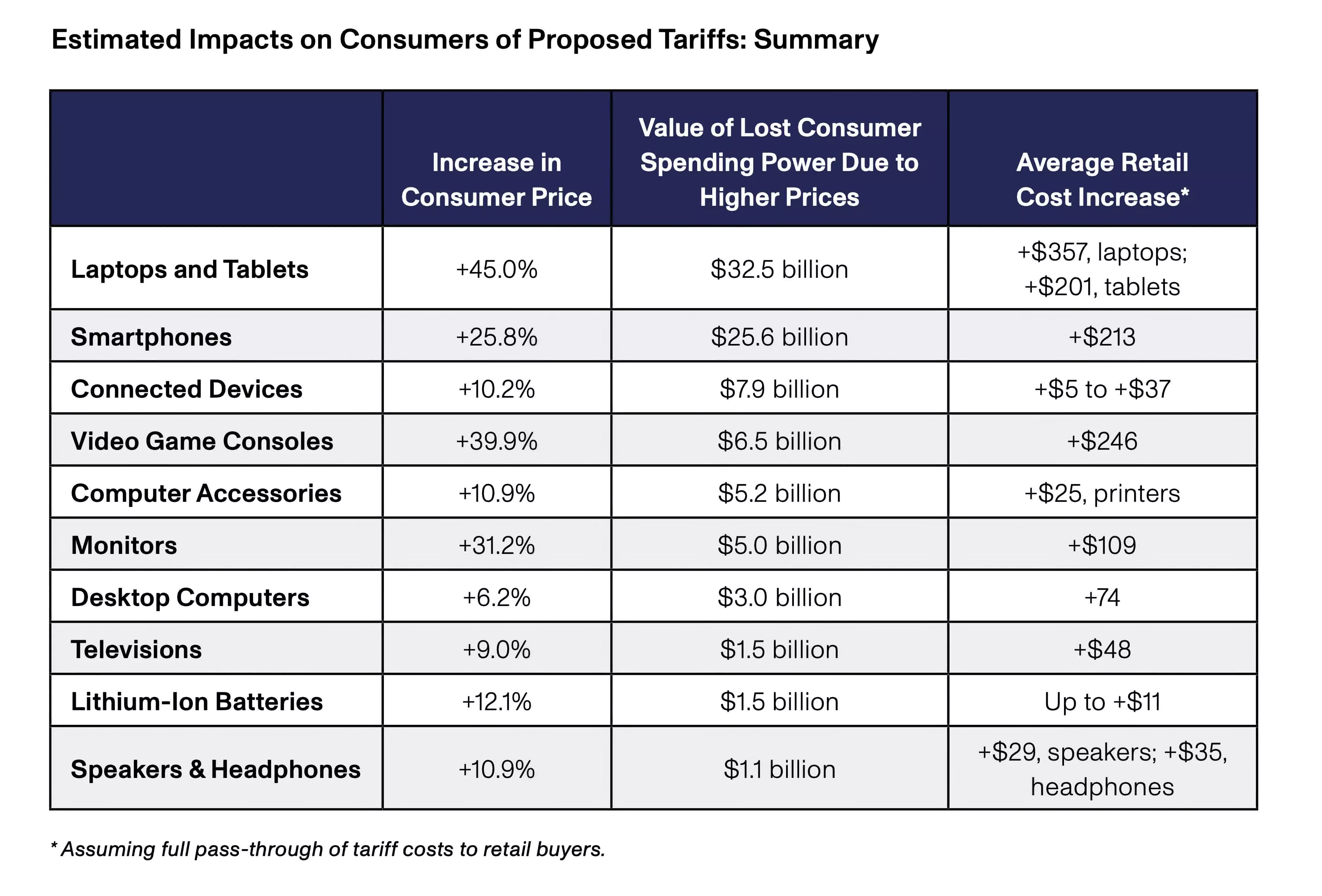

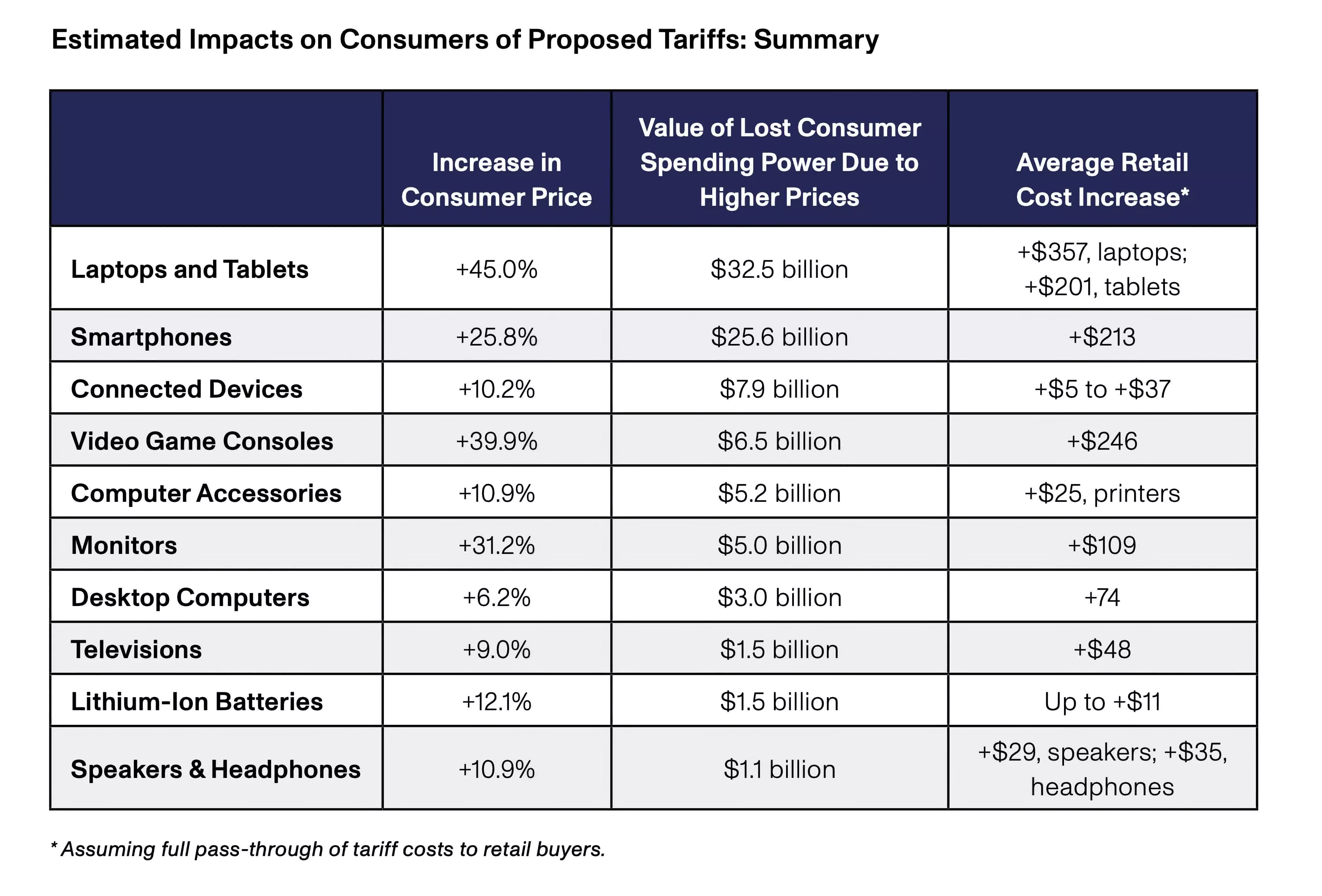

- Increased Production Costs: Tariffs directly increased the cost of importing crucial components for iPhones, iPads, Macs, and Apple Watches. This added expense impacted Apple's pricing strategies and profitability margins.

- Specific Product Impacts:

- Increased costs for iPhone components, particularly those sourced from Chinese manufacturers.

- Higher import duties on Apple Watches, impacting their competitiveness in the global smartwatch market.

- Elevated tariffs on Mac components, potentially increasing the price of these products.

- Mitigation Efforts: In response to these challenges, Apple initiated efforts to diversify its manufacturing base, exploring options in countries like India and Vietnam. This diversification, while promising long-term resilience, presented significant logistical and infrastructural hurdles.

Apple's Financial Performance During the Tariff Period

Keywords: Apple Financial Performance, Earnings Reports, Stock Price Volatility, Revenue Growth, Profit Margins

Analyzing Apple's financial statements during the tariff period reveals a complex picture. While Apple remained highly profitable, the impact of tariffs was evident in certain key performance indicators.

- Revenue and Profit Margin Fluctuations: Apple's quarterly earnings reports showed some fluctuations in revenue growth and profit margins during periods of heightened tariff uncertainty. While overall revenue remained strong, the rate of growth showed some moderation.

- Stock Price Volatility: The stock market reacted to the evolving tariff situation, resulting in periods of volatility in Apple's stock price. Investor sentiment was affected by uncertainty surrounding the long-term impact of tariffs on the company's profitability.

- Comparative Performance: Comparing Apple's performance with other tech companies facing similar tariff challenges provides valuable context. Some companies experienced more significant negative impacts, highlighting Apple’s relatively strong resilience.

- Key Financial Data Points:

- Quarterly revenue growth slowed slightly during peak tariff periods.

- Earnings Per Share (EPS) demonstrated resilience but reflected the added pressure.

- Profit margins were impacted but remained within a healthy range.

Warren Buffett's Response and Berkshire Hathaway's Strategy

Keywords: Warren Buffett, Berkshire Hathaway, Investment Strategy, Long-Term Investment, Apple Stock Ownership

Warren Buffett, renowned for his long-term investment philosophy, maintained a steadfast approach towards his significant Apple stock holdings. His strategy, focused on identifying fundamentally strong companies with durable competitive advantages, likely played a significant role in his response to the tariff challenges facing Apple.

- Buffett's Investment Philosophy: Buffett's focus on long-term value creation and his understanding of Apple's robust ecosystem and brand loyalty likely influenced his decision not to divest from Apple despite the tariff headwinds.

- Berkshire Hathaway's Response: Berkshire Hathaway's response remained largely passive, reflecting their belief in Apple's long-term prospects. There was no indication of significant adjustments to their Apple stock holdings during the tariff period.

- Long-Term Outlook: Berkshire Hathaway's continued confidence in Apple underscores the belief that the company’s fundamental strength would ultimately outweigh the short-term challenges posed by the tariffs.

- Public Statements: While Buffett rarely comments on short-term market fluctuations, his continued holding of Apple shares implicitly signaled his confidence in the company's ability to navigate the trade war’s complexities.

Alternative Sourcing and Mitigation Strategies

Keywords: Supply Chain Diversification, India Manufacturing, Vietnam Manufacturing, Reshoring, Tariff Mitigation

Faced with the vulnerabilities exposed by the trade war, Apple accelerated efforts to diversify its manufacturing base. This involved exploring alternative manufacturing locations in countries such as India and Vietnam.

- Challenges and Successes: Shifting production is a complex process, requiring substantial investment in new infrastructure, worker training, and logistical adjustments. While progress has been made, completely diversifying away from China is a long-term undertaking.

- Reshoring Considerations: While Apple continued to explore options in Southeast Asia, the possibility of reshoring some production to the United States – though less cost-effective – remained a topic of ongoing assessment.

Conclusion

This article explored the potential threats posed by Trump-era tariffs on Apple, a leading tech stock and key holding of Warren Buffett's Berkshire Hathaway. We examined the impact on Apple's supply chain, financial performance, and overall stock valuation. The analysis reveals that while the tariffs did present challenges, Apple’s strong brand, diversified revenue streams, and effective mitigation strategies allowed the company to weather the storm, demonstrating resilience in the face of significant geopolitical uncertainty. Buffett's long-term investment approach, driven by faith in Apple's fundamental strength, proved prescient.

Call to Action: Understanding the interplay between global trade policies and the performance of major tech stocks like Apple is crucial for informed investment decisions. Continue researching the impact of tariffs on Apple stock and other key players to make sound investment choices. Stay informed about the ongoing evolution of global trade relations and their potential influence on your portfolio. The lessons learned from Apple's experience offer valuable insights into navigating the complexities of global trade and its impact on investment strategies.

Featured Posts

-

Alix Earle How The Dancing With The Stars Star Became Gen Zs Top Influencer

May 24, 2025

Alix Earle How The Dancing With The Stars Star Became Gen Zs Top Influencer

May 24, 2025 -

Ihanete Gec Kalmayan Burclar Oefke Ve Intikam

May 24, 2025

Ihanete Gec Kalmayan Burclar Oefke Ve Intikam

May 24, 2025 -

Jonathan Groffs Just In Time Performance Bobby Darin Primal Needs And Broadway Buzz

May 24, 2025

Jonathan Groffs Just In Time Performance Bobby Darin Primal Needs And Broadway Buzz

May 24, 2025 -

The Jonas Brothers How Joe Handled A Couples Argument

May 24, 2025

The Jonas Brothers How Joe Handled A Couples Argument

May 24, 2025 -

Burclar Ve Cekim Guecue Seytan Tueyuene Sahip Olanlar

May 24, 2025

Burclar Ve Cekim Guecue Seytan Tueyuene Sahip Olanlar

May 24, 2025