Are Hedge Funds Betting On Norwegian Cruise Line (NCLH)?

Table of Contents

Analyzing Hedge Fund Holdings in NCLH

Tracking hedge fund positions is essential for understanding market sentiment and potential investment opportunities. We can gain valuable insights by analyzing 13F filings, which publicly disclose the equity holdings of institutional investment managers, including many hedge funds, on a quarterly basis. These filings, however, only provide a snapshot in time and may not reflect real-time trading activity.

Analyzing recent trends reveals [insert data on recent hedge fund ownership of NCLH stock – e.g., a slight increase, a significant decrease, or a relatively stable holding]. While precise figures often remain partially obscured due to the complexity of portfolio holdings, publicly available data suggests [insert specifics – e.g., a notable increase in NCLH holdings by X fund, while Y fund reduced its stake]. It's crucial to remember that hedge funds often employ complex strategies, and a single quarter's data might not paint a complete picture.

- Percentage change in NCLH holdings over the last quarter/year: [Insert data, e.g., a 5% increase in the last quarter, a 10% decrease over the past year].

- Comparison to other cruise line stocks (e.g., RCL, CCL): [Insert comparative data, e.g., Hedge funds appear more bullish on RCL compared to NCLH, possibly reflecting differences in debt levels or strategic initiatives].

- Significant changes in hedge fund sentiment towards the cruise industry as a whole: [Insert analysis, e.g., Overall sentiment toward the cruise industry is cautiously optimistic, with many funds seeing potential for recovery but remaining wary of lingering risks].

The Rationale Behind Hedge Fund Investments (or lack thereof) in NCLH

Hedge fund interest (or lack thereof) in NCLH is likely driven by a complex interplay of factors. A potential reason for investment might be a perception of undervaluation, particularly if the market hasn't fully priced in the anticipated recovery of the cruise industry. Furthermore, a belief in NCLH’s future earnings potential, driven by its strategic initiatives or expansion plans, could also attract hedge fund capital.

Conversely, a lack of interest might stem from concerns about NCLH's substantial debt levels, ongoing operational challenges related to post-pandemic recovery, or the inherently volatile nature of the cruise industry, particularly given the susceptibility to external factors like fuel price fluctuations or global travel restrictions.

Analyzing NCLH's recent financial performance is crucial.

- Key financial indicators (revenue, debt, profitability): [Insert data and analysis, e.g., Revenue is showing gradual improvement but debt remains a significant concern. Profitability is still below pre-pandemic levels].

- Industry-specific risks and opportunities (fuel prices, competition, travel restrictions): [Insert analysis, e.g., Fuel price volatility poses a significant risk, while the potential for increased international tourism presents an opportunity].

- NCLH's strategic initiatives and their potential impact: [Insert analysis, e.g., NCLH’s focus on cost optimization and enhanced customer experience could positively impact its future performance].

What Does Hedge Fund Activity Suggest for NCLH Investors?

Interpreting hedge fund activity requires a nuanced approach. While some funds may be betting on NCLH's recovery, others might be hedging their bets or exiting positions due to perceived risks. This mixed sentiment underscores the importance of independent due diligence.

- Potential risks and rewards associated with investing in NCLH: [List and analyze, e.g., High reward potential if the industry recovers strongly, but significant downside risk if the recovery is slower than expected or if debt levels become unsustainable].

- Comparison to other investment opportunities in the cruise industry or broader market: [Compare and contrast, e.g., Compared to competitors, NCLH might offer higher risk and higher potential reward, depending on the investor's risk tolerance].

- Advice on when to buy, sell, or hold NCLH stock based on the analysis: [Offer a balanced perspective, e.g., Investors with a high-risk tolerance and a long-term horizon might consider a small position, but those seeking stability should likely avoid NCLH for now].

Conclusion: Should You Follow the Hedge Funds on Norwegian Cruise Line (NCLH)?

Hedge fund activity surrounding NCLH reveals a mixed sentiment, reflecting both the potential for recovery and the inherent risks within the cruise industry. While some funds are showing renewed interest, others remain cautious. Ultimately, the decision to invest in NCLH should be based on your own thorough research and risk assessment, not solely on the actions of hedge funds. Consider factors like NCLH's debt levels, industry-specific risks, and the company's strategic initiatives.

Before making any investment decisions regarding Norwegian Cruise Line (NCLH) stock, conduct further research. Explore reputable financial news websites, analyze company financial reports, and consult with a qualified financial advisor to gain a comprehensive understanding of the risks and potential rewards. Remember that investing in the stock market always involves risk, and past performance is not indicative of future results. Carefully consider your risk tolerance and investment goals before investing in NCLH or any other stock.

Featured Posts

-

Truong Dh Ton Duc Thang Linh An Tien Phong Tai Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025

May 01, 2025

Truong Dh Ton Duc Thang Linh An Tien Phong Tai Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025

May 01, 2025 -

Gangs Of London Season 3 The Reality Behind The Violence

May 01, 2025

Gangs Of London Season 3 The Reality Behind The Violence

May 01, 2025 -

Remembering The Louisville Tornado Impacts And Recovery After 11 Years

May 01, 2025

Remembering The Louisville Tornado Impacts And Recovery After 11 Years

May 01, 2025 -

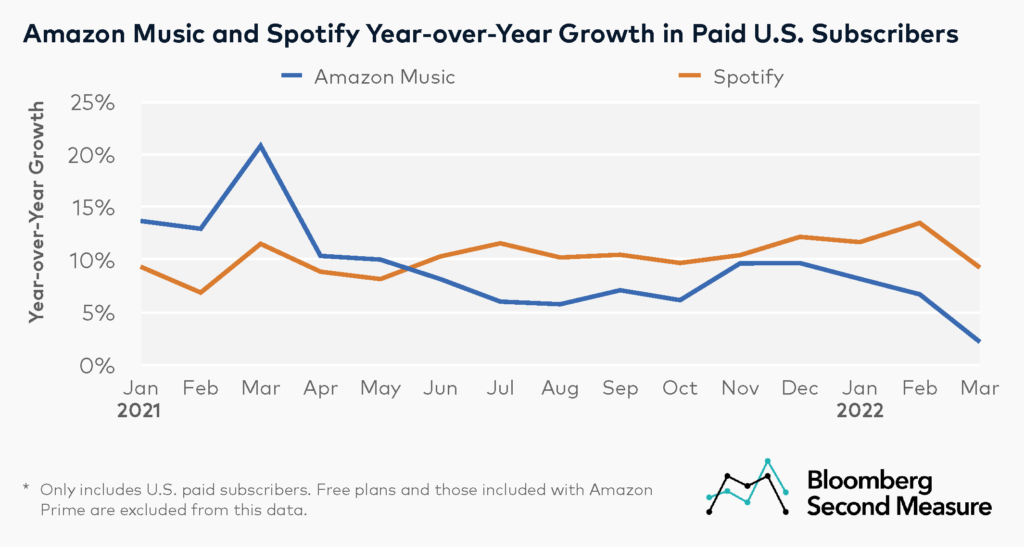

12 Subscriber Growth For Spotify Spot Financial Report Analysis

May 01, 2025

12 Subscriber Growth For Spotify Spot Financial Report Analysis

May 01, 2025 -

Agha Syd Rwh Allh Mhdy Bharty Hkwmt Ky Kshmyr Palysy Pr Tnqyd

May 01, 2025

Agha Syd Rwh Allh Mhdy Bharty Hkwmt Ky Kshmyr Palysy Pr Tnqyd

May 01, 2025