Are Driverless Uber ETFs The Future Of Investing?

Table of Contents

Understanding Driverless Uber ETFs and the Autonomous Vehicle Market

What are Driverless Uber ETFs?

Exchange-Traded Funds (ETFs) are investment funds traded on stock exchanges, offering diversified exposure to a specific market segment. Driverless Uber ETFs, while not yet a readily available product in the market (as of the writing of this article, no ETF directly tracks only Uber's autonomous vehicle division), represent a theoretical investment vehicle that would offer diversified exposure to the autonomous vehicle market. Instead of direct investment in Uber stock, which is subject to the performance of the entire company, an ETF would focus on companies involved in various aspects of autonomous vehicle technology, from software development to sensor manufacturing and infrastructure. This includes companies developing the technology for robotaxis, a key part of the autonomous vehicle sector.

This diversification is key. Investing in a single company carries high risk, while a well-constructed ETF would spread the investment across multiple companies in the sector, mitigating some of the risk. Think of it as a basket of stocks all related to the future of self-driving car technology.

- Diversification benefits: Reduced risk by spreading investment across multiple companies.

- Lower investment barrier: Easier access to the autonomous vehicle sector compared to individual stock purchases.

- Exposure to multiple companies in the sector: Gain from advancements across the entire industry, not just a single player.

- Potential for high growth: The autonomous vehicle sector is projected to experience substantial growth, offering high potential returns.

The Potential of the Autonomous Vehicle Market

The autonomous vehicle market is poised for explosive growth. Industry analysts predict significant expansion in the coming decades, transforming logistics, transportation, and various other sectors. The market is expected to be driven by technological advancements, increasing demand, and supportive government policies.

- Market size projections: Reports suggest the market will reach hundreds of billions of dollars within the next decade.

- Technological advancements: Continuous breakthroughs in AI, sensor technology, and mapping are accelerating development.

- Regulatory landscape: While still evolving, regulatory frameworks are gradually developing to support autonomous vehicle deployment.

- Impact on various industries: Autonomous vehicles promise to revolutionize logistics (autonomous trucking), ride-sharing (robotaxis), and even personal transportation.

Assessing the Risks of Investing in Driverless Uber ETFs

Investing in any emerging technology, including autonomous vehicles, carries inherent risks. While the potential rewards are substantial, investors need to carefully assess the challenges.

Technological Challenges and Development Risks

Self-driving technology is still under development, and there are significant hurdles to overcome before widespread adoption.

- Software development challenges: Creating reliable and safe autonomous driving software is complex and requires substantial ongoing investment.

- Safety concerns: Ensuring the safety of autonomous vehicles is paramount, and any major accidents could negatively impact investor confidence.

- Infrastructure requirements: Widespread adoption requires significant investment in supportive infrastructure, such as high-definition mapping and communication networks.

- Unforeseen technical issues: Technological development often encounters unforeseen problems that can cause delays and cost overruns.

Regulatory Uncertainty and Legal Liabilities

The regulatory environment surrounding autonomous vehicles is constantly evolving, creating uncertainty for investors.

- Varying regulations across jurisdictions: Different regions have varying regulations, adding complexity and potentially hindering market penetration.

- Liability in case of accidents: Determining liability in accidents involving autonomous vehicles is a complex legal issue.

- Insurance implications: The insurance industry is still adapting to the challenges posed by autonomous vehicles.

- Ethical considerations: Ethical dilemmas related to autonomous vehicle decision-making remain to be fully addressed.

Market Volatility and Investment Risks

The technology sector is inherently volatile, and investments in autonomous vehicles are no exception.

- Market fluctuations: Stock prices of companies involved in autonomous vehicle technology can experience significant price swings.

- Economic factors: Economic downturns can significantly impact investment in emerging technologies.

- Competition: The autonomous vehicle market is highly competitive, and the success of individual companies is not guaranteed.

- Timing the market: Entering or exiting the market at the right time is crucial but challenging to predict.

How to Invest in Driverless Uber ETFs (or similar)

While dedicated "Driverless Uber ETFs" don't yet exist, investing in the broader autonomous vehicle sector is possible through other ETFs that focus on technology, transportation, or robotics companies.

Research and Due Diligence

Thorough research is critical. Identify ETFs that align with your risk tolerance and investment goals. Analyze the underlying holdings, management fees, and historical performance.

Choosing the Right Broker

Select a reputable brokerage firm that provides access to the ETFs you've identified. Compare fees, trading platforms, and research tools offered.

Diversification Strategies

Don't put all your eggs in one basket. Diversify your investment portfolio across different asset classes to mitigate risk.

Long-Term Perspective

Autonomous vehicle technology is a long-term investment. Avoid short-term trading strategies and focus on the long-term growth potential.

Conclusion

Investing in driverless Uber ETFs, or similar autonomous vehicle investment opportunities, presents both exciting opportunities and significant risks. While the potential rewards are substantial, due diligence and a careful understanding of the technological, regulatory, and market risks are paramount. Conduct thorough research, consider your investment goals, and consult with a financial advisor before committing your capital. Learn more about the potential of driverless Uber ETFs and other autonomous vehicle investment options to make informed decisions for your portfolio. Consider consulting a financial advisor before investing in any ETF.

Featured Posts

-

Seguridad Reforzada En Las Instalaciones Del Cne Presencia Policial En La Capital

May 19, 2025

Seguridad Reforzada En Las Instalaciones Del Cne Presencia Policial En La Capital

May 19, 2025 -

Comesana Se Clasifica Para La Siguiente Ronda En Hamburgo

May 19, 2025

Comesana Se Clasifica Para La Siguiente Ronda En Hamburgo

May 19, 2025 -

Salami Au Chocolat Une Tradition Sucree De France

May 19, 2025

Salami Au Chocolat Une Tradition Sucree De France

May 19, 2025 -

I A Stasi Ton Xairetismon Odigos Gia Katanoisi Kai Ermineia

May 19, 2025

I A Stasi Ton Xairetismon Odigos Gia Katanoisi Kai Ermineia

May 19, 2025 -

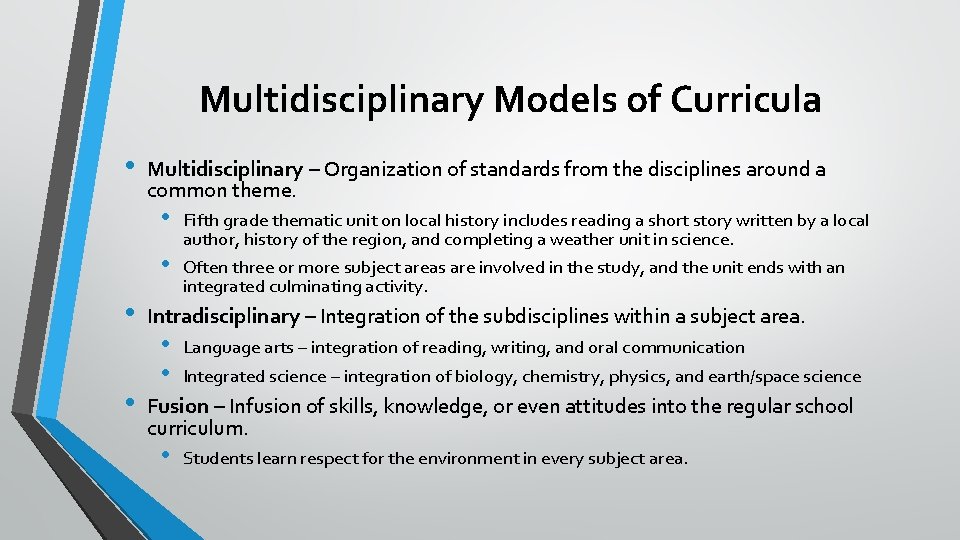

Interdisciplinary And Transdisciplinary Approaches A Key To Solving Complex Problems

May 19, 2025

Interdisciplinary And Transdisciplinary Approaches A Key To Solving Complex Problems

May 19, 2025