April's Uber Rally: Key Factors Behind The Significant Increase

Table of Contents

Resurgence in Ridership and Demand

The remarkable increase in Uber's stock price in April can be largely attributed to a significant resurgence in ridership and overall demand for its services. This upswing is a testament to several key factors.

Post-Pandemic Recovery

The ride-sharing industry, including Uber, experienced a significant downturn during the height of the COVID-19 pandemic due to lockdowns and travel restrictions. However, April's performance showcased a clear indication of a robust post-pandemic recovery.

- Increased travel: With travel restrictions easing worldwide, people are increasingly using ride-sharing services for leisure and business trips.

- Return to offices: The return to in-person work in many sectors has boosted demand for daily commutes, significantly increasing Uber's ridership.

- Easing of COVID-19 concerns: Decreased COVID-19 cases and a growing sense of normalcy have encouraged more people to utilize ride-sharing services.

- Pent-up demand: The suppressed demand during the pandemic has translated into a surge in travel and ride-sharing usage as restrictions eased.

Data from various sources suggests a double-digit percentage increase in ridership compared to the same period last year, with particularly strong growth observed in major metropolitan areas. Specific figures, once publicly released by Uber, will further illuminate the extent of this recovery.

Strategic Expansion and New Services

Beyond the post-pandemic recovery, Uber's strategic expansion into new markets and the introduction of new services contributed significantly to April's rally.

- Successful marketing campaigns: Targeted marketing efforts effectively reached new customer segments, driving increased demand.

- Expansion into underserved areas: Uber's continued expansion into previously untapped markets broadened its customer base and revenue streams.

- New partnerships: Collaborations with other businesses and organizations provided access to new customer segments and enhanced service offerings.

- Delivery service growth: Uber Eats continued its strong growth trajectory, adding another layer of revenue generation and overall company stability.

The growth of Uber Eats, for example, has shown impressive figures, showcasing its significant contribution to the company's overall financial health and contributing directly to investor confidence.

Improved Profitability and Financial Performance

April's Uber rally wasn't solely driven by increased demand; it was also fueled by demonstrable improvements in Uber's profitability and financial performance.

Cost Optimization Strategies

Uber implemented various cost-optimization strategies that enhanced its overall efficiency and reduced operational expenses. These efforts played a crucial role in improving profit margins.

- Driver compensation adjustments: While controversial, adjustments to driver compensation models were implemented to optimize costs without significantly impacting driver availability.

- Technological advancements: Investments in technology and AI-driven solutions streamlined operations, leading to increased efficiency.

- Streamlining operations: Internal process improvements reduced operational redundancies and increased overall productivity.

- Optimized pricing models: Dynamic pricing algorithms were refined to balance supply and demand more effectively, maximizing revenue generation.

These combined efforts resulted in a significant reduction in operational expenses and a marked improvement in Uber's profit margins, boosting investor confidence.

Stronger-than-Expected Earnings Reports

The release of Uber's April earnings report played a pivotal role in driving the stock rally. The results significantly exceeded analyst expectations, sending a strong positive signal to the market.

- Surpassed analyst expectations: Uber's revenue and profit figures comfortably exceeded the consensus estimates provided by financial analysts.

- Positive revenue growth: The company demonstrated robust revenue growth across its various service segments, highlighting a strong financial trajectory.

- Improved EBITDA: Improvements in Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) demonstrated enhanced operational profitability.

- Increased market share: Uber maintained or expanded its market share in key regions, reinforcing its position as a dominant player in the ride-sharing industry.

The specific figures from the earnings report confirmed a healthy financial position, reinforcing investor trust and contributing significantly to April's stock price surge.

Positive Investor Sentiment and Market Conditions

Beyond Uber's internal performance, broader market conditions and investor sentiment also contributed to April's rally.

Overall Market Trends

Favorable overall market trends and positive investor sentiment towards the technology sector generally supported the increase in Uber's stock price.

- Positive investor sentiment towards the tech sector: A general upswing in investor confidence in the technology sector positively impacted Uber's stock valuation.

- Decreased inflation fears: Easing inflation concerns contributed to a more positive outlook for the overall economy, benefitting growth stocks like Uber.

- Improved economic outlook: A generally more optimistic economic forecast improved investor confidence and risk appetite.

The broader positive market environment created a fertile ground for Uber's stock to experience a significant upward trend.

Analyst Upgrades and Positive Ratings

Several analyst upgrades and positive ratings from leading financial institutions further boosted investor confidence in Uber.

- Increased price targets from analysts: Several prominent analysts raised their price targets for Uber's stock, signaling a positive outlook for its future performance.

- Positive reports from financial institutions: Favorable reports from reputable financial institutions added weight to the positive sentiment surrounding Uber.

- Strong buy ratings: Many investment firms issued strong buy recommendations for Uber stock, contributing to the upward pressure on its price.

These positive assessments from industry experts further validated the positive momentum observed in April, attracting more investment and fueling the stock price rally.

Conclusion

April's Uber rally resulted from a confluence of factors: a strong resurgence in ridership driven by post-pandemic recovery and strategic expansion; significant improvements in profitability and financial performance, exceeding analyst expectations; and a generally positive investor sentiment boosted by favorable market trends and analyst upgrades. Understanding the factors behind April's Uber Rally is crucial for investors and anyone interested in the ride-sharing market. Continue your research to stay ahead of the curve! For more information, visit Uber's investor relations page.

Featured Posts

-

India Turns Away From Pakistan Turkey And Azerbaijan Economic Impact

May 18, 2025

India Turns Away From Pakistan Turkey And Azerbaijan Economic Impact

May 18, 2025 -

Fortnite I Os Exploring The Reasons For Its Removal From The App Store

May 18, 2025

Fortnite I Os Exploring The Reasons For Its Removal From The App Store

May 18, 2025 -

Spring Breakout Rosters 2025 Player Analysis And Predictions

May 18, 2025

Spring Breakout Rosters 2025 Player Analysis And Predictions

May 18, 2025 -

Alcaraz Predaje Rune Novi Sampion Barcelone

May 18, 2025

Alcaraz Predaje Rune Novi Sampion Barcelone

May 18, 2025 -

Tenis In Krali Djokovic Kortlarda Yenilmez Bir Yuekselis

May 18, 2025

Tenis In Krali Djokovic Kortlarda Yenilmez Bir Yuekselis

May 18, 2025

Latest Posts

-

Abd Li Derginin Tuerkiye Israil Gerilimine Dair Uyarisi Erdogan Ve Netanyahu Karsi Karsiya

May 18, 2025

Abd Li Derginin Tuerkiye Israil Gerilimine Dair Uyarisi Erdogan Ve Netanyahu Karsi Karsiya

May 18, 2025 -

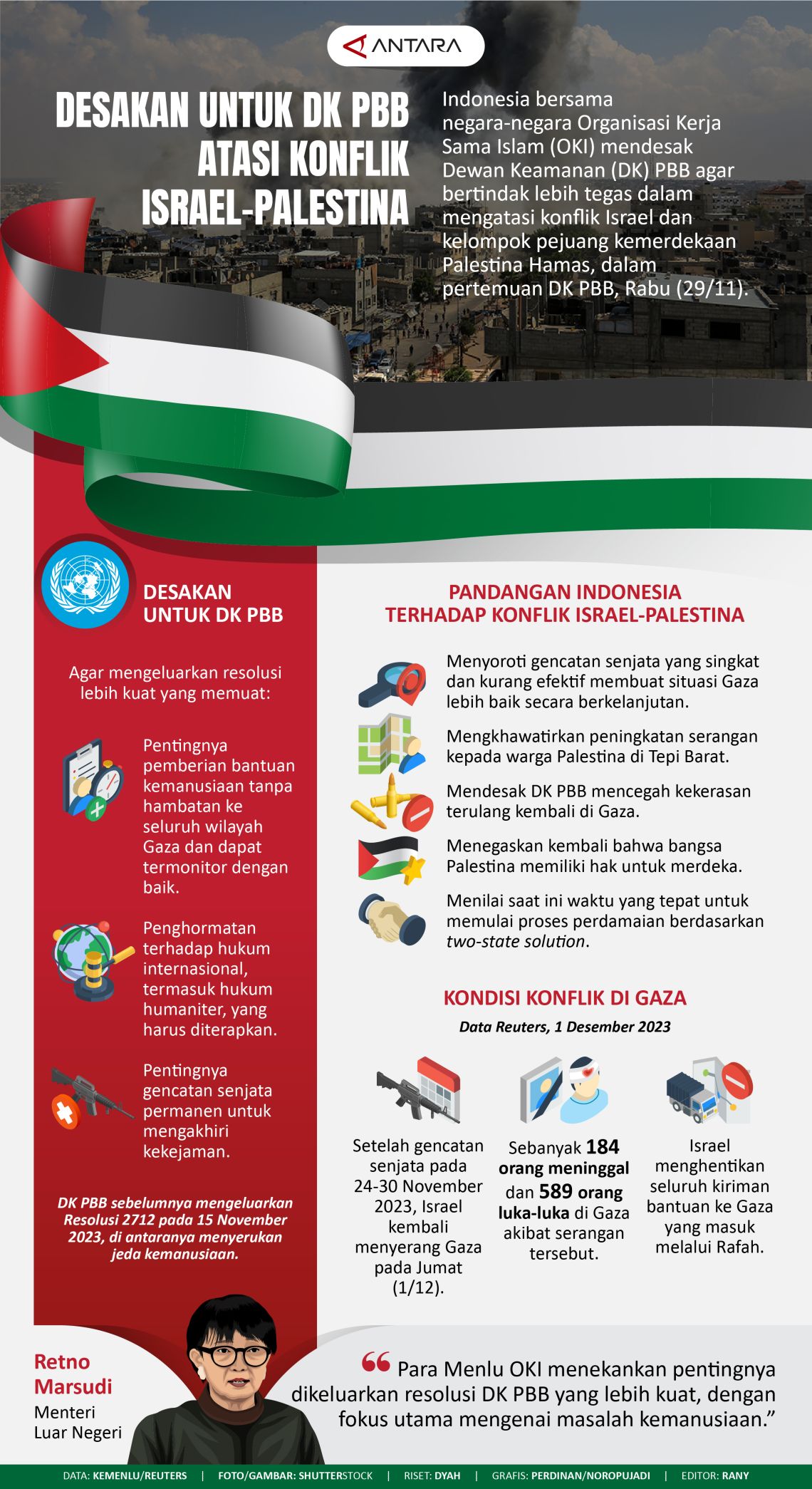

Infografis Pandangan Pbb Indonesia Dan Jalan Buntu Solusi Dua Negara Israel Palestina

May 18, 2025

Infografis Pandangan Pbb Indonesia Dan Jalan Buntu Solusi Dua Negara Israel Palestina

May 18, 2025 -

No Other Land Analisis Film Pemenang Oscar Tentang Konflik Palestina Israel

May 18, 2025

No Other Land Analisis Film Pemenang Oscar Tentang Konflik Palestina Israel

May 18, 2025 -

Abd Li Dergi Suriye Deki Tuerkiye Israil Catismasi Tehlikesi

May 18, 2025

Abd Li Dergi Suriye Deki Tuerkiye Israil Catismasi Tehlikesi

May 18, 2025 -

Infografis Pesimisme Pbb Atas Perdamaian Israel Palestina Dan Peran Indonesia

May 18, 2025

Infografis Pesimisme Pbb Atas Perdamaian Israel Palestina Dan Peran Indonesia

May 18, 2025