Are High Stock Market Valuations A Cause For Concern? BofA Says No.

Table of Contents

BofA's Rationale Behind Dismissing High Valuation Concerns

BofA's bullish stance on high stock market valuations isn't based on blind optimism. Their analysis rests on several key pillars: strong corporate earnings, the influence of low interest rates, and the potential for future growth fueled by technological innovation.

Strong Corporate Earnings and Profitability

BofA argues that current high stock market valuations are justified by robust corporate earnings and profitability. Many companies are reporting impressive revenue growth and healthy profit margins, suggesting a solid foundation for sustained market strength. This isn't just a broad trend; specific sectors are outperforming expectations.

- Technology: The tech sector continues to drive significant earnings growth, with companies like Apple and Microsoft posting record profits. Innovation in areas like artificial intelligence and cloud computing fuels further expansion.

- Energy: The resurgence of the energy sector, driven by increased demand and higher prices, has significantly boosted corporate earnings.

- Healthcare: Pharmaceutical and biotechnology companies are benefiting from new drug approvals and growing healthcare spending.

Low Interest Rates and Monetary Policy

Low interest rates play a significant role in shaping investor behavior and stock market valuations. BofA points out that the accommodative monetary policy adopted by central banks globally continues to provide ample liquidity in the market, supporting higher valuations. While interest rate hikes are anticipated, the pace and impact remain uncertain.

- Future Rate Changes: The Federal Reserve's (Fed) plans for gradual interest rate increases are expected to continue, but the extent and timing remain subject to economic data and inflationary pressures.

- Impact on Market: While interest rate increases can dampen investor enthusiasm and potentially lead to a market correction, BofA believes the current strength of corporate earnings can offset these effects.

Technological Innovation and Long-Term Growth Potential

Technological innovation is a key driver of future corporate earnings, justifying higher stock market valuations in BofA's view. Breakthroughs in various sectors, including artificial intelligence, biotechnology, and renewable energy, promise to unlock significant long-term growth potential.

- AI and Automation: The rapid advancement of artificial intelligence and automation is creating new markets and transforming existing industries, boosting productivity and profitability for many companies.

- Biotechnology: Advancements in gene editing and personalized medicine hold immense promise for healthcare, translating into significant investment opportunities.

- Renewable Energy: The shift towards renewable energy sources is driving innovation and investment in clean technology companies, offering compelling growth prospects.

Counterarguments and Potential Risks

Despite BofA's optimism, several counterarguments and potential risks need consideration when assessing high stock market valuations.

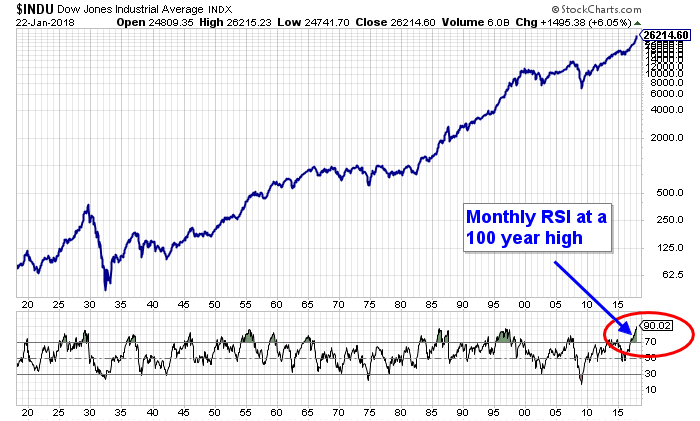

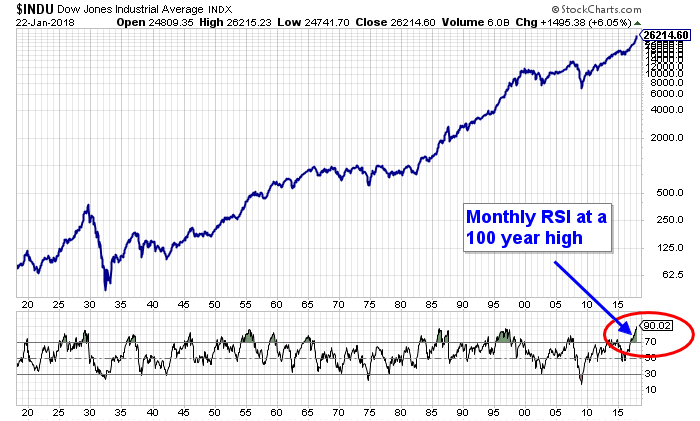

Valuation Metrics and Historical Comparisons

Using traditional valuation metrics such as the Price-to-Earnings (P/E) ratio and the Shiller PE (Cyclically Adjusted P/E ratio), some analysts argue that current valuations are stretched compared to historical averages. This raises concerns about overvaluation and the potential for a significant market correction.

- Historical Averages: Comparing current P/E ratios to historical averages reveals that valuations are indeed high, potentially indicating a risk of a market downturn.

- Market Corrections: History is replete with examples of high valuations being followed by substantial market corrections, highlighting the risks associated with current market conditions.

Geopolitical and Economic Uncertainty

Geopolitical instability and economic uncertainty pose significant risks to stock market valuations. Trade wars, international conflicts, and rising inflation can negatively impact corporate earnings and investor sentiment.

- Trade Wars: Ongoing trade tensions between major economies can disrupt supply chains and negatively impact corporate profitability.

- International Conflicts: Geopolitical conflicts create uncertainty and can lead to market volatility.

- Recessionary Fears: Concerns about a potential economic recession can dampen investor sentiment and trigger a market downturn.

Inflationary Pressures and Their Impact

Rising inflation erodes corporate profits and can significantly impact stock market valuations. While BofA might downplay this concern, persistent inflation could lead to higher interest rates, making borrowing more expensive for companies and potentially cooling economic growth.

- Impact on Corporate Profits: Inflation increases the cost of goods and services, squeezing profit margins for many businesses.

- Higher Interest Rates: Central banks might respond to rising inflation by increasing interest rates, potentially leading to a market correction.

Investment Strategies in Light of High Valuations

Navigating the current market environment requires careful consideration of investment strategies.

Diversification and Risk Management

Diversification is crucial to mitigate the risks associated with high stock market valuations. Spreading investments across different asset classes, sectors, and geographies can reduce the impact of market fluctuations.

- Asset Allocation: A balanced portfolio that includes stocks, bonds, and other asset classes can reduce overall portfolio risk.

- Sector Diversification: Investing in multiple sectors reduces dependence on any single industry's performance.

Long-Term vs. Short-Term Investment Horizons

The implications of high stock market valuations differ for long-term and short-term investors. Long-term investors can ride out market fluctuations, while short-term investors might need a more cautious approach.

- Long-Term Investors: Long-term investors can potentially benefit from the long-term growth potential of the market, even with high valuations.

- Short-Term Investors: Short-term investors might consider reducing their exposure to the stock market or adopting a more conservative investment strategy.

Seeking Professional Financial Advice

Given the complexity of the current market environment, seeking professional financial advice is strongly recommended. A financial advisor can provide personalized guidance based on your risk tolerance, investment goals, and time horizon.

- Personalized Financial Planning: A financial advisor can help you develop a comprehensive investment plan that aligns with your individual needs and risk profile.

- Understanding High Stock Market Valuations: A financial advisor can help you understand the implications of high stock market valuations for your portfolio and offer tailored strategies to manage your exposure.

Conclusion

While BofA maintains a surprisingly optimistic view on high stock market valuations, citing strong corporate earnings, low interest rates, and technological innovation, it's crucial to acknowledge counterarguments regarding valuation metrics, geopolitical risks, and inflationary pressures. Understanding these opposing perspectives is key to making informed decisions. To manage your exposure to high stock market valuations, carefully consider your risk tolerance and investment goals. Conduct thorough research, and seek professional financial advice to formulate a sound investment strategy that aligns with your individual circumstances. Learn to understand high stock market valuations and make informed decisions about high stock market valuations to navigate this complex market effectively.

Featured Posts

-

Podcast Onetu I Newsweeka Aktualnosci Ze Stanu Wyjatkowego

May 07, 2025

Podcast Onetu I Newsweeka Aktualnosci Ze Stanu Wyjatkowego

May 07, 2025 -

Dramatic Cup Final De Bussers Shoot Out Decides Go Ahead Eagles Fate

May 07, 2025

Dramatic Cup Final De Bussers Shoot Out Decides Go Ahead Eagles Fate

May 07, 2025 -

Navigating The Chinese Market The Difficulties Faced By Bmw Porsche And Other Automakers

May 07, 2025

Navigating The Chinese Market The Difficulties Faced By Bmw Porsche And Other Automakers

May 07, 2025 -

Minnesota Timberwolves Heating Up At The Right Time

May 07, 2025

Minnesota Timberwolves Heating Up At The Right Time

May 07, 2025 -

Peter Tazelaar De Onvertelde Waarheid Over Een Soldaat Van Oranje

May 07, 2025

Peter Tazelaar De Onvertelde Waarheid Over Een Soldaat Van Oranje

May 07, 2025